HDFC DP Charges

DP Charges

HDFC securities opens a free Demat account, but there are different kinds of charges levied when you place your trades in the stock market. One of those charges is a transaction fee called HDFC DP charges that many investors remain unaware of.

So if you are having an account with the broker, then here is the complete information on these hidden fees.

What are DP Charges in HDFC Securities?

When opening an account with the broker, investors consider different HDFC Securities charges but have you ever wondered about HDFC DP Charges. Let’s understand these particular charges with an example.

Himanshu opened his Demat account with HDFC and started trading by using the trading platforms offered by the firm.

Last week he sold some of the shares of Tata Steel and Infosys he bought a few months back.

He got the contract note where the brokerage was charged as per the plan he opted for, but the fees deducted from this trading account were different from what was mentioned in the contract note.

So, have you ever faced a situation similar to Himanshu?

Well! If yes, then do not get confused as these charges are the debit transaction charges commonly called DP charges.

DP charges are charged per scrip when the shares are sold or debited from your Demat account. These charges are levied by the depository primarily and not the stockbroker. In India, it could either be CDSL or NSDL.

Here it is important to note that the charges are levied per scrip and not on shares debited from your Demat account.

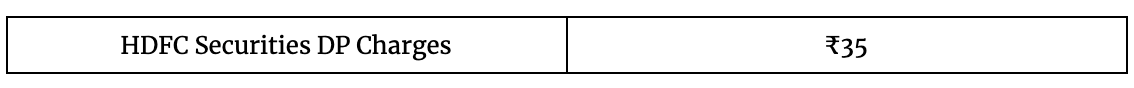

HDFC Securities DP charges are tabulated below:

Now, Himanshu bought two scrips, 10 shares of Tata Steel of ₹10,000 (1 stock=₹1,000), and 5 shares of Infosys worth ₹9,000 (1 stock= ₹1,800). He would not pay any DP charges on buying the stocks.

Let’s see how the DP is charged when he sells the shares.

Suppose after a month he decided to sell off 5 shares of TATA Steel, and 2 shares of Infosys.

Here the DP charges will be equal to ₹70 (₹35 per scrip).

On the other hand, if he sells 5 shares of TATA Steel in the morning and the rest of the 5 on the same day before the market closes, here the DP charges would be charged only once.

So, the total DP for the whole transaction would be ₹35 only.

From the above example, it is clear that the DP charges are imposed on the scrip and not on the number of shares sold.

Conclusion

DP charges are generally kept hidden and thus as a beginner, many investors are not able to find the extra fees deducted from their trading account.

Hope this article helps you in evaluating the extra cost levied on your sell order.

So stay updated and invest more with HDFC Securities. In case you would like to talk to us to understand more, just fill in a few basic details and we will arrange a callback for you: