Value Stocks

More On Share Market

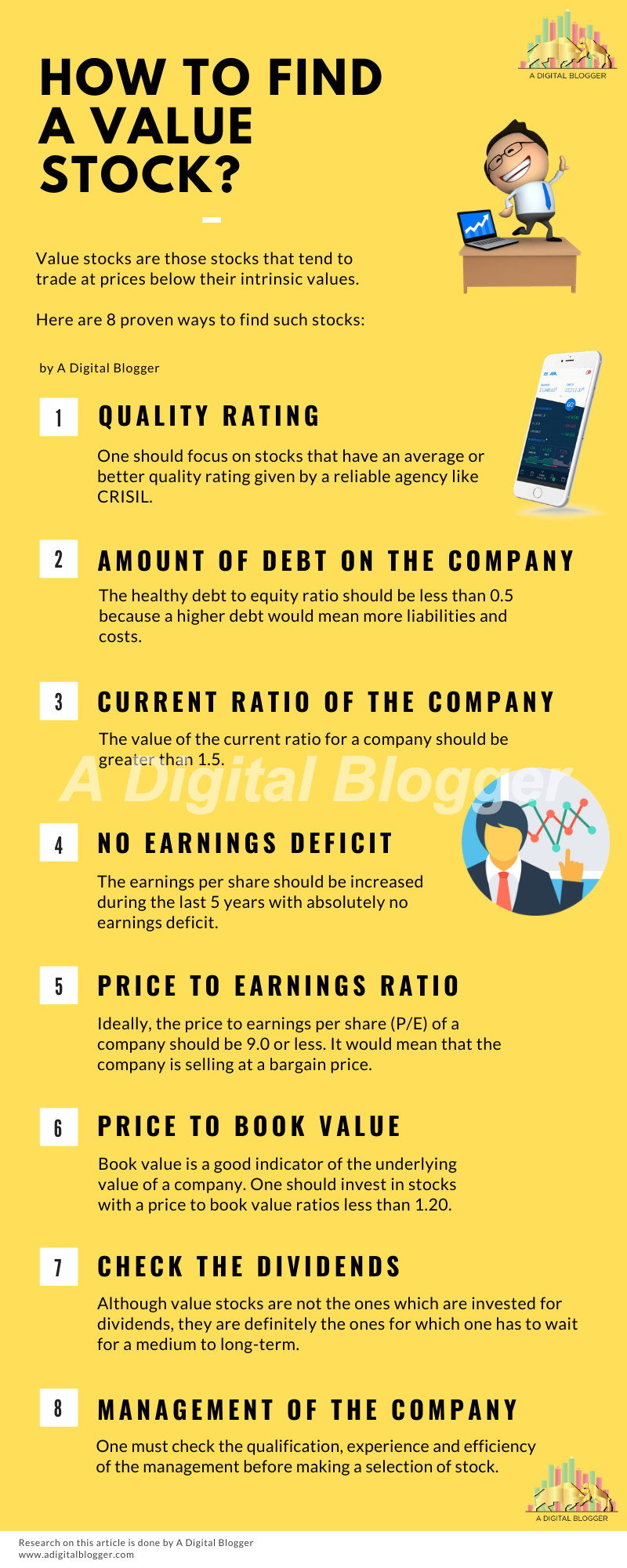

Value stocks are those stocks that tend to trade at prices below their intrinsic values.

But how to find those out in this huge ocean of listed companies in the stock market? Let’s find out more details about these types of stocks and the corresponding value and risks those bring along in this review.

Value Stocks Definition

The intrinsic value of a stock is calculated through various models based on fundamentals of the stock like dividends, earnings, sales, etc (also read Fundamental Analysis of Stocks).

Value investors are of the opinion that the current market price of the stock is low because of reasons other than the operations of the company like the presence of other hot stocks or the sector is out of favour at the present instant.

Therefore, they want to take advantage of the mismatch between the stock price and performance of the company by buying value stocks at lower prices and then, selling when the market has finally caught up and raised the price of the stock.

Also Read: Income Stocks, Growth Stocks

Value Stocks India

Some common ways to identify value stocks in India are as follows:

- The current stock price is lower in comparison to other companies in the same sector due to temporary glitches like the negative sentiment in the market due to some legal problems or unsatisfactory earnings reports in a quarter etc.

- Value stocks mostly are of stable companies with consistent dividend issuance that are temporarily experiencing unfavourable events.

- Sometimes, value stocks belong to those companies which have recently launched their IPOs and awareness about them is less in the market.

- A company that used to make losses has turned around and started showing profits from the last few quarters and the market has not factored that in yet.

- A company has been repaying its debt on a regular basis which is constantly decreasing the interest cost and the market has not factored that in the stock price yet.

But there are certain questions that a value investor must ask before selecting a stock like:

- Does the stock look like a bargain because it belongs to a dying industry?

- Is there any unforeseen problem due to which the price of the stock is quite low?

- Is the current problem in a company (if any) because of which the stock looks like a bargain short term or long term?

