HDFC AMC IPO Review

Check All IPO Reviews

| IPO Basic Details | |

| IPO Name | HDFC Asset Management Company Limited |

| IPO Dates | July 25-July 27, 2018 |

| IPO Size | ₹2,787.6 crores - ₹2,800.3 crores |

| Total Number of Shares | 2,54,57,555 |

| Face Value | ₹5 |

| IPO Price Band | ₹1095 to ₹1100 |

| Bid Lot | 13 |

| Amount of 13 shares | ₹14,235 to ₹14,300 |

| Total Retail Allocation | 30.5% |

| Exchanges | NSE, BSE |

HDFC AMC Background

HDFC Asset Management Company is one of the most profitable asset management companies in India, with total assets under management of ₹2,932.54 billion as on December 31, 2017. It was incorporated in December 1999.

Check HDFC AMC IPO Allotment Status LIVE

The company operates as a joint venture between Housing Development Finance Corporation Limited (HDFC) and Standard Life Investments Limited (SLI). The company offers a wide array of savings and investment products across all asset classes to create income and wealth for the customers.

HDFC Asset Management Company offers 127 schemes, as of December 31, 2017, of which there are 28 equity-oriented schemes, 91 debt schemes, 3 liquid schemes and five other schemes including exchange-traded schemes and funds of fund schemes.

Because of this flexibility, the company has been able to perform successfully in various market cycles and caters to customers ranging from individuals to institutions.

HDFC Asset Management Company also provides portfolio management and segregated account services to high net-worth individuals, family offices, corporates, trusts, provident funds, and global companies.

Check Now: HDFC AMC IPO Subscription Status LIVE

Because of the diversified product offering, HDFC Asset Management Company also manages efficient mutual fund schemes which can provide for different customer requirements and risk profiles, and also provides systematic investment plans.

HDFC Asset Management Company is a strong market player as a trusted brand, with strong investment performance, diversified product mix, profitable growth and experienced investment and management teams.

Now the business is looking to launch an IPO in the next week of July. In this detailed review, we will talk about the company background, financials, management and more to get an idea of whether you should be investing in the IPO or not.

HDFC AMC Management

HDFC Asset Management Company has 12 Directors, which includes six Independent Directors, one Managing Director and five Non-Executive Directors, including one woman Director.

Deepak Parekh is the Non-Executive Director and the Chairman, Keki Mistry, Renu Karnad, Norman Keith Skeoch and James Baird Aird are the Non-Executive Directors, Hoshang Billimoria, Humayun Dhanrajgir, P.M. Thampi, Deepak Phatak, Rajeshwar Bajaaj and Vijay Merchant are the Independent Directors and Milind Barve is the Managing Director of HDFC Asset Management Company.

Deepak Parekh

Non-Executive Director and Chairman of the Board

Mr Parekh has been on the Board of HDFC Asset Management Company since July 4, 2000. He is the nominee of HDFC and is the Chairman of the Board. He is on the Board of several other leading companies across various sectors.

Mr Deepak Parekh has won several prestigious awards in India and abroad, including Padma Bhushan and is an associate of the Institute of Chartered Accountants (England and Wales).

HDFC AMC IPO Data Points

The IPO of HDFC Asset Management Company will open on July 25, 2018 and close on July 27, 2018.

The issue size is about 25.4 million shares, of the total outstanding shares of 210.5 million shares.

Thus, the offer constitutes about 12.09% of the outstanding shares. Of the offer, 3.28 million shares are reserved for HDFC AMC employees, HDFC employees and HDFC shareholders.

The promoters of the company are HDFC and Standard Life Investments. HDFC owns 120.7 million shares constituting about 57.36% stake and SLI owns 80.5 million shares constituting 38.24% stake in the company.

Of the ownership, HDFC is offering 8.6 million shares up for sale and SLI is offering 16.8 million shares.

The face value of each share is ₹5 and the IPO price band is in the range of ₹1,095 to ₹1,100 per share. This makes the IPO issue size between ₹2,787.6 crores and ₹2,800.3 crores.

The investment lot size is 13 shares, making the minimum bid value between ₹14,235 and ₹14,300.

HDFC AMC Financial Performance

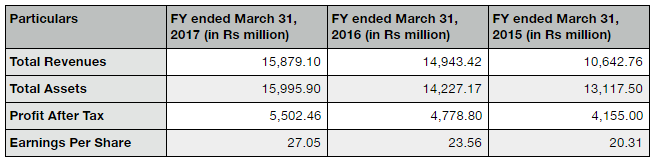

HDFC AMC has reported strong and steady financials over the past few years. The assets under management (AUM) of the company have grown at a CAGR of 27.1% from 2013 to 2017. The proportion of equity-oriented AUM to total AUM was 53% as on December 31, 2017.

The fee structure for equity schemes is higher than the non-equity ones, therefore, the product mix of HDFC AMC helps it achieve higher profits.

The total revenue of HDFC AMC increased from 2013 to 2017 at a CAGR of 19.3% and the net profit for the same period increased at a CAGR of 14.6%. The Dividend Payout Ratio increased from 40% in 2013 to 51% in 2017.

The company’s average return on net worth increased 40% every year since 2013 and was 42.75% for 2017.

HDFC AMC IPO Objective

The proceeds of the sale will be received directly by the selling shareholders in proportion of their holdings. The company will not receive any proceeds from the offer.

The objective of the offer is to bring the benefits of the listing of shares on the exchange to the company. The IPO will enhance the brand image and visibility of HDFC AMC and will provide a public market to its equity shares. The listing of HDFC AMC will reflect the value created by the company in the past 18 years.

HDFC AMC IPO Events

HDFC Asset Management Company filed the Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India ion July 13, 2018 and was approved on July 17, 2018.

The IPO will open for bidding on July 25, 2018 and will remain open till July 27, 2018.

The finalisation of the basis of allotment is expected by August 1, 2018 and the initiation of refunds will start by August 2, 2018.

The credit of equity shares to the demat accounts will occur around August 3, 2018 and the trading of the equity shares on the stock exchanges is expected to commence by August 6, 2018.

HDFC AMC Contact Information

If you require more information regarding the IPO or need to get in touch with HDFC AMC for more information about their business, following are the contact details:

HDFC Asset Management Company Limite

HDFC House, 2nd Floor

H.T. Parekh Marg, 165-166

Backbay Reclamation

Churchgate

Mumbai-400020

Maharashtra, India

Telephone Number: +91-22-6631 3333

Fax Number: +91-22-6658 0203

HDFC AMC IPO Recommendation

HDFC Asset Management Company is a trusted brand with a strong parentage.

The company has maintained a consistent leadership position in the Indian mutual fund industry. It has demonstrated strong financial performance supported by comprehensive investment philosophy and risk management.

The company has a customer-centric culture and serves customers in over 200 cities through the pan-India network of 183 branches and service centres.

In terms of financial performance, HDFC AMC has a track record of robust financial performance. The total revenues get at a rate of 19.3% and net profit grew at a rate of 14.6%.

The company had a net worth of ₹23,419.75 million as of December 31, 2017, and the return on average net worth was 42.75% for 2017.

The management of HDFC AMC is highly experienced and professional. All the Directors, staff and officers have years of experience in the industry and use their knowledge and experience to create income and wealth for the clients.

In the future, the company plans to maintain strong investment performance, expand its reach and distribution channels, enhance the product portfolio and invest in digital platforms to establish leadership in the digital world.

Based on the above-mentioned factors, HDFC AMC IPO is expected to have resounding success. The company is backed by strong companies, HDFC and SLI and it has been nurtured by both of them for 18 years.

The IPO will demonstrate the value created in HDFC AMC by its promoters. The company also has positive future plans and is expected to remain a market leader in asset management and wealth management.

Therefore, the recommendation for the IPO is HDFC AMC is to BUY!

Happy Investing!

In case you are looking for investing in this IPO or stock market trading in general, let us assist you in taking the next steps forward.

HDFC AMC IPO Advisors Information

The Registrar to the Offer is Karvy Computershare Private Limited.

The book-running lead managers are Kotak Mahindra Capital Company Limited, Axis Capital Limited, DSP Merrill Lynch Limited, Citigroup Global Markets India Private Limited, CLSA India Private Limited, HDFC Bank Limited, ICICI Securities Limited, IIFL Holdings Limited, JM Financial Limited, J.P. Morgan India Private Limited, Morgan Stanley India Company Private Limited and Nomura Financial Advisory and Securities (India) Private Limited.

The legal counsel to HDFC AMC as to Indian Law is AZB & Partners, legal counsel to HDFC as to Indian Law is Wadia Ghandy & Co. and legal counsel to Standard Life as to Indian Law is Cyril Amarchand Mangaldas.

The legal advisers to the book runners as to Indian Law are Khaitan & Co and as to International Law are Latham & Watkins LLP. B S R & Co. LLP are the statutory auditors of the company.