JM Financial Intraday Charges

Intraday trading is the most dominant trading segment in the Indian trading segment, so you should choose a broker who provides the best research and tips and charges minimum brokerage. So which broker can be good than JM Financial. But you need to know JM Financial Intraday Charges before starting intraday trading with this full service broker.

In this blog, we will explain JM Financial’s intraday charges and other charges that usually remain hidden from plain sight.

JM Financial Intraday Trading Brokerage Charges

JM Financial although a full-service broker but is known for charging the least intraday fees. Now, this becomes more beneficial for the traders executing multiple trades in a day.

The intraday trading brokerage charged by the broker is 0.02% of the turnover value.

Here are details in the table below:

| JM Financial Intraday Brokerage | |

| Intraday Brokerage Charges | 0.02% of the turnover value |

In case you are thinking about how JM Financial brokerage for intraday trade is calculated let’s show you an example.

Suppose a trader Akshay bought 50 shares for ₹ 5000 and sold them for ₹10000. So the total trade turnover is ₹ 15000

Now brokerage is charged on the buy-side is =0.02% of ₹5000 = ₹1

Intraday brokerage on the sell-side is 0.02% of ₹10000= ₹2

So total brokerages on turnover of ₹15000 is=₹3

In this way you can calculate equity intraday trade.

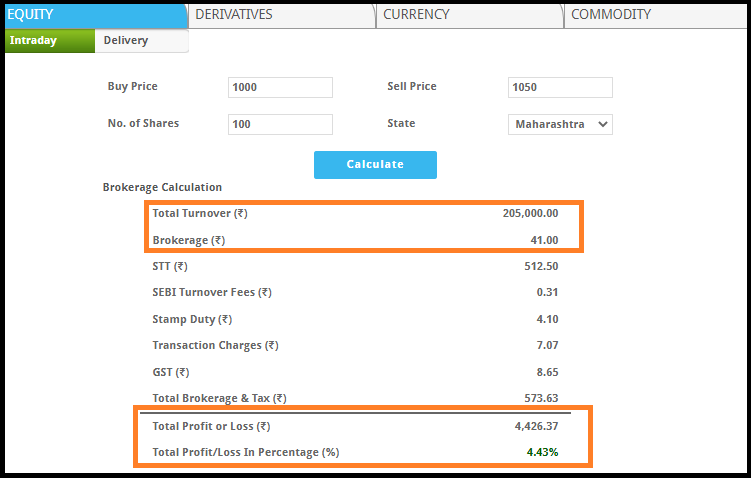

JM Financial Brokerage Calculator

As we have stated earlier apart from brokerage you have to pay some other charges like STT (Security Transaction Tax) and GST which goes to the Indian government, Stamp duty goes to states, Transaction Tax goes to Stock exchange NSE and BSE and SEBI charges.

All of these charges are as follow:

- SEBI Charges: 0.00015% of the turnover value

- Transaction Charges: 0.00345% of the turnover value

- Stamp Duty: 0.002% of buy value

- STT Charges: 0.25% of the turnover value

- GST Charges: 18% (Brokerage+Transaction)

Now to calculate these charges along with the brokerage, you can rely on the JM Financial brokerage calculator. Just enter the basic information like buy, sell price, and a number of shares.

Conclusion

Intraday trading involves multiple trades and with each trade burden of brokerage increases too. Also, intraday trading involves a high risk of losses so you should go with full-service broker JM Financial which also provides trading advisory and low brokerage charges.

With JM Financial’s trading advisory and low brokerage, you can maximize your trading returns.

As you have complete knowhow of JM Financial Intraday charges you can start intraday trading by opening a Demat account with JM Financial.

Want to begin your investment journey? Get in touch with us and we will assist you in opening a demat account online with a renowned stockbroker for FREE