- And is the management fully aware of it and taking or going to take any steps to cure it?

Benjamin Graham is considered to be the father of Value Investing.

He is the author of two of the best value investing books, “Security Analysis” and “The Intelligent Investor“. He suggested some criteria to look for while selecting value stocks for one’s portfolio.

Also Read: Are Stocks Risky?

Value Stocks Screener

Some of the criteria have been discussed below in order to filter out these types of shares:

1. An Average Quality Rating

One does not need to find the stocks with the best ratings because chances are that those stocks are already correctly valued or overvalued.

Therefore, one should focus on stocks that have an average or better quality rating given by a reliable agency like CRISIL.

2. Amount of Debt on the Company

The healthy debt to equity ratio should be less than 0.5 because a higher debt would mean more liabilities and costs which may decrease the overall profitability of a company.

Also, one must keep in mind that the financial ratios should be compared with peers in the same industry in order to make more sense.

The debt to equity ratio of companies of the certain industry could be overall higher than debt to equity ratios of companies of some other industry.

Therefore, it is imperative to compare the debt to equity ratio of a company with its competitors. Also, in comparison with its previous years’ ratios can also help in analyzing the financial health of the company.

3. Current Ratio of the Company

The current ratio is calculated by dividing current assets by current liabilities. The value of the current ratio for a company should be greater than 1.5. This is because one should make sure that the company has enough cash to bear any downturns in the economy.

Cash tells us the ability of a company to meet its expenses, pay dividends, repay its loans and invest in expansion activities without taking any loans or raise funds by other methods.

Also, do compare the current ratio of the company with its peers to make better sense of the number.

4. No Earnings Deficit

This is a very important criterion to judge the financial health of a company. The earnings per share should be increased during the last 5 years with absolutely no earnings deficit.

It is much safer to invest in such companies as compared to companies which have been showing earnings deficit in the last few years.

5. Check the Price to Earnings Ratio

Ideally, the price to earnings per share (P/E) of a company should be 9.0 or less. It would mean that the company is selling at a bargain price.

Although it is one of the quickest ways to identify a value stock, it is not the only criterion that should be used primarily because of its limitations in certain situations. P/E ratios can be misleading sometimes.

6. Check the Price to Book Value (P/BV) Ratio

Book value is a good indicator of the underlying value of a company.

One should invest in stocks with a price to book value ratios less than 1.20. This ratio is calculated by dividing the current Price by the most recent book value per share for a company. One would ideally find value stocks that are trading near or below their book values.

7. Check the Dividends too

Although value stocks are not the ones which are invested for dividends, they are definitely the ones for which one has to wait for a medium to long-term to reflect shares prices according to their actual values or worth.

That waiting period can be exhausting but if a company pays regular and decent dividends, then, the wait does not exhaust an investor. It becomes easier to wait for the correct timing to reap benefits from a value stock.

8. Know the Management of the Company well

Although it looks like a trivial point, in reality, it is one of the most important criteria to select value stocks for investing, especially because value investing involves holding stocks for a longer duration of time, unlike trading where traders are concerned about the stock price just for a few days or months.

In the longer run, management of the company has an immense impact on the operations of the company. One must check the qualification, experience and efficiency of the management before making a selection of stock.

Management is one of the biggest forces that come to rescue in times of difficulties.

Examples of Value Stocks

As far as value investing in India is concerned, every now and then there come a few investment opportunities which do not look lucrative initially and are generally overlooked by investors.

However, over the long-term investment horizon, they definitely do relatively well.

Some of the examples of value stocks as per the current context are as follows:

| Name | OPM | RoCE | ROA |

|---|---|---|---|

| Info Edge | 79.34 | 11.68 | 20.47 |

| Alkyl Amines | 17.13 | 27.39 | 12.2 |

| Phillips Carbon | 15.6 | 25.21 | 12.23 |

| Kajaria Ceramics | 12.21 | 20.48 | 10.14 |

| Endurance Tech. | 9.78 | 25.16 | 10.85 |

| Advanced Enzyme | 38.34 | 21.57 | 15.03 |

| KPR Mill | 15.17 | 26.13 | 12.12 |

| Hester Biosciences | 31.71 | 22.51 | 14.97 |

| Solar Industries India | 18.68 | 30.08 | 12.94 |

| Container Corp. | 19.24 | 12.44 | 9.9 |

Readers are suggested to perform their analysis before investing in any stock for any period. As far as the above-mentioned stocks are concerned, these are recommended based on the current market trends.

Obviously, these trends are subject to change and thus, make sure to analyze even these stocks before investing.

Value Stocks With High Dividends

Identifying and investing in a value stock is nothing less than a lottery which is going to give you sizable return on your investment over a regular period of time.

If such a stock starts giving away dividends as well, that’d be like a cherry on the top!

However, there are very few stocks that actually do that. Nonetheless, let’s take a look at the stocks that were mostly overlooked initially but then were actually value stocks intrinsically.

