Axis Direct Franchise

View All Sub-Broker Reviews

Axis Direct Franchise business comes from Axis Direct which further is part of the Axis group and a subsidiary of the Axis Bank (India’s third-largest private sector bank). It provides a wide range of products and services to its customers with the best research and advisory support to the partners.

Axis Direct Franchise Review

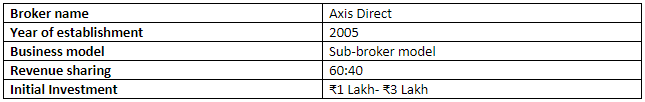

Axis Direct is a full-service stockbroker which was established in the year 2005. The head office of the broker is in Mumbai.

The broker enjoys its brand image in the financial market. Axis direct’s coverage and geographical presence are spreading steadily in the offline space.

The broker provides a 3 in 1 Axis Demat Account facility and support to their customers. It deals in almost all types of asset classes which include Equity, currency, Mutual funds to go along with commodity trading, and more.

The business partnership program of Axis direct was initiated in the year 2012. It offers only one kind of partnership program i.e a Sub-broker program. It can also be interchangeably called Axis Direct Franchise.

Here is a quick overview:

The broker has a membership with BSE, NSE, MCX-SX and MSEI. And here is the list of products and services offered by Axis Direct:

In this article, we are going to focus on different aspects of the Axis Direct Franchise and sub-broker business such as its business model, revenue sharing ratio, initial/security deposit, offers to the sub-broker and many more.

Axis Direct Business Models

As mentioned above, Axis Direct offers only one type of business model for its clients. As the company is a new entrant in the market, it offers only one model for now i.e.

- Sub-broker/Business partner model

The sub-broker program of the Axis Direct was initiated recently in the year 2012. This is the only model which is offered by the company. If anyone wants to start a business with Axis Direct then he/she will have to go with the sub-broker model.

Although, it can be seen as a limitation, however, the bright side of this proposition is that the broker is completely focussed on a single business model, thereby, the processes can be assumed to be way more structured and mature for interested partners.

Axis Direct Sub broker:

The sub-broker model of Axis Direct is similar to the sub-broker program of other brokers.

Under this program, the company partners with the sub-broker and allows them to use their trading platform and tools for themselves and for the clients of sub-brokers.

The main role of a sub-broker is to acquire more and more clients for the main broker i.e. Axis Direct for investing in different financial products offered by the company such as equity, currency, derivatives, IPOs etc.

The unique selling proposition of opening a 3-in-1 investment account definitely adds to the pitch armour.

Except for the above-mentioned role, a Sub-broker will also be associated with Axis bank to motivate clients to take home loans, auto loans, and many other types of loans offered by the banks to the customers.

In a sense, there will be room for cross-selling and/or upselling other financial products offered by the business.

Each of these sales has an added incentive for the Axis Direct franchise as well.

Axis Direct Franchise Revenue Sharing

Axis Direct shares the revenue with the sub-broker in the ratio of 60:40 i.e. The main broker (Axis Direct in this case) will take 40% of the revenue generated by the sub-broker and the sub-broker will get 60% of the revenue generated.

However, the revenue sharing ratio in case of Axis Direct Franchise is not fixed. It depends upon the initial security money and revenue generated by the sub-broker above target sales.

It means, if a sub-broker deposits more security money with the main broker, he/she will get a higher sharing ratio.

And, if a sub-broker generates more revenue than the target given, then also they can get a higher revenue sharing ratio. So, the revenue sharing ratio of the Axis Direct is flexible.

Furthermore, one cannot rule out the room of negotiation as well. You are advised to negotiate with the broker executive as much as you can since most of these numbers are open to change, most of the times, especially if you are bringing scale or an exclusivity factor to the broker.

Axis Direct Franchise Cost

If you want to start a partnership business as an Axis Direct Franchise, you will have to deposit an initial amount as a security deposit. Axis Direct demands ₹1 Lakh to ₹3 Lakh as initial deposit money from the sub-broker.

The security money is refundable during the exit of the broker. However, the membership charge/cost for NSE, BSE etc. is non-refundable.

The sub-broker/business partner will have to bear the cost of maintaining the back office like the phone bill, electric bill, internet charges etc.

Again to remind you more, the higher the amount of security deposit, the higher will be the revenue sharing ratio.

Axis Direct Franchise Offers

Following offers makes Axis Direct Franchise a profitable investment platform for the clients and the business partners.

- A variety of products and services offered to customers.

- 3 in 1 account makes fund transfer very easy.

- Availability of trading services across different digital platforms like mobile, desktop etc.

- Offers sound advisory service to the sub-brokers and clients for portfolio management services and Mutual funds.

- Makes portfolio management and portfolio creation an easy process.

- Extensive back-office support provided.

- Offers user-friendly trading platform and tools.

- A well organized, in-depth and you can say complete training is offered to the sub-brokers on all products and tools.

Axis Direct Franchise Registration

If you want to start a sub-broker/Business partnership with the Axis Direct, you will have to follow the following steps.

- Fill the details in the registration form. You can also choose the below-displayed form as well:

- You will get a call from the centre executive for the In-Person verification of your interest in the partnership business.

- An appointment will be fixed by a sales representative when he/she will call you.

- To know about the detail of the franchise business, meet the sales representative.

- Submit all required documents for the verification with the initial deposit money Cheque.

- Documents will be verified by the broker.

- Once the documents have been verified. You will get an Account ID.

- Start running your business operations. You are an authorized Axis Direct Franchise Now!

Axis Direct Franchise Benefits

There are many advantages of starting a partnership business with this brand as an Axis Direct Franchise. Here is a list of advantages.

- Axis Direct is a famous brand, it is known by almost all financial players. The brand is Axis Direct is a subsidiary of a reputed bank (Axis Bank). This helps in building customer trust and ease of acquisition.

- The broker provides different brokerage plans to the partners as per their needs. Check this detailed review on Axis Direct Brokerage Charges for more information.

- Axis Direct offers a powerful research tool for the clients which help them to get all required information related to trading.

- Offers various products and services to the clients under one roof.

- Axis direct has designed schemes by giving preference to the customers.

- The broker has won various awards for its service quality.

- It always maintains a balance between the risk and reward.

Axis Direct Franchise Support

Apart from the benefits mentioned above, you will get assistance from the Axis Direct Franchise business partnership in the following ways discussed below:

- Technological support provided by the main broker to the sub-broker to use different platforms of the company for trading.

- Research and advisory support by trained and knowledgeable advisors.

- Portfolio Management Support provided by Axis PMS.

- Marketing support provided to the sub-broker through pamphlets, banners, flexes etc.

- Sub-brokers get online Training Support via share market courses, demos, webinars etc.

Summary

From the above discussion, we can say that Axis Direct is one of the best options for young entrepreneurs who want to start a partnership business with the broker. It is well known among the players of the financial market.

The broker provides an opportunity for the partners to earn more by generating higher revenue.

Axis direct provides sound research and advisory service to the sub-brokers. So, the sub-broker can run their business smoothly with the help of the broker where required.

Hence, If you want a good and supportive partner to start the business in broking field, Axis Direct is definitely a good option.

In case you are looking to open a sub-broker or franchise business, then let us arrange a callback for you.

Just fill in the details below and you will get a call from B2B onboarding team:

Axis direct r not entertainment expand business area