How To Invest In Power Grid Investment Trust?

People looking for diversification often turn to stable options like Power Grid Investment Trust (PGInvIT) but remain unsure about how to invest in InvITs in India.

In this blog, we will uncover the details of the process and steps involved in InvIT investments.

How to Invest in Power Grid Investment Trust in India?

Power Grid Investment Trust (PGInvIT) is an infrastructure investment trust sponsored by Power Grid Corporation.

It pools money from investors and invests in operational power transmission assets like transmission lines and substations.

In return, investors receive dividend income and potential capital appreciation.

Think of it as owning a share in India’s electricity backbone.

The process of investment is same as other InvITs, so let’s get into the detail.

How to Invest in InvITs?

- Open a Demat Account – Just like stocks, units of PGInvIT are listed on NSE and BSE. So, in order to invest, open a demat account with brokers offering it, like Zerodha, Groww, and Angel One.

- Check Current Price – Search for “PGInvIT” on your trading platform. Before investing, compare its unit price and dividend yield.

- Place Buy Order – Add quantity and fill in other details to place the buy order.

- Hold and Earn – Investors get income distributions, usually 2–3 times a year.

For example, let’s say you want to invest Rs. 50,000. You would check the current price per unit of PGINVIT and calculate how many units you can buy.

If the unit price is Rs. 100, you could purchase 500 units.

What is the Minimum Subscription Amount for Public InvITs?

Now, to invest in InvITs, there is a minimum investment value, the details of which are given below:

-

Lower entry barrier: Remember when you needed at least ₹1 lakh to invest in public InvITs? Well, not anymore!

-

New SEBI rule: The minimum investment is now just ₹10,000–₹15,000 — that’s a huge drop and makes it way more accessible.

-

Who benefits: This is great news for everyday investors who’ve wanted a slice of India’s growing infrastructure story without breaking the bank.

How do InvITs Offer Returns to Investors?

Many investors look forward to investing in InvITs, but is it good to invest in infrastructure funds in India.

Let’s get into the details of how InvITs generate income:

- Dividends: A portion of the profits earned by the underlying power transmission projects is distributed as dividends. Since these are operational assets with long-term government-backed contracts, dividend payouts tend to be stable and predictable.

- Interest: InvITs often lend money to their underlying project subsidiaries. The interest earned on these loans forms another steady stream of income for investors.

- Return of Capital: Sometimes, a part of the payout comes as a return of capital, meaning the trust returns a portion of your invested amount. This isn’t taxed immediately—it reduces your cost of acquisition, affecting capital gains when you sell your units later.

Together, these components make PGInvIT an attractive choice for investors seeking regular income, tax efficiency, and exposure to India’s growing power infrastructure.

Power Grid Infrastructure Investment Trust Taxation

Now, let’s look at how Power Grid InvIT income is taxed can help investors plan better and maximize post-tax returns:

- Dividends: Dividends received from InvITs are generally tax-free in the hands of investors, as taxes are paid at the trust level.

- Interest Income: The interest portion is taxable as per the investor’s individual income tax slab.

- Capital Gains:

- If units are sold within 3 years, the gains are treated as short-term capital gains, taxed at 15%.

- If held for more than 3 years, they qualify as long-term capital gains (LTCG), taxed at 10% on profits above ₹1 lakh.

- If units are sold within 3 years, the gains are treated as short-term capital gains, taxed at 15%.

- Always review your Form 26AS and broker statements to ensure accurate tax reporting and compliance.

Power Grid Infrastructure Investment Trust Dividend

Dividend yield shows how much income an investor earns from dividends relative to the current price of the investment.

Also, Power grid is more stable in comparison to other investment products.

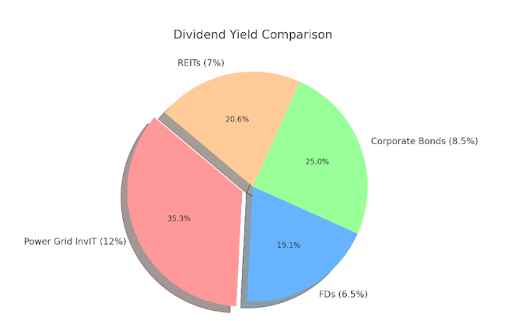

Below is the pie chart, visually shows the portion of annual returns investors get from different options based on a ₹100 investment:

- PGInvIT: ₹12

- FD: ₹6.5 (average)

- Corporate Bond: ₹8.5 (average)

- REIT: ₹7 (average)

- The largest slice highlights Power Grid InvIT (12%), showing it offers the highest annual income.

- FDs have the smallest slice (6.5%), indicating lower returns.

- Corporate bonds (8.5%) and REITs (7%) fall in between.

This visual makes it easy to see why PGInvIT is attractive for income focused investors.

How to Track PGInvITs Investment?

A smart investor is the one who invests and keeps track. This is how you can keep an eye on your investment:

- Check NSE/BSE websites for the latest unit prices and trading updates.

- Use your broker’s Demat/trading account dashboard to view holdings.

- Track dividend announcements through stock exchange filings.

- Follow PGInvIT’s quarterly/annual reports for financial performance.

- Enable price alerts or notifications on trading apps for quick updates.

Benefits of Power Grid InvITs

Here are the benefits of Power grid InvITs:

- Stable Income – Distributes at least 90% of its net income.

- Lower Risk – Backed by Power Grid, a government-owned company.

- Better Yield – Current yield of 12–13%, compared to 6–7% in fixed deposits.

- Easy Liquidity – Units can be traded anytime on the stock exchange.

If you are interested in investing in InviTs in India, then begin your journey now. To begin the process of opening a Demat account with a reliable stockbroker.

Still confused about choosing the right stockbroker? Fill in your details in the form below:

Risks of Power Grid InvITs

No doubt there are lot of benefits, but before investment, consider risks too:

- Interest Rate Fluctuations: Higher interest rates can make other fixed-income investments more attractive, potentially affecting the InvIT’s unit price.

- Operational Risks: Although rare, technical issues or maintenance problems with the transmission lines can impact cash flow.

- Lack of New Assets: The trust’s long-term growth and ability to sustain high dividend payouts depend on its ability to acquire new, revenue-generating assets. If the pace of new acquisitions slows, it could impact future returns.

- On the other hand, a major plus is the high dividend yield, which can be quite a bit higher than traditional fixed deposits. The trust is also highly rated by credit rating agencies, which speaks to its financial stability.

Conclusion

Investing in Power Grid Investment Trust is a smart choice for those seeking steady income and portfolio diversification. With dividend yields of around 12–13%, it clearly outperforms traditional options like fixed deposits, corporate bonds, or even REITs.

While there are risks related to market fluctuations and regulatory changes, the government backing and stable cash flows make it a relatively safer bet. For investors looking for long-term income and exposure to India’s growing power infrastructure, PGInvIT can be a strong addition to the portfolio.

FAQs

Q1. What is the minimum amount required to invest in Power Grid InvIT?

You can start with just one unit, priced around ₹100–110.

Q2. How often will I get dividends?

Typically 2–3 times a year, depending on cash flow.

Q3. Is this investment safe?

While returns are not guaranteed, it is backed by Power Grid Corporation, reducing risk.

Q4. Can I sell my units anytime?

Yes, units are listed on NSE and BSE for easy trading.

Q5. Who should invest in Power Grid Investment Trust?

Ideal for investors looking for steady income and diversification beyond stocks and FDs.