Dhan Option Trading Charges

Charges

Dhan another discount broker in the Indian stock market industry comes with advanced UI and features for options trading. But before accessing the app and services it is important to consider Dhan option trading charges.

In this article, know about the brokerage fees for options trading across segments and the taxes imposed on the trade.

Dhan Option Trading Brokerage Charges

Brokerage is the fee that the trader pays to its stockbroker for every executed trade. But the higher the brokerage fees less will be the profit, hence it is important to consider it right in the beginning.

Now as you already know that options are traded in lots. So, when it comes to Dhan brokerage, how the broker charges you the fees, is it on per trade or per lot?

Well, for this check the table below:

| Dhan Option Brokerage Charges | |

| Option Brokerage Charges | ₹ 20 per trade |

So, as per the detail, whatever the lot size you need to pay a flat ₹20 per trade for trading in equity, commodity, and currency segments irrespective of the lot size.

But apart from this, there are certain taxes, which vary and thus are discussed separately below.

Equity Option Charges in Dhan

You can easily trade index options and equity option contracts available for trading. However, the brokerage charges are flat ₹20 per trade, but this is not the only fee you need to pay for the trade.

There are some other charges and taxes like STT charges, GST, and SEBI turnover charges. These charges are imposed on the turnover value. Here is the complete detail of all these charges:

| Dhan Equity Option Brokerage Charges | |

| Equity Option Brokerage Charges | ₹ 20 per trade |

| STT Charges | 0.05% of sell value |

| Transaction Charges | 0.053% of trade value |

| SEBI Turnover Charges | 0.0001% of trade value |

| Stamp Duty | 0.003% of buy value |

| GST | 18% of (brokerage+transaction charges) |

Commodity Option Charges in Dhan

Now similar to equity segments there are taxes and other fees associated with commodity trading using Dhan app. These taxes are more or less similar. Check the details in the table below.

| Dhan Commodity Option Brokerage Charges | |

| Commodity Option Brokerage Charges | ₹ 20 per trade |

| STT Charges | 0.05% of sell value |

| Transaction Charges | 0.05% of sell value |

| SEBI Turnover Charges | 0.0001% of trade value |

| Stamp Duty | 0.002% of buy value |

| GST | 18% of (brokerage+transaction charges) |

Currency Option Charges in Dhan

Last comes the currency segment for which there are no STT charges in Dhan. However, other taxes and fees are imposed on the turnover value. The details are given in the table below.

| Dhan Currency Option Brokerage Charges | |

| Currency Option Brokerage Charges | ₹ 20 per trade |

| STT Charges | NIL |

| Transaction Charges | NSE: 0.035% of trade value |

| BSE: 0.001% of trade value | |

| SEBI Turnover Charges | 0.0001% of trade value |

| Stamp Duty | 0.0001% of buy value |

| GST | 18% of (brokerage+transaction charges) |

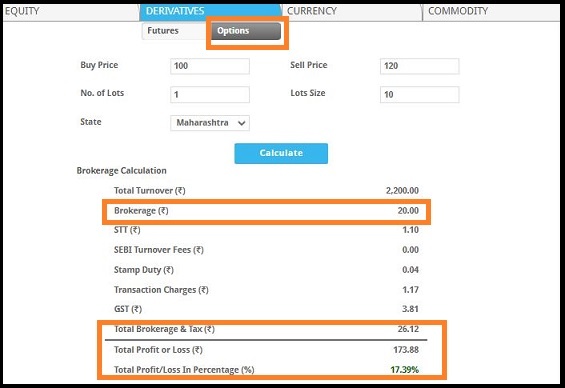

Dhan Brokerage Calculator

Dhan option trading charges thus are not limited to the brokerage. There are other taxes that should be considered before getting into the trade. However, even after knowing these fees, it is difficult for a trader to calculate exact charges correctly.

To solve this, here is the brokerage calculator where you can know the brokerage, taxes and total profit or loss percentage of a trade.

Conclusion

So, if you find the above fee structure and other details attractive, then gain a trading experience with the broker by opening Dhan demat account online. Make sure you activate the segment for doing options trading to avoid any hassle later.

If you are still confused about their services and charges, then get in touch with us. Just fill the basic details in the form below and we will assist you in choosing the right stockbroker and in opening a demat account online for FREE!

More on Dhan