MarketSmith India

List of all Advisory Firms Reviews

Founded by William J. O’Neil, MarketSmith was first initiated in the United States of America. It gained immense success in the US where the founder spent 50 years trying to educate the people on how to make some money in the stock market.

He has even written a book on this topic, which sold over 2 million copies all over the globe. The firm spread its wings for the first time outside the US and started the business in India and is called Marketsmith India.

MarketSmith India Review

Located in Bangalore, the prime aim of the firm is to educate the people of India, in an engaging and fun manner, about the Indian share market and how to make it large as an investor.

MarketSmith provides an app which is available on various platforms on computers and smartphones. This app gives you all the relevant data which will be necessary for you to decide whether to invest in a specific company or not.

MarketSmith initiated the CANSLIM method of investing in the share market.

According to the founder of the firm, in order to choose the best stock market winners, you need to carefully examine the past leaders.

This will help you know more about the various characteristics of these stocks before their prices jumped in the share market. O’Neil completed a detailed study of some of the greatest winners in the stock market over the past 100 years.

He grouped a few common features of these market leaders and came up with the term CAN SLIM. Every letter of the term denotes one of the 7 characteristics of these share market winning stocks just before they helped their shareholders taste great profits.

MarketSmith India Model Portfolio

When you take up the services of MarketSmith India, they will set up a model portfolio for you based on multiple aspects related to your investment requirements.

This needs to be understood that it is very simple to enter in the stock market by purchasing a few stocks of a firm. It is the exit level where most of the investors falter.

When to sell the purchased stocks, is one of the major questions which haunt many investors. This is where the CAN SLIM system of investing by market Smith will be of great help.

Current Quarterly Earnings (C): In this step, you are supposed to look for stocks which made it big in the last reported quarter. Growth of a minimum of 25% is a good way to start your search. It will also be a good idea to look for stocks which grew continuously over the past 3 periods.

Annual Earnings Growth (A): This step will involve targeting those stocks which reported annual growth of earnings of a minimum of 25% for the past 3 years or so. It will also be a good thing to look for those companies which promise a strong long-term growth.

New Product, Service, management or Price High (N): Some of the biggest in the share market had something new in them. They either had new services or new products or even a new condition in the entire industry. It is also important to keep an eye on new companies.

Supply and Demand (S): Supply and Demand happens to be one of the most basic of all economic principles. This principle is shapely demonstrated in the share market. High demand and low supply of shares will naturally push the price high and vice versa.

Leader or Laggard (L): Some of the true leaders in the share market will have some of the best growth in earnings, superior price performance, and strongest sales. Investing in such companies, which got stronger with time, is a good deal.

Institutional Sponsorship (I): Some of the best drivers of the stock market are banks, Mutual Funds, and various other professional investors. In order to help a stock become a top performer, it needs to have a proper institutional backup to help its prices go up the ladder.

Market Direction (M): Trading in sync with the market is a good way to make profits in the long run. This is keeping with the observation that 3 out of 4 stocks strictly follow the market trend. Always buy stocks in a confirmed uptrend and safeguard your capital in the right manner. That is why it is advisable to make a strategy for how to buy stocks and take the benefits.

MarketSmith India Services

MarketSmith provides a single package of Premium Investment Advisory Services to all its clients. However, you may also opt for the trial package before you decide to buy their package.

MarketSmith India Swing Trader

If you are into or looking to get into swing trading, then MarketSmith India Swing trader could be one of the options you may want to check out.

This comes in the form of a mobile app where you are provided with a fix of fundamental as well technical analysis of stocks that are being recommended. Each tip comes with its specific profit goal, trade set up and a stop-loss price.

You will also be provided with email and app notifications with the latest updates from your watch-list.

Although, the app is listed on the Google play store as well as iOS store, however, the feedback about the service has been pretty mediocre.

Thus, if you are looking to go ahead with the subscription, it is recommended that you choose the trial plan first, observe the performance for a few days and if satisfied, only then move to a regular plan.

Here are the details on its pricing:

| Pricing Plans | |

| 10 Days Trial | ₹499 |

| Quarterly | ₹4999 |

| Yearly | ₹17900 |

MarketSmith India Trial

MarketSmith offers a trial offer of a week to its new clients, after which you have the option of opting for its paid service. There are several features of the MarketSmith India services which you can avail under the trial offer.

Features:

- Chart Pattern Recognition: Under the trial offer you will get access to the Chart Pattern Recognition tool of MarketSmith. This tool algorithmically and automatically identifies various chart patterns and also highlights the different features of the pattern. You will also get a breakout points along with specific Sell, Buy, and Stop Loss Zones.

- Idea List: This list gives you 47 different stock ideas which are generated algorithmically on a weekly basis.

- Model Portfolio: Handpicked stocks that fulfil the CAN SLIM criteria with a complete hand-holding on the different buy and sell range. You will also receive various alerts related to the stocks.

- Custom Filtering: This feature will help you filter the stocks that meet your own criteria.

- Market Outlook: The market-timing system of MarketSmith will tell you when it is time to pull back on market exposure and when to invest further.

MarketSmith India Subscription

If you feel that you liked the services provided by MarketSmith and you gained during your trial run, then you may opt for their Premium subscription or Membership.

It will give you several features of their advisory services.

- Stock Evaluation: This will give you features such as proprietary ratings and rankings, investing wisdom quotes by William O’Neil, price and volume charts on a daily, weekly, and monthly basis, annual and quarterly sales or EPS data, key fundamental data, top-rated stocks in the same industry group, CAN SLIM and custom checklist, and stock alerts.

- IdeaLists: This will give you access to user portfolio, upon volume list, recently viewed stocks, Indian 47 Premium Idea List, and handpicked India Model Portfolio.

- User Lists and Screening: This will give you the user’s favourite list of stocks, user list of a maximum 50 different stocks, and all India stocks screener.

- Market Outlook: This will enable you to experience current market status, learning and special articles, and daily and weekly handwritten market analysis commentary.

- Pattern Recognition: This will help you enjoy full chart or evaluation view, mini-chart in idealists, and buy and sell ranges on the chart.

- Model Portfolio: This feature will help you enjoy a list of current holdings, weekly handwritten model portfolio commentary, and additional reports and weekly updates of model portfolio stocks.

