Short Box

All Option Strategies

The arbitrage situation makes the strategy almost risk-free and helps to make limited profits due to price discrepancies in the options.

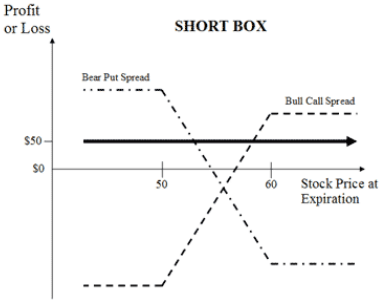

Short box is the exact opposite of the box spread. In box-spread, the spreads are bought, whereas in short box the spreads are sold. The condition for using this options strategy is when the spreads are overpriced compared to their combined value at expiration.

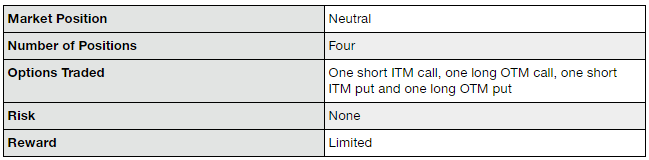

The short box strategy is constructed by four options combined.

It includes selling one in-the-money call, buying one out-of-the-money call, selling one in-the-money put and buying one out-of-the-money put. All the call and put options are at the same strike price and the same expiry. The benefit of using four legs is that the movement in one option balances out the movement in the other, and the net result becomes risk-free.

Profit is generated when the movement in one option is more in the right direction than the other option.

Short Box is a net credit strategy. The premiums are received when the strategy is set. Also, the box spread is direction neutral. The profits do not depend on the direction in which the price of the underlying asset moves.

Short Box Strategy Timing

The most suitable time to use the short box strategy is when the options are considered to be overpriced compared to their value at the time of expiration. The situation arises when the prices are soon to go down.

However, box spread is a complicated strategy and it must be used only when the trader is certain that the profits generated from the strategy will be enough to compensate for the commissions and brokerages paid.

To construct this options strategy, four option positions are taken.

This includes two calls, one in-the-money and one out-of-the-money, and two puts, one in-the-money and one out-of-the-money. It is critical to choose the correct strike prices because the profits vary with the different strike prices.

Thus, because of the presence of complementary options, if the price of the underlying moves, one of the spreads will definitely be able to generate a profit, making the strategy risk-free.

Short box is used when there are minor price discrepancies in the option prices.

The put-call parity gets disturbed and for that short duration of time, the imbalance is capable of bringing in profits. The trader needs to recognise this opportunity as soon as possible and take positions to capture the movement.

Short box is a limited profit strategy.

The amount of profit is very less, as a trade-off for the low or no risk. The expiration value of the box is equal to the difference between the higher strike price and the lower strike price.

The net profit generated is equal to the difference between the net premiums received and the expiration value of the box.

With respect to the risk profile, the short box is a risk-free strategy. It is an arbitrage strategy, so movement in one direction is balanced out by the movement in the other direction. This makes this options strategy a delta-neutral strategy.

Short Box Example

To understand the short box strategy in detail, let us consider a stock that is trading at ₹55 in the month of May 2018. In order to create a short box, we will first sell a bull call spread.

This is done by selling an ITM June call at ₹50 and buying an OTM June call at ₹60. The premium received for selling ₹50 call is ₹7 and the premium paid for buying ₹60 call is ₹1.50.

Similarly, we now have to sell a bull put spread. This is done by selling the OTM June put at ₹60 and buying ITM put at ₹50. The premium received for selling ₹60 put is ₹7 and the premium paid for buying ₹50 put is ₹2.

Now, we can make the calculations.

The cost of selling is the bull call spread is (7-1.5)= ₹5.5 and the cost of selling the bear put spread is (7-2)= ₹5.

Therefore, the total cost of this spread is (5.5+5)= ₹10.5.

The expiration value of the box is the difference in the strike prices. Therefore, it is (60-50)= ₹10.

Thus, profit is equal to (10.5-10)= ₹0.50, and the net profit will be calculated by further subtracting the brokerage and taxed.

In order to understand the process of arbitrage and risk-free element, let us take a few scenarios.

Scenario 1:

If the price of the underlying moves up to ₹60, the June 50 put, the June 60 call and the June 60 put will expire worthlessly and only the June 50 call will be exercised.

This makes the value of the box at expiration as (60-50)= ₹10.

Profit remains the same as (10-5-10)= ₹0.5.

Scenario 2:

If the price goes down to ₹50, the June 50 put, the June 60 call and the June 50 call will expire worthlessly and only the June 60 put will be exercised.

The value of the box will be (60-50)= ₹10 and the profit will still be (10.5-10)= ₹0.5.

Scenario 3:

If the price remains at ₹55, the June 50 put and June 60 call will expire worthlessly.

Both the June 50 call and June 60 put will be exercised and the value of the box will be (55-50) + (60-55)= 5+5= ₹10.

The profit will be (10.5-10)= ₹0.5.

Thus, we can observe that even when the price remains constant or goes up or down, the value of the short box remains the same.

The profit of the entire strategy also remains the same and the strategy remains free of any risk.

Short Box Advantages

Here are some positives of using this options strategy:

- It is a net credit strategy, so it does not require initial capital investment.

- The risk profile of short box strategy is almost always zero.

Short Box Disadvantages

At the same time, you must be aware of some of the disadvantages of using this strategy in your trades:

- The positions need to be stayed in till the expiration time and cannot be closed earlier.

- The profit potential of the strategy is very low.

- It is a complicated strategy and must be used only by the experienced traders.

- The brokerage and commissions may end up negating the profit completely.

Short Box in a Nutshell

As a bottom line, the short box is a suitable strategy to be used only when the trader can be certain that the commissions and brokerage will not end up wiping away the profits.

The strategy has no risk, yet the profit generated is very small.

In case you are looking to get started with options trading or share market investments in general, just fill in some basic details in the form below.

More on Share Market Education: