Portfolio Management Services

More about PMS

Portfolio management services or PMS are generally provided to an exclusive set of clients where they are provided with a personalized approach towards investing across different products.

These products may range from equity, debt funds, fixed deposits (in a few cases), and other related financial classes.

In this detailed PMS review, let’s try to understand different aspects related to Portfolio management services, how do they work in the Indian investment space, what are the related positives and concerns you must be aware of, etc.

A quick tip – if you are relatively new to this concept, try to take it slow to avoid any potential confusion.

Portfolio Management Services Meaning

As mentioned above, PMS or Portfolio management services are customized form of investing where although the ownership of all the investment products remains within your Demat account, all the brainstorming is done by expert fund managers.

Generally, a fund manager is allocated to your portfolio, however, internally most of the organizations require different fund managers to work together so that there is a constant re-iteration of different stock ideas and investment strategies.

This process chalks out any potential human errors that can harm a client’s portfolio returns.

We will talk about PMS types later in a different section, but this needs to be understood that the discretion of giving the complete investment freedom to your fund manager stays with you.

You may or may not allow total unrestricted access to your fund manager.

Portfolio management services are primarily suitable for HNIs or High Networth Individuals.

The fee one client needs to bear is based on the initial contractual agreement between the parties and is generally a specific percentage of the overall returns provided by the fund manager.

Also, know about what is the process of portfolio management?, How to Create Portfolio Like Warren Buffett? and enjoy the benefit of portfolio management services.

In fact, in most of the cases, there is an agreed term where the fund manager is supposed to provide returns reports to the client every quarter or 6 months.

Portfolio Management Services Features

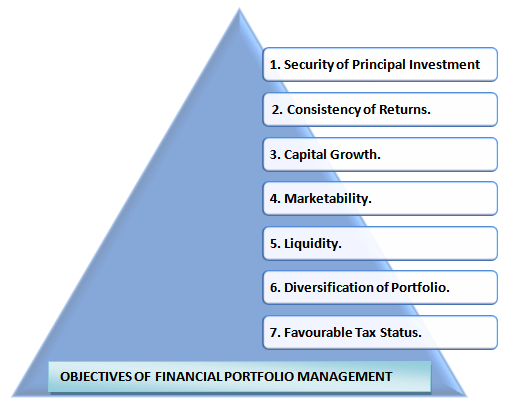

These Portfolio management services come with a set of objectives i.e. these services are obviously used for a set of reasons by investors. And each of these investors may have one or more reasons to go ahead with these.

Thus, the role of the service provider becomes much more crucial and it MUST have the technical know-how and the requisite skill-set to make sure these objectives are taken care of. Some of the features are listed below:

- The growth of the Invested Capital

- Principal amount security

- Liquidity

- Risk diversification

- Tax Planning

- Marketability of Securities

- Regular Returns

This is how it is portrayed:

Let’s briefly understand what these objectives basically imply for a potential investor:

Investment capital growth

In any country, be it India or outside, there is always going to be inflation. The percentage of inflation may vary, however, the purchasing power on the invested amount at that particular point in time is going to diminish in the future.

There could be other economic factors too that can add to that concern.

Thus, the principal amount should see an appreciation that beats all these economic factors. That is the whole point of investing in the first place, anyway!

Principal amount security

This is one of the foremost requisites for anyone to go ahead with Portfolio management services. The primary role of the PMS manager is to make sure that the principal amount stays safe and risk-free.

Obviously, the investor is looking for consistent returns but by any means, be it any downturn or market instability, PMS manager must be skilled enough to anticipate the concerns and make sure the investor’s capital amount is always 100% safe.

Liquidity

There could be situations where you would need a portion or all of the invested capital amount. Thus, the expectation from Portfolio Management Services is that the selected investment products are of such nature that it is relatively easy to get those liquified at any given point in time.

Risk diversification

The whole concept of Portfolio Management Services is that the complete principal amount is segregated into different investment products in such a way that the overall risk is mitigated to a desirable level.

There are investment products with low risk while there are others that have a relatively much higher risk.

However, the greater the risk factor, the higher are the returns.

Therefore, one’s portfolio must be kept in such a way that the overall PMS investment risk is manageable level.

Tax Planning

You can’t avoid taxes, at least in India. Thus, if you are looking at higher returns, the tax factor needs to be taken care of as well.

There are ways in which your portfolio can be designed that lower the impact of the tax burden, be it income tax, capital gains tax etc.

Marketability of Securities

This factor is definitely one of the most important ones. Getting someone invested into a specific portfolio of stocks and investment products is one thing BUT to make sure that one keeps a close eye on the chosen stocks and their current market perception, activity levels, the future potential is way more important too.

Thus, another Portfolio management services objective is to make sure one is constantly invested in those stocks that are actively listed on different indices and have a reasonable trade turnover.

Regular Returns

When someone puts money into any investment product, there is always a substitute opportunity cost that is let-off, assuming that the investment product chosen has a higher chance to provide better returns.