Some of those stocks are now even giving away dividends to their investors. Here is the list:

| Stock Name | Dividend Yield | PE Ratio | Industry PE Ratio |

|---|---|---|---|

| Vedanta | 12.99% | 10.64 | 10.62 |

| IOCL | 7.15% | 10.81 | 19 |

| REC Limited | 7.96% | 5.33 | 5.13 |

| Coal India Limited | 6.63% | 11.63 | 9.34 |

Remember that the stocks you identify as value stocks MUST be intrinsically much higher in valuation as compared to their current market price. There will be only a handful of such stocks and filtering stocks that give a dividend to investors are going to be very few.

Still, good luck finding those!

Value Stocks Vs Growth Stocks

Apart from value stocks, there is another kind of attractive stocks kind i.e. growth stocks.

These types of stocks are expected to grow at a rapid pace as compared to other related stocks. However, there are a few stark differences between both of these kinds of stocks.

For example, where value stocks are priced lower than the market expectations, growth stocks are priced pretty well based on the growth such stocks have been showing.

Similarly, value stocks come from the businesses that, are although on the right business path but still, have to prove themselves in the industry based on their differentials. On the other hand, growth stocks are from companies that have a proven business model and are inching towards high growth in the future.

Here are those differences listed:

| Metric | Value Stocks | Growth Stocks |

|---|---|---|

| Price | Lower priced as compared to general market | Higher priced as compared to general market |

| Sensitivity | Higher sensitivity as compared to general market | Lower sensitivity as compared to general market |

| Earnings | Priced below as compared to Industry peers | Higher Earnings |

| Volatility | Low volatility | High Volatility |

Value Stocks Vs Momentum Stocks

Before comparing both of these types of stocks, let’s try and understand what are momentum stocks first.

Well, the stocks that have seen a pretty good rate of returns over the last few months when the trader has bought those stocks and the same stocks have given very limited returns when those were sold, these kinds of stocks are termed as momentum stocks.

Comparatively, the value stocks are those that are still undervalued than the price they must be at. Thus, returns of any kind (high or low) are out of the context.

Nonetheless, value stocks will still potentially be providing you with high returns after a period of time while momentum stocks are mostly in the confusion phase where the selling has not brought much value to the trader.

Value Stocks Risk

Although, there is limited downside to investing in value stocks as the stock is already priced pretty low. However, there are chances that you might commit an error while identifying a value stock.

In such a case, there are limited chances that the stock, you thought was a value stock, is not really a value stock and you are stuck with an investment with no or limited returns.

Furthermore, since the investments in value stocks are for a relatively longer duration, you might be losing out money based on the inflation and money depreciation over the holding period.

To hurt you with the ground reality even further, there could have been better opportunities you could have invested in with the same capital amount resulting in bringing higher returns to your investment.

That is pretty much the risk you carry while investing in value stocks.

Value Stocks ETF

Well, there are a few value stocks ETF products that are relatively prominent in the industry for the kind of returns they have produced for their investors over a period of time.

We will not go at length about these ETFs, however, here is a quick list of value stocks ETFs that you choose to invest in:

- Invesco S&P SmallCap 600 Pure Value ETF (Returns: 11.91%)

- Invesco Russell 2000 Pure Value ETF (Returns: 16.6%)

- ProShares Russell 2000 Dividend Growers (Returns: 11.9%)

- Invesco S&P MidCap 400 Pure Value ETF (Returns: 15.0%)

- SPDR S&P 600 Small Cap Value ETF (Returns: 15.2%)

Again, you are strongly advised to perform your own research on the given recommendations before investing any capital into these products. We are not, in any form, liable for your stock market investments.

Final Words

Value investing is an art that can be mastered with a lot of knowledge, patience, skill and experience.

One must have the confidence to move in a different direction than the crowd because by virtue of the definition of “value investing“, one is looking for those stocks that are not in the hot list of the majority of the investors.

One must have the patience to wait for months, years or even decades for the stock price to finally catch up with its intrinsic value. Without these two virtues, value investing is not possible.

Other than these, one must be thorough in the analysis of companies through reading their balance sheets, income statements and cash flow statements.

One must know the different financial ratios used to analyze particular aspects of the companies and compare them with their peers.

Other than the numbers, one must pay attention to the quality of the management and read the management discussions of at least previous 5 years’ annual reports in order to know how well the management of a company is addressing its problems and if they are fulfilling their promises timely or not.

All the factors when combined show the true picture of a company.

Apart from these, one must always be aware of the current happenings that may affect the performance of his/ her stocks in the longer term.

It is not advisable to just sit and wait for the stock price to rise, one must remain updated with all the knowledge around so that one is able to reconsider his / her position if needed.

So, one needs to keep eyes and ears open all the time in order to enjoy good returns from value investing. This is what makes value investing different from other methods of investing.

Always remember:

Benjamin Graham says, “The best investment decisions are based on facts, not speculation.“

In case you are looking to get started with stock market investments or trading in general, let us assist you in taking your next steps forward: