Cover Order

More on Intraday Trading

Receiving a considerable amount of loss in the stock market is hardly impossible since such complex markets are full of risks. However, what if we tell you that you can limit your losses with the help of a cover order! Sounds relaxing, right?

But, if you don’t have an understanding of the stock market along with this kind of order then it’s hard to make profits in the trading positions.

Well if you are thinking that why should you learn such order? Then, it’s simple. To maximize your earnings and to cut your losses in Intraday Trading.

So, let’s get started and begin with the meaning of cover order!

Cover Order Meaning

The stock market offers you various segments in which you can trade to earn a good profit. But when trading in any segment, for instance, equity intraday, futures, etc, you have to pay a certain margin amount.

Now, this margin amount is generally imposed to cover the losses that may happen during the trade.

But do you know that you can get a chance to pay a lower margin?

It is possible through cover order.

Cover order is the type of order that offers an opportunity to the trader and broker to reduce trading risk and at the same time giving the trader an opportunity to reap high leverage.

In the share market, the cover order is the market order that is placed along with the stop-loss order.

Here the market order is the order that is placed at the current value, while the stop-loss order is the order type that allows you to minimize the losses if the market condition reverse.

Now since cover order makes use of stop-loss, so here there are least chances to suffer losses.

To understand this, let’s suppose you place a cover order to buy 1000 shares of Infosys available at ₹1250 each.

Now, since it is a cover order, so here you enter the stop loss at ₹1230. Thus, you can face the loss of a maximum of ₹20 per share or overall ₹20,000.

Since here, the loss is being calculated in advance so the margin requirement can be reduced substantially.

To understand it further let’s first understand its types followed by examples.

Types of Cover Order

Depending upon the position, cover order is generally of two types, long cover order, and short cover order. Both types of trading are executed with an objective to earn maximum profit and minimizing losses.

But what’s the basic difference between the two is being discussed one by one below.

Long Cover Order

Before explaining the concept of long cover order, let’s proceed with its example.

Let’s assume that Mr. X desires to buy the stocks of SAIL (Steel Authority of India Limited) and puts in a Long Cover order at the stocks costing Rs. 200 per share, and at the same time putting a stop loss at ₹190.

Hence, in the case of long cover orders, a trader majority sets the SL order value less than the value of the purchase of stock or share.

“ Long Cover Order = stop-loss lesser than stock price”

Now, let’s understand the meaning of Long cover order.

Thus long cover order is placing a market order along with stop loss at the price below the buying price. In this, the trader buys the stock which shows a bullish trend.

Short Cover Order

Short cover order is completely opposite of long cover order but before understanding its term, let’s have a look at its example!

Let’s say for instance that Mr. Y desires to sell the stocks of a firm named SAIL or Steel Authority of India at Rs. 250 per share cost and while trading he puts a short position by placing a stop-loss order at Rs. 260 per share.

Now, when the price of the underlying asset reaches Rs. 260 the trade will be automatically squared off.

Hence, in the case of short cover order, the stop-loss order value is usually higher than the current value of the stock.

“Short Cover Order = Stop Loss higher than stock price”

While trading, when a trader or an investor places a sell order of an organization, it is supposed to be a short cover order.

By going short, just like Mr. Y, the investor aims to sell the underlying asset or security at a bit higher price which he has purchased at a quite lower value.

Cover Order Example

To understand the concept, let’s take one example.

Let’s suppose, Mr. Sharma wants to trade in the stocks of TCS. The current share price is ₹967. He wants to place a cover order to buy 1000 shares.

Along with this, he enters the stop loss at ₹960. So, here if the stock price goes down and reaches ₹950 or below then the order gets executed thus minimizing much loss in the overall trade.

How Cover Order Works?

Considering the above example, let’s understand how exactly this order works. So when you fill in all the details the order get executed activating the stop-loss order

When you click on the buy button after placing the cover order, the stop loss limit order activates. Now arises the two different situations:

1. Market Follows the Upward Trend

Here you would be able to sell the shares at a higher price and exit the market by making a good profit. So in the above example if the share price reaches ₹1000, then you can exit the trade by reaping the profit of ₹33 per share or ₹33,000 in the overall trade.

2. Market Trend Reverses

If before the square-off time, the market trend reverses and goes beyond your assumption still you would be able to minimize your losses with stop-loss. So let’s suppose the market goes down and the price of the stock goes down to ₹940, still your order gets executed at ₹950 thus preventing you from the heavy loss.

Thus, in the above trade, Mr. Sharma would be able to suffer the loss of ₹7 per share i.e. ₹7000 in the overall trade.

How to Place a Cover Order?

Once you have knowledge about this risk alleviating order then you might be interested in learning how to place such orders.

To place a cover order, you must have a demat account with a registered stockbroker, which can be Zerodha, 5Paisa, IIFL Securities, Fyers, Samco, Motilal Oswal, or any other available in the market.

