Put Option

More on Derivatives

Put option is a form of contract that is taken up by a party when the expectation is that stock is going to go down with a bearish sentiment.

Let’s understand how this form of trading works practically in this detailed review.

Options are the contracts which give the buyer the “right” to buy or sell a financial instrument at a specified time in the future, at a predetermined price.

It is to be noted that the buyer has the right, and not the obligation, to exercise the option. So, he may or may not choose to exercise it, depending upon the price of the security in the future.

On the other hand, the seller or the writer of an options contract has the “obligation” to buy or sell the financial instrument, in case the buyer wishes to exercise his option.

Options are derivatives as their price is dependent on the price of the underlying asset.

The Put Option is mostly exercised when you are bearish towards the market and believe a particular stock or index is going to be valued down.

They add a lot of flexibility to the portfolio as they benefit both the buyer and seller in hedging, speculation, income generation and tax management (more on this later).

Options contract can either be a call option or a put option. There is a difference between the call option and put option. Here we discuss the latter.

Put Option Meaning

Put Option is an options contract wherein the buyer has the right to sell the underlying financial instruments at a specified price during a specified time in the future.

It is like an insurance policy where the owner of the security insures himself against any heavy downtrends in the market by fixing his sale price at a predetermined position.

The specified price is called the strike price and the specified time is the options expiration date of the contract.

If the price of the security falls below the strike price before the expiration date, the buyer exercises his option and sells the security at the strike price thus saving himself from the loss of selling at the lower current market price.

However, if the price of the security remains the same or increases, he can choose to not exercise the option and earn a profit by selling the stocks in the secondary market at a higher price, obviously.

There is a premium or fee attached to entering into a put option contract, like any other contract. So, the only loss will be the premium paid to the option contract writer.

In other words, the buyer saves him/her self from buying a whole lot of shares and just lose on the premium paid as part of the contract.

Put Option Example

To state an example, let’s say that a trader thinks that the stock of Tata Motors is overpriced right now at ₹190 per share, so it will soon consolidate or crash down. He is also aware that the company is soon going to release its earnings report which is expected to be not so positive.

In this case, the best option the trader has is to buy the put option on the stock of Tata Motors at a lower exercise price of ₹185 (strike price), with a premium of ₹5 per share.

Now, when the earnings report is released soon, the share price tumbles down to ₹170.

The buyer of a put option has the right to still sell the shares of IBM at ₹185 thus giving him a profit of ₹15 per share minus the premium of ₹5, which is ₹10 per share.

If the trader bought that put option for 100 such shares, then the profit would be in the range of ₹1000,

This is a sure-shot profit scenario when the buyer of the put option is sure that the prices are going to go down.

In another case, it is also possible that instead of going down the price went up to ₹195. In that case, the buyer has the right to not exercise his option and the only loss he makes is of the premium that he paid of ₹5 per share.

Thus, profits are unlimited, but the losses are only limited to the options contract fee paid (or we call it the premium).

Again assuming he bought the right for 100 such shares, then the total loss would be ₹500.

The writer or seller of the put option, in this scenario, will earn the premium fee as the option was not exercised.

Put Option Types

Within this form of options, there are two types that are used by different kinds of traders and investors depending on their market expectations in terms of the trend, direction and momentum.

This needs to be understood that it really depends on the kind of strategy you execute in your put option trading when it comes to risks and potential profits.

Nonetheless, let’s have a quick look at both types:

Sell Put Option

If you are looking to sell a put option, you need to be aware of the fact that you will be required to own that specific underlying security at a pre-determined price. In other words, if a party decides to buy this option and then exercise the contract, then you will be REQUIRED to buy.

It makes sense to sell a put option when and if the net price of the underlying security is attractive.

Here is a quick example:

There is a company RR Infotech that is doing really well in its software exports. It has recently got a deal worth $200 Million from one of the largest financial houses in the US.

The share of this company is currently trading at 454 on NSE.

You think this company’s stock is going to go wild in the next few months and you are looking to make some money while that happens.

You can either go ahead and buy 100 shares of this company which will cost you 45,400.

Else, you have the option to sell a put option for this stock. The arrangement can be a 425 Option expiring in 2 months with a premium of 50.

In simpler terms, you are expecting a buyer to pay your 5,000 as premium now for the 100 stocks that you are looking to sell.

If the stock price of RR Infotech falls to 425, you are committing to buy 100 shares at 425, 2 months from now. If such a case happens, the net cost to you will be (425 – 50) X 100 i.e. 37,500.

At the same time, if the stock does not fall to 425, the option expires worthlessly and you get to keep the premium of 5000.

