7 Investment Options for New Investors

Check All Investment Services

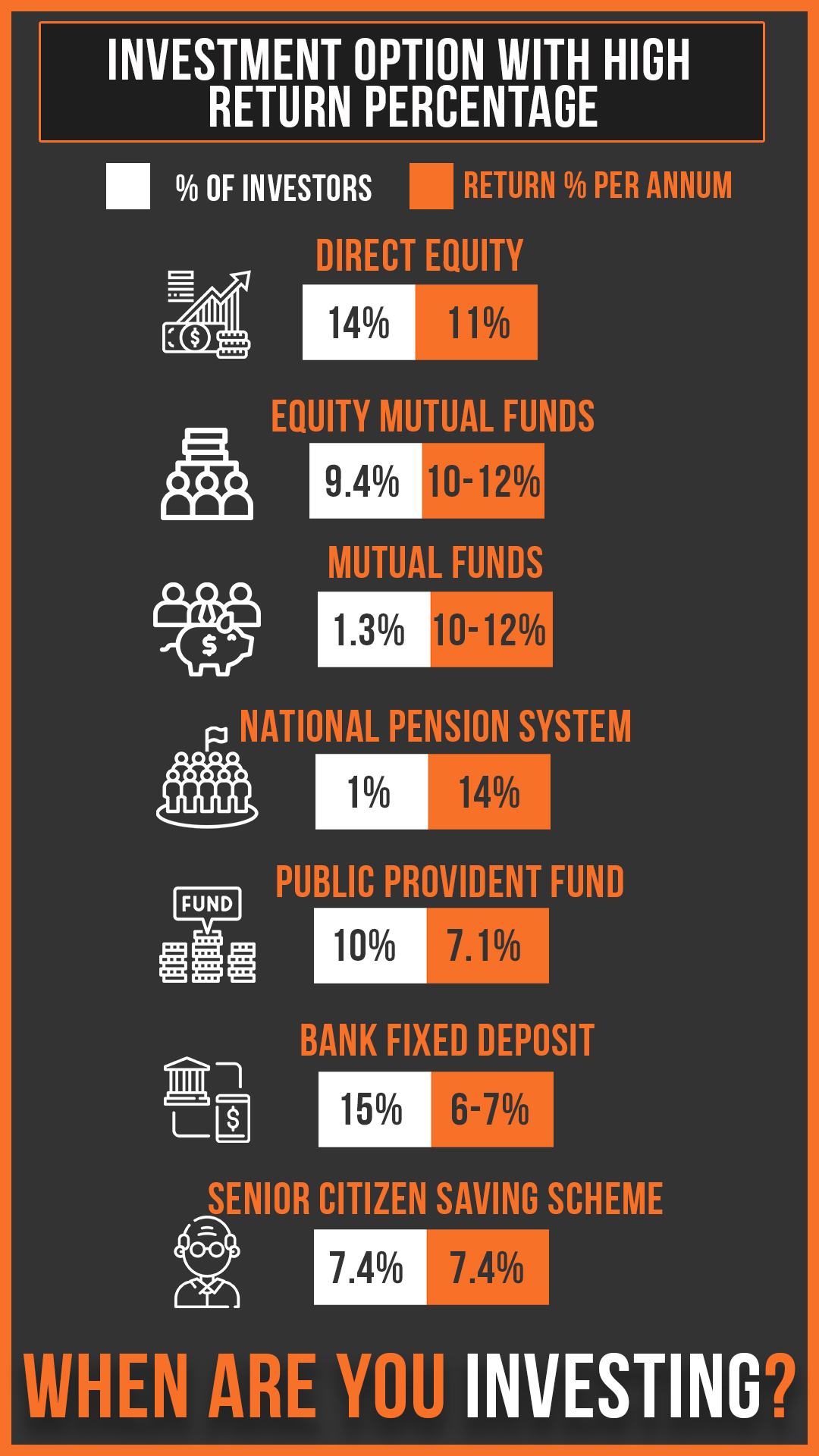

Those who seek to invest their money often do so with the idea of accruing returns that surpass the initial amount they choose to invest. Moreover, they hope not to lose out on this principal sum and hope that the returns they generate are accessible in no time. For this, it is always better for them to look for investment options for new investors in India.

To help you with here we have enlisted some of the investment ideas that can help you in generating good returns.

Investment Ideas for New Investors 2022

High-return, low-risk investments, however, are hard to come by and can be thought of as unrealistic. Risks incurred and returns generated are tethered to one another such that the greater the risks the greater the returns and vice-versa.

Prior to selecting an investment, you must assess your own capacity for risk and compare it against the risks associated with the potential investment that has caught your eye.

The market presently has a number of investment tools that bring with them high risks but also have the potential to secure greater inflation-adjusted returns in comparison to others over long time frames. On the flip side, there also exist several investments that carry low risks and therefore only generate fewer returns.

Viable investment options in India to be considered for this month are as follows.

1. Direct Equity

While everyone might not gravitate to stocks owing to their volatile nature and lack of guarantee on returns, they have been shown to deliver greater inflation-adjusted returns in comparison to all other asset forms. This holds true in the case of long time frames.

2. Equity Mutual Funds

Apart from the direct equity, there is another investment option in India for new investors that offer high returns with comparatively low risk.

Such schemes primarily invest in equity stocks. Equity mutual funds, which invest at least 65 percent of their holdings in equity and equity-tethered tools, may be actively or passively managed.

In the case of the former, returns are primarily dependent on the fund manager’s capabilities to amass returns. Exchange-traded funds along with index funds are passively managed and focus on an underlying index.

3. Mutual Funds

These schemes are ideal for investors that seek steady returns. Owing to their comparatively less volatile nature, they are understood to have lesser risks in comparison to equity funds.

These funds focus on fixed interest accruing securities which include but aren’t limited to corporate bonds, treasury bills, and government securities.

4. National Pension System (or NPS)

This is a long-term scheme oriented towards retirement that the Pension Fund Regulatory and Development authority manages. You are required to contribute a minimum of INR 1000 to remain active for an NPS Tier-1 account.

This system is responsible for investing in a wide range of tools ranging from equity and fixed deposits to government funds, liquid funds, and corporate bonds. You must decide the amount of money you invest in equities via this system keeping in mind your risk profile.

5. Public Provident Fund

Such funds have a tenure that amounts to 15 years, compounded tax-free interest allows you to reap good returns on the initial sum you choose to invest. Moreover, as the interest earned and the principal invested are upheld via a sovereign guarantee, the money you invest is secure.

Each quarter the government reviews the interest rate applicable to the public provident fund.

6. Bank Fixed Deposit

Also known by the acronym FD, it is often viewed to be a comparatively safer investment in comparison to equity and mutual funds in the country.

As per deposit insurance and credit guarantee corporation norms, depositors at banks are insured right up to INR 5 Lakhs at most as of February 2020 keeping in mind the principal and interest amount. This amount was previously INR 1 Lakh.

7. Senior Citizens Saving Scheme

Another investment option in India for keen investors is the Senior Citizens Saving Scheme.

Most retirees are likely to opt for this investment option which is available to senior citizens and early retirees exclusively. Those over the age of 60 can invest in this scheme via a post office or a bank.

With a tenure of five years which can be extended to an additional 3 once the scheme matures, it has an upper investment cap of INR 15 Lakhs. Investors can hold more than one account under this scheme. The interest rate applicable here is payable on a quarterly basis and is taxed in its entirety.

Conclusion

Here are the top 7 investment options in India for beginner investors that can help you in gaining good returns, but the question here is how and from where to invest. You can reap the benefit out of it by beginning at the right age. In general, investing early helps you to earn more money and success in investment.

Well if you are thinking of the same then here is the way. Open your account with Angel One and get started smartly and quickly.

At Angel One, investors are provided with the resources needed to allow for easy investing. The knowledge imparted is free as well and available in the form of podcasts, webinars, and text such that users can select a means that is most conducive to their learning.

Pick the best investment option and begin now by opening a demat account online for FREE!