Thus, a specialized investment manager needs to consistently bring returns on the invested capital amount by looking for better investment avenues for the investor all the time.

Portfolio Management Services Types

Primarily, there are 4 types of Portfolio Management Services that come with their own set of objectives. Let’s have a quick look:

Active Portfolio Management

As the name suggests, this portfolio management requires one to be on the toes all the time. Make sure you do not get influenced by short-term market movements and look for value investing. That is why you need portfolio management.

While doing so, such stocks are to be looked for that have the future potential to be a multi-bagger and are bought at a price that is currently undervalued.

Passive Portfolio Management

In this Portfolio Management Service type, you trust the market fundamentals. It is assumed that in the long run, all the short-term factors get neutralized and a fundamentally strong stock will eventually bring returns on your investments.

For instance, if a particular stock XYZ comprises 5% of the overall NIFTY50 Index’s valuation, then 5% of your investment portfolio will be assigned to that particular stock.

Discretionary Portfolio Management

Here, you trust the portfolio manager. As an investor, once you have provided the principal amount, the investment objectives, and the corresponding investing period, your job is done.

The investment manager gets 100% autonomy in deciding the investment products and the corresponding stocks and the trading style.

Non-Discretionary Portfolio Management

Here, the portfolio manager works more like a financial advisor than anything else. He/she takes your inputs and then suggests the corresponding investment avenues you may want to put your capital into. However, whether you want to go ahead and make that choice is entirely your call.

Finally, irrespective of the portfolio management services you choose, you must make sure that your risk level, investment objective, return expectations, and the corresponding timeline are never compromised. Otherwise, it kills the overall purpose itself.

Portfolio Management Services Manager Eligibility

In order to become a Portfolio management services manager, you need to have a specific set of skills and backgrounds. This position comes with huge responsibilities since one would be managing the wealth of its clients and these capital numbers are huge, both in scale and volume.

Here are the eligibility criteria one needs to meet in order to be a portfolio manager:

- Registration fees of ₹10 Lakh to SEBI

- Must have an office space with adequate staff and equipment to run the operations.

- Educational background in finance, business management, law or accountancy from a government recognized university or college.

- A net worth of at least ₹50 lakh as an individual or a firm.

- At least 2 employees with minimum 5 years of experience as stockbrokers, financial advisors, portfolio or investment managers.

The license provided by SEBI comes with a validity of 3 years post which the individual needs to get it renewed.

Also, know about PMS Registration and PMS Companies.

Portfolio Management Services in India

In India, there are 100s of the small, medium, and large enterprises that provide portfolio management services. Some of those are listed below:

and 100s more.

Each of these businesses has its own sets of pros and cons. Some provide better returns while others also offer better customer service, smooth investment platforms, research and other related factors.

While considering any of these portfolio management services, you must consider not only the cost aspect but what kind of returns and the timelines the firm has been able to offer to its clients in the past. It makes total sense to have a word with one of their clients by getting a reference from the first itself to have a first-hand about the service.

These checks are important since you are going to trust them with your hard-earned capital.

Who Can Provide Portfolio Management Service?

Although it has been neglected, for the most part, Portfolio Management Services have been getting noticed as a great investment tool lately.

The investors, usually HNIs who either don’t have an understanding of the stock market or lack the time to make the proper investment are found to be opting for portfolio management service

There are many PMS companies operating in the nation and investors have a decision to make in regards to who to trust their portfolios with.

Many of the biggies of the stockbroking world offer PMS service. Then there are Investment management companies that will provide the same services to an investor.

Investors who would want to go for the well established stockbrokers can approach names such as Motilal Oswal, IIFL. As for investment management companies – Alchemy Capital, NJ Asset Management Private Limited are top options.

Portfolio Management Services SEBI Regulations

SEBI has laid out specific regulations are portfolio managers fall under and must comply with at any given point in time. Not obliging with any of the regulations may lead to the cancellation of their professional license. These regulations were laid out by SEBI in the year 1993.

Here is a quick summary:

- The portfolio manager registration process has been done with due diligence validating the applicant background, application fee, infrastructure, professional qualification, an experience of at least 10 years, minimum employment of at least 2 persons with 5 years of experience between them.

- A portfolio manager before getting into a business assignment with any client must enter into a contract that specifies mutual rights of both the parties, obligations and corresponding liabilities, restrictions, areas of investments, objectives and the services to be provided.

- The funds received by the portfolio manager from his/her client MUST be invested in the specific investment products that have been mentioned in the agreement between both the parties.

- Renewal of a portfolio fund MUST be treated as a fresh placement in the books.

- For the renewal process, the application needs to file 3 months before the expiry of the current certificate.

- If the application is rejected, the board must inform the applicant within 30 days along with stating the grounds based on which the application was rejected.

- Once rejected, the affected portfolio manager MUST cease to provide its services on the day of receipt of the rejection letter.

