Dhani Stocks

List of Stock Brokers Reviews:

Dhani Stocks is a discount broker (recently pivoted from full-service stockbroking) from the house of Dhani Stocks Group. Based out of Gurgaon, the stockbroker has a presence in 18 cities of the country with a client base of 7 Lakhs.

The broker is part of a large conglomerate, with broking services being one small part of the huge pool of businesses the group runs.

It has recently shifted towards discount broking and is now offering some of the most differentiated subscription-based brokerage plans in the industry (more on this later).

With these brokerage plans in place, Dhani Stocks is seen as one of the brokers that provide zero brokerage unlimited trading plans to its clients.

Let’s dig a bit deeper and understand the different value propositions it has in place for you as its trading client.

Dhani Stocks Review

Now have an exclusive trading experience with the Dhani Stocks, earlier known as Indiabulls.

Being a discount broker offers the best trading services at a discounted price or says charge flat fees to trade in different segments.

When it comes to opt for the trading segments, the broker offers multiple options to its clients. Since it is registered with the BSE, NSE, NCDEX, and MCX you can trade in almost all the segments like:

“Dhani Stocks has an active client base of 40,357 for the financial year 2020.”

This stockbroker was established in the year 2000 and is registered with SEBI. Thereafter, the company gets listed on the National Stock Exchange and BSE while its Global Depository Receipts (GDRs) listed on the Luxembourg Stock Exchange.

In short, the firm showed tremendous growth and quickly joined the top league of stockbrokers in India. However, by time, it has not been able to keep its momentum going and is now left out as an average performing stockbroker.

It is known for its research quality but customer service and few other areas need quick attention, as we look at multiple aspects in this detailed review.

Divyesh Shah, CEO – Dhani Stocks

Dhani Stocks Trading

Dhani Stocks is the pioneer of the online trading platform and offers the benefit of seamless trading to its customers.

And since it is a part of the Dhani Stocks Group that is involved in other businesses like housing finance, real estate, personal financing it grows far better in its technological advancement and other services.

When it comes to trade in different segments it offers a seamless way to open a demat account. The best benefit of initiating trade with the broker is offering you exclusive services like you can just trade for ₹500 per month.

Not aware of online trading, still you can make efficient use of the trading platform as it gives you the option to dial and trade without charging any additional fees.

Also, the broker offers multiple options for online trading like the mobile app, Dhani web, and trader terminal that offers you a unique experience of trade.

Dig more to know complete details about the Dhani Stocks trading platforms.

Dhani Stocks Trading Platforms

Dhani Stocks is one of the few stockbrokers that charges its clients for using some of the trading platforms it offers to go along with the brokerage charges.

In this detailed review, we will talk about the trading platforms that are developed in-house and are then offers this software to clients across the devices:

Dhani Stocks App

In the wide range of the mobile trading app, Dhani Stocks does not lag behind and comes up with the advanced and user-friendly app, Dhani Stocks App.

To access the app, you just need to open the Dhani Stocks Demat Account.

Some of the features of the mobile app include:

- Customized watch-list provision where you can track different trading segments including commodities, currency pairs, equity stocks within the same watch-list.

- Best-in-class and trade with a single click.

- In-depth market research and market analysis.

- Hassle-free fast trading experience.

- 100% paperless trading.

- Use of advanced technology.

- An option to create a customized watchlist.

- Real-time market quotes with minimal feed delay.

- Usage of margin funding can be automated within the app.

To use the app, just download the app on your smartphone, and choose the subscription plan and account opening fees.

Once you open the account, you would be provided with the login credentials (username and password). Login using it and start trading right away.

This is how the app looks on Mobile and Tablet devices:

These are the stats from the Google Play store for Dhani Stocks mobile app:

| Number of Installs | 100,000+ |

| Mobile App Size | 54 MB |

| Negative Ratings Percentage | 15% |

| Overall Review |  |

| Update Frequency | 2-3 Weeks |

There are a couple of concerns this app carries that you must be aware of:

- Details such as transaction summary, ledger balance sheets not available in the current version of the app.

- Login issues observed with OTP at times.

- Make sure your mobile has decent RAM otherwise you might face performance/app crashing concerns.

