Check All Brokerage Reviews

Zerodha being the first discount broker offers the opportunity to traders to trade at the minimum cost. So, if you are thinking of opening an account with the broker, here is the complete detail of the Zerodha brokerage charges.

Let’s take a close look!

Zerodha Brokerage Charges

Zerodha is known not only for the discount brokerage plans but also for various other propositions such as:

- High-Performance Trading Platforms

- Free Delivery Trades

- Investing is allowed across multiple trading segments including Equity, Commodity, Currency, Mutual funds, etc.

The brokerage charges of Zerodha have a maximum cap of ₹20 per executed trade, be it any segment. Furthermore, the brokerage can be even less depending on your trade value.

Apart from Brokerage, you are charged the following as well:

- STT – Securities Transaction Tax is charged by the Government of India.

- Transaction Charges – a charge levied by specific exchanges (NSE or BSE)

- SEBI Charges – SEBI is a regulatory body in the Indian stock market ecosystem and charges specific rates on your trades.

- GST – the much-talked-about Goods and Service tax is levied on the sum of the brokerage generated and transaction charges.

- Stamp Duty – is levied by your specific state in India and it varies based on the state in you opened your trading account in.

For complete details, let’s check the Zerodha brokerage charges across different segments:

Zerodha Equity Charges

The equity segment allows you to trade and invest in listed shares of a company. One can invest in shares by placing a CNC order in the Kite app.

Other than this, there are multiple trading options where one can hold an equity share for a day by execution MIS trade or can trade in contracts (futures and options) to execute the trade at the predetermined price in the future date called the expiry date.

For all the segments, there are separate brokerage charges charged by the broker which are explained below.

Zerodha Delivery Charges

The Equity Delivery Trades have ₹0 Brokerage attached to them. In other words, if you buy a stock today and sell it on any other day – then you will not be charged any brokerage. Yes, there will be few taxes and other charges but as far as the brokerage is concerned, you will not pay anything for such trades.

Here are the details:

| Zerodha Delivery Brokerage | |

| Delivery Brokerage Charges | ₹0 |

Zerodha Intraday Charges

If you are someone who trades at an intra-day level i.e. buys and sells the stocks on the same trading day, you will be levied a maximum of ₹20 per executed trade.

Here are the details:

| Zerodha Intraday Charges | |

| Intraday Brokerage Charges | 0.03% or ₹20/Trade whichever is lower |

Zerodha Futures Charges

For traders preferring to trade in the futures segment, the brokerage charges remain the same as Intraday trades.

Zerodha charges less than Angel One which you can see if you do Angel One vs Zerodha comparison on this basis. Zerodha charges a minimum of 0.03% or ₹20 whereas the former levies flat ₹20.

Here are the details for Zerodha futures fees:

| Zerodha Futures Brokerage Charges | |

| Future Brokerage Charges | 0.03% or Rs. 20/executed order, whichever is lower |

Zerodha Option Trading Charges

In Options Trading in the equity segment, Zerodha charges flat at ₹20 per executed trade without any dependency on your trade value or lot size. Thus, even if your trade in 100 lots, the brokerage will still be ₹20.

| Zerodha Option Brokerage Charges | |

| Option Brokerage Charges | Flat Rs. 20 per executed order |

Zerodha Commodity Brokerage

As far as commodity trading is concerned, the brokerage for both futures and options segments would be 0.03% or ₹20 whichever is lower.

| Zerodha Commodity Brokerage Charges | |

| Commodity Futures Brokerage Charges | 0.03% or Rs. 20/executed order whichever is lower |

| Commodity Options Brokerage Charges |

Zerodha Currency Brokerage

Like commodities, there are futures and options contracts for currencies too. In the Indian share market you can trade in four different currencies, namely:

- US Dollar

- Euro

- Pound

- Japanese Yen

There are different contracts with expiry dates are available for trading and here are the charges you need to pay once the order is executed.

| Zerodha Currency Brokerage Charges | |

| Currency Futures Brokerage Charges | 0.03% or Rs. 20/executed order whichever is lower |

| Currency Options Brokerage Charges |

STT Charges in Zerodha

The STT charges generally refer to the tax you need to pay for trading in the market even before you make a profit.

The Securities transaction charges differ for different segments. Here are the updated STT charges in Zerodha.

| Zerodha STT Charges | |

| Equity Delivery | 0.1% of the turnover on both buy & sell |

| Equity Intraday | 0.025% of the selling side turnover |

| Futures (Stock & Index) | 0.01% on selling side turnover |

| Options (Stock & Index) | 0.05% on selling side turnover |

| Currency Futures | No STT |

| Currency Options | No STT |

| Commodity Futures | 0.01% on selling side turnover |

| Commodity Options | 0.05% on selling side turnover |

Zerodha Stamp Duty Charges

As mentioned above, stamp duty varies based on your state in India and correspondingly charges are levied on your trades. This is charged only on the buy side, i.e. on the basis of buying value.

| Zerodha Stamp Duty Charges | |

| Equity Delivery | 0.015% or ₹1500 / crore on buy side |

| Equity Intraday | 0.003% or ₹300 / crore on buy side |

| Equity Futures | 0.002% or ₹200 / crore on buy side |

| Equity Options | 0.003% or ₹300 / crore on buy side |

| Currency Futures | 0.0001% or ₹10 / crore on buy side |

| Currency Options | 0.0001% or ₹10 / crore on buy side |

| Commodity Futures | 0.002% or ₹200 / crore on buy side |

| Commodity Options | 0.003% or ₹300 / crore on buy side |

Zerodha Transaction Charges

As mentioned above, apart from brokerage there are other charges you are supposed to shell out in your trades. Transaction charges are levied by the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) and are a small percentage of your trade value.

In other words, the higher your trade value – the higher is the transaction charge you end up paying. But still, the percentage value is very minuscule as shown below:

| Zerodha Transaction Charges | |

| Equity Delivery | NSE: 0.00345% |

| BSE: 0.00345% | |

| Equity Intraday | NSE: 0.00345% |

| BSE: 0.00345% | |

| Equity Futures | NSE: 0.002% |

| Equity Options | NSE: 0.053% (on premium) |

| Currency Futures | NSE: 0.0009% |

| BSE: 0.00022% | |

| Currency Options | NSE: 0.035% |

| BSE: 0.001% | |

| Commodity Futures | Group A: 0.0026% |

| Group B: 0.00005%-0.0005% | |

| Commodity Options | 0.05% |

How to Check Zerodha Brokerage Charges?

You can easily check those charges after placing a trade in any of the above segments by following few simple steps:

- Login to Zerodha Kite app and click on Console.

- Now click on Funds and then on Statement.

- Choose the segment.

- Now select the date from which you want to check the brokerage details.

- The complete list of debited amounts along with the trade details will appear on the screen.

Other than this you can click on Report and then on P&L statement to check the brokerage details.

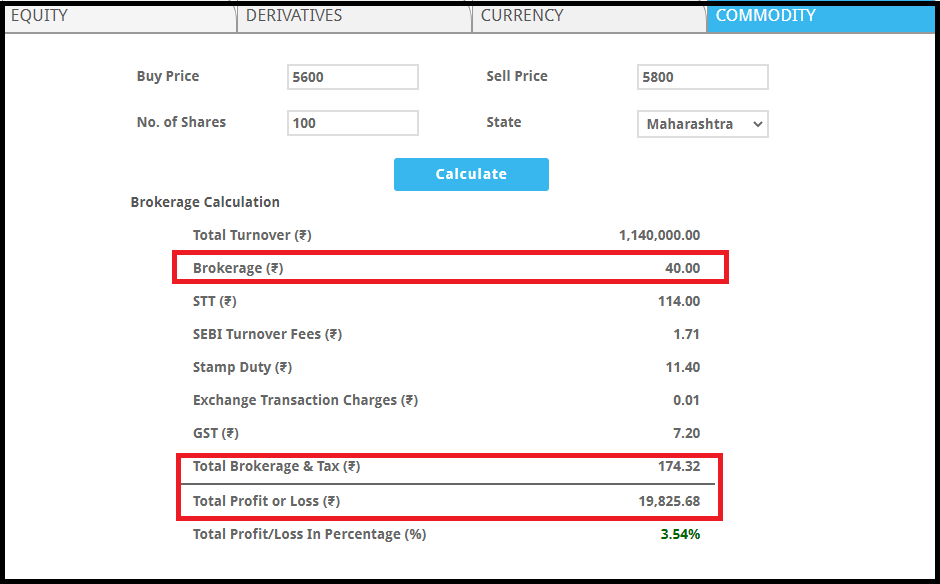

Zerodha Brokerage Calculator

If you are a beginner and finding it difficult to calculate the exact brokerage after considering the transaction, STT, hidden, and other charges, then here is the solution for you.

Make the best use of the calculator to find the total fees you need to pay at the end of each trade. Here’s how it looks like:

Just enter the information like buy/sell price, the number of shares, state and click on calculate button. You will get to know the total charges for that particular trade.

Conclusion

This sums up this piece on Zerodha Brokerage charges. The broker attracts many traders and investors due to its minimum fees that help the trader to trade without any foundation.

Apart from this, the broker is known for offering the best support services, a user-friendly and advanced trading platform, Zerodha Kite that makes trading much easier.

So are you Interested to open an account?

Enter Your details here and we will arrange a FREE Call back.