Fairwealth Franchise

View All Sub-Broker Reviews

Fairwealth Franchise business has been around for a while and has its major footing in the western and southern parts of India.

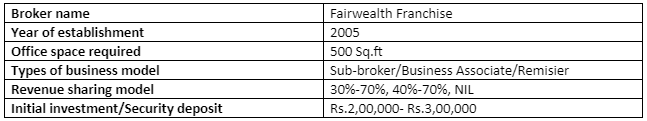

As a stockbroker, Fairwealth securities is one of the leading financial services companies in the country, established in the year 2005. The headquarter of the broking company is in Mumbai.

The company started its business with the aim of providing all financial solutions to the clients under one roof and at the same time, the client must get value for their money. To date, it has been successful in its different goals and targets and looks forward to a win-win for its various stakeholders, including business partners.

Fairwealth Franchise Review

Fairwealth securities has an interest in multiple asset classes including financial services, trading across equity, commodities, currency etc.

The network of the company is spread over 420 cities and more than 2500 working terminals in different parts of India gives you an opportunity to become a business associate of the company and grow with them.

The full-service stockbroker offers an extensive investment solution in retail Retail and Institutional broking, Real-estate Advisory, Wealth Management, Depository services.

You can offer your clients an opportunity to invest and trade in the following segments.

- Equity

- Commodity

- Currency

- Portfolio management services

- Derivatives

- Institutional broking

- Depository services

- Insurance

- Mutual funds

- IPO

- Loans

In this article, we are going to discuss the different aspects of Fairwealth franchise like types of business model, revenue sharing ratio, advantages, offers, security deposit etc.

Fairwealth Franchise Advantages

If you start a partnership business with Fairwealth, you will get the following advantages;

- You will get an opportunity to start a partnership business with a fast-growing brand.

- You will be benefited by the association with the 2nd largest broking house in the country (in terms of the number of the trading terminal).

- As a business associate, you will get free-of-cost back office support for any queries you may have.

- The state-of-the-art back-office facility provided by the broker will help you in convenient dealing with the main broker and with your clients.

- You will get one of the best trading platforms offered by the broker in terms of speed, risk management and convenience.

- An option of multiple business models, you can choose and go with any business model according to your convenience. You will also get a flexible business deal.

- The broker will give you marketing support in the establishment of your business like advertisements through television, newspaper, pamphlets, mouth-to-mouth publicity etc.

- A dedicated relationship manager will be assigned to each business partner to help you with queries related to your business.

- You will not face any problem in getting your funds. You will get the timely payout on a regular basis.

- The broker has an in-house chat platform will help the business associate in intercommunication with the broker.

- You can enjoy the online fund transfer.

- Each business partner will get the personalized attention of the broker.

- Through regular investor meet, you can clarify most of your confusion.

- You can provide your clients with a quick account opening facility and depository operations.

Fairwealth Franchise Eligibility

- An entity (Company, partnership business or individual) with a good track record and reputation in the financial market or any business or social circle with a strong client base.

- Minimum 1 year of experience as a sub-broker/Remisier/Authorized person/Mutual fund distributor/Loan advisor/Insurance advisor/an employee of existing sub-broker or broker in selling financial products.

- Ability to deposit some the security money or ability to make an initial investment of minimum ₹2,00,000-₹3,00,00 when required in your business or infrastructure.

- Minimum 10th pass qualification from a recognized board for partnership firm or an individual.

- Required office space of minimum 500 square feet for the set up of your office in the prime location of your city/town.

Fairwealth Franchise Types

Fairwealth offers three types of business model.

- Sub-broker

- Business Associate

- Remisier

Fairwealth Sub-broker:

Sub-broker model is the first business model offered by Fairwealth. Under this model, you can start a partnership business of your own with your clients. You are required to acquire clients and work with them to generate more and more revenue.

You will have to set-up your separate office with the required infrastructure. Your office must be well furnished with a minimum of 500 sq.ft of the working area and in the prime location of the city where you want to start the sub-broker business.

A sub-broker will get the right to use all technology and trading software of the broker for their clients.

Benefits:

- You can start a business of your own.

- Right to acquire clients for making the client base strong.

- Multiple product offerings.

- Attractive revenue sharing.

- Right to access everything like tools, research and analysis report, trading platform etc.

- Right to change the brokerage fee and charges for your clients.

Fairwealth Business Associate:

Most of the successful broking house use the Business Associate model to run their business successfully in this competitive age. Under this model, one get benefitted from the already established brand name and set infrastructure of the broker.

Fairwealth offers four types of business associates for you.

- Sit-in business Associate: Aspiring entrepreneurs who have a low-risk appetite and want to start a business with low investment and with a small client base.

- Normal business associate: Those who have a modest risk appetite and can invest an average amount as an initial investment with the average client base. They want to work in their own office.

- Marvel business associate: Aspiring entrepreneurs who can take the higher risk, higher investing capacity, strong client base and ready to increase the geographic reach for their business.