Dhani Stocks PIB

Power Dhani Stocks is a terminal software-based trading application which users can download and install on their machines.

This is majorly used for high-volume traders or people who can put in decent trading hours especially if they trade on an intraday basis.

Some of the features of Power Dhani Stocks are:

- Multiple Market watch with customization across segments available

- Alerts can set as per user preferences when the Last traded price, volume, or percentage change is observed in the scrip

- Get access to market top gainers/losers and the stocks with the most volatile movements across the day

- Real-time reports available with stats on the net portfolio or current obligation price of the company stock

- Customizations and personalization of widgets, look, and feel allowed to users as per preferences.

- Also, see what is happening across the globe that can impact the Industries of your holdings, etc

“Users are charged a non-refundable usage charge of ₹750 to active Power Dhani Stocks against their account. “

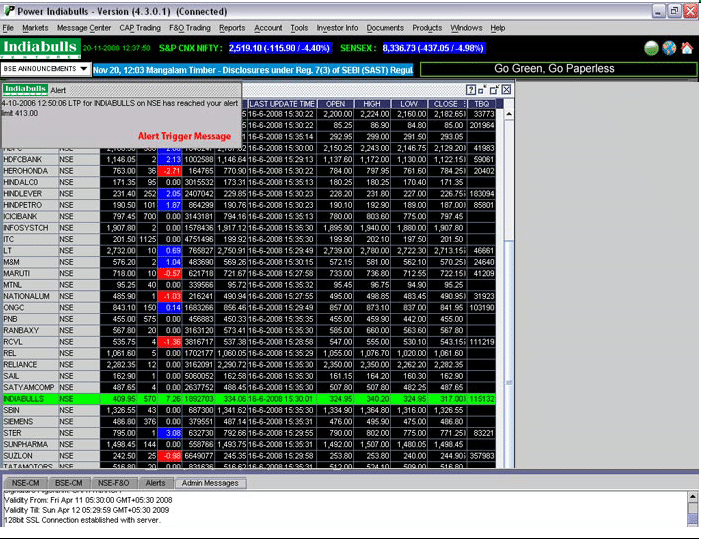

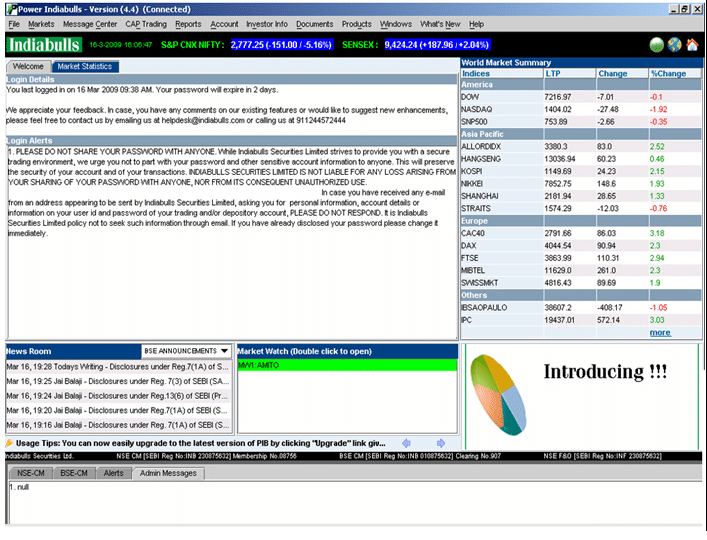

Here is how the trading platform looks like:

Dhani Stocks Web

This discount stockbroker also allows you to perform trading through the web using a browser. With this trading application, you do not need to download or install any software and it can be accessed through your laptop or desktop.

Once you have downloaded their app or software, after that all you need to do is learn Dhani Stocks Login process, which is very easy.

This web-based trading terminal helps you in availing information like real-time streaming, market data, advanced charts, etc.

Since this web-app is not responsive in nature, it does not give you the best of the experiences when you access it through a mobile or a tablet device.

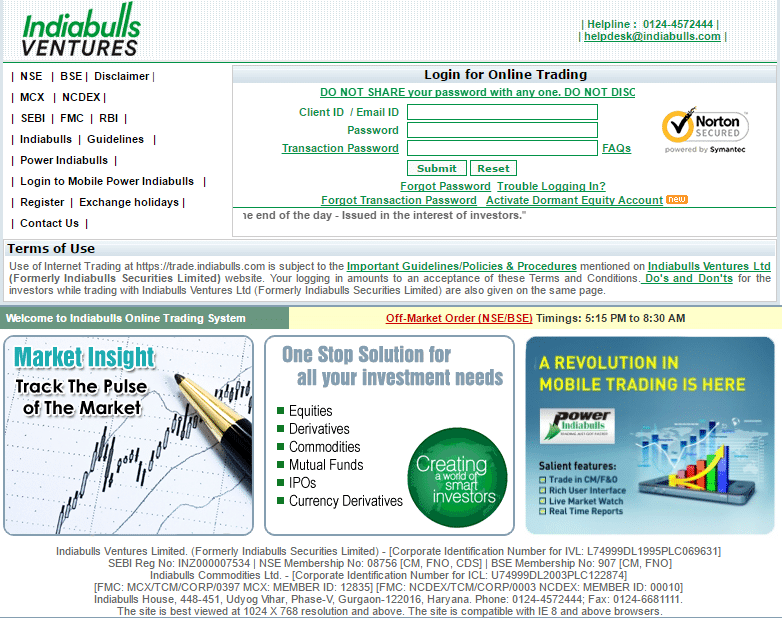

Compatible with IE8 browsers and above, this is how the Dhani Stocks Web looks like:

The application is pretty basic in its design and compatibility.

Especially looking from the overall industry dynamics where multiple stockbrokers are coming up with breakthrough solutions via their trading platforms, solutions such as this web-based application needs to improve on a few aspects.

Having said that, some of the tops features Dhani Stocks Web carries are:

- Quick online payment transfers through gateways

- Research with daily tips

- IPO analysis

- Market Statistics on a real-time basis

- Portfolio tracking

Dhani Stocks Research

Dhani Stocks is a hybrid stockbroker, thus offering the full-service brokerage service at a discount price.

Now since it offers the full-service broker service it has an in-house team of research experts team that performs fundamental as well as technical research for its clients.

These reports and trading calls are available online through its trading platforms as well as other communication channels such as SMS and emails.

Some of the features of the research provided by this discount stockbroker are:

- Research covers around 540 listed stocks on different indices of the stock market

- Each stock is given details in regards to its fundamentals, valuations, and associated risks

- The idea of potential growth

- Updated on a regular basis with information on mergers, acquisitions etc.

This stockbroker is known for its quality of research for both long-term investors and short-term traders and certainly can be trusted to an extent.

Dhani Stocks Customer Care

The discount stockbroker provides the following communication channels to its clients as shown:

- Physical mail

- Phone

- Offline branches

Generally, expectations from a discount stockbroker are pretty low and rightly so. Most of the discount stock brokers don’t even try too hard in bringing quality to their clients through their customer service. However, Dhani Stocks is just average in this department with its laid-back approach.

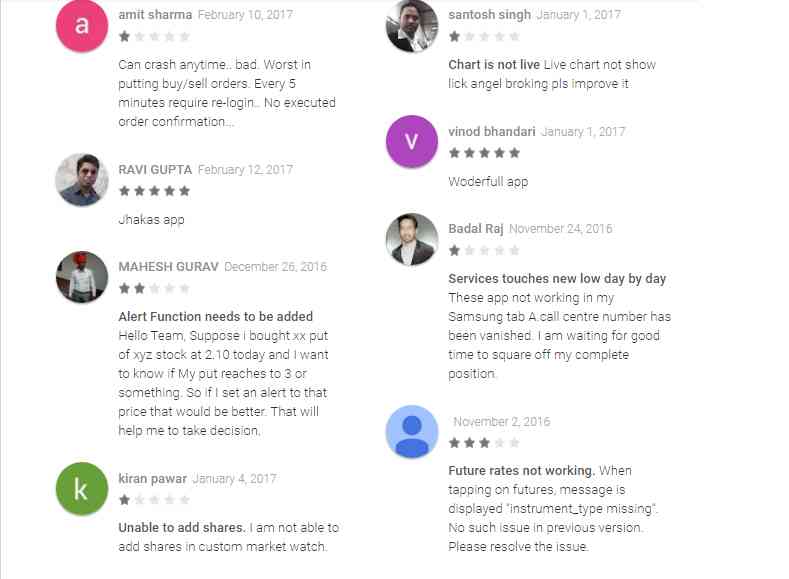

For instance, if you look at their Google Play store mobile app page, there is not even a single response to around 1o0 comments (read complaints) they have received for specific issues with the mobile app.

