How to Invest in Dividend Stocks?

Check All Investment Services

The Stock market comes up with many different options to multiply your investment, one such is the dividend stocks. But here comes the question of how to invest in dividend stocks?

Investing in dividend stocks gives an assurance of regular passive income and capital appreciation on the stock as time passes.

For example, You invest ₹50,000 in 100 shares of TATA in the year 2020, offering a dividend of ₹50 per share yearly. Now let’s say the share price increases to ₹650 per share. Thus you would be able to generate a profit of ₹15000 (₹65000-₹50000) plus the dividend of ₹5000 (50*100).

Thus you would be able to make a total capital of ₹20,000, a return of 40% on your investment in a year.

Now irrespective of the price of the share you would be able to generate income through dividends as long as the company continues to pay the sum.

Interesting, right?

But the question remains the same: how to invest in dividend stocks?

So, let’s delve in to learn the steps to start investing in the share market.

How to Invest in Dividend Stocks in India?

So now it is clear that by investing in the shares you would be able to get the ownership of the company and also the profit share of the company in the form of dividends.

In India, there are many companies like IOC, PTC India, Coal India, HPCL, etc that pay out the dividends on a quarterly or annual basis but to reap the benefit of investing in such firms, here is the investing guide for young adults and beginners in the share market

1. Open a Demat Account

The first step to begin investing in the dividend stock is to open a Demat account. There are many stockbrokers offering online services to open accounts.

Here it becomes essential to choose the stockbroker with the minimal brokerage fees and incomparable trading platforms and other services.

Once you pick the broker, go through the list of documents required for the Demat account and apply online to start trading and investment without delay.

Now open a Demat account for FREE with the renowned stockbroker of India. Just fill in the basic details in the form below:

2. Research Low Volatile Quality Stocks

The next important step is to look for the company paying dividends on stocks. Now which companies pay the profit share with their investors?

Well! For this, you have to look for the big corporation that is fundamentally strong and has less volatility in its stocks. These are generally those companies that have enough capital to withstand the market fluctuations and keep the business active even in bad quarters.

Some of the major companies paying dividends on stocks are Bajaj Auto, GAIL, Hindustan Zinc, Oil India, etc.

Pick the right company by doing an in-depth fundamental analysis of stocks by reading the annual statement that includes, balance sheet, income statement, and cash flow statement. This helps you in gaining a better understanding of the growth and background of the firm.

3. Read the Stock Quote

After selecting the stock, read the stock quote. Reading a stock quote includes the following points:

- Company Name

- Stock Exchange

- Symbol

- Current Price

- Open Price

- High & Low Price

- Market Capitalization

- Previous Close

- 52 weeks high and low

- Dividend Yield (this is represented in percentage and is calculated by dividing the next 12 months of dividend per share with the current market price)

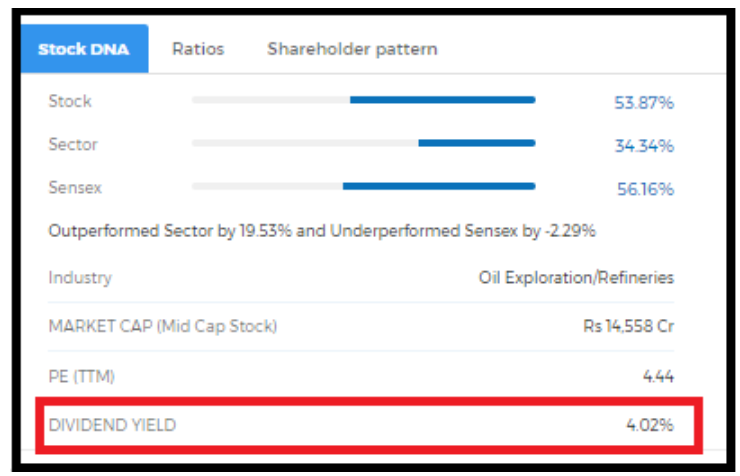

You can easily avail this information in the mobile trading app. Here is the screenshot of Oil India displaying the dividend yield of 4.08% per share.

4. Reinvest Your Dividends

Now there are two ways to get the dividend, either you can collect it in cash and reinvest in another potential stock or shares or you can reinvest it via DRIP.

DRIP is the Dividend Reinvestment Plan where your broker reinvests the dividend in the share on your behalf. For this, you need to contact your broker, who will then reinvest your fund in more shares on the payday.

5. Track Your Dividends

Similar to the share price the dividend value fluctuates continuously This makes it necessary for you to track the dividend amount regularly using your brokerage account and withdraw the funds as soon as the dividend payout drops below the threshold of your need.

Conclusion

No wonder, the dividend payments seem to be the major incentive on investment but it is not essential that the company paying dividends are strong enough to give you long-term returns.

Sometimes the small companies pay the dividend just to attract potential investors to invest in the shares and on the other hand, there are many financially strong companies that do not pay dividends at all.

So, do a proper analysis to get the best way to invest in dividend stocks.

In case you need any help from us in figuring out how to invest in dividend stocks, let us know your contact details and we will call you to assist further: