Trustline Securities Franchise

View All Sub-Broker Reviews

Trustline Securities Franchise comes under the umbrella of offerings of full-service stockbrokers in India as a business opportunity. The broker offers products and services in the different segments including equity, currency, and commodity trading to meet the requirement of its customers.

Full-service stockbroker – Trustline securities was established in the year 1989 and have been able to capture the financial market since then.

The broker offers customized investment services to its clients which includes corporate, retail investors and institutions through its wide network spread all over the country by dealing in the insurance, financial markets, insurance, real estate & bullions.

Trustline Securities Franchise Review

Trustline offers its services through both online and offline channels. It has robust technology, experienced staff, and user-friendly platforms to make the trading experience smooth for its clients and partners.

It deals in both cash and derivative segments of BSE and NSE. Furthermore, it has a membership of NSDL and CDSL as well. Here is the list of different segments of products and services in which the broker deals.

- Equity

- Currency

- Commodity

- Portfolio management services (PMS)

- IPO

- Gold

- Insurance

- Real estate

- Research-based services

In this article, we are going to discuss different important aspects of the company including business model, revenue sharing, offers to the sub-broker, investment requirement, benefits and support etc.

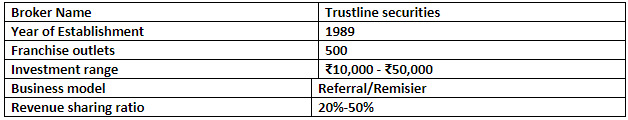

Here is a quick overview of Trustline Securities Franchise:

Trustline Securities Franchise Model Types

The business model of Trustline securities is very simple and straight-forward in its proposition.

The main goal of the broker’s business model is to make long-term clients, not the ones that are flirting with money. In other words, attracting and retaining clients for the long-term relationship is the cornerstone of the Trustline Securities business model.

The company offers only one type of business model: Referrals/Remisier model.

Referral/Remisier model:

If you want to become a partner with the Trustline securities, you will have to go with Referral model of the broker. Under this model, word-of-mouth plays an important role in making the client base strong for the company.

To start a business under this model, all you need to open an account with the broker and then you are free to invite clients as many clients as you want. There is no capping.

Every trader who trades by your reference will generate income for you as long as they trade. This model gives you an opportunity to earn even after you stop trading. You will be given a share of the brokerage generated by every referred client, who trades through Trustline securities.

In this way, you can earn for a lifetime as long as the client is using the services of this full-service broker. It obviously means your earning will increase with the increasing number of the referred clients.

Trustline Securities Franchise: Revenue sharing ratio

Actually, in the referral model, a business partner gets revenue sharing in the range of 20%-50% of the brokerage generated by their clients depending on different conditions. You will be paid a percentage of the brokerage generated by your referred clients each time they trade.

Here is a quick overview for your reference:

Trustline Securities Franchise Costing

Trustline securities have a minimal range of initial investment. The range is ₹10,000- ₹50,000 to be submitted by the business partner as an initial investment. This amount includes some security deposit as well as charges for some basic office equipment provided to the partner within the broker’s office.

This is how it looks:

Trustline Securities Franchise: Pros and Cons

Here are a few positives and negatives of going ahead with a partnership with Trustline securities franchise, that you must be aware of:

Pros:

- Low initial investment.

- Reasonable revenue sharing ratio.

- An opportunity to earn lifetime.

Cons:

- Only one business model.

Trustline Securities Franchise Offers:

Trustline Securities provide following offers to their business partner to attract them to do business with the company.

- Ongoing support will be provided by the broker in every field where the business partner will require help.

- A business partner needs to advertise their business to attract clients. Trustline Securities help the business partner in the advertisement of the sub-broker business.

- Training will be provided to the business partner at the nearest company-owned branch.

- Marketing related support will be provided to the partner.

- A proven business model is also provided.

- The low initial investment is required to start a business with the broker.

- The business partner will be supported in getting minimum requirements like trading terminal, desk etc. by the broker within their office.

Trustline Securities Franchise Eligibility

To join hands with the Trustline securities, you are not required to fulfil any tough criteria. But, it requires minimum and mandatory eligibility to start a broking business.

- An individual Entrepreneur who can investment easily by taking the risk.

- Prior experience in the same or related field is a plus point to start the business.

- An individual must have entrepreneurial characteristics like leadership quality, team player etc.

Trustline Securities Franchise Registration:

If you want to start a partnership business with the Trustline Securities you will have to follow the following steps:

- Fill-up the registration form available on the website. You can get started by filling in the below-displayed form as well:

- You will get a call from the call centre to verify your interest in the partnership business with the broker.

- After confirmation, you will have to wait for another call from the broker side.

- By attending another call, you will be asked to fix an appointment with the sales representative.

- The Sales representative will clear your all queries and confusion related to the business.

- Submit all the required documents for verification purpose.

- After verification, You will get an account ID.

The entire process will take almost 6-8 business days to complete.

Trustline Securities Franchise Problems

There could be some issues of starting a business with the broker.

- Only the Referral business partnership model is available. Thus, anyone wants to do business with the Trustline Securities at any other level will have to search for another broker.

- The density of branches is not more all over India. It is limited to the Northen side. So, it will create a bit problem for the clients of remaining all sides of India.

- The Brand equity of the broker is low.

Trustline Securities Franchise Benefits

Finally, here are some of the benefits of partnering with Trustline Securities:

- The broker shares an aggressive revenue sharing slab.

- Affordable initial investment or security deposit required.

- The broker has a high offline presence.

- Trustline offers one stop solution for all financial needs.

- The technology used by the broker is of the high quality, helps the client and business partners to access records and orders in a smooth, safe and seamless way.

- A business partner and client can enjoy the benefits of a dedicated research team and research expertise which ultimately helps in quality trading.

- A business partner will get marketing support from the Trustline Securities team in expansion and advertising of their business.

Trustline Securities Franchise Summary

From the above discussion, it is clear that Trustline Securities is an old name in the financial market, which provides the one-stop solution for all products and services required to the client or partner. It offers only one business model till date with a very low range of initial investment.

So, if you are looking to start a partnership business in broking field and with a low initial investment. You can think about the Trustline Securities business.

In case you are looking to partner with Trustline Securities, let us assist you in taking things forward with the formalities.

Trustline Securities Franchise Locations

Here are some of the locations where Trustline Securities is currently present: