Power Grid Infrastructure Investment Trust Dividend

The PowerGrid Infrastructure Investment Trust dividend isn’t just another payout—it’s a gateway into India’s high-voltage infrastructure story.

Think of an Infrastructure Investment Trust (InvIT) like a special kind of mutual fund.

It pools money from people like us to invest in huge, income-generating infrastructure projects, things like roads, pipelines, and, in the case of POWERGRID InvIT (PGInvIT), massive power transmission lines.

What makes PGInvIT stand out? It’s India’s first InvIT to be backed by a government entity, the Power Grid Corporation of India.

This government support and its focus on fully operational assets make it a strong contender for a stable investment, especially for those looking for regular income.

A dividend from Power Grid InvIT is the regular income that investors receive when they invest in units of the trust.

How Do InvITs Offer Returns to Investors?

SEBI mandates that InvITs distribute 90% of their net distributable cash flow to investors. For PGInvIT, this translates into payouts in three forms:

- Interest

- Dividend

- Return on Capital (ROC).

Most distributions occur quarterly or semi-annually, providing investors with regular cash inflows, much like rental income from property.

Historical Dividend Performance

PGInvIT has consistently maintained attractive dividend payouts since its listing.

For example, in FY 2024–25, it offered yields of around 12–13%, significantly higher than traditional fixed deposits.

Compared to another big InvIT like IndiGrid, PGInvIT’s pay-outs have been more stable due to strong government backing.

The trend has shown minimal fluctuation, adding to investor confidence.

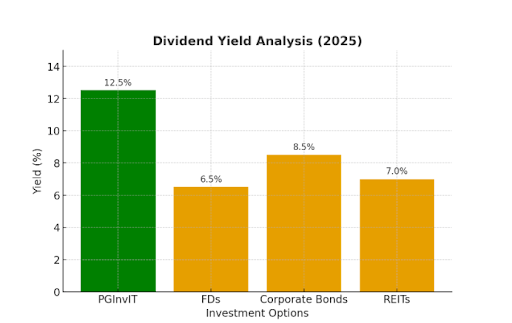

Dividend Yield Analysis

Now, to get a better understanding, let’s calculate the Dividend Yield:

Dividend yield is calculated as annual payout ÷ current unit price × 100.

With PGInvIT currently yielding ~12–13%, it easily beats FDs (6–7%) and even corporate bonds (8–9%).

REITs, another popular investment trust, usually give around 6–8%.

Clearly, PGInvIT stands out for income-seeking investors.

Let’s understand the graph:

- PGInvIT gives the highest yield (~12.5%) – meaning investors earn more income compared to other options.

- Fixed Deposits (FDs) have interest rates that are significantly lower (~6.5%), which is why many people opt for InvITs for better returns.

- Corporate Bonds (~8.5%) offer decent income but still don’t match PGInvIT’s payouts.

- REITs (~7%) provide real estate-based income, but again, the yield is lower than PGInvIT.

- Overall, the chart highlights that PGInvIT stands out as the top choice for steady, high income in 2025.

In comparison to others, PGInvITs offer a good return and making it an attractive investment option. So, if you are looking for a stable product, then know how to invest in Power Grid Investment Fund?

Once you have figured out the details, it’s equally important to understand how InvITs’ Dividend Taxation can impact your actual returns. While the returns may seem attractive at first glance, being aware of the tax implications helps investors make more informed and smarter decisions.

Let’s dive deeper into how dividends from InvITs are taxed, whether they’re tax-free or taxable in the hands of investors

InvITs Dividend Taxation

Tax treatment depends on the type of payout.

- Interest: taxed as per your income slab.

- Dividend: tax-free in most cases.

- Return on Capital: reduces your cost of purchase, taxed later during exit.

Let’s break that down with a detailed example.

Suppose Riya invests ₹10 lakh in the Power Grid Infrastructure Investment Trust (PGInvIT). Over the year, she receives a total pay out of ₹60,000, which is typically divided into three parts:

- Interest: ₹30,000

- Dividend: ₹15,000

- Return of Capital: ₹15,000

Now, here’s how her tax works:

- The interest component (₹30,000) is taxed as per her income slab. If Riya falls under the 20% tax bracket, she’ll pay ₹6,000 in tax.

- The dividend component (₹15,000) is tax-free in her hands (since the InvIT pays taxes before distributing it).

- The return of capital (₹15,000) is not taxed immediately—it simply reduces her cost of acquisition to ₹9.85 lakh. This adjustment will matter later when she sells her units, as it will affect her capital gains tax.

So, after tax, Riya effectively takes home ₹54,000 this year, translating to a 5.4% post-tax return.

Compare that to a fixed deposit (FD) at 7%, where the entire interest is taxed. For someone in the 20% tax bracket, the FD’s post-tax return would be around 5.6%, almost the same as PGInvIT. But if Riya were in the 30% bracket, her FD post-tax return would drop to 4.9%, making PGInvIT’s payout structure even more attractive for higher-income investors seeking tax-efficient income.

If you are interested in investing in InvITs in India, then begin your journey now. To begin, start with the process of opening a Demat account with a reliable stockbroker.

Still confused in choosing the right stockbroker, fill in your details in the form below:

Conclusion

PGInvIT plans to expand by acquiring more transmission assets, strengthening its long-term income potential.

Market experts believe dividend payouts will remain sustainable as regulated cash flows remain robust.

FAQs

Q1. What is the current dividend yield of Power Grid InvIT (PGInvIT)?

As of September 2025, PGInvIT has a dividend yield of -12.46%.

Q2. How often does PGInvIT pay dividends?

PGInvIT tends to pay its distributions quarterly. For example, in FY 2024-25, it made four ₹3.00 per unit payments.

Q3. What are the tax implications of PGInvIT dividends/distributions for a unit holder?

Distributions characterized as interest are taxed as per the investor’s income tax slab.

Q4. When was the latest dividend declared by Power Grid Infrastructure Investment Trust?

Power Grid Infrastructure Investment Trust has declared a dividend on 05/08/2025 of ₹3.00.

Q5. How many times did Power Grid Infrastructure Investment Trust declare a dividend in the current financial year?

Power Grid Infrastructure Investment Trust has declared a dividend 2 times of ₹6.00 twice in the current financial year (FY2025-2026).