Stoxkart Futures Margin

Margin

Are you having an account with Stoxkart and want to trade in derivatives segment, then it is essential to gain a proper understanding of Stoxkart Futures Margin.

Futures trading allows you to trade in derivatives at a predetermined date and price in the future. It is little complex but gives an opportunity to make profit even when the market downfall.

But here you have to trade in lots that means you need high initial investment. For this, you can reap the leverage of margin trading. In this article, we will discuss about the Stoxkart Future Margin and the concept behind the margin funding.

Before moving ahead, here is a quick review of the Stoxkart Broker.

Stoxkart, a discount broker, is a part of SMC Global Limited and widely known for its highest amount of Margin that has ever been given by a discount broker in the Indian Financial service sector?

Established in 2019, presently, Stoxkart has around 1,24,000 active customers buying and selling stocks, shares, bonds, or other securities through their trading platforms.

Since the broker is listed in the major stock exchanges of India like NSE, BSE, MCX it allow you to trade in equity, commodity, currency and derivatives segments.

Now, let’s discuss about the Stoxkart Future Margin.

Stoxkart Future Trading Margin

As it is already discussed that margin is the money that you can borrow from your broker to trade more with a limited fund.

Here futures margin is the money that trader must deposit or keep in hand to open their futures position. It is generally a smaller value of the contract i.e. around 3-12% per contract. This is called initial margin.

Once the trader takes the position in the futures contract, the initial margin money gets blocked and is not released until the position is squared off.

The initial margin is defined as a sum of span and exposure margin. Thus, you can calculate the margin amount as follow:

Initial Margin= Span Margin + Exposure Margin

You can calculate the span margin and exposure margin, you can use the Stoxkart Margin Calculator. This helps you in knowing the right value of margin you have to maintain to execute trade in the futures contract.

In general, the stock future demands more initial margin than index futures. This is because stocks are more volatile than indices.

Other than the initial margin there is the marking to market margin (MTM margin). In this, the profit or loss for each session is maintained in the trader’s account at the end of each trading session.

This amount is decided on the basis of Daily Settlement Price (DSP).

For example, if you have a long position rise in DSP led to profit and vice versa. On the other hand, holding a short position, the fall in DSP leads to profit.

Now if you earned a profit at the end of session then the amount is credited to your account and if you faces the loss then the account debits from the account.

Thus, by holding the initial margin money in the account, the exchange assures that none of the counterparties involve in trade does not back-off and execute the contract successfully.

Stoxkart Futures Margin list helps you in understanding the different segments in which you will be getting a margin from this broker.

Either you buy stocks, shares, bonds, or other securities in different asset classes like equity, commodity, F&O, currency, etc. you can refer to the underneath table-

| Stoxkart Future Margin List | |

| Trading and Investment Segment | Stoxkart Future Margin |

| Equity Future | Up to 2 times |

| Currency Future | Up to 2 times |

| Commodity Future | Up to 2 times |

Hence it is clear the Stoxkart Future Margin in three different segments- equity, currency, and commodity is up to 2 times the amount available in your trading account.

Let’s clear it with the help of an example- Suppose Gagan has Rs. 1, 50,000 in his Trading account, and he wishes to invest in Infosys stocks with a price of Rs. 2,50,000 at the fixed date in the future.

Then, he can opt for Stoxkart Future Margin in which he can double of Rs. 1, 50,000 i.e., 1, 50,000 x 2 = Rs. 3,00,000.

Hence, he will be receiving Rs. 30,000, and he can also lower this amount as he only needs Rs. 2,50,000.

Apart from this, if you opt for another kind of Order Types such as Bracket Order or Cover Order, then The Stoxkart Future Margin for Equity, currency, and commodity segment is 7x, 4x, and 6x respectively.

| Stoxkart Future Margin for Different Orders | ||

| Trading and investment segment | Stoxkart Order Type | Stoxkart Future Margin |

| Equity Future | Bracket Order(BO) and Cover Order(CO) | Up to 7 times |

| Currency Future | Bracket Order(BO) and Cover Order(CO) | Up to 4 times |

| Commodity Future | Bracket Order(BO) and Cover Order(CO) | Up to 6 times |

Do you know that equity delivery trades are free on Stoxkart, and you have only required to pay flat Rs. 15 brokerage for Intraday traders only if you make a profit out of the deal?

Furthermore, you can get up to 25x exposure with Bracket Order or Cover Order in Equity Intraday.

If you wish to get more detail, you can also refer to Stoxkart Equity Margin.

Now, do you know that before starting your investment deal, you can determine the Stoxkart Future margin that you can avail? Let’s understand how!

Stoxkart Future Margin Calculator

Stoxkart Future Margin Calculator is definitely one of the best features of Stoxkart.

As the name says, you can evaluate the amount of margin that Stoxkart can provide you based on your trading account balance and the chosen segment.

This information can be viewed on their official website under the “Pricing” page. The view of the page seems to be like this on the laptop-

Additionally, you can view this information on your mobile or on your desktop too.

Here, choose the category along with Exchange- NSE, BSE, or MCX (in certain segments, it is prefixed) and select the product – futures or options.

Now, in the Segment section, scroll down or search for the desired scrip. Then, enter the total number of the scrip you wish to make an investment in the “Net Quantity” section in which a lot size can be 5000.

Choose the “Buy” or “Sell” button as per your preference.

Finally, click on the “Add” button, and on your right side, you can view the total Stoxkart Future margin offered to you.

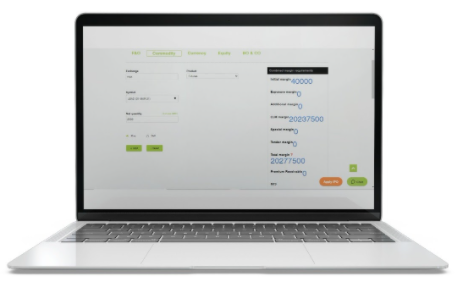

Just like the below picture, the details will be shared right in front of your screen.

Here, as you can see, I have selected the Lead scrip dates 31 March 2021 under the commodity futures segment.

The Stoxkart commodity margin is 2 times under normal trade and 6x when placing BO or CO order in the futures segment, which is quite great.

Further, I have chosen the quantity as 20009 (you can select more or less) in the “Net Quantity” button, and after filling in all the details, I have clicked on the Add button box.

Within a few clicks, the Stoxkart Future margin will be displayed.

Closing Thoughts

Stoxkart Future margin is generally for the traders and investors keen to avail extra amount as bargain money from this discount broker.

Presently, this broker has around 1,24,000 active customers that are buying and selling stocks, shares, mutual funds, bonds, etc., from their trading platforms.

Stoxkart Future margin in equity, commodity, and currency is up to 2 times of the total amount available in the trading account. Also, different Stoxkart future margin is applicable on Bracket and Cover Order.

In addition to this, Stoxkart future margin calculator helps the trader and investors to have information regarding the margin available or given by Stoxkart on the desired scrip.

Apart from Stoxkart future margin, you can easily avail margin for delivery trading in Equity Intraday.

Frequently Asked Questions

People who are keen to avail Stoxkart Future Margin majorly have some common questions related to the same, and through this section, we tend to solve them in a better way.

Some of the frequently asked questions in Stoxkart Future Margin are shared underneath-

1. Can I avail Margin in the future segments?

Yes, Stoxkart future margin is provided to its registered customers willing to have it.

2. How much margin is given on equity futures to the customers?

Equity future investors can obtain up to two times the margin on the total amount available in their trading account.

3. If I opt for Cover Order or Bracket Order, can I still get Stoxkart Future margin?

Absolutely, yes! Either you choose Bracker Order (BO) or Cover order (CO), you can quickly get the instant margin.

4. Can I know how much margin amount will I get even before buying the stock?

Stoxkart future margin calculator helps you pre-determine the margin amount that you can get against your desired scrip.

5. How much is the Stoxkart future margin in the currency segment?

In the currency segment, you get up to 2 x margin based on the amount available in your trading account.

6. How much margin is given on Bracket order and Cover order in Currency, equity, and commodity?

Under the Bracket Order and Cover order, the Stoxkart future margin offers you up to 4x in the currency, 7 x in the equity, and 6 x in the commodity segment.

Wish to open a Demat Account? Please refer to the form below

Know more about Stoxkart