Laxmi Organics IPO- Is it Worth Investing?

More on IPO

Are you someone who is always on the lookout to invest in some great IPOs? Then, you must be excited about the Laxmi Organics IPO.

If you are thinking should you invest in Laxmi Organics IPO, hop on because we will unravel everything in this article.

Laxmi Organics IPO Details

The Laxmi Organics IPO is ready to be listed in both the stock exchanges, NSE and BSE. Gearing up for the IPO, read along some details related to Laxmi Organics IPO.

- The Laxmi Organics IPO date is March 15, 2021. The closing date of the Laxmi Organics IPO is March 17, 2021.

- The price band of the IPO is decided at Rs.129-Rs.130.

- The issue size of the IPO is Rs.600 crores.

- The face value of the Laxmi Organics IPO is Rs. 2 per equity share.

- The market lot is set at 115 shares, with a minimum order of 115 shares.

- The promoters of the company are Yellow Stone Trust and Ravi Goenka.

Laxmi Organics Company Details

When you are pondering should you invest in Laxmi Organics IPO , it is also essential that you have complete knowledge about the company as well.

Laxmi Organics Industries Limited was established in 1989 and is a leading manufacturer of specialty chemicals in India. The two significant areas of business include Acetyl Intermediates (AI) and Specialty Intermediates (SI).

It leads to ethyl acetate production in India, covering more than 30 percent share in India’s ethyl acetate market. It is also the only company that manufactures diketene derivatives in the Indian market.

The company has a vast geographical presence with a client base from 30 different countries. It has two manufacturing units in Mahad, Maharashtra.

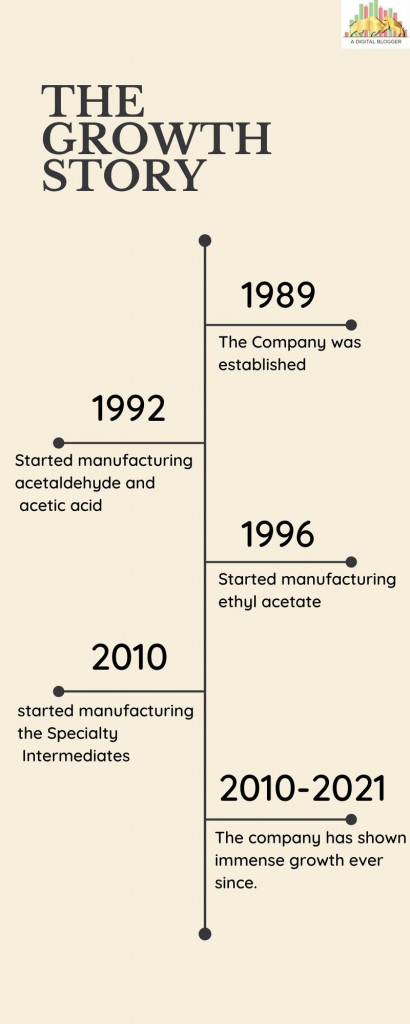

The Growth Story

The company has shown immense growth ever since it was set up in 1989. The graph has also surged upwards. The company started its journey in 1992 by manufacturing acetaldehyde and acetic acid.

Later in the year 1996, it started the manufacturing of ethyl acetate. Later in the fiscal year 2010, it started manufacturing the Specialty Intermediates as well. The company also successfully acquired Clariant’s diketene business.

Over the span of all these years, it has continued to expand and make a mark not only in the Indian market but also in the international market as well.

Objectives

Let us now have a look at the objectives so that you can make a decision of should you invest in Laxmi Organics IPO.

- They want to set up a new manufacturing unit by investing in its subsidiary firm, Yellowstone Fine Chemicals Private Limited.

- By investing in Yellowstone Fine Chemicals Private Limited, they are looking for financing their working capital requirements.

- Also, financing the CAPEX for the expansion of the Specialty Intermediates manufacturing facilities.

- For the purchase of proper machinery and plant for infrastructure, primarily for the expansion of SI facilities.

- For the payment and also repayment of the company borrowings.

- For achieving general corporate purposes.

Financial Details

The chart below gives the financial details and emphasis on the economic growth of Laxmi Organics Industries for the past three years so that you can decide should you invest in Laxmi Organics IPO.

| 30-Sep-2020 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | |

| Total Assets | 10,371.32 | 10,706.33 | 10,144.88 | 8,947.34 |

| Total Revenue | 8,143.55 | 15,386.21 | 15,743.23 | 13,960.75 |

| Profit after Tax | 454.84 | 702.12 | 723.91 | 756.95 |

(Rs. in millions)

Competitive Strengths

The company is coming with its IPO backed up by a lot of positive traits. Some of the competitive strengths of Laxmi Organics IPO are as follows.

- It is one of the leading manufacturers of ethyl acetate in India, which gives it a prominent place in the market.

- It is also the most extensive and only manufacturer of diketene derivative products in India.

- It has a very diversified customer base across various industries and countries.

- The company also has a very consistent financial performance.

If after reading the competitive strengths you still are not sure should you invest in Laxmi Organics IPO or not, then you should also read about the risks involved.

Weakness

When you are analyzing an investment, you have to analyze it from every perspective. Therefore, it is essential to discuss the weakness of the IPO as well.

- It has a broad customer base across various nations and an increased dependency on global market fluctuations.

- There was a prominent impact on the company because of the COVID-19 crisis.

Final Verdict

We know that the investment in an IPO is exciting but also challenging at the same time.

The industry was adversely impacted due to the global pandemic because of the decreased demand. But the industry, because of the broad customer base, also projects benefits in the long run.

The answer to should you invest in Laxmi Organics IPO is totally your decision. After going through all the advantages and disadvantages, we are sure that you will now make a profitable decision.

Want to apply for IPO? Refer to the form below

Know more on How to apply for the upcoming IPO 2021