Alice Blue Online

List of Stock Brokers Reviews:

Alice Blue Online is a Chennai-based discount stockbroker that was incorporated in the year 2006.

In this detailed review, we will talk about various aspects related to this broker and hopefully, by the end of the review, you will be able to figure out whether it is a suitable broker for you or not.

Alice Blue Online Review

With more than 750 franchises across the country, Alice Blue (also called Alice Blue Financial Services) gives you a taste of offline assistance (that is generally provided by Full-Service stockbrokers).

As per the broker claims, the major focus of Alice Blue is technology in terms of the online share trading applications it has to offer. Recently, they have come up with an algo trading solution as well.

It has running memberships with NSE, BSE, MCX, MCX-SX, NCDEX and thus, allows its clients to trade and invest in the following segments:

- Equity

- Commodity Trading

- Currency Trading

- Depository services

Sidhavelayutham M, Director – Alice Blue Online

Alice Blue Demat Account

To get into the trade with Alice Blue you need to open the demat account.

The broker is again known for offering a completely paperless process for opening an account. So if you are willing to have Alice Blue demat account then follow the basic steps mention below:

- Visit the website, and enter the basic details along with the mobile number.

- An OTP is sent to your mobile number.

- Now verify your email id and proceed further by clicking on the NEXT button.

- Upload your ID proof like the Aadhaar card, PAN card, etc.

- Now upload the bank details and link your bank account with the trading account.

- The next step is to upload your photograph and signature.

- Click on proceed and click on the verification by completing the e-sign process by entering the Aadhaar number and OTP received on the registered mobile number.

You can smoothen the whole process of demat account opening, by completely relying on us. Just fill in the basic details in the form below and open a demat account for FREE!

Alice Blue Trading

You can trade online using the Alice Blue trading platform. So once you open a demat account with Alice Blue you can trade in different segments using the trading app and other online platforms provided by the broker.

To trade in segments further you need to pay the brokerage charges, the detail of which is provided ahead in the article.

So, let’s dive in to the detail of the trading process, platform and other related information.

Alice Blue App

When it comes to trading platforms and focus on technology, Alice Blue Online has a lot to work upon. Mostly for the reason that technology is one aspect that cannot be ignored – be it any industry. Although, the broker has not ignored it, at the same time it has not taken the responsibility on its own as well.

Completely out-sourcing the trading platforms and relying on third-party trading softwares lets the broker focus on other business aspects. Life becomes easy!

But looking from the customer’s point of view, in case there is any feedback or comment or concern – the broker is going to act as an intermediary and nothing beyond.

Nonetheless, let’s talk about these trading platforms one by one:

NEST

NEST is a terminal-based trading platform by Omnesys Technologies, with Alice Blue Online as one of the licensees. The users need to download and install this software on their desktop or laptop to carry out trading. Some of the main features of this trading software are:

- Market Watch usable across order types

- Auto and admin square off

- Aftermarket orders placement

- Live monitoring of the market

- News alerts and notifications

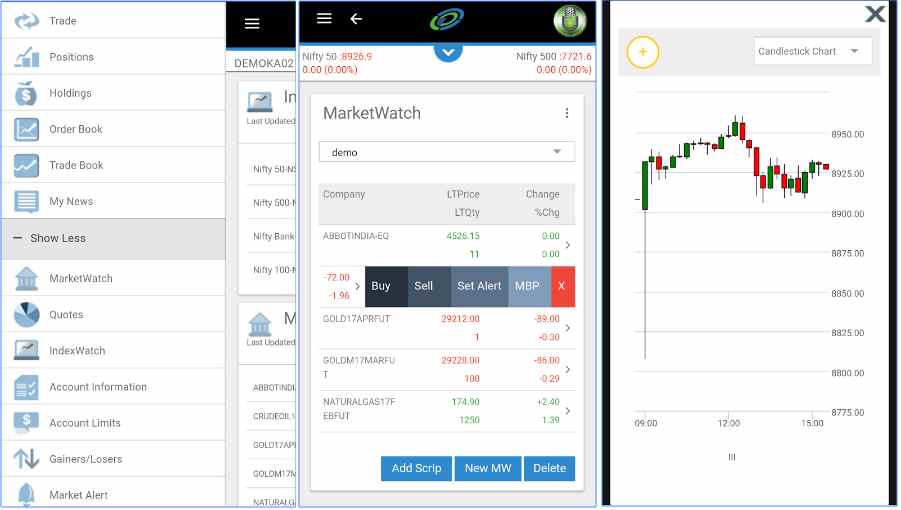

This is how the NEST trading platform looks like:

Alice Blue ANT

The discount broker has recently come up with ANT eco-system of new kinds of trading platforms for its clients. Within this, you get access to a couple of terminal softwares as well as a mobile trading app. Let’s have a quick glance at some of the features provided within ANT applications:

ANT Meta

ANT Meta is a terminal-based application that allows you to analyze the share market across segments such as Equity, Commodity, Currency. Apart from that, you can develop different trading techniques so that those can be executed on your orders as and when required.

Some of the top features of this application are:

- 50+ charts tools as well as technical indicators

- Drawing tools for personalized share market analysis

- Basics features such as Market Watch, toolbar etc

This is how ANT Meta looks like:

ANT Desk

ANT Desk is a mainstream terminal trading application that allows you to trade across different segments. The application needs to be downloaded on your computer, laptop or desktop.

Some of the features that are provided in the ANT Desk are:

- Charting tools at both Intraday (30 days) as well as Historical levels (10 years)

- AMO (After Market Order) book available

- Real-time market quotes from BSE, NSE, MCX etc.

- Daily market research reports provided

ANT Mobi

The discount broker provides a mobile version of ANT tools as well named ANT Mobi. This mobile application is certainly better than the one generally provided by the broker (discussed in the next section) in terms of user experience and the number of features.

Some of those are discussed here:

- Multiple types of orders allowed (Regular, Cover Order, AMO)

- 6 types of charts with 15 different frequency/time-frame variants

- Around 70 technical indicators

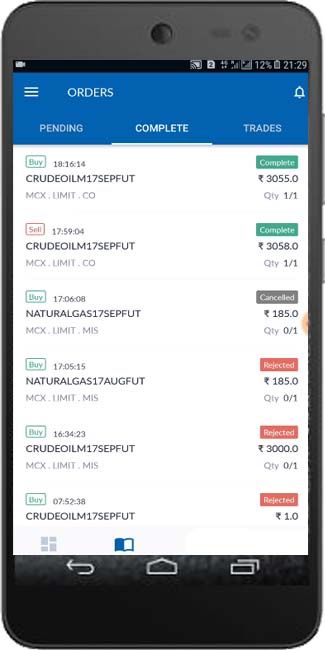

This is how ANT Mobi looks like:

Here are some of the stats about ANT Mobi from Google Play Store:

| Number of Installs | 10,000+ |

| Mobile App Size | 12 MB |

| Negative Ratings Percentage | 18.66% |

| Overall Review |  |

| Update Frequency | 3-4 Weeks |

Alice Blue Mobile App is an “okayish” app in nature with a room for improvement in quite a few aspects. But first, let’s talk about some of its features:

- Push notifications based on your preferences on market and portfolio updates

- Trading across segments possible

- Custom watch lists as per your requirements

- Quick access to news and index watch

- Risk management check is done at the individual client and order level.

Here is how the app looks like:

Here is how the app is rated at the Google play store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 38.1 MB |

| Negative Ratings Percentage | 27% |

| Overall Review |  |

Some of the concerns with the mobile app (based on client reviews and user interviews) :

- Auto quick log-outs

- Few Issues in order closings

- Quickly disconnects at low internet connection areas

You can use either of these platforms to trade in Alice Blue.

Alice Blue Online Customer Service

The discount stockbroker allows you to communicate through the following channels in case you are looking to get in touch:

- Web-f0rm

- Offline Branches (16 in total)

- Phone

Although Alice Blue Online is a discount stock broker, still it has a limited offline presence in the states of Tamil Nadu, Kerala, Andhra Pradesh, Telangana, Karnataka, Maharashtra, West Bengal, Orisa and Bihar.

As far as the other channels are concerned, the quality is around average with executives having limited proficiency in the products and services the stockbroker has to offer to go along with the way the market operates.

In simpler terms, keep your expectations minimum if you are looking to open your trading account with Alice Blue Online, as far as customer support is concerned.

Alice Blue Charges

Alice Blue online offers zero brokerage trading but their pricing plans are based at the subscription level. Here are the Alice Blue charges in detail:

Alice Blue Account Opening Charges

Here are the details of the account opening charges:

| Alice Blue Online Account Opening Charges | |

| Demat Account Opening Charges | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹0 |

Alice Blue Brokerage

At the same time, the brokerage charges levied by the stockbroker are flat in nature and gives a clear idea of how much you will end up paying in your trades to the broker.

Alice Blue brokerage plans come up with a special discount offer for trader.

Its latest Freedom 15broker allows you to trade at the flat fees of ₹15 across segment.

Here is the detail of the brokerage fees below:

| Alice Blue Online Brokerage | |

| Plan Name | F15 |

| Equity Delivery | ₹0 |

| Equity Intraday | ₹15 or 0.01 whichever lower |

| Equity Futures | ₹15 or 0.01 whichever lower |

| Equity Options | ₹15 per lot |

| Currency Futures | ₹15 or 0.01 whichever lower |

| Currency Options | ₹15 per lot |

| Commodity | ₹15 or 0.01 whichever lower |

| Commodity Options | ₹15 per lot |

So whether you trade in intraday, futures the broker charges the flat fees of ₹15 per trade or 0.01% of the turnover.

The delivery trading charges are nil and the Alice Blue option charges are kept flat ₹15 per trade.

Earlier the broker charges the fees according to its F20 plan. So if you are an existing customer of the broker, you can update the plan by following few steps:

- Visit the website and click on Login.

- Select BOT from the drop-down menu and now login using your User Id and Password.

- Click on ‘My Request’ on the left side and click on the brokerage plan.

- Scroll down to the bottom of the page and now click on the ‘Freedom 15 brokerage plan’.

- The brokerage plan is changed and the request for updating the brokerage plan is disabled.

Apart from the brokerage, in case you avail the call and trade facility, there is a charge of ₹20 per executed order.

Lastly, the broker charges a Demat transaction fee for CDSL at ₹15 +Gst

You can use this Alice Blue Online Brokerage Calculator for more details.

Alice Blue DP Charges

Apart from brokerage, one must consider the DP charges.

These charges are generally levied on selling per scrip per day.

The broker here comes with the minimum plan where you need to pay the fees of ₹15 per scrip per day as the depository transaction fees.

| Alice Blue DP Charges | |

| DP Charges | ₹15 per scrip |

Alice Blue Auto Square Off Charges

Apart from the brokerage, there are the auto-square-off fees charged by the broker which is imposed if you skip closing the intraday position before the market closes.

Here is the detail of the fees in the table below:

| Alice Blue Auto Square off Charges | |

| Auto Square off Charges | ₹20 per trade |

Alice Blue Online Margin

The discount broker offers the following exposure values across different trading segments:

| Alice Blue Online Margin | |

| Trading Segment | Margin |

| Equity Delivery | 4x |

| Equity Intraday | upto 6x |

| CO: Nil | BO: upto 6x | |

| Futures | CNC/NRML: 1x |

| MIS: 1.25x | |

| CO: 1.25x | |

| BO: 1.25x | |

| Options | CNC/NRML: 1x |

| MIS: 1.25x on Buy and Sell | |

| CO: 1.25x on Buy | |

| BO: Nil | |

| Commodity | CNC/NRML: 1x |

| MIS: 1.25x | |

| CO: 1.25x | |

| BO: 1.25x |

Alice Blue Online Disadvantages

Here are some of the concerns if you go ahead with the services of this discount stockbroker:

- Trading platforms especially the mobile app needs to be improved (as discussed above)

- Strict policies in account maintenance (can be closed if there is no activity for 6 months)

Alice Blue Online Advantages

At the same time, you get the following benefits if you have your trading account with Alice Blue:

- Multiple pricing plans with complete transparency

- Exposure up to 20 times available for Intraday Trades

- Knowledge centre available for basics and fundamentals of trading and investment

Interested in opening an Account? Enter Your details here to get a callback!

More on Alice Blue Online:

If you are looking to know more about this discount broker, here are some other reference articles for you:

Video Review

Video Review

Alience blue giving very worst customer service !! They did not understand customer pain and suffereing .. they are not worth fr service … I never experience this type of bad , worst service

Aliceblue is the biggest cheater in this world. They charge stamp duty with highest possible rate 600 per caror and never return any money that they took. Even contacting SEBI they don’t take any action. Contact me if you have any question. I will share my worst experience with proof. Thanks.

I think about open account in Alice blue

Due to given more exposure

What about customer service ?

How trading platform ?

His trading platform how different from other ?

Please tell us about experience

I think about open account in Alice blue

Due to given more exposure

What about customer service ?

How trading platform ?

His trading platform how different from other ?

Please tell us about experience

Worst ever platform for trading. getting irritating daily with this platform.

I open online account my wife name but sare papar speed post se bhejne par aaj 15 din se mera account nahi open kiya he.custmer care par call karne par koi proper response nahi deta kai mail kar diye,kaya karu

Payin charges deducted from my account

I have payin 5000 from upi but I received just 4988.12 it’s 0.23%.

I have checked on lots of online platform nothing found.