STT Charges in Zerodha

Charges

If you are planning to Zerodha Sign Up for stock market trading it would be advisable for you to know about brokerage and other charges including STT charges In Zerodha.

In case you are thinking about what are STT charges, here is the answer.

What is STT Charges in Zerodha?

For trading in different segments, you need to pay different kinds of charges like Zerodha Brokerage, GST on trade, etc. Now, apart from these charges, there is a Security Transaction Tax.

STT charges also known as Security Transaction Tax, is a direct tax levied on every buy and sell order of securities that are registered on the stock exchanges (NSE and BSE).

But STT charges are not uniform and they vary according to trading segments and transaction types.

They are termed direct taxes because STT charges are paid directly to the government of India and these are calculated on average price.

STT Charges look minuscule but when you average they form a considerable part of returns in stock market trading that is why you should know STT charges before you decide to start trading with any of the trading segments.

Here is the list of STT charges in Zerodha in different trade segments like Equity, Commodity, and Currency.

| Zerodha STT Charges | ||

| Trade Segment | STT Charges | Transaction Type |

| Equity Delivery | 0.1% of the turnover value | Buy and Sell Side |

| Equity Intraday | 0.25% of the turnover value | Sell Side |

| Equity Futures | 0.01% of the turnover value | Sell Side |

| Equity Options | 0.05% of the premium value | Sell Side on (Premium Value) |

| Currency Futures | No STT | - |

| Currency Options | No STT | - |

| Commodity Futures | 0.01% of the turnover value | Sell Side |

| Commodity Options | 0.05% of the turnover value | Sell Side |

How to Calculate STT Charges in Zerodha?

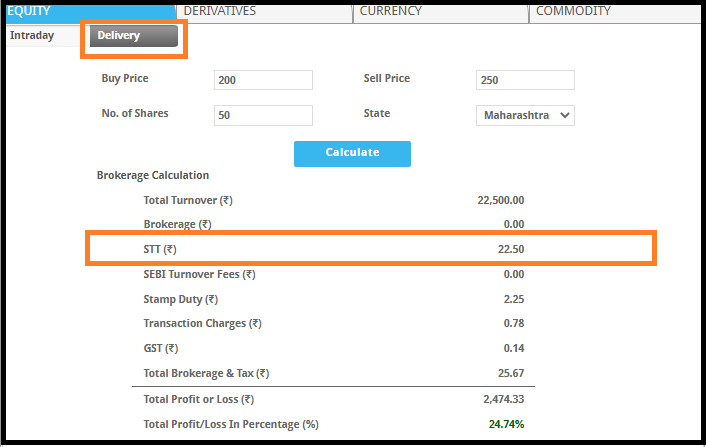

When it comes to calculating the brokerage in Zerodha, it becomes important to understand the calculation of each and every type of charge. Let’s show you how STT charges are calculated with a trading example.

Suppose you have 50 shares of TATA at a price of ₹200 per share and sold those shares for ₹250 after 2 months. Thus, you executed trade in equity delivery segment. So, as per the charges enlisted in the above table, you have to pay 0.1% on your turnover value as STT charges.

STT on Buy Side= 0.1%* (200*50)

=₹10

STT on Sell Side=0.1%* (250*50)

=₹12.5

So the total STT on the buy and sell side will be ₹22.5

In this way, you can calculate STT charges for other trading segments too. Also, if you have already placed a trade then you can check brokerage charges in Zerodha by logging in to Console.

In case you find it confusing and complex you can use the Zerodha Brokerage Calculator.

Zerodha Brokerage Calculator

To simplify the calculation of brokerage and other taxes levied on your trade you can rely on the digital calculator, where you just need to enter the buy price, sell price and other details.

Here not only the taxes or brokerage, but you will also be able to know the total profit or loss in a trade.

Conclusion

STT charges remain hidden from plain sight and most often they are ignored by traders and investors too,

When these charges appear on receipt of the final trade segment, they unpleasant their trading experience. You can avoid such unpleasant situations by knowing about STT charges in advance.

Also, you can choose a trading segment with low STT Charges and maximize your profit potential.

Want to begin your investment journey in the stock market? Get in touch with us now and we will assist you in opening a demat account online for FREE!