In case, you do not have a demat account, then we are here to help you! Quickly enter the details in the given form below and don’t forget to add your full name and working mobile number.

Each stockbroker has different trading platforms hence, the placing process also differs. However, not at a much level. So, you can follow this method on any online trading platform.

To place a cover order, simply follow the steps given below-

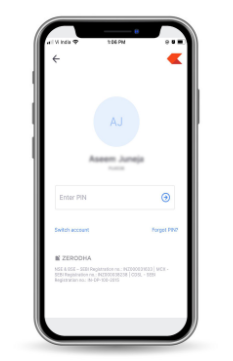

- Open your mobile application such as Stock Note, Zerodha Kite, IIFL Markets App, Stoxkart Pro Trader, Upstox Pro, MO Trader, MO Investor, etc., and enter the login credentials- user name and password. Some apps might even ask for Date of Birth or PAN number.

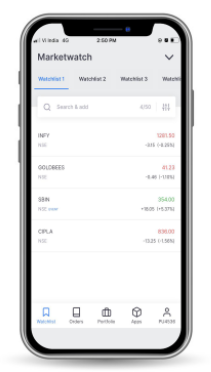

- Now, choose the scrip from the watchlist or you can also use the “search” button available in your mobile application.

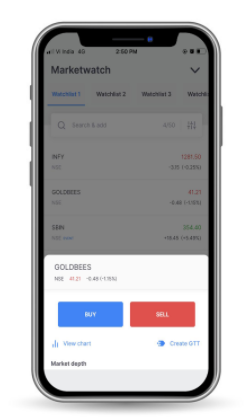

- Once you have chosen the scrip, simply click on it and select the order position- BUY or SELL depending upon whether you want to execute long or short cover order.

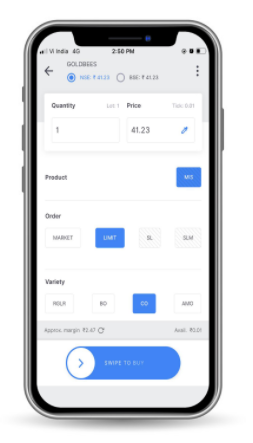

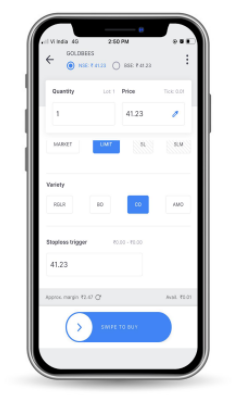

- After choosing the position, you can select the exchange (if provided), then select the MIS. Now click on order type as “CO” or “Cover Order”. Once you click on it, you will observe that except Market and Limit, all other options hide or get removed.

- Choose, either a Market order or a Limit order as per your requirement. Finally, complete the last process by entering the “stop-loss trigger order”.

- Submit the order or swipe the button to buy or sell the order. Hence, your cover order will be placed in a few steps.

Similarly, you can follow the procedure for placing cover orders on web trading platforms.

How to Calculate Stop Loss?

Till yet we talk all about cover order, and how to place it.

Now here, you have an idea of where to enter into the trade. Right?

But have you ever wondered that how to determine the right value to set the stop loss. Well! this depends upon certain methods like:

- Percentage Method

As the name goes, here you can calculate the stop loss value by evaluating the percentage of loss you can bear from any particular trade.

- Support Method

Next comes the support method, where analyzing the support level of the last few trading sessions or periods can give you a fair idea of setting the stop loss. In general, the stop loss is set a little below the support level.

- Moving Average Method

Making use of the 33 days EMA can further give you the idea of stop-loss value. The EMA of the stock crossing below the closing price of the shares generally works as a support level and hence one can set the stop loss below that price point.

Make the use of different indicators and analyze your risk potential to determine the stop loss value to make the best out of your trade.

How to cancel or modify a Cover Order?

What if you wish to change the values entered while placing a cover order? Then, you alter the same with ease. However, unfortunately, once an order is executed, you cannot modify or cancel it. You can only exit the cover order by squaring it off.

Ways to exit or modify:

As discussed, before execution you can alter both, Limit Order and the Stop Loss Order. In any case, when the Cover Order is executed, just the Stop Loss Order can be altered. You can change the Stop Loss Order if you meet the requirements of margin since the margin required fluctuates with stop-loss levels.

In case you do not want to modify the cover order, rather you wish to leave a Cover Order, then the position will initially change this order over to a buy or sell order and automatically it will be squared off at the current market cost.

To cancel or modify the existing cover order, follow the steps below-

- Find “Order Book” in your application

- Click on “View orders and traders”.

- Make the changes in the desired scrip by selecting it from the orders.

- On some applications, the “Order Book” is available on the Menu or Main menu only.

