Swing Trading

More on Online Share Trading

Swing Trading is a popular method of active trading, wherein the financial instrument is held for short to intermediate-term, ranging from two days to two weeks. The positions are at least held overnight in swing trading.

The swing traders work on similar principles as day traders, as the purpose is to make profits from short-term price movements.

In this detailed review, we will discuss several aspects of this form of trading, including:

- Meaning, Basics, Definition

- Tips

- Techniques

- Indicators

- Strategies

- Screeners

By the end of this tutorial, you should be able to figure out the different facets that you need to be aware of as well understand how to start swing trading!

Swing Trading Meaning

When you hear somebody using the term ‘Swing trading’, you need to understand that this is just a shorter format of a delivery trade where the trader is going to exit the position in a few days.

A lot of traders confuse it with the intraday trading format. Well, there is a difference between Swing Trading and Day Trading.

In intraday trading, the positions are all squared off before the end of a trading day, while in swing trading the positions are held at least overnight and may extend to few days to few weeks.

In order to be successful at swing trading, the traders use a mix of both technical and fundamental analysis.

The technical analysis of stocks is used to predict the price movement and to find out the stocks that have the potential of large price movement in a short duration. While when we talk about the fundamental analysis of stocks, it is used to assess the intrinsic value of the stocks.

Remember this basic difference if you wish to succeed in analysing and selecting stocks for your investments.

Also Read: Swing Trading Pros and Cons

On the basis of both technical and fundamental analysis, the swing traders determine the stocks or securities that can give him maximum returns on a short-term or intermediate-term basis, with least risk, especially when the prices are either reversing back to the average or a rally is fading.

Swing trading is mostly used for stocks and options.

Now, we will go a little advanced into the concept and learn some of the basic strategies of swing trading.

Swing Trading Strategies

In a proper swing trading setup, the profits expected is generally 5-10%, which may seem less but the strategy is to make cumulative short profits over a short period of time to give big overall returns.

Similarly, in order to take cumulative benefits, stop loss also has to be at 2-3%, compared to 7-8% in other forms of trading, to ensure that losses are also less.

This brings swing trading to a healthy 3:1 profit to loss ratio, which is a fair portfolio management rule for success.

Some of the strategies used for swing trading are as follows:

1. Support & Resistance Triggers

The usage of support and resistance levels has proven its worth in all forms of trading, including swing trading.

Support is the level below the current price where buying overcomes selling pressure. A swing trader enters into a buy trade on the bounce off the support line with a stop-loss just below the support line.

Similarly, the resistance level is above the current price where selling overcomes buying pressure.

Here, the swing traders enter a sell trade on the bounce off the resistance level, with a stop-loss just above the resistance level.

2. Channel Trading

This is used when the trader wants to trade with the trend. A channel is plotted around the trend, bearish or bullish, and the position is taken where the prices bounce off the top line of the channel.

3. Simple Moving Averages

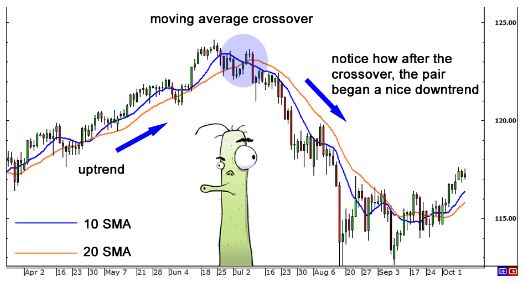

It is a popular swing trading strategy wherein the simple moving average is used to smoothen out the price data over a period of, say, 10 days or 20 days.

The averages are connected to form a smooth line, eliminating the surrounding noise.

With a 10 and 20-day swing trading system, when the 10 day SMA crosses above the 20-day SMA, a buy signal is generated and vice versa.

4. Moving Averages Crossover

It is a popular strategy wherein there are two lines: the MACD line and the signal line, and a buy or sell signal is generated when these lines cross each other.

Swing Trading Indicators

Do you use technical indicators for your stock market analysis?

You must be using those for the technical or fundamental form of research? Well, on a similar basis, there are a few handy swing trading indicators that put you in a comfortable spot in order to figure out the “right” kind of stocks suitable for your swing trades.

Some of those are listed below:

RSI or Relative Strength Index

There are instances in the market when it is either flat, oversold or overbought. In order to figure out the ideal timing of entering the market, the RSI indicator is really helpful.

Now, how that actually works?

See, this indicator value is anywhere between 1 to 100. If it is at a scale of around 70 or more, then the market or stock is overbought and in the coming time, it is going to correct itself i.e. the stock value will go down.

At the same time, if the RSI is placed at 30 or so, then it can be seen as the market being undersold and the stock is going to pick up its value in some time.

Visual Analysis Indicator

This indicator “shows” you some of the market “patterns” that can help you in taking the “right” decisions of entering or exiting the stock at the “right” time.

At times, when you look at patterns, the stock analysis works like a charm instead of you performing all sorts of data mining activities.

Thus, the visual analysis indicator provides you with the right kind of visuals of the market performance to take a call for your swing trade.

Moving Average Indicator

This indicator for more “mathematical” in nature i.e. number based. For instance, here, the indicator will be summing up the closing prices of the (let’s say) last 28 days and dividing the sum by 28.

It keeps on repeating this pattern of summation and division to give you an idea of how the average closing price is faring for the last few trading sessions.

If the current market index value is lesser than the average moving average, it obviously implies that the market is moving towards a weaker trend and similarly, the other way around when you are looking to spot a stronger market trend.

Swing Trading Tips

Every form of trading has its own set of tips and tricks.

So, is the case with Swing trading!

Since this trading format is lesser strict than intraday trading and may require lesser commitment as compared to delivery trading, a lot of times, traders end up goofing up in their trading decisions.

Thus, you may choose to remember these swing trading tips and apply those in your real-time market investments:

- Don’t give too much of importance to market news, sometimes it is just to create a short-term hype and has no market significance.

- Price action is the primary parameter you must be monitoring, rest all may actually be just distractions.

- Holding time is of high importance that ends up deciding whether you lose or make money in your trade and how much!

- Don’t just jump every wagon you see out there on the road. Sometimes, it’s not going to come back and end up hurting you.

- Keep an eye on the market calendar in terms of different announcements, results, collaborations etc. These events may have a direct or an indirect impact on how the stock may move in short-term.

This, by now means, is an exhaustive list of all sorts of swing trading tips. In fact, we encourage you to share what you think should be part of this list based on your trading experience.

Swing Trading Techniques

In order to begin swing trading, the most crucial decision is to choose the correct stocks.

The key is to choose stocks with the highest liquidity. For this reason, swing trading is also called momentum trading. The liquid stocks have a high volume and follow a trend.

It is imperative for the swing traders to follow a trend and trade only when the market is moving, instead of trading in flat markets. In order to identify trends in swing trading, various methods are used like moving average convergence divergence, average directional index or fast-moving averages (discussed above).

In terms of the tools, swing traders use similar tools and software as intraday traders. They use trading software and charts, however, the charts used are usually for longer time frames like 60-minute, daily and weekly charts.

Technically, swing trading happens when the trending stocks pause in-between trends and follow corrections and then start moving in the direction of the trend.

It is this plus moment that the swing traders intend to capture and capitalise on, as at the pause moment risk-reward ratio is the best and use of capital is optimum.

The key here is to identify the pause moment, which is done through various tools. Some swing traders use the support and resistance levels of the previous swing highs and lows, while others use moving average to find out the point where the reversal is expected i.e. the price of security moves back to the previous top of the bottom.

Many other swing traders make use of stochastic oscillators to find out the overbought and oversold points as their points of entry into the market.

Swing Trading Books

Swing trading is the opportunity to make a profit from the stock market in short term with comparatively lesser risk. But like any other type, there are a few things that a trader must consider to increase the chances to earn profit.

For this, it is important to gain an understanding before diving into the trading world. So, if you are beginner, it is good to refer some of the books written on swing trading.

Here is the detail in the table below:

| Swing Trading Books | |

| Mastering the Trade | John F. Carter |

| How to Swing Trade | Andrew Aziz and Brian Pezim |

| Come Into My Trading Room | Dr. Alexander Elder |

| Swing Trading for Dummies | Omar Bassal |

| Swing Trading As A Part Time Job | Brett Brown |

| Swing Trading with Technical Analysis | Ravi Patel |

| The Definitive and Step by Step Guide to Swing Trading | Mr. Andrew Johnson |

As a bottom line, swing trading is an effective method of trading when intermediate-term good profits are expected, with risks being limited to a few days to weeks.

In case, you are looking to perform intraday trading but do not know which stockbroker suits the best for you, just fill in your details below.

We will arrange a callback for you, absolutely free!

More on Share Market Education:

If you wish to learn more about different types of trading and their related intricacies, check out some of the references below: