Collar Strategy

All Option Strategies

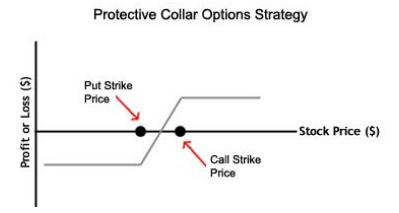

Collar strategy is an options trading strategy which is used when the trader wishes to protect himself from the downward move in the market. In the collar strategy, the trader holds the underlying security, along with selling an out-of-the-money call option and buying an out-of-the-money put option.

The purchased put must have a strike price lower than the market price and the written call must have the strike price higher than the current market price.

The expiry month and the number of contracts must be the same for the call and put options.

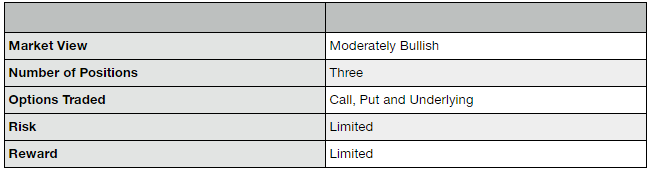

The collar strategy is used when the trader is mildly bullish towards the market. He expects the prices to go up, but at the same time, he wants to limit his risks if the prices go down.

It is ideally not used by the traders who have very strong bullish sentiments, as this strategy limits the profits to the strike price of the call.

Also Read, Stress Free Trading

Theoretically, collar strategy is a combination of a protective put and a covered call.

The trader is able to benefit from the price rise by holding the underlying security and receives ownership benefits like dividends. At the same time, the risks are limited to the use of protective put.

The premium paid for the put is compensated by receiving premiums by selling the call options.

Thus, if the price falls, a protective cushion is offered by the protective put and if the price rises, profits are gained with a limit to the strike price of the calls.

Collar Strategy Timing

The ideal time to use a collar strategy is when the trader is conservatively bullish towards the market. The trader expects the prices to go up for his holdings, but at the same time, he wants to cushion himself against the fall in prices. It is not an ideal fit for traders with a strongly bullish outlook, as this strategy limits the profit as well.

A collar is formed by combining the holding of the underlying with a protective put and a covered call. The trader will write covered calls to earn premiums and at the same, he will buy protective puts to limit the losses.

The maximum loss in a collar strategy is limited to the difference between the purchase price of the underlying security and the strike price of the put option. The net premiums received are then factored in. In the absence of this strategy, the trader could have faced unlimited losses.

Only by paying the premium for the additional put option, he is able to limit his losses. The premium paid for the put option can also be compensated by the premium received by writing the call option.

The maximum profit in the collar strategy is also limited. It is equal to the difference between the strike price of the short call and the purchase price of the underlying security. The net premium received is added to it.

By putting a cap on the losses, the profits also get capped at the strike price of the call.

Collar Strategy Example

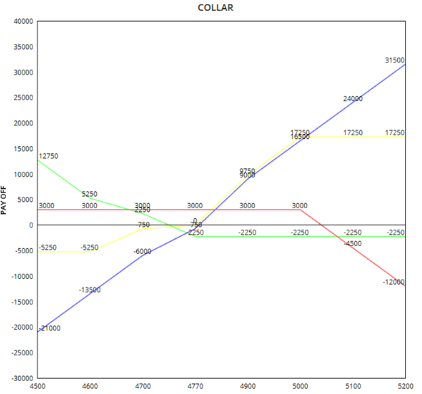

To understand the Collar strategy in detail, let us consider a trader who owns shares of Kama Holdings Ltd., which are trading at ₹4780.

The trader expects that the price will rise slightly, but he wants to protect himself from the risk of the prices going down. In order to do that, he buys a protective put at ₹4700 for a premium of ₹30 and sells a covered call at ₹5000 for a premium of ₹40.

Scenario 1:

If the price of Kama Holdings shares goes up to ₹5100, the put option will expire worthlessly and the call option will be exercised and the trader will have to pay ₹100.

The trader will make a profit of 5000-4780= ₹220.

In terms of premiums, the trader will receive 40-30= ₹10. The net payoff will be (220-100+10) = ₹130.

In case the trader had not opted for the collar strategy, the profit would have been 5100-4780= ₹320.

Thus, with the use of the collar strategy, the profit gets limited to the strike price of the call, and the trader loses the chance to make unlimited profits if the price keeps going up.

Scenario 2:

If the price of Kama Holdings shares goes down to ₹4600, the loss gets limited due to the put option at 4700. The total loss, in this case, is 4780-4700= ₹80. The call option will expire worthlessly and a net premium of ₹10 is paid.

The net loss is ₹80-10= ₹70.

In case the trader had not adopted the collar strategy, the loss would have been 4780-4600= ₹180.

Thus, by using the collar strategy, the traders are able to limit their losses. The premium paid for the put option is also compensated by the premium received for the call options.

Thus, we can conclude from the example that collar strategy helps in limiting the losses. However, it also limits the profit which can only be suitable when the trader was not expecting prices to go much high.

If the trader is moderately bullish, he can use this strategy to limit the risk, but if he is strongly bullish, this strategy should not be used as it may end up reducing the potential profit.

Advantages of Collar Strategy

Let’s quickly understand some of the benefits of using the Collar strategy in your trades:

- The trader still owns the underlying and can get ownership benefits like dividends and voting rights.

- The risk gets limited if the price of the security goes down.

Disadvantages of Collar Strategy

- The potential for making profits also becomes limited to the strike price of the call option. The trader could have made more profits without the collar strategy if the prices go very high.

Collar Strategy in a Nutshell

As a bottom line, collar strategy is an excellent strategy when the trader wants to hold security and still protect himself from the downward movement in the prices.

The losses are controlled with the help of protective put and position is maintained with the help of covered call, holding the underlying alongside.

In case you are looking to start trading in the share market, just fill in some basic details in the form below.

More on Share Market Education:

You can read this review in Hindi as well.