Cover Order Margin

Getting a Margin while doing Intraday Trading is an excellent way to trade smoothly and effectively.

So, when traders avail cover order margin while placing the orders, they are helped to purchase stocks or shares more than the amount they have in their trading account.

Although this “Borrowing” money varies from broker to broker, however, we have listed a few prominent brokers who provide attractive margin value to their customers.

Also, you must note that the margin interest also differs from one broker to another.

Additionally, cover order trading doesn’t need a higher margin because a stop-loss order is placed along with it, yet getting a margin is always an extra benefit.

Hence, if a higher value is placed in stop-loss then a higher margin will be required and if a lower value is used in stop-loss then a trader will look for a lower margin.

Let’s proceed ahead and look at the table below depicting the margin of some of the well-known stockbrokers prevailing in the market-

| Cover Order Margin | |

| Stockbroker | Margin |

| Zerodha | 6 to 20 times (almost double than MIS) |

| Upstox | up to 25 times in NSE or BSE cash |

| India Infoline (IIFL Securities) | Up to 20 times |

| Angel Broking | Up to 40 times |

| Stoxkart | up to 25 times |

Hence, as per the information mentioned above Angel Broking offers maximum cover order margin to its Intraday traders. Apart from these, there are several other brokers who provide margin on CO such as SAMCO, Sharekhan, Motilal Oswal, Fyers, and many more!

So, depending on your registered broker you can avail of this CO margin while doing Intraday Trading.

Now, it’s time that we must look at the advantages and disadvantages of Cover Order. So, let’s get started. Shall we?

Advantages and Disadvantages of Cover Order

Now, we have an idea about what are cover orders and we have gone through their placing process too.

Before coming to the conclusion part, let’s look at their advantages and disadvantages so that you can make a better idea about using them or not.

Also, prior familiarity with the associated risks or disadvantages helps to set foot in the right way.

Advantages of Cover Order

There are two essential advantages of Cover Order which set it apart from other Orders available in the market, such as Bracket Orders, AMO, etc.

- Higher Leverage

Almost every trader appreciates availing higher leverage on the trading position through Cover Orders as it consolidates the mechanism of Stop-Loss Order.

This system altogether lessens the risks a trader can get contrasted with regular trading order, and hence, brings higher leverage. For example, leverage on equity cash can be just about as high as multiple times the value of an agreement.

- Reduces the risk level

While placing a Cover order (CO) during the trading process, the risks or losses related to the position goes down drastically. It is a direct result of the Stop-Loss Order.

However, if there’s no stop loss then a major amount of loss might occur too. Henceforth, it permits a trader to put in a purchase or sell order according to his or her risk appetite.

Moreover, traders don’t have to continuously watch out for the fluctuations happening in the share costs reliably and limit losses.

Disadvantages of Cover Order

Although advantages weights cons, but let’s have a look at a couple of downsides of Cover Order –

- Well, unfortunately, traders can’t drop the Stop-Loss Order. However, he can modify the same before it’s squared off.

- With Cover Orders, traders can’t leave an order before it is squared off before the trading day.

- Again, unfortunately, if the price of the underlying asset didn’t hit the stop loss value, then chances of lower capital gains is possible as it will be executed automatically before the day ends, which is typically 3:20 p.m.

Let’s close the article with a brief explanation through its summary.

Closing Thoughts

Cover Orders are risk managing orders that play very well with two other orders- market order along with the stop-loss order.

Stop-loss order is compulsory in CO however, from market order and limit order one has to be chosen. These are a couple of setbacks that most traders can confront when they submit Cover orders during trading.

Typically, orders like BO and CO are picked by intraday traders since it represents the fluctuations happening in the value of the underlying asset within a day.

Hence, it helps to proceed with intraday trading by limiting or reducing the possible risks.

Before one steps in this kind of order, one must be familiar with how the stock market works and also understand various concepts related to the order of execution.

To achieve the same, one can learn through books, courses, and even virtual trading apps.

All Cover Orders are Intraday orders as a matter of course, hence these orders don’t work on a manual basis. Rather a position is automatically squared off at the timings available for different stock exchanges.

If you use cover order in NSE equity or NSE F&O, then your square off time will be around 3:15 p.m. whereas, for Currency (NSE), the market closing timing is 4:45 p.m.

If a trader uses cover order in the commodity segment under MCX exchange, then the square off is flexible; till 11:30 p.m.

Cover Orders can be put uniquely during normal market hours and can be set during the pre-market exchanges (9:00 a.m. – 9:15 a.m.) just for Equity Cash and post-market exchanges or as an AMO order from 3:40 pm – 4:00 pm for Equity Cash and F&O.

Please note that square off timing varies from broker to broker, hence you must have proper information about the same.

Wish to start trading in the Share Market? Refer to the form below

Know more about Share Market