Motilal Oswal Delivery Brokerage

Check All Brokerage Reviews

Want to start investing with Motilal Oswal? If yes, then gain complete information on the Motilal Oswal Delivery Brokerage.

Being a full-service stockbroker, Motilal Oswal imposes higher charges to trade in different segments but at the same time provides investors with research tips and updates that help them in making the right investment decision.

Here is the detail of the delivery brokerage charges in Motilal Oswal.

Motilal Oswal Equity Delivery Brokerage

Motilal Oswal, being a full-service stockbroker, levies higher brokerage fees. It is generally calculated in percentage and depends upon the total turnover value of the trade.

For Example, With the understanding that Mr. X knows how to trade in Motilal Oswal, he invests in the share of ABC having a CMP of ₹1000 per share. The total trade value is 10,000.

Here:

For equity delivery, the broker imposes a charge of 0.5% per order is imposed on the investor. Thus, in that case:

Motilal Oswal Delivery Brokerage = ₹50 (0.5%*10,000)

Therefore, Mr. X will end up paying ₹50 for that single trade.

Also Read: What is Delivery in Motilal Oswal?

Motilal Oswal Delivery Brokerage Calculator

Yea, Mr. X paid ₹50 but does that mean this is what he pays overall on this trade. Not really!

The investor ends up paying taxes and other hidden fees along with the brokerage.

To get a complete idea of the charges, here is the Motilal Oswal Brokerage calculator, which helps in calculating the exact brokerage and profit/loss you can make with a particular investment.

This small exercise will tell you the different kinds of charges you’d need to pay including DP charges in Motilal Oswal, STT charges, and more.

To understand this, let’s take an example:

Let’s assume, Daya has gone through the demat account opening with Motilal Oswal and wants to start trading in delivery. For that, he will check the brokerage in delivery trading as this trading type suits his preferences.

Now, he wants to invest in the shares of Infosys. So, he followed the following steps to calculate the brokerage.