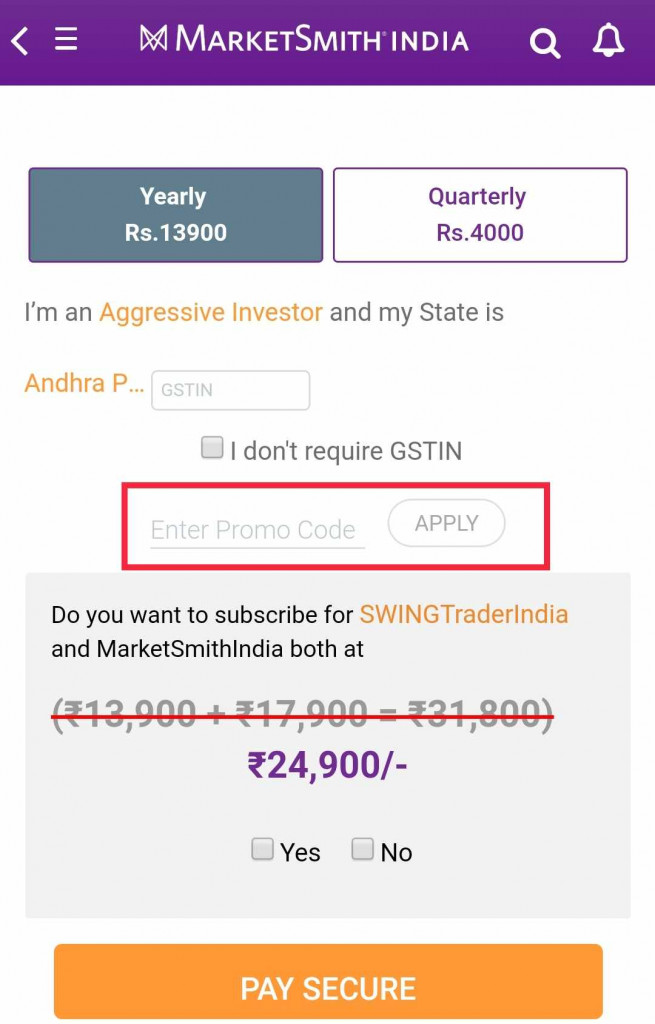

MarketSmith India Pricing

As an investor, MarketSmith India provides a single package for all its investors which they have named Premium Investing Content and Exclusive Stock List. They have 2 different packages under this membership.

The first one is for a period of a quarter and priced at ₹4000.

The other is for a time span of a year and priced at ₹13,900.

MarketSmith India Promo Code

Well, here is the best part.

The readers of A Digital Blogger get an exclusive discount of 25% on the different subscription plans of Marketsmith India.

To avail the discount, you just need to download the MarketSmith India App and use the below mentioned coupon code while taking the subscription. Your overall amount will be deducted by 25%.

Here is the Promo code or Referral code that you can use in the app as shown below:

ADB25

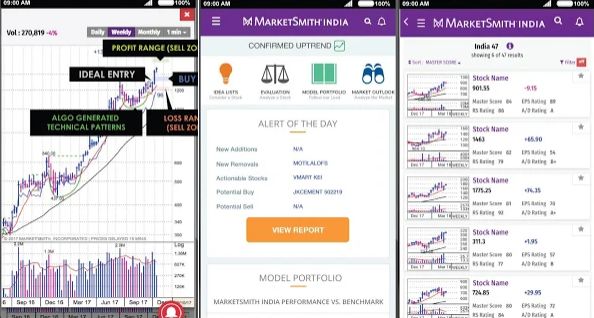

MarketSmith India App

The research firm offers a mobile app for both Android as well as iOs versions and provides different features to its users. Some of those features are listed below:

- Pattern Recognition

- Lists and reports on different stocks

- Market Commentary

- Option to follow and learn the research methodology

This mobile app from MarketSmith has a few concerns, as listed below:

- Average app design

- Performance and speed can be improved

The app design looks like this:

Here is how the app is rated at Google Play store:

| Number of Installs | 100,000+ |

| Mobile App Size | 4.8MB |

| Negative Ratings Percentage | 15.7% |

| Overall Review |  |

| Update Frequency | 6 Months |

MarketSmith India Advantages

Listed below are some of the advantages of seeking the services of MarketSmith India.

- Gives you an algorithm based stock recommendations which are practical and useful in the long run.

- Has a paid trial period of a week and a single membership plan which is quite reasonably priced.

MarketSmith India Disadvantages

Here are some of the disadvantages of signing up with MarketSmith for their advisory services in the share market.

- The data can be extensive and some users may take time just to understand the true meaning of the data.

- A limited number of services to offer.

The algorithmic stock list is the primary attraction offered by MarketSmith India. Although they have just a single membership plan, as a first-timer investor it is always suggested to go for the trial offer rather than the paid membership.

Once you are sure about the benefits of their advisory services, you may go ahead with their paid services.

In case you are looking to get started with the advisory service, just fill in some basic details in the form below.

A callback will be arranged for you:

Also Read:

If you wish to know about some of the other advisory firms, here are a few references for you:

Unfortunately, I have subscribed for many years just on the trust of their commitments of best services. But the company doesn’t meet the requirement of services like MetaStock, Bloomberg and eSignal, and do not help whenever you need the most.

Very bad experience with shady team of marketsmithindia. Avoid any subscription of their services otherwise you’ll be disappointed. Thanks.