Price Band

More on IPO

NSE Price Band is basically a range of prices at which the IPO is bid for. This information is generally contained in the Draft Red Herring Prospectus (DRHP) published by the company filing for the IPO. The NSE price band contains a floor and a cap price and the difference (or spread) between the two cannot be more than 20%.

Also Read: IPO Full Form

The NSE Price band is used when a company is looking to launch an IPO or is trying to enter the market. It hires a team of underwriters who perform an exhaustive study of the company, its peers, the financials over the years, and so on.

Based on these details, a lot of pricing experiments are performed and a corresponding price range is constructed.

The company launching the IPO may choose to revise the NSE price band as well, although, there are a few provisions and implications related to this process.

Along with it, read the Difference between BSE and NSE and optimize your knowledge.

The different ways in which a business can be revised include providing timely information to the regulatory bodies including exchanges (BSE, NSE for instance), providing this information on their own website, and of course by doing a press release.

Price Band in IPO

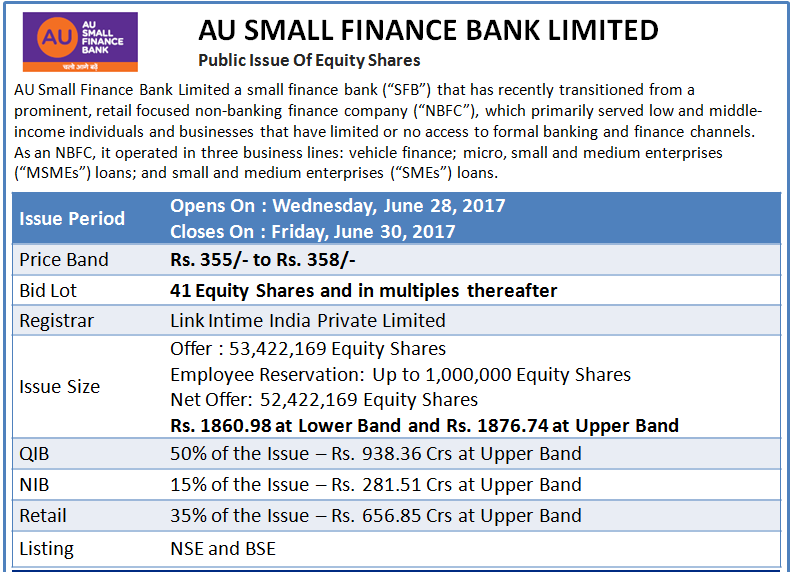

Let’s take an example to understand the concept and usage of NSE Price band in IPO on a real-time basis.

For instance, if a company ALPHA-BETA files for an IPO, its NSE price band can potentially be ₹1000 to ₹1200. This also means the minimum bidding by the buyers for the IPO must be ₹1000. If they fail to do so, their application will be outrightly rejected.

The NSE Price band in IPO gives an idea to the potential buyers about the prospected value of the company to go along with ideation of their possible returns.

You must perform a comprehensive analysis of the IPO keeping the price band in mind so as to take a final judgement on whether to go ahead with the IPO investment plan or not.

You must have noticed such notices in the business newspapers:

You can observe that the Price range for this particular IPO is ranged between ₹355 and ₹358. Such information will always be available in any IPO listing you would see.

Based on the NSE Price band, a lot of other related financial aspects are calculated that can actually make or break the deal for the business that is launching the IPO.

A lot of calculation, quantitative analysis and research go behind the calculation of a rationale price band.

Know about the price band of the upcoming IPO 2021 in the table below:

| IPO Price Band | |

| Upcoming IPO | Price Band |

| Paytm IPO Price Band | [●] – [●] |

| Suryoday Small Finance Bank IPO Price Band | ₹303-₹305 |

| Kalyan Jewellers IPO Price Band | ₹86 - ₹87/equity share |

| Craftsman Automation IPO Price Band | ₹1488-₹1490/equity share |

| Laxmi Organics Industries IPO Price Band | ₹129 - ₹130/ equity shares |

| Anupam Rasayan IPO Price Band | ₹553-₹555/equity shares |

| Easy Trip Planners IPO Price Band | ₹186- ₹187/equity shares |

| MTAR Technologies IPO Price Band | ₹574-₹575 /equity shares |

| Apeejay Surrendra Park Hotels IPO Price Band | [●] |

| Craftsmen Automation IPO Price Band | [●] |

| Barbeque Nation Hospitality IPO Price Band | [●] |

| Puranik Builders IPO Price Band | [●] |

| Aadhar Housing Finance IPO Price Band | [●] |

| ESAF Small Finance Bank IPO Price Band | [●] |

| Macrotech Developers IPO (Lodha Group) Price Band | [●] |

| India Pesticides IPO Price Band | [●] |

| PowerGrid IPO | [●] |

If there is some sort of vagueness in background research, the IPO can be disastrous in its bids and overall subscription.

Who decides the NSE Price Band in IPO?

It is the company that is filing the IPO that decides the price band in IPO. However, they do take professional assistance from lead managers or merchant banks.

Some users believe that SEBI has a role to play in deciding the price or NSE price band in IPO. However, this is incorrect. SEBI has nothing to do when it comes to pricing.

SEBI is a regulatory body and focuses on validating the content of the IPO prospectus.

Furthermore, lead managers perform a detailed market study, competitive analysis within the industry, launch road shows, and do a lot of other things to figure out the right bracket range for the price range and the exact price value. This is a crucial step.

Simply because, if the NSE price band is put higher than the investor expectations, then the IPO may go under-subscribed as the investor might feel it to be expensive and less lucrative for future returns.

Otherwise, if the price band is lower than the expectations, then yes, there will be over-subscription but the company filing the IPO may lose out on potentially much higher capital that it could have risen.

Also Read:

In case You are interested to Apply in IPO?

More on Upcoming IPO 2021

| Upcoming IPO List | |

|---|---|

| IPO | Issue Size |

| Craftsman Automation IPO | ₹820 Cr |

| Laxmi Organics IPO | ₹600 Cr |

| Anupam Rasayan IPO | ₹760 Cr |

| Easy Trip Planners IPO | ₹510 Cr |

| MTAR Technologies IPO | ₹596.41 Cr |

| Kalyan Jewellers IPO | ₹ 1750 Cr |

| Bajaj Energy IPO | TBA |

| Nureca Limited IPO | TBA |

| Nazara Technologies IPO | TBA |

| Studds Accessories Ltd IPO | TBA |

| Suryoday Small Finance Bank IPO | TBA |

| Stove Kraft Ltd. IPO | TBA |

| Barbeque Nation IPO | TBA |

| Home First Finance Company IPO | TBA |

| Soma Comstar IPO | TBA |

| Apeejay Surrendra Park Hotels IPO | TBA |

| Craftsmen Automation IPO | TBA |

| Puranik Builders IPO | TBA |

| Aadhar Housing Finance IPO | TBA |

| ESAF Small Finance Bank IPO | TBA |

| Macrotech Developers IPO (Lodha Group) | TBA |

| India Pesticides IPO | TBA |

| PowerGrid IPO | TBA |

| LIC IPO | TBA |

| Policy Bazaar IPO | TBA |

| Arohan Avishkaar Group IPO | TBA |

| Seven Islands Shipping IPO | TBA |

| Nykaa IPO | TBA |