Bank Demat Account

Check All Frequently Asked Questions

Bank Demat Account is basically a demat account offered by a bank-based stockbroker. In this detailed review, we will have a look at some of the topmost bank demat accounts, their corresponding costing, brokerage and finally we will see whether it makes sense for you to open a demat account with a bank or not.

Bank Demat Account Basics

Before we move into the actual discussion on whether to go ahead with a bank-based stockbroker for your demat account and trading account, let’s go through some of the basics first.

Most of the banks in India have their respective trading arms across different parts of the country. Some of these banks include ICICI Direct, SBI Securities, HDFC Securities and so on. Now, since these trading arms come from prominent banking houses of the country, they get to enjoy free brand equity and customer trust without proving themselves in the market.

This statement could be a stretch as well, but most of the time, the Bank Demat Accounts gain a “perception” of trust from their potential clients that are looking to invest or trade in the stock market.

Nonetheless, let’s perform an autopsy of these claims and user perceptions and figure out by ourselves, whether it makes sense for you to go ahead with a bank demat account or not.

Bank Demat Account Positives

Let’s talk positives first:

First and foremost, like mentioned above, the bank demat account gives a “feel” of trust, integrity, and safety to the user base, especially the ones that are at a beginner level and have little or no knowledge of the stock market.

Such users “feel” that bank-based stockbrokers will always be trustable with their money and stocks lying in their kitty

Secondly, most of these bank-based stockbrokers have in-house research and advisory services that provide tips, research, and recommendations to their clients at both technical and fundamental levels. This is again, something a beginner level trader will prefer to have in place where he/she is provided with tips and recommendations on a regular basis.

Thirdly, a 3 in 1 Demat account is something that is exclusively provided in these bank demat accounts where your trading account is integrated with your bank account. With this in place, fund transfers between the two accounts happen automatically and you don’t need to perform any manual operations.

Fourthly, Part of the user base prefers their broker to have a physical presence around their location in the form of a branch office etc. Now, as we are talking about banks here, some of the most prominent banks such as SBI Securities has one of the vast physical coverage across different parts of India including villages and 3rd tier towns.

Finally, a beginner trader will get a top welcome if the customer support provided by the broker is professional and quick in nature. Yes, there are stockbrokers in India that offer some of the laziest support teams that are of no assistance to their clients, but user requirement is always going to be at a top-notch level.

This is how a beginner trader “perceives” a bank-based stockbroker.

Now, let’s look at the other side of the coin.

The good thing in favour of these bank demat accounts is that they get access to the customer base due to the base built by their parent brands. But do these brokers justify the benefits they get?

Do they actually provide the kind of values, users’ perceive about them?

Are they pocket-friendly for beginner-level users who start with low initial capital in the first place?

Which is the Best Bank for Demat Account?

While we are learning about bank demat accounts and their corresponding formalities & details, its good time to understand the best banks out there for you to open your demat accounts.

Most of the banks in India, especially the private ones have their trading arm in the form of a stockbroking firm.

Some of the reputed and trustable such banks with trading facilities are:

- ICICI Direct

- HDFC Securities

- Kotak Securities

- Axis Direct

- SBI Capital

So, in case you are looking to go ahead with a 3-in-1 demat account with a leading bank-based stockbroker, the upper mentioned ones could be few options for you to check out.

Bank Demat Account Facts

Here are some of the facts about such bank demat accounts that you must have the understanding about, before making your conclusion about your trading account:

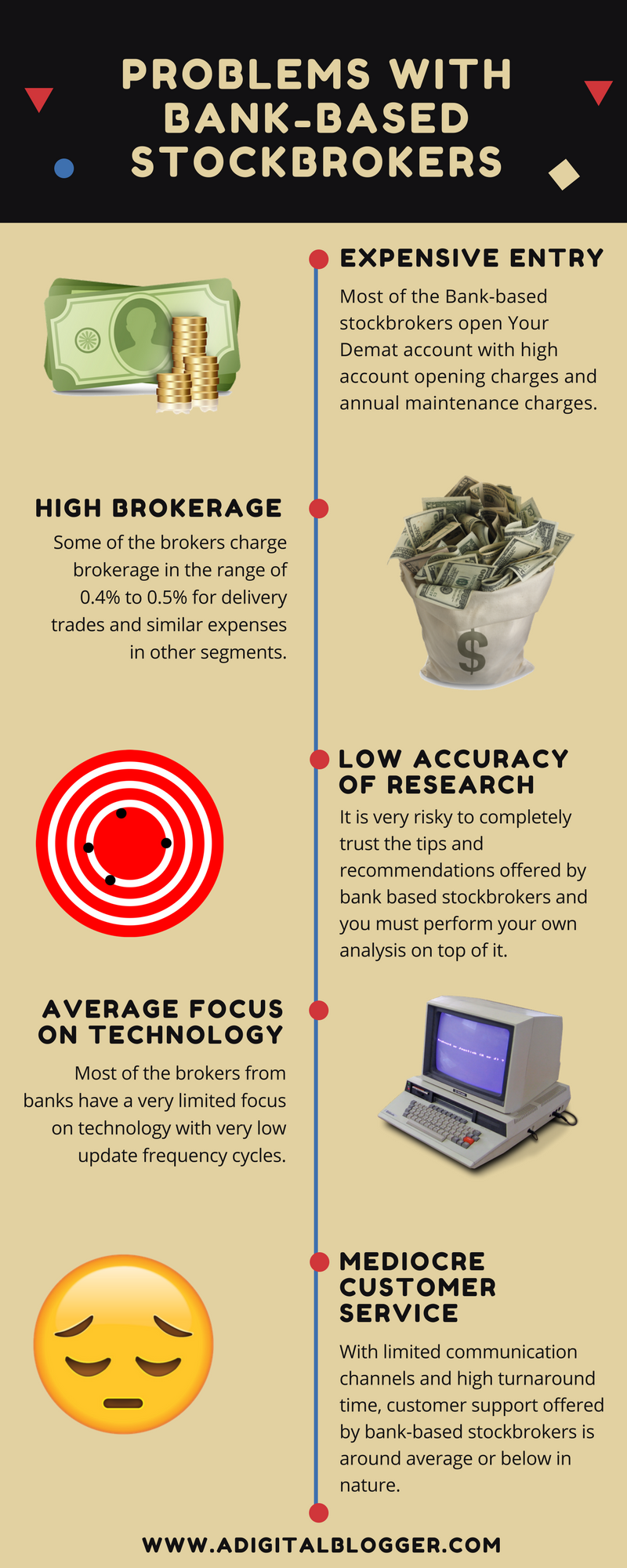

High Account Opening and Annual Maintenance Charges (AMC) can make the entry for a lot of beginner traders either expensive or discouraging in the first place.

Most of the bank demat accounts charge pretty expensive account opening charges to go along with high annual maintenance charges that are supposed to be paid every year.

The story does not end at high account level charges, but it continues at the brokerage level as well.

This hurts more since brokerage is something that you will pay on a consistent basis every time you place a trade on the stock market.

The brokerage falls in the range of 0.4% to 0.5% at delivery and ₹120 to ₹250 for derivatives trading.

Yes, beginner level traders need some initial handholding in the form of tips, research, and recommendations but this research needs to have a reasonable level of accuracy.

Very few bank-based stockbrokers can claim decent accuracy in their tips while mainstream full-service stockbrokers (and a handful of discount stockbrokers) provide much better research accuracy.

When it comes to technology or imbibing technology in their services and offerings, it seems that bank-based stockbrokers are the ones that go into a hibernation state.

Yes, brokers such as ICICI Direct Trade Racer, HDFC Securities with HDFC Blink provide some value to their clients.

But on a generic level, most of the trading platforms offered by these bank-based stockbrokers are pretty average in performance and overall trading experience.

Finally, with their primary focus on banking services – bank demat accounts get a very miniscule chunk of their revenue from their trading services.

This impacts the overall customer service they actually provide on a ground level to their clients.

The major concerns are the turnaround time that executives take in order to resolve your queries, skill-set of executives, personalization of communication, and so on.

Also, know about Trading Account Charges In SBI and reap its benefit.

This is how Bank-based stockbrokers “actually” perform

Bank Demat Account – Shall You Open?

So what’s the Answer? Should You Open a Bank Demat Account?

Well, we are not going to keep it diplomatic or grey for you.

Frankly speaking, the answer is NO.

It does not make sense to open a bank demat account unless you want to:

- Pay hefty charges when there are discount brokers offering 20 to 25 times fewer brokerage charges

- trust on relatively less accurate tips and recommendations

- use trading platforms that are updated at very-low-frequency levels

Yes, opening your bank demat account makes sense only and only when:

- You have no trust in SEBI doing its job across different stockbroker types.

- You are open to paying more but want to use your bank only for a 3 in 1 Demat Account

But before we end this piece, we would still like to remind you that you need to make sure that the stockbroker you are actually choosing, be it any type – full-service, discount, bank-based, does not matter.

You need to perform some checks such as:

- Check the background of the broker, including its client base, year of launch, the parent company, SEBI/NSE/BSE etc licenses etc.

- Carefully sign the PoA (Power of Attorney) – you are not required to sign everything in a PoA as per the latest curriculum of SEBI. Thus, be cautious about what parts of the PoA you are signing.

- Get all sorts of charges discussed in writing from the official email id of the brokers’ executive.

With this, let’s wrap up this edition on whether to go ahead with a bank demat account or not. We hope you will be able to make a decision for yourself in the most objective manner.

Nonetheless, if you need a suggestion on a stockbroker that matches exactly with your requirements, you can use the form below and broker details will be sent to you:

Read this review in Hindi here.