- Referral business associate: Under the referral model, you will get an opportunity to earn a fix commission on the basis of revenue generated by your referred client.

Benefits:

- Various types of business associate model.

- Can start a business with low as well as a high initial investment.

- Can access every technology of the broker except referral model.

- An attractive revenue-sharing model under each model of a business associate.

Fairwealth Remisier:

Remisier is the third business model offered by the Fairwealth. Under this model, you are just required to acquire clients for the company with a team of Fairwealth. This model does not need any infrastructure cost means if you are working as a Remisier of Fairwealth you are not required to make any expense on infrastructure.

That is why this model is also known as Zero investment model. This model helps the Fairwealth to acquire the potential customer.

As the effort is limited to the client acquisition and investment is also zero, the revenue sharing ratio is accordingly.

Benefits:

- Zero investment required.

- Can work under the same roof as the broker.

- The workload is limited.

- Revenue sharing ratio is on par with the industry.

Fairwealth Franchise Revenue Sharing Ratio

When you become a partner to a stockbroker in any capacity, then there is a specific percentage of profit that is shared with you on the brokerage you generate. This brokerage is generated through the trades placed by your clients.

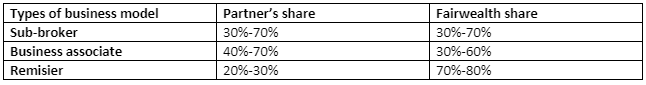

Depending on the business model, there is a set ratio or percentage of revenue sharing. Here are the details as far as Fairwealth is concerned:

Sub-broker:

As the sub-broker model is just like starting a new business of your own with separate risk-taking of the business, the revenue sharing ratio is accordingly. The range of revenue sharing ratio is 30%-70%.

It means a sub-broker will get highest 70% of revenue generated by their clients and the Fairwealth will get the remaining share.

This sharing ratio is not fixed, it can be increased by the broker by sitting with them and bargaining. It also depends on security deposit money and revenue generated.

Business Associates:

As the Fairwealth offers four types of business associate model, the revenue sharing ratio also varies as per their security money, workload and business generated. The average range of revenue sharing ratio under this model is 40%-70%.

Remisier:

As the remisier performs very limited work for the company, the revenue or commission sharing ratio is also accordingly. The remisier will get revenue in the range of 20%-30%. The maximum share of revenue will be kept by the broker because of their huge work is done after the client acquisition.

Fairwealth Franchise Security Deposit

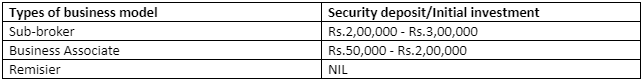

In order to set-up your business with any stockbroker, you are required to provide an initial deposit (most of the times) to the broker. This deposit money is refundable in nature, although, you are advised to check with the stockbroker about this part before you deposit any money.

In the case of Fairwealth, the initial deposit amount varies with the business model as discussed below:

Sub-broker:

A sub-broker starts its business on a large scale, so they need more expense on infrastructure and office set-up. The range of security deposit for the sub-broker model is ₹2,00,000 – ₹3,00,000. Revenue sharing ratio also increases depending on the security deposit.

Business Associate:

The range of security deposit/initial investment under the business associate model is ₹50,000 – ₹2,00,000. There are various sub-models under this model, some needs more investment and some does not require any investment. So, this range is an average range of security deposit.

Remisier:

As this model does not require any investment for infrastructure or office set-up. Also, the job of a Remisier is limited. So, this model requires Zero investment.

Fairwealth Franchise Support

- Research support: As a business partner, you will get support in research related things like reports on commodities, equities, currency etc. Regular SMS for important trading and tips.

- Training support: You will get regular training on important matters required to run your business. Seminars are also arranged for the associates.

- Back-office support: Fairwealth provide their business partners support related to back-office like Access to online account statement, risk management cell, Revenue evaluation on day to day basis, performance sheet of the clients etc.

- Connectivity support: Technical tie-up of the broker with Airtel, Financial technology will support you in getting the best connectivity through the internet, broadband etc. through the IT team of the broker.

Fairwealth Franchise Registration

- Fill-up the registration form available on the website with the required details. You may choose to use the below form as well:

- Receive a call from the call centre executive to verify your interest.

- Receive another call from the broker to get brief of the partnership model with the Fairwealth. An appointment will be fixed in this call with the team of the broker.

- In the meeting, you can clarify everything which you want to know.

- Submit all required documents for verification with the initial investment/security deposit cheque.

- After verification, you will get an account ID to start your business.

- Now, you can start your partnership business.

The whole process will take 8-10 business days to complete.

Summary

Fairwealth is not a too old brand in broking space. It has a wide offline presence. It offers a multi-business model with a wide range of security deposit. The services offered by the broker like trading platform, reports, trading tool etc are of average quality.

The broker also provides various support to their business partners in a different field to run their business smoothly.

So, if you are looking to start a business in the broking field with an average quality of broker, you can go with the Fairwealth.

In order to get started with the franchise or sub-brokership business, just fill in a few basic details in the form below: