Long Call Condor

All Option Strategies

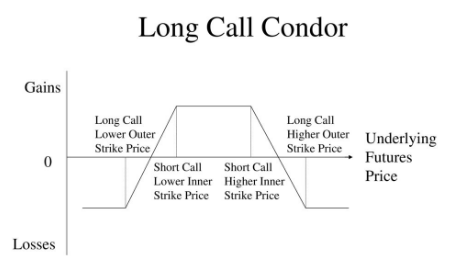

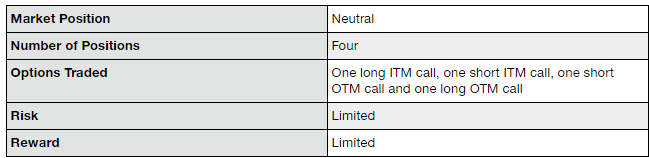

Long call condor is the options trading strategy which includes four legs, made up of four different call options with different strike prices, but same options expiration date. The strategy is used when the trader expects little or no movement in the price of the underlying asset.

Long call condor is a direction-neutral strategy. It is not necessary to know the direction in which the market is expected to move. In fact, it works at the time when the implied volatility is low, and the price is not expected to move at all.

The strategy is constructed by using one long lowest in-the-money call, one short middle in-the-money call, one short middle out-of-the-money call and one long highest strike out-of-the-money call.

This structure makes it a combination of an in-the-money bull call spread and an out-of-the-money bear call spread.

The strategy holds a limited risk and limited reward profile.

The maximum profit is recorded when the price of the underlying lies between the two middle strike prices at the expiration date.

The maximum loss is incurred with this strategy when the underlying price is either below the lowest strike price or above the highest strike price at the time of expiration.

Long Call Condor Strategy Timing

The ideal time to use the long call condor strategy is when the underlying asset prices are expected to be stable and not move in the near future. At this time, the investor can use the long call condor to earn profits even without the price movement.

So, when the investor is expecting the price to remain within a narrow range, he will create a long call condor.

This is done by buying one ITM call with the lowest strike price, selling one ITM call with the lower middle strike price, selling one OTM call with higher middle strike price and buying one OTM call with the highest strike price. This ensures that if the price remains between the lowest and highest strike prices, the strategy will generate profit.

A loss will be incurred if there is high volatility and price goes below the lowest or above the highest strike price.

The long call condor is a modification of the long call butterfly strategy in a way that the two middle strikes have different strike prices. This leads to a reduction in the profit potential, but the risk also reduces.

The range of making a profit is wider in the long call condor, thus reducing the risk. Long call condor is a better bet when the investor is more uncertain of the price movement.

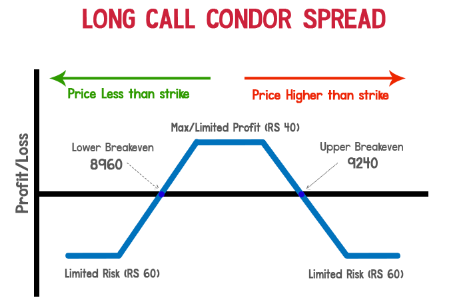

The maximum profit from the strategy is limited to the difference between the middle strikes, less the premiums paid. The maximum profit situation is reached when the price of the underlying is between the two middle strike prices at the time of expiration.

The maximum loss from the strategy is also limited to the total amount of premiums paid. The situation of maximum loss arises when the market is volatile and the price of the underlying is below the lowest strike price or above the highest strike price at the time of expiration.

Long Call Condor Example

Considering the NIFTY prices as an example, let us assume NIFTY to be at 9100. The trader expects that the price will remain within a narrow range.

Long call condor is made by buying a deep ITM call at 8900 for a premium of ₹240, selling an ITM call at 9000 at a premium of ₹150, selling an OTM call at 9200 at a premium of ₹40 and buying an OTM call at 9300 for a premium of ₹10.

The net premium paid is -240+150+40-10= ₹60.

Scenario 1:

If NIFTY closes at 9000, the strategy will generate profit. The highest OTM will expire worthlessly and a premium of ₹10 is paid; the higher middle strike OTM call will expire worthlessly and a premium of ₹40 will be received.

The lower middle strike ITM call will also expire worthlessly and a premium of ₹150 is received.

The lowest strike ITM call will be exercised and the net loss will be (9000-8900)-240= 100-240= -₹140, i.e. a loss of ₹140.

The net payoff from the strategy will be -10+40+150-140= ₹40.

This is the maximum profit that can be obtained from the strategy. The price of the underlying is 9000 at expiration, which is between the two middle strike prices of 9000 and 9200.

Scenario 2:

If NIFTY closes at 9600, the strategy will incur a loss as the price has gone up sharply and shows high volatility. All the options are in the money.

The profit from the deep ITM lowest call is (9600-8900)= ₹700 and premium of ₹240 is paid so the net profit will be 700-240= ₹460.

The lower middle strike ITM call will generate a loss of (9600-9000)= ₹600 and premium of ₹150 will be received.

The net loss will be 600-150= ₹450.

The higher middle strike OTM call will also generate a loss of (9600-9200)= ₹400, but after receiving a premium of ₹40, the net loss will be 400-40= ₹360.

The highest strike price OTM call will generate a profit of (9600-9300)= ₹300, but after paying a premium of ₹10, the net profit will be 300-10= ₹290.

Thus, the net payoff will be 460-450-360+290= -₹60, i.e. a loss of ₹60.

Hence the strategy will generate a loss of ₹60, which is the maximum loss from the strategy and is incurred when the price goes beyond the lowest or highest strike prices.

Scenario 3:

If NIFTY closes at 9240, the highest strike OTM call will expire worthlessly and a premium of ₹10 will be paid. The higher middle strike price OTM call will give a loss of (9240-9200) = ₹40, which will be compensated by ₹40 received as premium.

The net payoff will be zero.

The lower middle strike ITM call will generate a loss of (9240-9000)= ₹240, but after receiving a premium of ₹150, the net loss will be 240-150= ₹90.

The lowest strike price ITM call will bring a profit of (9240-8900)= ₹340, and after paying a premium of ₹240, the net profit will be 340-240= ₹100.

Thus, the net payoff of the strategy will be -10+0-90+100= 0. The net payoff will be zero and this is one of the break-even points of the strategy.

Advantages of Long Call Condor

Here are some of the top advantages you must be aware of before using this strategy:

- The strategy has the capability to generate profit even when there is low volatility in the market.

- The profit is limited, but the risk is also limited.

- Compared to other strategies like long call butterfly, long call condor has a wider range to generate profits, thus reducing the chances of risk.

Disadvantages of Long Call Condor

At the same time, you must know these concerns with Long Call Condor strategy as well:

- The amount of premiums paid is high due to the four legs of the strategy.

- The amount of profit is less compared to other strategies.

- The selection of appropriate strike prices is very critical.

Long Call Condor in a Nutshell

Thus, long call condor is a complex strategy, but it has limited risk exposure and limited profit.

The profit generated is limited and less but the chances of risk are also reduced as the prices can move to a wider range of strikes before leading to losses.

It is an excellent strategy to be used in times of low volatility and uncertainty.

In case you are looking to invest in options or share market in general, let us assist you ahead.

More on Share Market Education: