Nazara Technologies IPO- Is it Worth the Hype?

More on IPO

By this time, you should not be surprised if we say that another IPO is set to make its market appearance soon. A prevalent gaming and sports media platform, Nazara Technologies IPO is set to launch on the 17th of March.

Should you invest in Nazara Technologies IPO? Are you drowning in this dilemma?

Worry not because we have a complete list of facts that you should know before concluding. We will guide you and pull you out of the confusion.

Nazara Technologies IPO Details

The Nazara technologies being a prominent name in the gaming industry is coming with its very first IPO. This will be the first-ever IPO of such an industry marking its presence in the stock market.

This is one of the reasons that the IPO has managed to create enough buzz around it. But the bigger question is should you invest in Nazara Technologies IPO?

Opening on the 17th of March, the IPO will close on the 19th of March. The company aims to raise Rs. 582. 91 crores, with 5,294,392 equity shares.

The Nazara Technologies IPO price band is Rs.1100- Rs.1101 per equity share, with a face value of Rs. 4.

The market lot size of the IPO is 13 shares. An investor can apply for upto 13 lots, summing it up to 169 shares.

Ready to be listed in the BSE and NSE, Nazara Technologies IPO is all set to enter the market.

Nazara Technologies Company Details

The growth of the gaming industry has always been on an upward surge, and Nazara Technologies Limited is a prominent name in that. But even after being such a showstopper Should you invest in Nazara Technologies IPO?

Established in 1999, the company is one of the leading sports media and gaming app company in the country.

It does not have its presence only in India but has also managed to grab a name in the global markets of Africa, Latin America, and many more.

Rakesh Jhunjunwala backs up Nazara Technologies Limited. It offers a wide range of products around the concept of interactive gaming.

Not only this, but it is also one of the leading on-demand and live streaming eSports media content providers in the country. This quality of Nazara Technologies Limited definitely takes them up by a notch.

World cricket championship, bakbuck, carrom clash are some of the games that it offers. They also provide some kids-centric games like Chhota Bheem Surfer, Chhota Bheem Jungle Run, and many others.

Joining the diversified range of products that the company has to offer, gamified early learning (Kiddopedia) is another hit product.

In eSports, they have Nodwin and SportsKeeda. With its wide range of products, Nazara Technologies IPO is worth the buzz.

Nazara Technologies IPO Objectives

One of the very first gaming companies to come up with their IPO, the objectives behind the Nazara Technologies IPO are as follows.

- They want to achieve the primary motives of listing their equity shares in the stock exchanges.

- They want an enhancement of their company brand name.

- They want to provide liquidity to the current shareholders by carrying out a sale of 5,294,392 Equity Shares.

Nazara Technologies IPO Promoters

Giving out their constant support and back to Nazara Technologies Limited, the promoters of the company are as follows.

- Vikash Mittersain

- Nitish Mittersain

- Mitter Infotech LLP

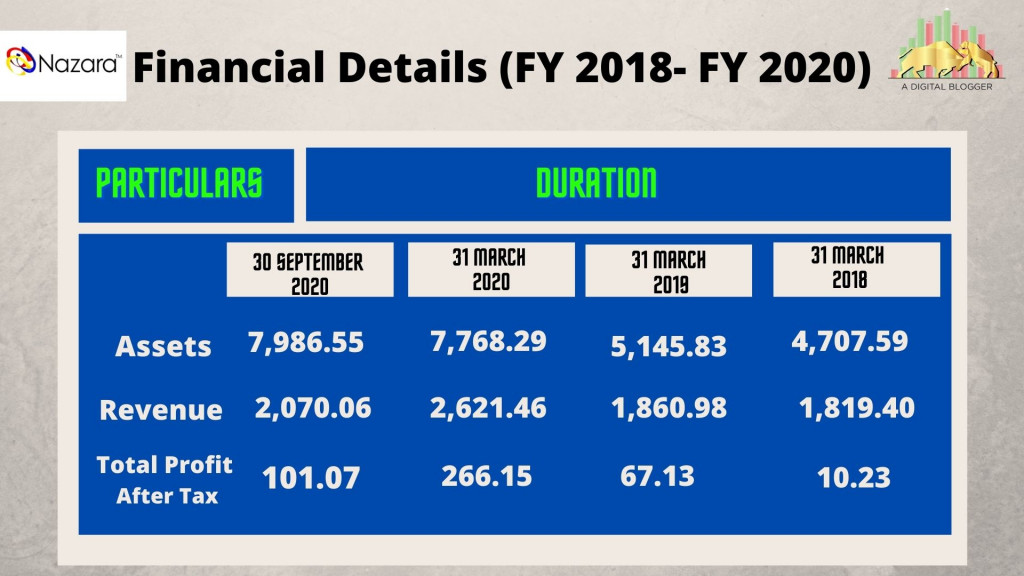

Financial Track of the Company

The financial growth of the company plays a vital role in determining Should you invest in Nazara Technologies IPO.

The financial details of Nazara Technologies Limited are as follows:

Competitive Strengths

Nazara Technologies has some prominent benefits that you can keep in if you are thinking should you invest in Nazara Technologies IPO. It is one of the leading gaming and eSports company in the country.

- It is one of the leading gaming and eSports company in the country.

- It has a diversified range of products.

- It has a geographical presence with its products reaching the global markets of Africa, Middle East Asia, Latin America, and others.

- It has strong leadership and also has the back of some prominent investors like Rakesh Jhunjunwala.

- It has a great business model.

Risks Involved with Nazara Technologies IPO

Just like the competitive strengths, there are some risks involved with the Nazara Technologies IPO as well. Let us now have a look at all the risks.

- It is the first IPO of the company, so there is a lack of prior experience.

- The financial growth of the company has also been fluctuating in the past, creating confusion amongst the investors.

Final Verdict

Ultimately the whole discussion comes to a single question, should you invest in Nazara Technologies IPO?

It is the first gaming and sports platform to come up with its IPO. It has created hype ever since its announcement because it is backed up by Rakesh Jhunjunwala.

Its diversified and globally widespread reach makes it an interesting IPO to invest. However, the declining financial progress can take a toll on the investor’s mind.

We suggest you go through all the pros and cons of the IPO before making any investment.

Want to invest in this IPO? Refer to the form below

Know more on Upcoming IPO Date 2021

Upcoming IPO 2021 Date IPO 2021 Opening Date Closing Date Rolex Rings IPO Date 28 July 2021 30 July 2021 Paytm IPO Date [●] [●] Suryoday Small Finance Bank IPO Date 17 March 2021 19 March 2021 Kalyan Jewellers IPO Date 16 March 2021 18 March 2021 Laxmi Organics Industries IPO Date 15 March 2021 17 March 2021 Craftsmen Automation IPO Date 15 March 2021 17 March 2021 Anupam Rasayan IPO Date 12 March 2021 16 March 2021 Easy Trip Planners IPO Date 08 March 2021 10 March 2021 MTAR Technologies IPO Date 03 March 2021 05 March 2021