In this competitive environment today, especially with the advent of low-cost discount stockbrokers, it is difficult to acquire and retain clients. People have much better options than to stay stuck with a broker that does not really care much in terms of servicing its client base well post acquiring them.

Thus, Dhani Stocks certainly needs to pull up its socks and make sure the clients acquired do get deserved attention in different aspects they need help in.

Dhani Stocks Charges

Here are the different charges the stockbroker levies on its clients:

Dhani Stocks Account Opening Charges

Here are the account opening and maintenance charges levied by the discount stockbroker.

| Demat Account opening charges | NIL |

| Demat Account Annual Maintenance Charges | NIL |

Dhani Stocks Brokerage

As far as the brokerage is concerned, the broker charges the following brokerage rate to its clients if the client falls under ‘Dhani Stocks Online’ plan:

| Dhani Stocks Brokerage | |

| Equity Delivery | NIL |

| Equity Intraday | NIL |

| Equity Futures | NIL |

| Equity Options | NIL |

| Currency Futures | NIL |

| Currency Options | NIL |

| Commodity | NIL |

Use this Dhani Stocks Brokerage Calculator for complete charges and your profit.

At the same time, if you have taken the ‘Dhani Stocks Subscription’, then you just need to pay the subscription charges of the plan taken and there will be no brokerage charges levied on your trades. Furthermore, there are no charges for the ‘Call & Trade’ facility as well.

These subscription plans are available across Equity (intraday trading, Delivery), Futures and Options and Currency segment.

If you are looking to trade in the F&O segment, then you are required to pay ₹1000 for the month and you can place an unlimited number of trades in this segment.

Here are the details of the Dhani Stocks Subscription plans for the Equity segment:

| Plans | 30 Days Fees (₹) | Margin Funding (₹) |

| 1 | 1,000 | 0 |

| 2 | 2,000 | 1,00,000 |

| 3 | 3,000 | 2,00,000 |

| 4 | 5,000 | 3,25,000 |

| 5 | 7,500 | 5,00,000 |

| 6 | 10,000 | 6,50,000 |

| 7 | 12,500 | 8,50,000 |

| 8 | 15,000 | 10,00,000 |

| 9 | 20,000 | 12,50,000 |

| 10 | 25,000 | 15,00,000 |

| 11 | 30,000 | 17,50,000 |

| 12 | 35,000 | 20,00,000 |

| 13 | 45,000 | 22,50,000 |

| 14 | 50,000 | 25,00,000 |

| 15 | 1,00,000 | 50,00,000 |

Under this plan, you get an exposure of 5 times in the intraday segment as well.

Lastly, the best part is that you do not need to pay any subscription charges for the first month i.e. first-month brokerage is completely free.

How is Brokerage Calculated?

In the case of discount stockbrokers such as Dhani Stocks, the brokerage is calculated at a flat rate unlike in the case of full-service brokers. In the latter’s case, the brokerage depends on your trading turnover. The higher the turnover, the higher is the brokerage you end up paying.

For instance, if your brokerage rate is 0.3% for delivery and you are trading for ₹1,00,000 – then you will be charged ₹300 as brokerage rate excluding any taxes or transaction charges. Compared to premium stockbrokers such as ICICI Direct or Sharekhan, Dhani Stocks stands far better.

Dhani Stocks Transaction Charges

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00250% |

| Equity Options | 0.0550% |

| Currency Futures | 0.00250% |

| Currency Options | 0.0550% |

| Commodity | 0.0030% |

The discount stockbroker charges relatively higher transaction charges. Few stockbrokers such as Dhani Stocks, keep their brokerage marginally less and get it covered through other avenues.

In this case, this stockbroker charges higher transaction charges in Futures and Options as well as Commodity. Thus, make sure to get this aspect cleared in your discussion with the executive of the broker before you open an account.

Dhani Stocks Margin

Exposure or leverage is basically a short-term loan offered by different stockbrokers such as Dhani Stocks, at an interest rate of 12%.

This interest rate is one of the lowest ones in the industry since most of the stockbrokers charge an interest rate in the range of 18%.

Thus, this low-interest-rate percentage works as one of the differentiators for Dhani Stocks.

At the same time, you must be very cautious while using it as its a risky concept and can eat up your trading capital. Here are the values offered across different segments:

| Equity | Upto 10 times for Intraday, & 3 times for Delivery |

| Equity Futures | Upto 3 times Intraday |

| Equity Options | No Leverage |

| Currency Futures | No Leverage |

| Currency Options | No Leverage |

| Commodity | Upto 3 times Intraday |

If you are looking for exposure or leverage, well Dhani Stocks does not really offer much of it. You can check out this detailed article on stockbrokers that provide high exposure across multiple trading segments.

Dhani Stocks Disadvantages

You must be aware of some of the concerns before going ahead with this discount stockbroker:

- Clients need to pay for using the trading platforms

- Low exposure values offered across different segments

- Average customer service

- Slightly high transaction charges, especially in Future and options segments

“Dhani Stocks has received 8 complaints until 2019 for this financial year 2019-20 which is 0.01% of its overall client base. The industry average also stands at 0.01%.”

Dhani Stocks Advantages

At the same time, you get the following advantages while trading through this discount stockbroker:

- Multiple Brokerage plans

- Overall, low brokerage charged.

- Decent trading platforms across devices

- One of the prominent research houses of the country

- A reasonable number of trading and investment products available.

- Dhani Refer and Earn gives you the benefit of making additional money each month.

Looking to open an account and start trading?

Provide your details in the form below and we will set up a free call back for you right away:

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

Dhani Stocks Membership Information:

Here are the details on the different membership details of the discount stockbroker:

| Entity | Membership ID |

| SEBI | INZ000007534 |

| BSE | INF000000907 |

| NSE | INF000008756 |

| ICL | U74999DL2003PLC122874 |

| MCX | 12835 |

| NCDEX | 10 |

| Registered Address | Indiabulls Ventures Limited, M-62 & 63, First Floor Connaught Place, New Delhi- 110001 |

The details can be verified from the corresponding entity websites.

Dhani Stocks FAQs:

Here are some of the most frequently asked questions about Dhani Stocks that you must be aware of:

Is Dhani Stocks a safe stockbroker?

This discount stockbroker has been around for 17-18 years and has a presence in other business domains such as Insurance, Housing, Real estate etc.

The overall market capitalization of the group is US$5.1 billion, which is pretty stable by most standards. Thus, from a ‘trust’ perspective, yes this stockbroker can certainly be assumed to be safe and trustable.

What are the account opening charges with Dhani Stocks?

To open an account with this broker, you are required to pay ₹750 at the onset. Furthermore, an AMC (annual maintenance charge of ₹450 is applied every year).

What trading and investment products are offered by Dhani Stocks?

The discount stockbroker offers multiple trading and investment products such as Equity, Commodity, Currency, Mutual funds, Insurance, Derivatives, Depository services etc.

Ensure you understand the charges and type of accounts required to invest in these products before going ahead with the broker.

Does Dhani Stocks charge for usage of its trading platforms?

Yes, you will be charged ₹750 for the usage of its terminal-based trading platform Power Dhani Stocks. Normally, clients are not charged for usage of the trading platforms but in the case of this stockbroker, this charge is in place.

How is the quality of research provided by Dhani Stocks?

Research quality is better than average at both the fundamental and technical level.

Thus, clients can surely use the trading calls, research reports, weekly/quarterly reports and tips coming from the broker and use those for their trading and investment post a necessary check on their end.

You can check detailed comparisons of Dhani Stocks Vs Other Stockbrokers here:

More on Dhani Stocks:

Here are a few reference information pieces on Indiabulls that can help you to learn more about the broker:

Its an average broker honestly. Indiabulls can certainly work on their service.

My experience of last twelve years is – to hell with the customer.

kindly mail me your chennai DP office for equity trading.