HDFC Securities Charges

Check All Brokerage Reviews

HDFC Securities is a bank-based stockbroker offering full-service broking services for years. But what is the account opening fees, brokerage and other commission broker imposes on its customers? Well! for this it is good to look into the details of the HDFC Securities charges.

HDFC Securities Charges List

What are the charges one must look at before opening a Demat account with any broker? Now here, you can reap the benefit of trading in different segments like equity, commodity, currency, derivatives, and IPO and so it becomes important to individually consider the brokerage fees to trade in these segments.

Apart from this, the account opening fees and AMC charges are the other important aspect one should keep an eye on.

In all, we are going to cover the following details of HDFC Securities charges.

- Account Opening Charges

- AMC Charges

- Brokerage Fees

- Transaction Charges

- DP Charges

- Taxes and Other Fees

HDFC Demat Account Charges

The charges for opening a Demat account are the one-time fees charged by the broker, but these days offer the benefit of Free Account Opening to its customers.

Considering the HDFC Securities, it too comes up with free Demat account services for its customers. Thus, if you are willing to open HDFC Demat account, then you can easily open it online without paying any charges.

To know more about these charges in detail, refer to the following segments.

HDFC Securities Account Opening Charges

Being a bank-based full-service broker, HDFC Securities allows the traders or investors to open the all-in-one investment account with no charges. Hence, an applicant can open the trading and Demat account altogether without paying a single penny while going ahead with the HDFC Securities Sign Up process.

So, when you go ahead with the HDFC Securities Account Opening process, you need to pay the following account opening charges to this stockbroker:

HDFC Securities Account Opening Charges Account Opening Charges Nil

HDFC Securities AMC Charges

The AMC refers to the Account Maintenance Charges that are to be paid annually by the investors to maintain the Demat account.

Talking about HDFC Securities, the broker imposes the fees of ₹750 per year.

However, if you are having a saving account in HDFC bank then you are given specific benefits of zero AMC that opens a gateway for a lifetime free Demat account with no annual charges.

To know more about it in detail, check the following table.

| HDFC Securities AMC Charges | ||

| Account Maintenance Charges | Standard Charges | ₹750 |

| Preferred Customers | ₹300 | |

| Classic Customers | ₹250 | |

| Imperia Customers | Nil |

HDFC Securities Brokerage

The brokerage charges are the ones that are levied for executing the stocks. These are charged by the broker and are based on the percentage of transactions.

Just like other charges, it is also important to check the brokerage charges of the broker before executing the order.

Lets’s check the brokerage charges imposed by the broker to trade in different segments.

HDFC Securities Delivery Charges

If you are planning for long-term investment, then you can easily choose the equity delivery trading option in the HDFC app.

But before you executed the trade in any scrip, it is good to check the delivery brokerage fees imposed by the broker. So let’s look into the table to evaluate the commission to be paid:

| HDFC Securities Delivery Charges | |

| Standard Brokerage | 0.50% or ₹25 whichever is higher |

| Scrip less than ₹10/share | 0.05/-per unit |

HDFC Securities Intraday Charges

Next comes intraday trading, since it follows the full-service brokerage model and therefore imposes a bit more than other stockbrokers in the industry today.

Here is the detail of intraday brokerage tabulated below:

| HDFC Securities Intraday Charges | |

| Standard Brokerage | 0.05% or ₹25 whichever is higher |

| Scrip less than ₹10/share | 0.05/-per unit |

HDFC Securities Option Brokerage

If you are interested in doing trade in derivatives, then you are provided can execute a trade in the futures or options.

Now the brokerage for options depends upon the lot size and the premium you pay while executing the trade.

Here is the detail of the charges:

| HDFC Securities Options Brokerage | |

| Options Brokerage Charges | 1% of Premium or ₹100 per lot |

HDFC Securities Futures Brokerage

Next to the options, comes the futures brokerage charges where the charges depend upon the option of square off or non-square off-trade.

For square-off futures trade, the brokerage is 0.025% of the trade while for the non-square off the charges are a bit higher and are equal to 0.05% of the trade value.

In both cases, the minimum brokerage charge is ₹25 per trade.

| HDFC Securities Futures Brokerage | |

| Square-Off Trade | 0.025% or ₹25 whichever is higher |

| Non-Square Off Trade | 0.05% or ₹25 whichever is higher |

HDFC Securities Commodity Trading Charges

Although HDFC Securities is a bank-based stockbroker, here you get an option to trade in commodities as the broker is registered with MCX and NCDEX.

Wondering how much the broker charges to trade in commodity options and futures segment, check the details in the table below:

| HDFC Securities Commodity Trading Charges | |

| Commodity Futures | Square-Off Trade: 0.020% or ₹20 whichever is higher |

| Non-Square Off Trade: 0.025% of 20 whichever is higher | |

| Commodity Options | ₹100 per lot |

HDFC Securities Currency Trading Charges

Along with the commodity, another segment that allows you to trade in futures and options contract is currency. The brokerage charges for currency trade in HDFC securities again depend upon whether you opt for square-off or non-square-off trades.

The details of the charges are tabulated below:

| HDFC Securities Currency Brokerage | |

| Currency Futures Charges | Square Off Trades: ₹12 each side |

| Non-Square Off Trades: ₹23 each side | |

| Currency Options Charges | Square Off Trades: ₹10 each side |

| Non-Square Off Trades: ₹20 each side |

HDFC Securities Charges Example

No doubt, most beginners often remain confused regarding the brokerage charges of the HDFC Securities. If you too are not able to understand the fees imposed by the broker, then here is a simple example that helps you in understanding the fees plan.

Suppose Mr. Raman is an intraday trader who trades actively. He executed the trade in the stock of NTPC the CMP of which is ₹116.50.

Now he buys 100 shares of NTPC and sold it at ₹120 each. The total turnover of his trade is thus ₹23,650.

Let’s calculate the brokerage i.e. 0.05% of the trade value.

Here, 0.05%*23650= ₹11.82

Now since the broker charges minimum fees of ₹25 so here, Mr. Raman ends up paying ₹25 to execute the trade.

If Mr. Raman executed the trade of let’s say ₹60000, then the brokerage would be

0.05%*60000= ₹30

Here the total brokerage to be paid is thus ₹30.

Similarly, you can calculate the brokerage for other segments by considering different parameters.

HDFC Securities Brokerage Plan

With the growing competition, different brokers are coming up with minimum brokerage plans for their customers. Being the oldest and renowned stockbroker in the market, it too comes up with certain options that help traders to trade at the minimum cost.

The broker offers the Value Plan that gives you the opportunity to trade at the minimum cost. Let’s dive into the details to check how you can increase your profit margin by choosing the right plan option.

HDFC Securities Value Plan

Value Plan comes with the added benefits in brokerage for both new and seasoned traders and investors. Along with this, you can get the advantage of free delivery volume for a period of 360 days.

Wondering what other benefit you can reap by subscribing to the Value Plan of HDFC Securities, then here it is:

- Ultra-low brokerage across segments.

- Free Premia services worth ₹2999 on subscribing to the plan of ₹10,000 or more.

Here are different Value Plans of equity and F&O segments, the details of which are tabulated below:

| HDFC Securities Equity Value Plan | ||||||

| Scheme Name | VPD 40 | VPD 35 | VPD 30 | VPD 25 | VPD 20 | VPD 15 |

| Upfront Fees | ₹1500 | ₹3000 | ₹10,000 | ₹25,000 | ₹50,000 | ₹1,00,000 |

| Delivery Trading | ||||||

| Free Equity Delivery Volume | ₹4 lakh | ₹10 lakh | ₹40 lakh | ₹1.50 crore | ₹4 crore | ₹12 crore |

| Effective Delivery Brokerage (during validity period) | 0.032% | 0.25% | 0.21% | 0.14% | 0.11% | 0.07% |

| Intraday Trading | ||||||

| Brokerage | 0.040% | 0.035% | 0.030% | 0.025% | 0.020% | 0.015% |

| Post Validity Brokerage | 0.040% | 0.035% | 0.030% | 0.025% | 0.020% | 0.015% |

Apart from this the value pack plan for the Futures and Options segment is given is explained below:

| HDFC Securities F&O Value Pack | |||||

| Scheme | VPD 30 | VPD 25 | VPD 20 | VPD 15 | VPD 10 |

| Upfront Fees | ₹4000 | ₹8000 | ₹12000 | ₹30000 | ₹60000 |

| Free Equity Delivery Volume | 175 | 500 | 1000 | 3000 | 10000 |

| Effective Price Per Option Lot | ₹19 | ₹14 | ₹10 | ₹8 | ₹5 |

| Option Price Post Validity | ₹30 | ₹25 | ₹20 | ₹15 | ₹10 |

| Futures Brokerage | 0.025% | 0.020% | 0.015% | 0.010% | 0.005% |

From the above table, it is interpreted that to minimize the brokerage fees you have to pay certain brokerage fees in the range of ₹1500 to ₹1,00,000 for the equity segment.

On the other hand, the F&O segments come with slightly different offers, in which you need to pay the upfront charges of ₹4000-₹60,000 to trade at the lowest cost of ₹5 per lot or 0.005% per trade-in options and futures respectively.

Willing to trade at the lowest fees, open a Demat account now.

HDFC DP Charges

The DP charges are charged basically on the sell transactions of those stocks that are present in the Demat account. Apart from this, the DP charges are the one that acts as the earning source of the depository participants and depositories.

The DP charges of HDFC Securities are equal to ₹35 per scrip.

| HDFC Securities DP Charges | |

| DP Charges | ₹35 per scrip |

To understand the calculation of brokerage charges, let’s take an example.

Suppose Mr. Raman has holdings of 100 shares of Infosys and 50 shares of HUL in his Demat account. He sold 30 shares of Infosys and 10 shares of HUL on a particular day. Here the DP charges will be equal to:

DP charges on Infosys= ₹35

DP charges of HUL= ₹35.

Now changing a scenario a bit, let’s consider that Mr. Raman sold 30 shares of Infosys in the morning while the rest 70 shares in the evening before the trading session ends.

Here most of the investors evaluate the DP charges equals to (₹35+₹35) ₹70. Right?

Wrong! As the DP charges are calculated per scrip and not on the number of debits done in a day. Thus even if Mr. Raman sold Infosys shares twice still he has to pay DP charges only once i.e. ₹35.

HDFC Securities Transaction Charges

Apart from the brokerage fees, the traders or investors need to pay certain transaction fees as well. The transaction charges are the fees that are charged by the stock exchange for trading on both sides, i.e., buying and selling.

To know more about these charges, refer to the following table.

| HDFC Securities Transaction Charges | |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.0019% |

| Equity Options | 0.005% |

| Currency Futures | 0.0011% |

| Currency Options | 0.004% |

HDFC Securities Charges Calculator

Apart from the charges discussed above, there are STT charges, Stamp duty, and GST that need to be paid along with the brokerage. Since these charges can directly affect your profit or loss margin, it becomes necessary for you to consider them while calculating your brokerage.

The details of HDFC additional charges is provided in the table below:

| HDFC Securities Hidden Charges | |

| STT Charges | |

| Equity Delivery | 0.1% of transaction value (Both Side) |

| Equity Intraday | 0.025% of transaction value (Sell Side) |

| Equity Futures | 0.01% of transaction value (Sell Side) |

| Equity Options | 0.01% of transaction value (Sell Side) |

| CTT Charges | |

| Commodity Futures | 0.01% of transaction value (Sell Side) |

| Commodity Options | 0.01% of transaction value (Sell Side) |

| SEBI Turnover Tax | |

| 0.00015% | 0.00015% |

| Stamp Duty | |

| 0.002% of the turnover value | |

| GST | |

| 18% of brokerage & transaction value |

If the charges are becoming complicated in calculating, and you are wondering how to calculate brokerage in HDFC Securities then here is the best solution for you.

Just fill in the details and calculate the charges as done below.

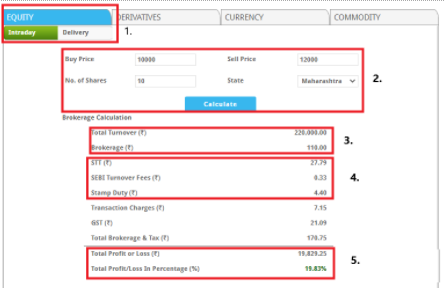

The calculator will display the above-presented information with the following mentioned steps.

- Select the segment.

- Fill in the details, and click on the “Calculate” button.

- The calculator will show the “Total Turnover” along with the “Brokerage.”

- Apart from this, it will present the taxes like STT, Sebi Turnover Fees, and Stamp Duty.

- At last, an investor or trader can quickly check the Total Profit or Loss from the calculation.

Conclusion

Before starting trading with a broker, it is important to check the charges. Just like that, HDFC Securities allows the trader and investor to trade efficiently with its best trading platforms in India.

If in case, you are an existing client and as the services of this stockbroker, you can always choose to use the HDFC Securities Refer and Earn plan and make a good passive income.

Nonetheless, Few charges are important to revise, like DP charges, brokerage, and transaction charges, before you execute the order.

Hence, if you have compared the charges, and want to trade with the broker, then it is time for researching more, checking more, and trading more!!

Wish to get into the trade with the broker then why to wait more? Open your Demat account for FREE!

More on HDFC Securities