Buy Put Option

Buying a put option, on the other hand, is not that complicated an affair.

If you are expecting the market or stock to go down (you are bearish!), then it makes sense for you to buy a put option.

How?

The put option will give you a RIGHT to sell the contract at a pre-determined price anytime before the option expiry date. Thus, in a sense, you are taking a short position while the put option seller is taking a long position with bullish expectations.

Depending on how the stock moves by the expiry date, the corresponding party takes home the money.

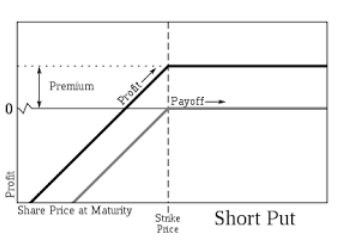

Put Option Payoff

In a put option, the payoff depends on whether you are on the selling side of the contract or the buying side of it.

Let’s say you are selling the contract at INR 500 with a market price of INR 200. Remember, the put option gives you the “right” to sell the contract at a pre-determined price by the expiry date.

If the stock price goes down to INR 50, then you’d definitely exercise the option and take away the difference of (200 – 50) X 100 as your payoff from the put option. In order to do so, you’d be required to buy the stock at INR 50 and then sell it for INR 200.

At the same time, if the stock price goes to INR 250, then you won’t exercise your option (exercising is not an obligation in this case!).

In simpler terms, the payoff depends on your anticipation of the stock direction and the actual price movement of the stock.

Put Option Formula

If you are looking to calculate the value of a put option, then you’d need 2 parameters:

- Exercise Price of the Stock

- Market Price of the Underlying Asset

If the option is exercised, then you can calculate the value of it by performing this simple calculation:

= Exercise Price – Market Price of Underlying Asset

If the option is not exercised, then it carries no value at all.

Put Option Premium

The calculation of the put option premium is dependent on a couple of factors:

- Intrinsic Value of the Stock

- Time Value

To calculate (1), you would need the current market price of the stock and the strike price. The difference between these two price points is your intrinsic value of the stock.

Similarly, the time value of the stock depends on how far is the expiration date from the current date. The time value of a stock sees a lower value as the expiration date of the contract nears.

Also, the higher volatility of the stock is, higher is the time value of the stock.

Both these parameters are considered during the calculation of the put option premium.

Put Option Maximum Loss

The maximum loss in a put option is based on the fact that whether you are the put option seller or the buyer. Let’s talk about both the options:

Buyer: As a buyer, your maximum loss is the premium that you to the seller while getting into the contract. This will happen when the market did not move as per your expectations and you had to decide to not to exercise the option.

Seller: As a seller, you receive premium while getting into the contract. Thus, your maximum loss is the strike price – premium amount.

This would happen when the buyer of your contract decides to exercise the option contract.

Put Option Trading

Just like call options, put options are also used for speculation, income generation and tax management.

Speculation: It is used extensively when the traders are definitely expecting a decline in the market. Using the put option, they limit their losses and make huge profits instead.

Income Generation: This is mostly used by the writers of the option. Instead of just holding the security, they sell a put option on the security, hoping that the option will not get exercised and they will earn the premium.

Tax Management: Put Option is an excellent way to manage taxes.

For instance, a person who holds certain shares and knows that the prices are going to decline, he might as well sell the stock and buy later at the lower prices; but by doing so, he will have to pay huge taxes on the capital gain from the sale of the stock.

Instead, by using the put option, he is only going to end up paying taxes only on that put option trade.

Thus, put option is a good mechanism to make money and to limit losses, especially in the scenario when the traders are expecting the market to go down.

Conclusion

Before we end this review on Put Option, this needs to be clearly understood about the concept:

- One who is buying the option has a bearish perspective towards the asset or stock in question while the trader who is selling the right to exercise is either bullish or neutral towards it. He/she is definitely NOT looking at a bearish future trend.

- The buyer of the put option gets the RIGHT to sell the asset or stock at the pre-decided price (or the strike price) once the expiration date is met. He may choose to exercise the right or not as per his/her choice.

- The seller of the put option is OBLIGATED to buy the asset or stock at the strike price if the buyer wants to sell it. There is no other option.

Hope we were able to make it clear for you. Let us know in the comments section below in case you have any doubts whatsoever. We will try to clear those for you.

In case you are looking to get started with share market trading and specifically trading in derivatives, just fill in the form below.

We will arrange a callback for you, right away:

More on Share Market Education:

If you wish to learn more about options or stock market investments in general, here are a few references: