When to Sell Call Option?

More on Derivatives

Choosing options particularly the call option is not a bad profit-making strategy, but to earn a good profit it is good to know when to sell call option.

Today, this options trading guide will enlighten you with information on how this bullish strategy plays out in the stock market.

But, before setting out let’s get started with the meaning of the option and see what is a call option?

Also, know about Spot Price and Strike Price that usually people consider the same but actually, they are not.

Well, no investor and trader are exempted from the information of options prevailing in the investor world. But, if you are new or if you are less familiar with the term of the options then worry not, we got you covered!

Here’s a quick explanation of options:

- Options are a financial instrument and a part of derivatives trading.

- Options offer the right to a buyer and seller to purchase or sell an underlying asset or security at an agreed price and within the contract’s validity.

- Option contracts are exercised by both parties without an obligation.

- Option contracts include a small fee or Premium amount that is to be paid by the buyer or holder of the option contract.

Each option contract has a specific expiration date within which the option holder can exercise his right.

Also, each contract is different from another in terms of amount too as each option contract has a fixed price, also known as the strike price, at which the trade will be executed.

So, no matter whether the underlying asset’s price has fallen down or dropped the trade will be executed at the Strike Price only. So, if you are thinking to sell call option without strike price then that is not possible in actuality.

The call option will be exercised only at the strike price that was fixed initially.

Unlike futures, the option holder is not required to execute the trading deal i.e. buy or sell the underlying asset if they choose not to.

- Call options give the right to the holder to buy the underlying asset or security at a given price and prior to the expiry of the contract.

- Put options permit the holder to sell the stock, share, or any asset at a fixed amount on or within a defined timeline.

Thus, there is a difference between the call option and put option. Know the difference and choose accordingly.

Call Option is exercised by the investor as a bullish strategy using an alternative to minimize risk and leverage to buy stocks or shares.

Majorly, the holder of the call option assumes that an increase in the stock price will be seen after buying the options contract.

And, to be honest, if he wishes to earn a call option profit then the stock price must increase before the expiration of the contract.

Along with it review Pros and Cons of Option Trading and Option Trading Risk in detail

Now, let’s talk about the when to sell call option with the help of examples and diagrams.

When to Sell Call Option Before Expiration?

You might have seen many Indian movies on twin sisters who feel the same when they get hurt or experience happiness.

If one is badly injured, the other one is injured too, and if one is very happy, others get happy too, just like the Indian movie “Alone,” whose dialogues hit the cinema world.

You might be wondering why are we talking about this here?

Well, the reason why we’re talking about this mythical movie here is that the option buyer and the option seller are somewhat comparable to these sisters.

Whatever happens to the option seller in terms of Profit & Loss (P&L), the exact same thing happens to another party too, and vice versa.

So, to avoid such a situation and execute with maximum profits, you must know when to sell call option and when not to.

An investor should sell a call option if there is a belief that the cost of the underlying asset may fall down and if it actually drops to a certain value before its Strike Price, then you keep the premium amount.

- The seller of the call option is typically known as a writer.

Anyway, let us now understand the same with an example of ‘DLF’ and build a case of when to sell call option.

Please refer to the chart shared below-

- The price of the stock has extremely fallen down, clearly going in Bearish condition.

- Due to this situation, it’s sure that the majority of the investors and traders who have invested in this company would be stuck in hopeless long positions

- As soon as there is an increase in its stock price, it will exist from long positions.

- Also, there is very little chance that the prices will quickly increase in the coming term.

- Since an increase in its stock price currently seems to be challenging, selling its call option and collecting the premium will be a wise decision.

By following the above criteria, the option writer decides it to be the right time to sell call option.

- The key point to note here is that the option seller is selling his call option because he is sure that the DLF is going to be in bearish condition for a long time. Hence, he’s clear that the stock price will NOT CHANGE in the coming period of time.

Hence, we come to a few key points:

- A call option is sold when the writer is experiencing a bearish condition on the underlying stock or asset.

- A deposit in the form of margin is made when you sell a call option.

- When the seller or writer decides to sell a call option, his profit is limited to the degree of the premium he has received and also, his loss can potentially be unlimited.

- There is asymmetrically opposite Profit & Loss behavior in the buyer and seller.

- In India, all options are done in European style: the option is exercised before the expiry of the contract.

- Breakdown point = Strike Price + Premium Received

- Whenever a call option is sold a premium is received.

Now, you might be confused that how he can sell the call option. Well, to be sure there are two different ways to sell a call option, namely Naked Call Option and Covered Call Option.

Let’s start with the covered call option.

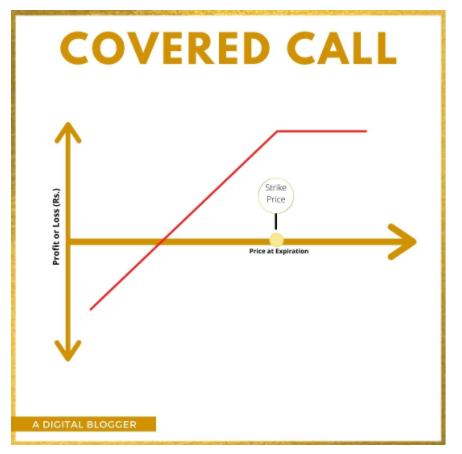

1. Covered Call Option

- The covered call option method is used to sell the call option when the seller posses ownership of the underlying asset or security and he has been holding this position for a long time.

- Selling through this way will offset the chances or probability of potential declines in the stock price and will also lead to an extra income.

- This way is called the covered call option since the option seller gets ‘covered’ against a loss since if the buyer exercises his option, the seller can offer him the shares of the stocks that he has already bought at a lower value than the strike price of the option.

- Although his profit will be limited to the increase in stock, however, he will be saved from any potential losses.

Let’s understand with an example:

An investor named Nitika Jamwal holds shares of a company named ABC India, completely hypothetical.

Although, she is in favor of its long-term projects and its share price, however, she feels that in the shorter term the stock will likely trade comparatively flat, perhaps with multiple rises in its current price of Rs. 425.

If she sells a call option on ABC India with a strike price of Rs. 427, he will earn the premium from the option sale but, for the duration of the option, she will put a cap on a potential increase of Rs. 427.

Assume the premium she has received for selling a three-month call option is Rs. 100 (Rs. 10,000 per contract or 100 shares).

Now, here comes two different scenarios:

- ABC India shares trade underneath the strike price of Rs. 427. The option will terminate uselessly and the investor will keep the premium from the option. In this situation, by exercising the buy-write technique he has effectively outflanked the stock. She still owns the stock however now he has an extra Rs. 10,000 in his pocket, fewer expenses.

- ABC India shares rise above the strike price – Rs. 427. The option is worked out, and the potential gain in the stock is covered at Rs. 427. In the event that cost goes above Rs. 527 (strike cost in addition to premium), the investor would have been better to take his hands off the stock. Although, in the event that he anyway wanted to sell at an increased value of Rs. 550, selling the call option would have given him some extra Rs. 23 per share.

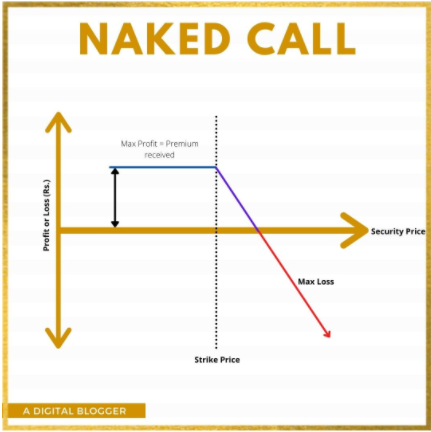

2. Naked Call Option

- A naked Call option is said to be risky as the profits are limited and potentially huge losses for the investors. It’s all based on your analysis and luck.

- The naked call option strategy is opposite to the covered call option. Here the option seller sells the call option without possessing ownership of the underlying asset or security. Here the losses of an underlying asset cannot be ‘covered’.

- When a call option holder exercises his right, the naked option seller is obligated to purchase the underlying stock at the current market value to offer the shares to the option holder.

- If the price of the stock exceeds the strike price, then the difference between the current market value and the strike price denotes the total loss to the seller.

- Most option sellers in the stock market charge a very high value or fee to repay for any losses that may take place.

For example, Bunty Thukral thinks that the share price of ABC Cement will remain at Rs. 255 or may experience bearish condition- the price may fall below.

He doesn’t own any shares in ABC Cement firm, but he can write a call option for 100 shares with a strike price of Rs. 260 per share.

He collected the premium of Rs. 5000 with Rs. 5 price difference on 100 shares.

Now, two scenarios can appear in the market:

- If the price of ABC Cement doesn’t rise in the market, he can keep the premium amount of Rs. 5000 as profit and that option will never be exercised.

- However, if the stock price increases in the market, Bunty’s losses will also increase in proportion to the stock price rise. After a while, the stock prices shoot up to Rs. 263 per share cost. The investor who bought the call option exercised it and Bunty had to buy 100 shares at Rs. 263. Thus, giving him a considerable loss!

Closing Thoughts

Generally, bullish investors who are keen to trade through call options have a question- when to sell call options.

And today, through this article, we tend to guide you the same in a simple and straightforward way through multiple examples.

At certain times in the trading, you might feel that it’s the right time to sell your call options. But you must be sure of it and that can be achieved by understanding the market and company reports.

The most appropriate time to grow profits and save yourself from unlimited losses by selling call options is when the price of an underlying asset or security increases more than its strike price before its expiry date.

And what else is required? An eye….

Yes! Keeping an eye on the market and stock price can help you in determining the flow of the underlying asset.

If you play this game strategically and get familiar with when to sell call options you can unleash a wide array of benefits related to it such as cost-efficiency, risk multiplication, unlimited profits, and a lot more!

There are two different ways to sell call options- The naked call option and the covered call option. Both of these strategies have been discussed above, along with examples.

If you have any question, you can write to us in the comment section given below-

Want to start Options trading? Open a Demat Account, for that refer to the form below