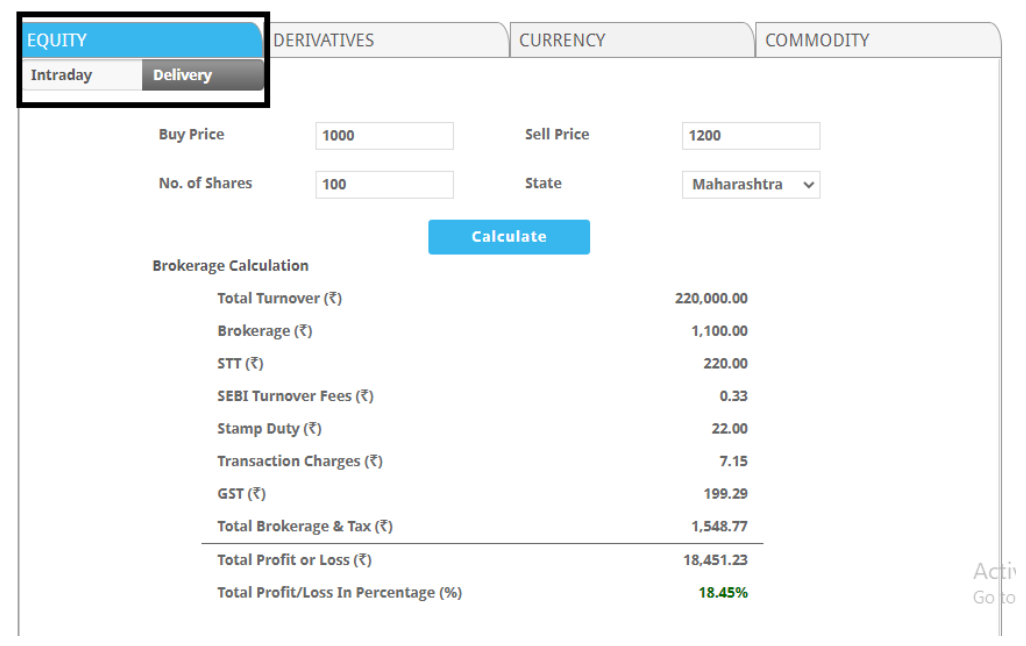

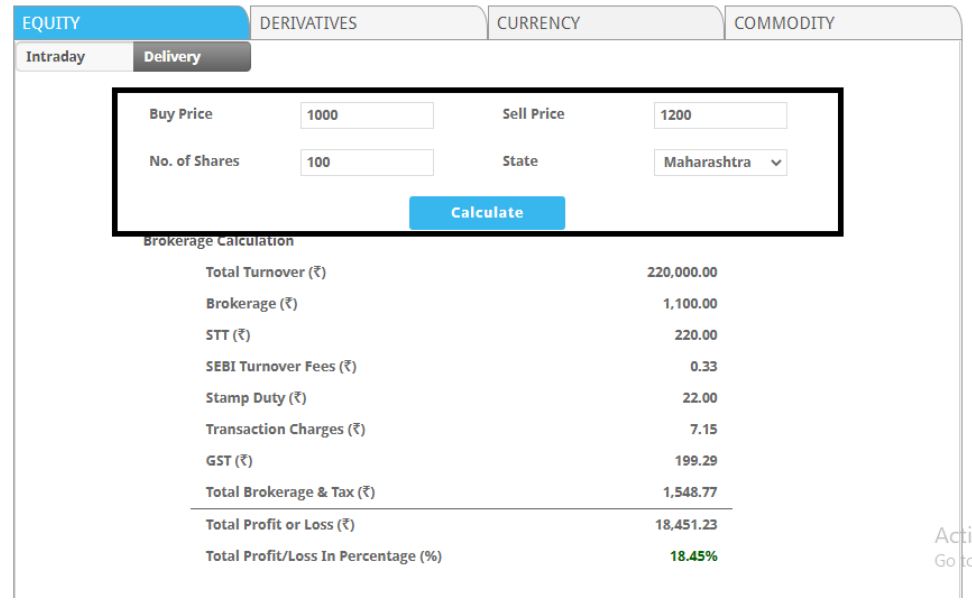

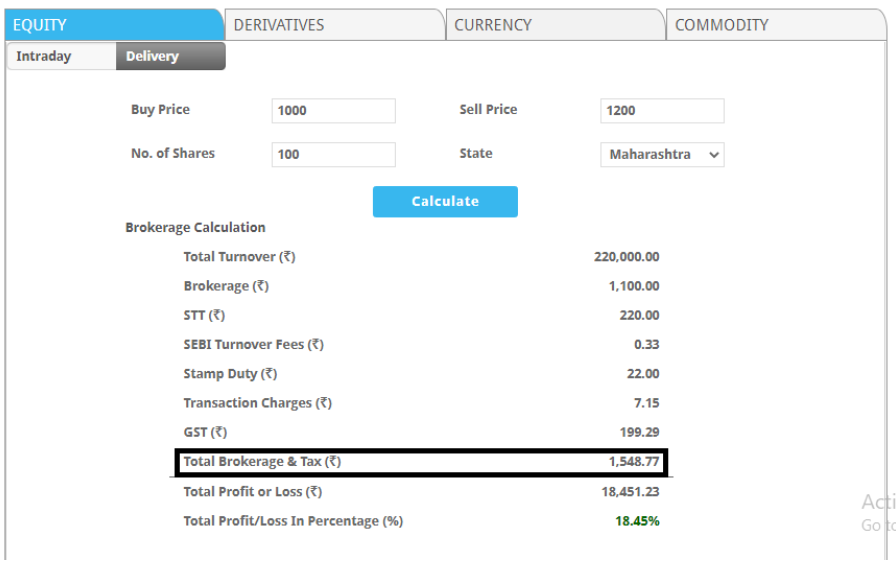

- Daya opened the calculator and selected the equity segment. Under the segment, he chose ‘Delivery’.

- Now, he entered the ‘Buy Price (₹1000), Sell Price (₹1200), and Number of Shares (100)’ and then clicked on ‘Calculate’ to get the figures.

- In total, he made an order execution of ₹1 lakh.

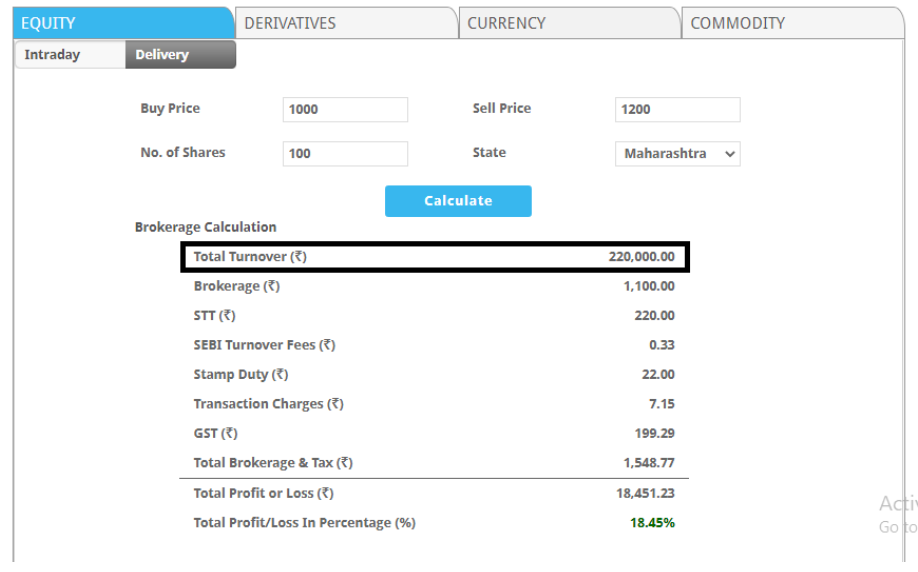

- After clicking ‘Calculate,’ he got the following numbers. The calculator represented the ‘Total Turnover’ as ₹220,000.

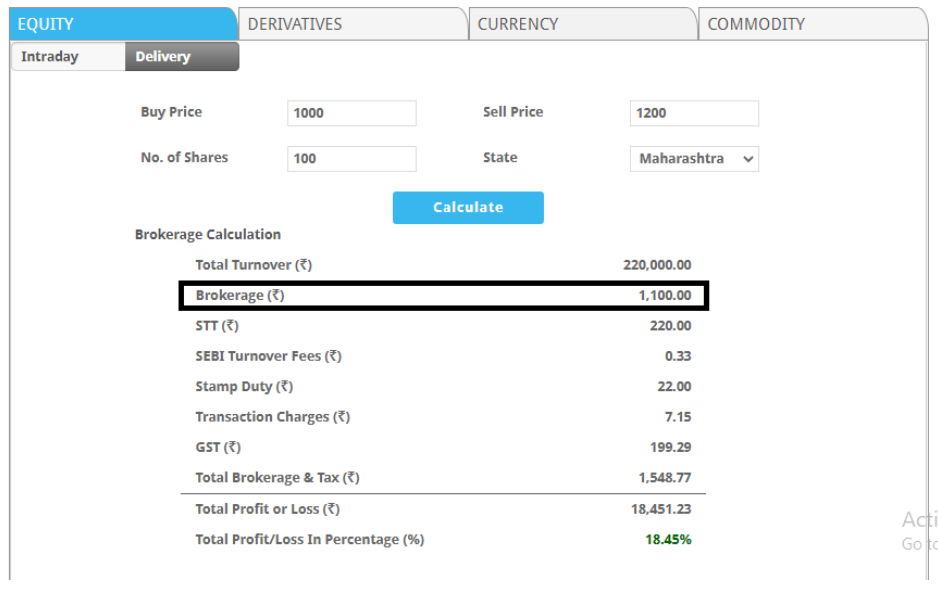

- Based on the brokerage of 0.50%, he got the actual brokerage of ₹1,100.

- Apart from these, he got the ‘Total Brokerage & Tax’ including tax (STT, Sebi turnover, stamp duty transaction charges) of ₹1,548 that is to be paid by him to the broker.

Conclusion

To make the trading easier, reliable, and efficient, the brokers offer brokerage calculators to provide transparent figures or data before executing the order.

So, to get crystal clear information on the Motilal Oswal delivery brokerage and get into a trade with the broker now.

In case you need any assistance in understanding the process, let us know your details below and we will call you to assist further: