Call Option

More on Derivatives

Call Option is a part of trading which requires a good amount of understanding before you go ahead and start using those for your trades. In this quick review, we will talk about the basics and advanced form of trading using this concept.

You are advised to get a deep understanding of call options and the related concepts and only then put your hard-earned capital into this form of investment.

Let’s start with some fundamentals!

Options are quite complicated, but once learnt and understood, they provide ample opportunities for hedging and speculation and help in reducing the risk of holding an asset. One of the two types of options is a Call Option.

Call Option Meaning

Call Option is a derivative contract between two parties, a buyer and a seller. Here, the buyer of the call option has the right to be able to exercise his option and buy a particular asset during a specified period of time in the future, at a specified price.

Nonetheless, before we go even deeper about this concept, let’s quickly take a step back and understand the concept of Option trading as such.

Option Trading is a type of contract wherein the trader has a right to buy or sell a security at a specified time for a specified price. The most important characteristic of an options contract is that there is no obligation or compulsion to fulfil the contract.

The trader has only the right, so he may or may not buy or sell the security, and he is entering into a contract to buy or sell the securities that he actually does not hold.

This is very helpful in minimising the risks. The price of the options is based on an underlying asset, thus it becomes a derivative.

Coming back to call option, it is to be noted here that the buyer of this type of option has the right and not the obligation.

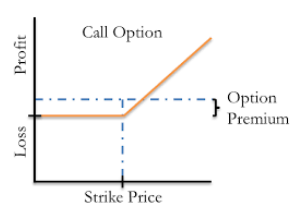

Therefore, the profit that the buyer of the option can earn is unlimited, whereas the loss is only limited to the amount that was paid to buy the call option contract.

The securities can be bought anytime before the specified time which is called the options expiration date, at the specified price which is called the strike price.

Types of Call Option

As we have discussed here and in other multiple reviews, there are two major types of options – one of which is the call option. However, within call options, there are no further types.

Yes, there are multiple call option strategies (discussed later), but within this concept, there is no further segregation.

Intrinsic Value of a Call Option

In an options contract, you’d know the values of two price points:

- Current Market Price of the Stock

- Exercise Price at the time of Expiry

To calculate the intrinsic value of a call option, you need to simply find the difference between the price points listed above. The value obtained post this quick calculation will be the intrinsic value of the call option.

Now based on the value from the above calculation, there are further 3 situations:

- Value is Negative: It becomes ‘Out of the Money’.

- Value is Positive: It becomes ‘In of the Money’.

- Value is Zero: It becomes ‘At of the Money’.

Call Option Premium

The premium of a call option is directly related to the price of the underlying security.

In simpler terms, if the price of the underlying security increases, the call option premium increases and at the same time, if the price of the underlying security decreases, there is a corresponding decrease in the call option premium too.

Furthermore, volatility also plays an indirect role in impacting the call option premium. Increased volatility leads to an increased premium and vice versa.

Call Option Strategies

There are multiple strategies you can employ while using a call option in your trade. We have listed some of those below:

- Short Call

- Short Call Butterfly

- Covered Call

- Bull Call Spread

- Long Call

- Bear Call Spread

- Long Call Condor

- Short Call Condor

- Synthetic Call

- Long Call Butterfly

- Protective Call

Remember, whatever strategy you pick up, you need to be wary of various aspects including market volatility, strike price, the premium to be paid, days left to contract expiry, and so on.

Along with it, you must not avoid the factor about when to sell call option?

The topmost factor apart from the ones mentioned above is what is your outlook on the market trend and movement. For more information, you can choose to click on the specific strategy and know more.

Call Option Contract

As mentioned above, a call option or any other form of the option is a contract or let’s say an agreement between two parties.

A contract comes with the following details:

- Info of both the parties

- Underlying Asset

- Expiration Date

- Current Market Price

- Strike Price

- Premium Value

- Number of Lots

There might be few other details around the contract and the parties in question, however, the ones listed above entail the primary set of information you’d need as an investor.

Remember, the call option contract gives the buyer the right to exercise the option without any obligation. This condition will differ with the contract type and the party type (buyer or seller).

Call Option Example

As an example, if the stock of Wipro is trading at ₹273 per share and the trader enters into a call option contract to buy the shares at, say, ₹275.

Then the buyer of the call option has the right to buy the stock at ₹275 which is considered as the strike price, irrespective of the current stock price, before the contract expires on, say, April 30.

Stock Price – ₹280

So, in this case, even if the price of the share goes up to ₹280, the trader can still buy the shares at ₹275 as long as the call option has not expired.

Here, as the price of the underlying security has gone above the strike price, the call option is said to be ‘in the money’ or ITM and will be exercised by the buyer of the option.

Stock Price – ₹273

If the price of the stock does not budge at all and stays in the range of ₹273, then the buyer would still need to write it off as a loss since he/she has already paid a premium of ₹2 on top of the current market price.

Stock Price – ₹270

However, if the price of Wipro share goes down to ₹270 instead of going up, the buyer of the call option will not exercise the option as he will have to pay ₹275 for the share that he can otherwise get for ₹270.

In this case, the option is ‘out of money’ or OTM, will not be exercised and the premium will be kept as a profit by the seller of the option.

In other words, if the buyer sees a potential loss in the trade for which call option has been put in place, he/she gets the right to go ahead with the call option exercising or not.

The risk, in this case, is just the premium that the buyer has paid in advance to the seller.

Call Option Trading

Call Option is mostly used by the options traders for one of the following purposes:

Speculation: Call options are an excellent way to speculate the price movements.

When a trader is speculating that the price of Wipro shares will go up, he can either directly buy multiple shares of Wipro, but by doing that he is risking his entire capital and may end of losing everything, as we know there is nothing sure-shot in trading.

So, in such cases, he uses call options as buys the right to purchase shares at the lower prices. If the price of shares goes up, he gets unlimited profits, but if the price does not go up or goes down instead, he will only end up losing the amount that he paid for buying the contract.

Income Generation: This is the case when a trader becomes a seller or the writer of the call option.

He already holds the shares or the securities, and along with holding that underlying security, he sells a call option and generates income when the price of the security does not go up and the option expires worthless.

Although, by doing so, he is also limiting his profit potential in the case the price actually goes up.

Tax Management: Call Options are also used by traders to save themselves from tax liabilities, by not actually selling the assets, but only reducing the exposure to the security by selling a call option.

The trader saves the tax and only ends up paying the amount equal to the contract price.

Thus, a call option is a good way to manage the trading and it gives the trader good exposure to hedging, speculation, risk management and proves useful in making unlimited profits with very limited downside risks.

Call Option Formula

If you are looking to calculate the value of the call option, then you’d need two parameters to decide that value:

- Price of the underlying asset

- Exercise Price

The calculation of the call option can be done using the following formula:

Call Option Value = max(0, underlying asset’s price − exercise price)

Thus, after you subtract the exercise price from the price of the underlying asset, you get a positive value, then that value is the call option value.

Else, if the resulting value post this subtraction is either negative or zero, then the call option value is zero.

Call Option Profit

Payoff calculation is an important aspect while you are trading through derivatives. This basically implies the profitability of your option across different market conditions.

The actual value of the payoff depends on whether you are going long or short towards the option:

For the long call option, here is the payoff calculation technique:

Call Option Value = (Max(Stock Price – Strike Price), 0) – Premium Value

So basically, to get to this value, you need to calculate the difference between the stock and the strike price and see whether it is positive.

- If it’s not, then the option payoff is a loss.

- If it is positive, then you need to subtract the premium value from it

- If this result is negative, the payoff is a loss

- If this result is positive, then the payoff is profitable.

Similarly, you need to check the payoff for the short call option and here the formula is the exact opposite to what has been discussed above i.e.

= Premium Value – (Max(Stock Price – Strike Price), 0)

Although, we would have given a few examples to illustrate the above-mentioned formulae. However, those seem to be pretty much self-explanatory.

In the Money Call Option

An in-the-money call option is a situation when the current market price of the underlying security is greater than the strike price.

With that happening, the buyer of the call option has the right to exercise the option and then go ahead with buying the stock at below the current market price or strike price in this case.

This situation gives birth to another entity called the intrinsic value of the call option which is the difference between the current market price of the underlying security and the strike price of the stock.

By reading the article you must be thinking is it possible to sell call option without strike price? That is not going to be possible. Because the call option is going to be exercised at the strike price that was fixed initially.

Writing a Call Option

When you hear someone say “I am writing a call option”, what he or she is implying that he is looking to sell-off his call option.

Furthermore, he/she will be “obliged” to sell that stock for the promised strike price, mandatorily.

You know what? Let’s take a quick example to understand this concept.

For instance, if you own SBI 1000 call option and you strongly believe that the stock price will see no or limited volatility. Thus, the stock price of SBI will not budge upwards and may actually see a small bit, if not neutral.

You place your position and Savita bids for your option at INR 25 with a 1050 call. This implies that Savita is bullish about the stock and believes that it will see a price point of more than 1050 in the next few days.

She is paying 25 X 100 i.e. INR 2500 as a premium to get into this contract. Now, this INR 2500 is yours, no matter what! However, there can be 3 situations from here:

Stock Price Stays at 1050

If the stock price moves up but does not cross the threshold of 1050, then it makes almost no sense for Savita to exercise the contract as the stock is available in the market for the same price anyway.

You, on the other hand, make INR 2500 from this deal!

Stock Price drops to 990

Wow!

Stock Price actually dropped and you were right! So, in such a case, again, Savita will not exercise the call option as she can get the same stock for a much cheaper price from the stock market directly as compared to the strike price of INR 1050.

Stock Price jumps to 1120

Oops!

So Savita was correct in her stock analysis. The stock price jumps to 1120 but she buys it at 1050 from you.

With this, she makes a profit of INR (1120 – 1050) X 100 i.e. 7000. You need to deduct the premium of INR 2500 she pays.

So her final profit in this contract is INR 4500, which is not bad at all.

This is how writing the call option works.

Call Option in Share Market

This is THE most important part of this detailed review on Call Option – When Shall You Buy?

Well, the answer to that is pretty straight-forward, theoretically. However, when it comes to the practicality part – things may get a bit tricky.

You will always have to keep a close eye on the specific sector or the market in general. When the stock/sector/market seems bullish, you need to make sure you place the call option at an optimal price point. Once you have fixed the price point, its (hopefully) all uphill for you.

Protect yourself by paying a small margin at the onset instead of putting yourself into a tricky state of actually buying all those stocks against your account. If your analysis and calculation turn out to be right, its all profit. If not, the loss is limited to the margin amount you paid.

So, in case you are looking to gear up for the share market trading, and especially for derivatives trading – just fill in the details below.

But here it becomes necessary to maintain the minimum maintenance amount in the account in order to avoid the margin call from the broker.

We will arrange a callback for you to get you started:

More on Share Market Education:

If you wish to learn more about options trading or the stock market in general, here are a few references for you: