How to Set Stop Loss in Intraday Trading

Check All Frequently Asked Questions

Is your stop loss not providing you better results? Are you using the right stop loss value for intraday trading? In this article, we are discussing how to set stop loss in intraday trading?

So, if you are new in the stock market and want to trade safely by minimizing your losses then here is the way for you that helps you in exiting the market at the right time.

Let’s begin to know how to calculate stop loss in day trade and how much stop loss is to be set for intraday trading?

How Much Stop Loss To Set for Intraday Trading?

For those who are looking for a way how to be a trader in share market, it is important for them to include the use and understanding of stop loss in the list.

Every other trader knows what stop loss is, but when it comes to putting the stop loss, the major challenge that comes in front of the day trader is what should be the value of stop loss and how to set stop loss in intraday trading.

Although it is a very subjective thing and one can generalize the value, but there are certain ways that can help you in setting the right value of your stop loss.

1. Use Percentage Method

What loss you can bear in intraday trading? No doubt, intraday trading is generally done in stocks that are highly volatile and there are chances that the market gets reverse leading to your losses.

Every intraday trader enters the market by setting a certain target price depending upon his analysis and the current market trend.

The same goes with the stop loss value.

For this, it is good to check for the volatility of the stock in the last few minutes or hours and choose the value that can prevent you from facing loss.

The percentage varies and ranges from as low as 2% to as high as 10%.

For example, You enter in trade in the stock the current market price of which is ₹250 per share. Now seeing the volatility you fix the target at ₹260 per share, but at the same time to prevent loss you pick the stop loss 2% below the CMP i.e. ₹5 below ₹250 i.e. ₹245.

Now if the trend reverses and drops to ₹240 then you would be able to exit the trade as the price hits the Stop loss value.

2. Use Support and Resistance Level

Now intraday trading gives you to take the long and short positions.

Here using the support and resistance level can help you to set stop loss for intraday trading. Wondering how?

First, let’s consider the case where the trader takes the long position in the bullish market. For this refer to the image below.

When taking a long position in a bullish run, then set the stop loss at the last support level.

As seen in the image above, if you take the position at ₹399 then looking at its last support, the stop loss should be set at or around ₹396.

Similar goes with the case when you go short in the intraday trade. Here instead of Support, one must consider the last resistance to define the stop loss value.

*In the case of short selling, the stop loss value is higher than the entry price.

Here if you take a short position at ₹406 then seeing at the resistance, it is better to put your stop loss at ₹408.

This is how support and resistance level can help you in defining and putting stop loss value thus helping you in minimizing the loss.

So when it comes to how to make money in intraday trading, then not only setting the target price, by choosing the right value for stop loss is necessary to reduce losses in trade.

Here as a beginner trader, it becomes equally important to draw support and resistance at the right level. For this one can focus on the basic understanding for which they can take stock market courses or read best technical analysis books.

Let’s now move further to understand how to place stop-loss orders.

How to Place Stop Loss in Intraday Trading?

Now when you get the information on how to set stop loss in intraday trading, now let’s discuss how to place the stop loss order using the trading platform.

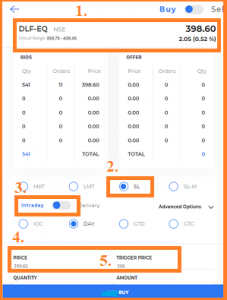

For a better understanding, here we have taken the reference of Choice Broking mobile app, Jiffy.

Here for the explanation, we have picked DLF stock the CMP of which is ₹398.60.

Seeing the bullish trend, the trader decided to take a long position and proceed ahead with the steps mentioned below:

- Open the Buy Window, by clicking on DLF.

- Select the order type, SL order.

- Scroll the bar towards intraday.

- Enter the entry price. You can either select the market price to trade at the CMP or set the limit order by defining your entry point.

- On the basis of risk or analysis enter the trigger price i.e. Stop loss price at ₹396.

On entering the complete details now click on the ‘Buy’ button.

How to Set Trailing Stop Loss in Intraday Trading?

Sometimes, the stop-loss is triggered too early which leads to missing an opportunity of earning gains in the trade. So how to set stop loss in intraday trading in that case.

In such cases, you can use the trailing stop loss.

As the name suggests, this stop loss trails along with the price. To understand this let’s take an example.

Let’s say you take a long position in a DLF stock at ₹400 and set the stop loss value at ₹398. Now, what if due to volatility the share price reaches ₹398 but then bounces back to ₹405?

Here to prevent yourself from missing an opportunity to earn a intraday trading profit, you can use trailing stop loss along with stop loss.

This is generally set in percentage, so let’s say you set the trailing stop loss value of 1%.

So with a gain of 1% in the entry price the stop loss value increases by 1%.

In the above example, 1% of ₹400 is ₹4, so when the CMP reaches ₹404 then the stop loss value increased to 401.98 and so on.

With this, you can minimize your losses and at the same time would not get impacted by the volatility.

Conclusion

So, as you have seen setting a stop loss all depends upon your risk appetite and if you want to do it using the right intraday trading strategy then here follow the right rule by looking at the support and resistance level of the stock.

Enter into the trade by defining the right stop loss value and preventing yourself from facing losses even if the trend goes against you.

But before you set stop loss for intraday trading, consider the following points:

- A Stop-loss order is not meant for active traders.

- It should not be used in the highly volatile market.

So, set your limit now by analyzing your risk appetite.

Start share market investment today, by opening a Demat account online for FREE! Get in touch with us and we will assist you in choosing the right stockbroker.

More on Intraday Trading