This was a quick snapshot of the portfolio management services regulations one MUST take care of. Avoidance, at any level, can be a professional hazard without an iota of doubt.

Also, read PMS SEBI.

Portfolio Management Services Example

Understanding Portfolio management services with an example may make the whole concept for you a pretty straight-forward one.

Let’s say, Vijay, a businessman from Pune who deals in clothing, just sold off a piece of land that was passed onto him from his grandparents. The overall value he received from this deal was ₹30 Lakh.

Now, he has a few options for using this money.

The safest option is putting everything into a fixed deposit. He can earn a fixed 7% interest rate on a yearly basis, thereby, leaving him with an interest of around ₹17k-18k on a monthly basis.

He discusses this with his best friend Swapnil who works in a bank.

Swapnil suggests him to use portfolio management services for such a capital so that he can get better returns with a low-mid range risk.

Vijay makes up his mind to have a word with a few portfolio managers to see which one brings the best of the ideas on returns and also eases out on the risk level.

After meeting a few portfolio managers, he goes ahead with ADB PMS who based on Vijay’s objectives, recommend him to diversify in equity stocks, mutual funds, ETFs with some of the funds in government bonds. Vijay goes ahead with these ideas and gets a contract with this portfolio manager.

In a year’s time, Vijay sees a return of 17% on its principal amount that he re-invests into the products advised by ADB PMS.

This is pretty much the way Portfolio management services work.

Is PMS A Good Investment?

PMS is a huge investment. As SEBI has mandated investors should make a minimum investment of Rs 50 Lakh so as to be eligible to avail the service.

The whole idea of trusting their investment portfolio with a portfolio manager can leave an investor frightened. To be honest, this exactly is the reason that makes PMS a good investment.

An investor who doesn’t have adequate experience to operate in the stock markets and lacks the time that the selection of financial instruments for their portfolio will take should definitely have a go ahead with the service.

The investor hands over the reigns of their portfolio to a Professional Portfolio manager. who helps in making the correct investment decisions at the right time, diversify the portfolio across various financial instruments to minimize risks.

The investor can rest assured that they are just handing over the portfolio manager the permission to transact on their behalf. There is no scam involved here.

Portfolio Management Services Returns

As far as the returns on portfolio management services are concerned, there are multiple factors that decide the percentage. Aspects such as skill-set and experience of the portfolio manager, market conditions, risk appetite of the investor etc.

Generally, if we talk about the top 5 portfolio management services in India, their return percentages can be as high as 37% and can be as low as 22%.

These percentages may vary from broker to broker and from year to year, however, it should be able to give a good idea on what is the general range of returns one can expect while availing these services.

Portfolio Management Services Disadvantages

Let’s talk about some of the concerns associated with using the portfolio management services:

- One must make sure that over-diversification of investment does not take place. Because what would that do is, it will increase the marginal loss of expected return as compared to the marginal benefit of reduced risk. It kills the whole purpose of better returns that ways.

- Usage of Portfolio management services requires you to start with a high initial capital(in the range of ₹25 Lakh), thereby, setting barriers for regular investors who would want to avail such services.

- Keep an eye on the PMS charges since a few brokers may charge a lot of money while providing their services.

Portfolio Management Services Benefits

Obviously, there are positives of using these services too and you must be aware of all such benefits:

- Better investment choices are made if you diversify your portfolio and understand how each investment products provides returns at a specific risk level.

- You can track the performance of each of your investment entities and shuffle around post discussion with your portfolio manager (depending on the type of PMS you have availed).

- Using Portfolio management services will enable you to invest on a regular basis thereby making it a habit.

- And obviously, the financial understanding you carry will also improve based on the investments you make.

- The liquidity of investments is in your control and in case of an emergency, you may convert your investments into liquid money.

- With the diversification of your disposable income investment, the overall risk you carry will also get diversified and thus, mitigated.

How Important Is Portfolio Management?

Portfolio Management is the term that you must have come across, Let’s hop into its importance and avail its benefits

- Allocation of Funds for Maximum Returns

- Reducing Risk

- Diversification

- Tax Planning

- Managing Adverse Conditions

The above are the points that show how important portfolio management is.

How Can An Investor Invest In Portfolio Management Services?

Also, since PMS is an exclusive service that can be availed by HNIs only, the general public seems to be confused as to How Can An Investor Invest In Portfolio Management Services.

As for the eligibility criteria which has already been mentioned above, PMS service can be availed by opening a PMS account with a PMS company.

This PMS account is nothing but a Demat account exclusive for the portfolio of investments. The investor will need to provide a few documents such as a PAN card, identity card, and Address proof.

The PMS service provider will make the investor sign a POA (Power Of Attorney) form, which will grant the company permission to manage the investor’s portfolio on the investor’s behalf.

If in case you are looking to avail portfolio management services from one of the top financial houses in the country, let us assist you with that:

Also Read:

How are getting world sensex news up down