Zerodha Delivery Charges

More on Zerodha

Generally, beginners prefer long-term investment. So if you are thinking of opening a Zerodha demat account for delivery trading then it is essential to consider the Zerodha delivery charges.

Zerodha Brokerage Charges for Delivery

Zerodha being the first discount broker comes up with a relaxation in paying any brokerage. So, if you are planning to invest in shares with the broker, then you do not need to pay any charges.

But is this for equity trade or for all trade types in Zerodha?

Let’s dive into more detail.

Zerodha Equity Delivery Charges

Buying and holding shares for more than one day is what comes under equity trade. Here being a discount broker, Zerodha equity charges do not charge any brokerage fees.

| Zerodha Delivery Trading Charges | |

| Delivery Trading Charges | Zero |

Zerodha Options Delivery Charges

When trading options in equity, one has to settle the trade by buying or selling of shares. In simple terms, the delivery of shares takes place. Here, the brokerage charged is as per the Zerodha options charges.

The detail of fees is given below:

| Zerodha Option Brokerage Charges | |

| Option Brokerage Charges | Flat Rs. 20 per executed order |

Zerodha Hidden Charges

Apart from the brokerage charges, there are some hidden fees in Zerodha. This includes DP charges, STT, and other taxes.

Here DP charges are charged on the sell transactions and are calculated per scrip, STT is the transaction tax on the trade. The details of each of these charges along with other taxes are explained below.

Zerodha DP Charges

DP charges are Zerodha sell charges that are levied on every transaction when the shares are debited from your demat account. The depository participant charges a small fee, i.e., the broker and the depository (CDSL or NSDL) on selling.

The Zerodha delivery DP charges are ₹13.5 + GST per scrip (irrespective of the quantity).

| DP Charges in Zerodha | Charges |

| DP Charges | ₹13.5 per scrip+18% GST |

STT Charges in Zerodha

Securities Transaction Tax is the fee charged on the buy and sell value in the delivery trade. In Zerodha, it is equal to 0.1% of the turnover value.

So, for example, if the trade value is equal to ₹1,00,000 then the STT charges in Zerodha would be:

=0.1%*1,00,000

=₹100

| Zerodha STT Charges | |

| Equity Delivery | 0.1% of the turnover on both buy & sell |

Similarly, there are other fees and taxes. Here is the complete detail.

| Zerodha Delivery Trading Tax | |

| Transaction Charges | NSE: 0.00345% |

| BSE: 0.00345% | |

| SEBI Charges | ₹10 / crore |

| Stamp Charges | 0.015% or ₹1500 / crore on buy side |

| GST | 18% on (Brokerage + SEBI Charges + Transaction Charges) |

Call and Trade Charges in Zerodha

Zerodha offers the call and trade facility where you can multiple trades in one order, modify or place a cancel request on call. Now one uses this facility when they are not able to use the online platform for trade or due to some other reasons.

In any of case, on using this facility, one has to pay an additional ₹50 per order. So, even though the delivery brokerage charges are zero still you have to pay this fees along with other taxes as discussed above.

| Zerodha Call and Trade Charges | |

| Call and Trade Charges | ₹50 per order |

Zerodha Delivery Charges Example

Let’s understand this with a simple example.

Rahul is a delivery trader who is investing with the goal to finance his children’s higher education 10 years later. He has an active Zerodha demat account and has recently bought 100 shares of Infosys for ₹400 per share.

He expects a 20% to 25% return at the time of the goal completion. This means that he is eyeing a return of approximately ₹80 per share.

Let’s now calculate Zerodha delivery charges for the above trade.

First, comes the Zerodha brokerage.

Brokerage=0

As discussed, DP charges are imposed on the selling shares. Let’s assume that he sold all the holdings in one day.

DP charges= 13.5+(18%*13.5)

=13.50+2.43

=₹15.93

STT Charges= 0.1%* (40000+48000)

=0.1%*88000

=₹88

Other taxes

Transaction Charges= 0.00345%*880000

=₹30.36

Stamp Duty=0.015%*88000

=₹132

SEBI Charges= 0.00001%*88000

=₹0.008

GST= 18%* (0+30.36+0.008)

=₹5.46

Here Zerodha brokerage on penny stocks for delivery trade also remains the same and is calculated as discussed above.

*Apart from this, you can choose to trade in delivery using the Zerodha iceberg order which breaks your order into multiples and reduces the overall impact cost of trade there you have to pay Zerodha iceberg order charges on the basis of a number of legs.

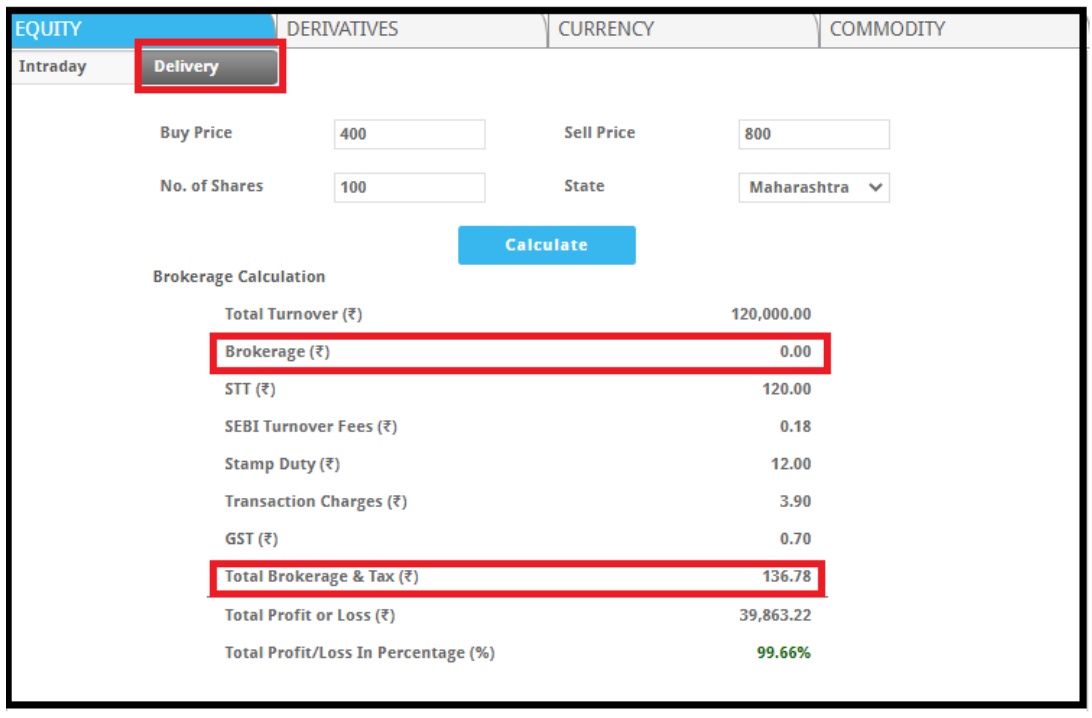

Zerodha Brokerage Calculator

Wondering how to check Zerodha brokerage charges. So, once the order gets executed you can find the details of charges under the Funds or Reports section in Console.

However, if you want to get an idea of fees and taxes before executing the trade, then you can use the digital calculator.

The brokerage calculator makes it easy for you to calculate the brokerage of any segment and also provides you the information on Profit and Loss percentages.

So, while executing the trade, enter the buy or sell price, quantity of shares, and state. The complete charges will be evaluated.

Conclusion

There is a huge client base of Zerodha and the factors that helped it reach these heights are many. One of them is the introduction of revolutionary charges for traders and investors.

Zerodha delivery charges are zero and with the introduction of discount brokers, the entire industry has shifted the scenario to highly affordable brokerage plans.

Is there any other broker offering the same services and benefits? For this check the complete review of Zerodha vs Groww stocks charges.

To start reaping the benefit of the discount brokerage plan by opening a demat account with the broker now.

Just fill in the basic details in the form below and open the demat account for FREE.