Zerodha Options Trading

More on Online Share Trading

Options trading is a kind of derivatives contract that gives traders a chance to minimize the share market risk and earn a good profit even when the market is following a bearish trend. Having an account with Zerodha, learn how to get into Zerodha Options Trading.

Before diving into details, let’s grab a little information about a broker.

Zerodha is a discount broker established in 2010 under the leadership of Mr. Nithin Kamath. It is a SEBI registered stockbroker with a membership of various stock exchanges like NSE, BSE, and MCX.

It is a registered depository participant with CDSL and NSDL. The stockbroker allows you to trade in multiple financial instruments like:

- Equity

- Commodity

- Currency

- Government Securities

- Mutual Funds

- IPO

- Derivatives

Now that we know about the broker, let’s discuss the topic – Options Trading in Zerodha.

Options Trading in Zerodha

Options Trading is a type of Derivative Trading and thus comes under its umbrella. Are you wondering what option trading is?

Don’t worry! We got you covered.

Options trading is a contract that gives the seller or buyer the right to buy or sell an asset in the future at a price set today. This contract is not obligatory.

The party that pays the premium in the contract is permitted to deny the transaction in the future.

Let’s understand this with an example.

Suppose Harsh has a plot worth ₹50 Lakhs, and he is feeling bearish about its price. He searches for a willing buyer and finds Yash, who is interested in buying the property.

They enter a Contract for a day six months from today.

Yash is willing to buy the plot because he knows that a Mega Mall will be constructed here in the months to come and will skyrocket the price of this plot.

For signing the contract, Yash pays Harsh a premium of ₹2 Lakhs. This premium is nonrefundable.

After four months, the Mall is ready to be inaugurated. Harsh regrets getting into a contract with Yash as the prices have increased by a huge margin.

But, he has no option but to execute it as Yash paid the premium in advance.

The option to cancel the deal remains solely with the individual who pays the premium.

Contrarily, imagine that the plan of constructing a Mega Mall is dropped. The prices of the plot decrease by a large percentage and land on ₹40 Lakhs. Yash calls up Harsh to cancel the contract.

Buying this property is now a direct loss of ₹12 Lakhs to him, but it is much better than owning a property that doesn’t have a prospective growth in its prices.

Similarly, when you feel bearish about any commodity, currency, or equity, you can enter an options contract and trade them with ease. The situation is the same for the financial securities.

Now that the concept of options is clear, we should discuss Zerodha Options Trading Account.

Option Premium in Zerodha

Premium defines the value of the option at the current market time that depends upon the difference between the spot price and strike price. Apart from this, its value is calculated on the basis of time left for expiry.

This is the amount that the buyer pays to the option seller to get into the position at which he wants to buy or sell the underlying asset on the day of expiry.

You can find details of this premium value in the Zerodha option chain for both call and put options under LTP column.

Apart from the LTP % change column gives you the detail of the increase or decrease in the value on the option on the basis of volatility, trend, etc.

Once you execute the trade in options using Zerodha Kite you can view the details under Funds option in the application. Here the negative premium value depicts the amount received on option selling.

Zerodha Options Trading Account

Do you think that you’ll have to open a separate Zerodha options trading account?

Well, let me tell you that you are wrong. It is because your Zerodha trading and demat account has the facility to trade in multiple financial instruments.

When you open an account with the broker, you get to choose the segment you wish to trade.

If you decide to trade a new segment, all you need to do is activate the segment (the process has been discussed in the upcoming section) by accessing the back-office platform – Zerodha Console.

Let’s learn the process of activating a new segment for a demat and trading account in Zerodha.

How to Activate Option Trading in Zerodha?

To begin options trading in Zerodha, the foremost task is to activate the segment. For this login to Zerodha Console with the login ID and password.

Here you need to submit the income statement and proceed further by following the steps below:

- There select the segment and click on the NSE/BSE Futures and Options.

- Now either submit the income proof or you can select the holdings as your income proof.

- Select your current holding value.

- The notification for activating your segment is sent and you can trade in options once the segment gets activated.

Generally, it takes 48 hours after submitting the application to activate the segment.

Zerodha Option Chain

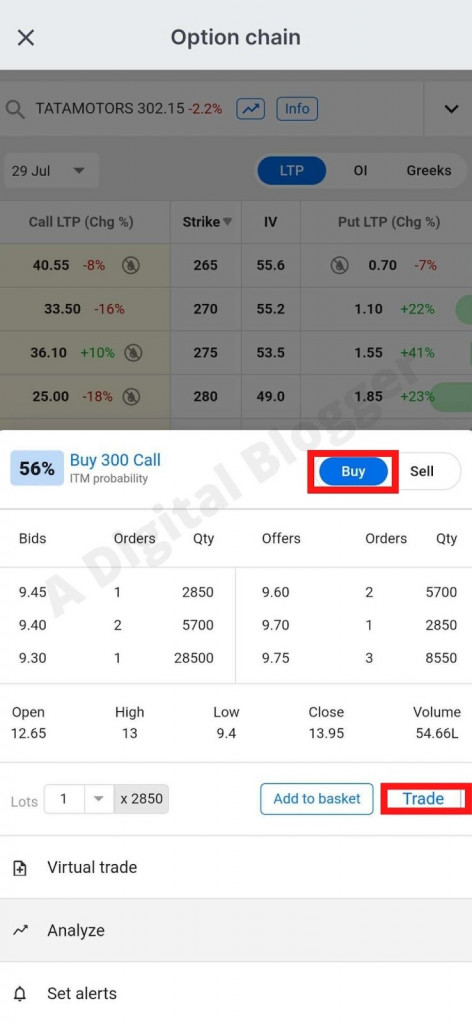

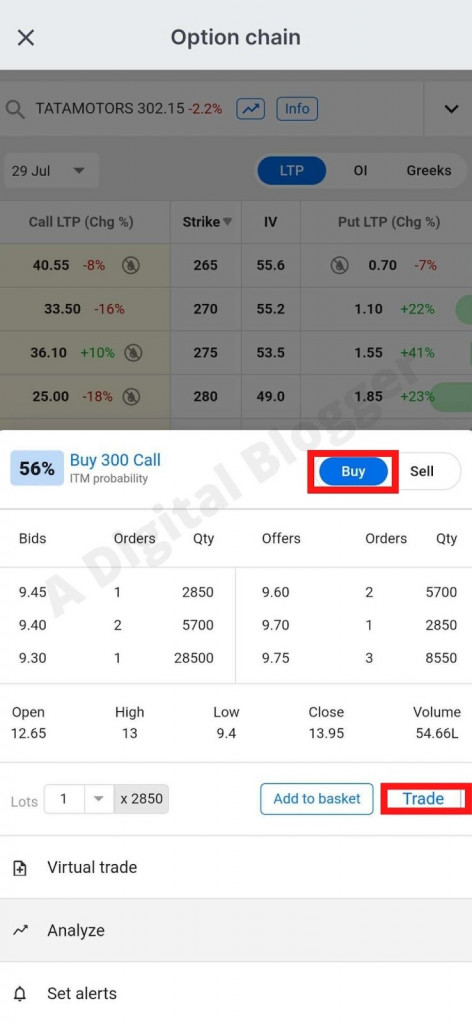

Now once you activate the option segment you can trade in any available option contracts by analyzing the value and other parameters using Zerodha Option Chain.

Zerodha provides you access to view the Sensibull option chain that is advanced and helps you in determining the change in option value with the help of Greeks.

Also, the data is easy to read as almost all the data is available in percentages with different colors (red and green) that help the trader in gaining an idea of the trend, price changes, etc.

How to do Options Trading in Zerodha?

Once the segment gets activated, you can trade in the option segment. In this quick section, we will learn how to sell option in Zerodha and buy too.

For this, it becomes vital for you to learn the basics of options and how to read the option chains.

- To execute the trade, select the option contract.

- Click on the option chain and select the strike price corresponding to the call or put option.

- Now click on the buy or sell button.

- The buy/sell window appears where you can enter the quantity (no. of lots), price and validity.

- Click on Buy/Sell button, your order gets executed.

You can also place option trade in Zerodha using call and trade facility. However, to use this service, there are additional call and trade charges in Zerodha.

Now, let’s learn about the Zerodha options trading platform.

How to Carry Forward Options in Zerodha?

Sometimes, the chosen strike price tends to expire out of the money which results in losses for the buyer. At the same time in the money options become a major reason for seller losses. So, in this case, is there any way to rollover or carry forward your trade position in options?

Well! this provision is only available for futures where both buyers and sellers are obligated to settle the trade. In the case of an option, if you want to continue with the same position but for the next expiry then first you have to exit your current position and then take a new position for the same strike price.

This means you already have a long position in the option, then you need to place a sell order and create the new long position. On the other hand, if you have short your current position, then buy option and then again create the sell order using Zerodha Kite app.

Zerodha Strike Price Range

Now trading option using the Zerodha Kite platform is simple and straightforward but do you know that you cannot trade in all the available strike prices, especially if you are buying options for intraday trading.

This is generally to minimize the risk because of the minimum liquidity of a few strike prices, for example, deep OTM options.

Other than this, as per the exchange rule, Open Interest data play a vital role in determining the strike price that is allowed for options trading.

As per the rule, the strike price for which the Open interest data equals to or more than 500 crores or 15% of the total OI are restricted for intraday trading.

However, you can sell at all the available strike prices or when you want to hold options for overnight.

Zerodha Options Trading Platform

Trading in the options segment is facilitated by the stockbroker, and the trades can be executed using a few trading platforms by Zerodha. Some trading platforms by Zerodha are Coin, Console, Kite, NestTrader, and Streak.

The trading platform that permits trading in the options is Zerodha Kite. It is available in two interfaces – Web and Mobile Application.

Furthermore, you get the provision to use Sensibull Zerodha, specialized trading software for options trading.

The process of trading in either of them remains the same, and it has been discussed in detail in the next section.

Options Trading in Zerodha Kite

Once the activation request has been concluded, you will be able to trade in the Options segment with Zerodha Kite. When you trade in the derivatives segment, the way of placing your order is similar to placing other orders for the different segments.

The only thing you do extra is to look at the ‘Option Price Ladder’.

This ladder contains varied information like Volume, Options Interest (OI), etc. One side of the ladder shows you Call option details and the other shows Put option details.

In the middle of these two is the Strike Price of the specific option. The ladder provides you with the strike price, and Put Option and Call Option prices. You can choose the security according to these prices.

Also Review Spot Price and Strike Price in detail.

When you click the security you are planning to buy or sell, you get all the related information about it like charts, technical analysis data, and much more. You can analyze it and decide a suitable plan of action.

Now, let’s talk about the Zerodha options trading charges.

Zerodha Options Charges

Whenever you place or execute a trade, you have to bear a few charges. Although, Zerodha trading charges are the least there are other fees by the regulatory body or the Government that is important for you to know before getting into the trade. A list of these charges is as follows:

- STT or CTT

- Transaction Charges

- SEBI Charges

- GST

- Stamp Charges

- Brokerage Charges

These charges are mandatory, and you don’t have the option not to pay them. Further, these charges vary according to the segment you trade.

Every stockbroker charges a fixed amount of brokerage for executing the orders placed. These charges vary with the financial segment traded by the trader or investor.

For trading options in the equity, commodity, and currency segments, the charges are discussed below.

Zerodha options trading brokerage is ₹20 on every equity options order executed and 0.03% or ₹20 per executed order, whichever is lower for commodity and currency options.

For an easier understanding of the charges levied on trading with Zerodha, they have been tabulated below:

| Zerodha Option Trading Charges | |||

| Trading Segment | Equity Options | Commodity Options | Currency Options |

| STT/CTT | 0.05% on sell side (on premium) | 0.05% on sell side | No STT |

| Transaction Charges | NSE: 0.053% (on premium) | Exchange transaction charge: 0 | NSE: Exchange transaction charge: 0.035% BSE: Exchange transaction charge: 0.001% |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI Charges | ₹5 per crore | ₹5 per crore | ₹5 per crore |

| Stamp Charges | 0.003% or ₹300 per crore on the buy side | 0.003% or ₹300 per crore on the buy side | 0.0001% or ₹10 per crore on the buy side |

| Brokerage Charges | Flat ₹20 per executed order | 0.03% or ₹20 per executed order, whichever is lower | 0.03% or ₹20 per executed order, whichever is lower |

To calculate options brokerage along with other taxes and fees you can use Brokerage Calculator Zerodha Options. This helps you in finding the total brokerage along with the profit percentage calculation.

Zerodha Leverage For Options Trading

Zerodha provides leverage according to the order type selected by the trader or investor. Currently, it offers a margin facility for MIS orders and Cover Orders (CO). The facility for Bracket Orders (BO) has been temporarily suspended due to the volatility.

BO leverage facility will resume once the expected volatility subsides. The MIS leverage and CO leverage have been tabulated below for an easier understanding:

| Segment | MIS Leverage | Cover Order Leverage |

| Index F&O | Total of 20% of SPAN + 100% Exposure | 3.7X(27% of NRML margins) |

| Stock F&O | Total of 20% of SPAN + 100% Exposure | - |

Zerodha Options Trading Time

The trading time for different trading assets is different based on the exchange they are being traded on. Thus, your trading time is dependent on financial security.

The trading time for the equity segment is 9:15 AM to 3:30 PM. If you wish to execute a day trade, the intraday square off time for Zerodha is different for the trading segments.

For equity or cash, equity derivatives, currency derivatives, and commodities, the square off time is 3:20 PM, 3:25 PM, 4:45 PM, and 25 minutes before the market closing respectively.

For easier understanding, these timings have been tabulated below:

| Zerodha Options Trading Time | ||||

| Trading Segment | Equity or Cash | Equity Derivatives | Currency Derivatives | Commodities |

| Auto Square Off Time | 3:20 PM | 3:25 PM | 4:45 PM | 25 minutes before the market closing |

Conclusion

So to get started with Zerodha Options trading all you have to do is to open a demat account with the broker and activate the trading services using Console.

Since Zerodha is a discount broker, you can reap the leverage of minimum brokerage by opening a demat and trading account.

Wish to start Options Trading? For let us have the honor to help you

Know more about Zerodha