Zerodha Currency Brokerage

More on Zerodha

If you are a currency trader and have recently opened a Zerodha Demat account, you must be looking for the Zerodha currency trading charges. Well, you have reached the destination where all your questions will be answered in detail.

There are a variety of currency trading charges in Zerodha. The important one is the brokerage fee. So, let’s start with it.

Zerodha Currency Trading Charges

Being the discount broker, you need to pay the flat brokerage fees of ₹20 per trade to trade in the currency segment.

Apart from this, whenever you trade in the currency segment, you have to bear a list of charges. These charges are levied by various participants of the industry – regulator, stockbroker, and government (state and central).

Here is the list of these charges:

- Brokerage Charges

- Securities Transaction Tax (STT)

- Transaction Charges

- GST

- SEBI Charges

- Stamp Charges

Since we are aware that trading in currency is carried out through the trading instruments known as Options and Futures. So, in the upcoming sections, we have discussed all the Zerodha currency trading charges independently.

Zerodha Currency Option Brokerage

As discussed above, there is a range of charges. The most significant charge is that of brokerage. In the general case of Zerodha, the highest brokerage charge is ₹20. For currency options, you have to pay 0.03% or ₹20 per executed, whichever is lower.

Unlike other trading segments, the currency segment is free of STT (securities transaction tax). The GST charges are 18% irrespective of the trading segment.

Zerodha currency trading charges for options are tabulated below:

| Zerodha Currency Option Brokerage | |

| Brokerage Charges | 0.03% or ₹20 per executed order, whichever is lower. |

The other trading instrument is futures. Let’s talk about it now.

Zerodha Currency Futures Brokerage

For currency futures, you have to pay 0.03% or ₹20 per executed, whichever is lower than brokerage charges.

Unlike other trading segments, the currency segment is free of STT (securities transaction tax). The GST charges are 18% irrespective of the trading segment.

| Zerodha Currency Futures Brokerage | |

| Brokerage Charges | 0.03% or ₹20 per executed order, whichever is lower. |

Here it is important to note that Zerodha sell charges will be calculated separately and will be charged whenever you close your existing long position. Also, on using the call and trade facility to place currency trade, the trader has to pay an additional ₹50 per order as call and trade charges in Zerodha.

Zerodha Brokerage Calculatorwith Stamp Duty

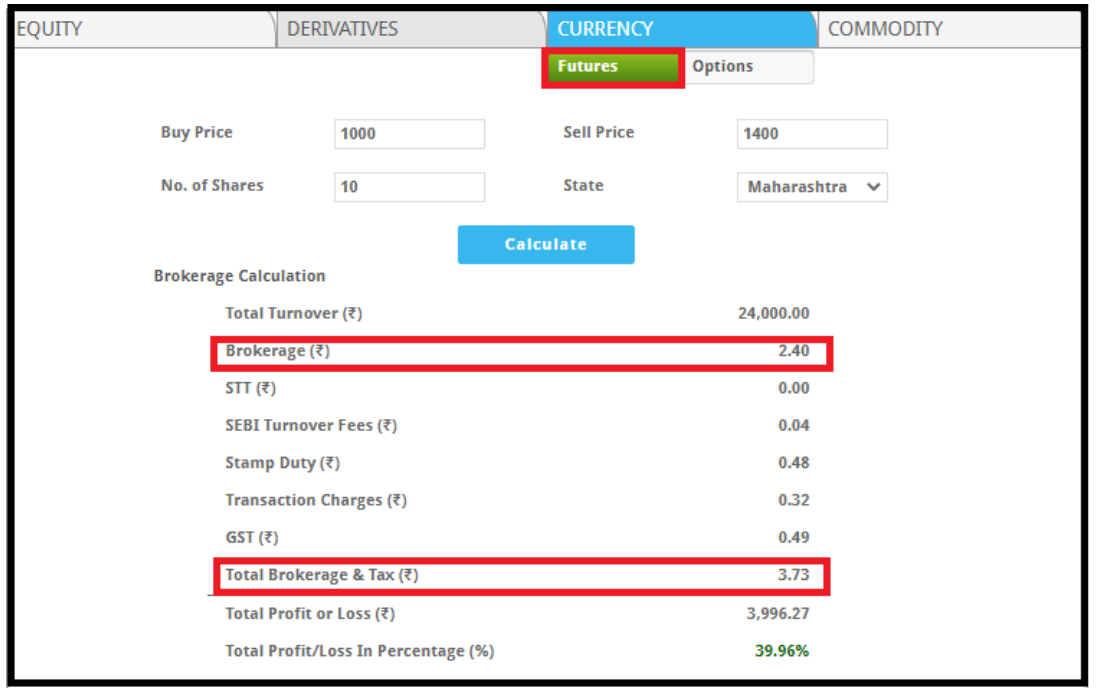

Now as discussed above, apart from the brokerage fees, you need to pay certain taxes as well.

So what is the actual brokerage you need to pay?

Well! It seems to be a little confusing especially for beginners, but you can evaluate the brokerage fees for any segment before executing the trade by using the brokerage calculator.

Just enter the buy, sell price, number of shares, and state and get the perfect evaluation of the brokerage fees charged for the particular trade.

Also, it helps you to grab an idea of the profit or loss percentage.

Conclusion

When a trader decides to open an account with any broker, they look for the charges to be borne by them as they trade in the trading segment of their choice. The reason this is a common practice is that they decide on the expense percentage.

It helps in knowing a rough amount that is to be deducted from every transaction made. So, knowing the Zerodha currency trading charges is extremely important for a currency trader.

We hope that your query was sorted.

In case you still have doubts, use the form below, put your details and we will call you right away to get those cleared: