5Paisa Insurance

More on 5Paisa

5Paisa Insurance is an example that has been in the limelight in the recent past in the domain of health and term insurance. This initiative comes from the house of 5Paisa, a leading discount broker in India.

Started as an experiment into the insurance space, 5Paisa Insurance has been able to gain a reasonable mileage among the potential client base in the last few months.

5Paisa Insurance Reviews

Insurance is certainly one of the most promising investments you may look forward to.

With various sorts of uncertainties in life, an Insurance plan always works as Plan B in our lives. Furthermore, with different kinds of recurring expenses including house rent or monthly instalment, rentals, debts etc – having an insurance plan becomes even more crucial.

Historically, there has been an eco-system with insurance companies and insurance agents where the latter approaches you and sells you a plan for a specific company he/she is tied with.

If one buys from the agent, apart from the premium that needs to be paid, there is a specific ‘hidden’ commission that the agent charges. That has been the livelihood of insurance agents.

However, with the advent of technology, the middlemen are getting out across the business domains. This not only makes the overall process smoother and quicker but also makes the product or service even cheaper.

Apart from multiple financial companies, 5Paisa Insurance is another example that has been in the limelight in the recent past. Although, 5Paisa in itself is primarily a stockbroking company with a decent client base. However, 5Paisa Insurance is another business entity opened up by the stockbroker for a specific client base.

The business claims to have more than 3.5 Lakh customers, 60k+ policies sold with a turnover of ₹138 Crore from last year premiums.

In this detailed review of 5Paisa Insurance, we will discuss different products offered, pricing structure and how you can apply for an Insurance using their services.

5Paisa Insurance Products

There are 2 different products offered by 5Paisa Insurance, namely:

- Health Insurance

- Term Insurance

5Paisa Health Insurance

If you are looking to insure yourself and/or your family members against any potential health hazards, then going for a Health Insurance plan makes total sense.

For all kinds of specific diseases or health issues, there is a specific pre-decided amount that is disclosed with you.

If unfortunately, you or any other insured family member is diagnosed with a disease, the corresponding amount will be paid to you. You may also opt for an add-on cover for additional benefits in case the base policy does not cover them.

Once you opt for health insurance, you are supposed to make payments on a set frequency to the insurance company and whenever there is a medical issue that needs a monetary address – the health insurance policy will take care of that.

Lastly, make sure you understand and are aware of all the diseases or health hazards that your medical policy covers. This needs to be known that there will be few diseases that may have half or no cover at all.

Some of the benefits of using health insurance are:

- There is a provision of cashless-hospitalization i.e. you are not required to make any transactions at your end. The complete monetary transaction will happen between the hospital and the insurance company.

- Going through 5Paisa Insurance makes the overall process cheaper since there are no commission or operational costs involved.

- As per your requirements, you have the option to choose your policy from different available insurance companies. Some of the companies 5Paisa Insurance has a running tie-up on health insurance are:

- Star Health

- Religare Health

- SBI Health

- ICICI Health

If you are looking to buy a health insurance plan, you just need to provide some basic details such as:

- Gender

- Pincode

- Age of Insured members (only 2 adults can be added to one insurance policy)

- Annual Income

- Disclosure of any diseases the members may have

Based on the details are have provided, 5Paisa Insurance provides you with a list of different Insurance schemes its partner companies can offer you. It looks like this:

From here, you may choose to go ahead with any of the Insurance plans as per your preference.

5Paisa Term Insurance

Term Insurance and Life Insurance mean the same thing on a general level. Here, in lieu of the premium you pay, there is a definite amount (that is decided at the time you buy the policy) your family will receive in case of an eventual situation.

Like in the case of Health Insurance, you need to make sure you perform reasonable back-end research about the reputation of the company, claim settlement ratio etc. Some of the advantages of buying term insurance are:

- You can avail tax-deductions

- Like mentioned above, term insurance works as a plan B in your absence

- Quick issuance of the insured amount

Remember, you may need to go through a medical check-up (if required).

As far as the benefits of going with health insurance using 5Paisa Insurance are concerned, here is a quick look:

- Cheaper pricing

- Provision to see multiple options before choosing an insurance plan.

- There are different companies 5Paisa has a partnership with, including:

- Aegon

- ICICI Insurance

You will need to provide details such as:

- Gender

- Age

- Marital status

- Tobacco User?

- Sum to be Insured

- Pincode

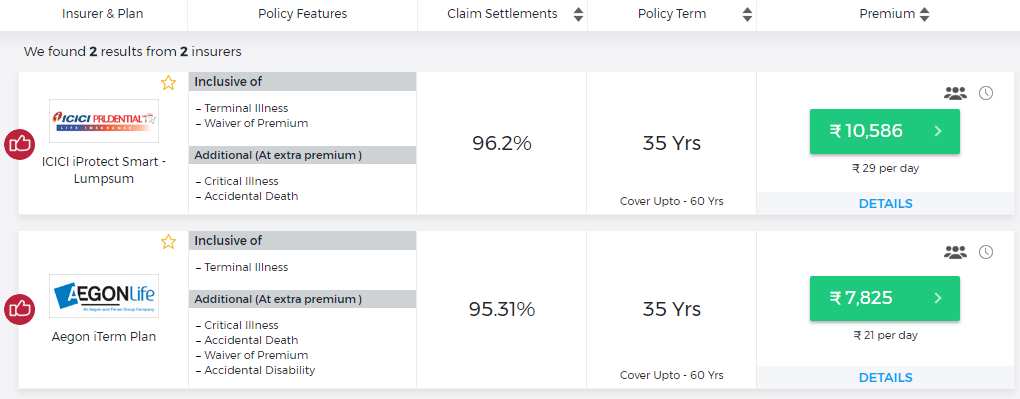

Based on these inputs, the corresponding insurance policy details will be displayed to you:

Depending on your preferences and requirements, you may choose to pick any of the plans that are displayed to you. You will be required to make an initial payment to get your instalment started. You also have the option to make a lump sum payment as well.

Conclusion

Finally, whether you should be going ahead with 5Paisa Insurance or not, this is entirely based on your preferences. However, if you choose to go ahead with it, there is a definite cost advantage, ease of the process and a scope of different options to choose from.

At the same time, 5Paisa Insurance still needs to introduce even more insurance options to choose from, for the benefit of the clients.

Furthermore, when the details of different policies are shown, there is still more room for going even more detailed. The idea must be that the user must get complete in-and-out idea about the policy, its returns, associated risks, payments formalities, Network hospitals etc.

Nonetheless, there are few other companies that can provide you similar assistance but looking at the way 5Paisa, as an overall financial solution provider, has grown – it certainly gives a sense of trust for a long term as well.

Thus, we would suggest you have a quick word before making up your mind on whether to go ahead with 5Paisa Insurance or not.

In case you are looking to get a quick call, just fill in these basic details.