Lower Circuit

In the share market, to keep a check on the price, there are circuit breakers, upper circuit, and lower circuit.

As the name implies, on one hand where the upper circuit limits the rise in the price of the particular share, the lower circuit limits the falling of price beyond an extent.

In this article, we will be discussing the lower circuit in detail.

Lower Circuit in Share Market

Let’s begin with the meaning of the lower circuit.

Imagine that you bought 60 eggs for a month. Now you have to use it in a way that these eggs last for 30 days.

Now, what if you start consuming at the rate of 3 eggs per day. It will be over in 20 days, leaving nothing in your hand for the next 10 days.

Therefore, you will HAVE TO set a certain limit of a maximum of 2 eggs per day to meet your monthly diet requirement.

Similarly in the stock market, the stock trading at a particular price cannot fall beyond the limit to prevent losses. This limit is called the lower circuit in the stock market.

The lower circuit share price is dependent on a lot of factors and affects the market to no small extent.

To understand its meaning we can say that, the lower circuit is the benchmark until stocks’ prices will go downwards on a particular trading day. When a stock enters this low price range, there are only sellers and no buyers thus making it difficult for traders to exit.

Now, if the share or index hits the lower circuit, the circuit breaks and the market halts for a few minutes to hours or sometimes for the whole day.

Lower Circuit Limit

In the share market, the prices of stock keep fluctuating. The sudden rise and fall in share prices in the stock market can often create havoc among investors. At this time, circuit limits work in full swing.

The inconsistently rising and falling prices of stocks often cause them to enter the upper and lower circuits. The latter in the stock market can cause a significant loss to the investor if he/she is involved in a falling market.

When a stock reaches the lower circuit, then there are no buyers and only sellers. Thus, here the lower circuit breaker is a regulatory tool to check that the price doesn’t degrade too much and the loss does not increase.

In general, the stock market regulatory body has set the pre-defined lower circuit limit for every stock in the range of 10%, 15%, and 20%.

Understanding this with an example, let us say that Richa has bought a stock for Rs. 400, and the limit set on it is 20%.

That means 20% of 400, which is equal to 80. So, if the stock is allowed to drop 20% for the day, then it means that it can drop to Rs. 320. The price will stop at this point, and there will be a halt on the trading.

The hold will ensure that investors don’t suffer too much because of panic buying or selling. Suppose there is no circuit limit, and the price drops indefinitely, both the short-term trader and long-term investor will suffer a very significant loss.

Lower Circuit NSE

The constant fluctuations in the market often result in volatility. In a way, to stop these crazy changes, NSE sets some rules for lower circuits.

So when any stock hits this price range, there are certain rules set for both market and traders to be followed.

- The lower circuit percentage depends on the volatility and popularity of the stock. This percentage can range anywhere from 10% to 20%.

- The circuit concept is not applicable for stocks trading in futures and options trading.

- An investor has to keep a keen eye on the market, and the updates of circuit limits are also available on the official website of NSE.

Now that you are familiar with the concept, let’s understand how the lower circuit works in the stock market.

The National Stock Exchange of India (NSE) and the lower circuit BSE cause many effects when the limit is breached in the stock market.

What Happens When the Stock Hits Lower Circuit?

What do you think about why the stock hits the lower circuit? What would really happen?

Think of the condition when there are only sellers i.e. traders are more toward exiting their position.

This could be due to many factors like any rumor around the company, or news alerts of bankruptcy, etc.

To explain this better, consider the case of 2020 when the Corona pandemic condition hits globally. Now many investors panic seeing the falling of index value and start selling abruptly.

This led to hitting the 10% lower circuit and hence the market halt for 45 minutes on March 13, 2020.

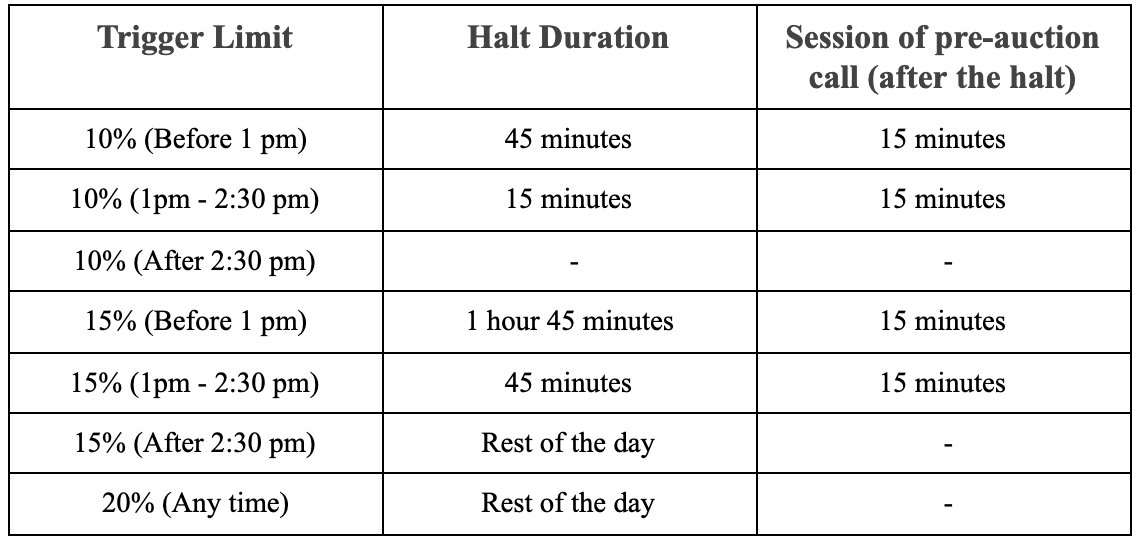

Now, why these 45 minutes? This time limit again depends on various factors like the time at which the lower circuit is triggered and the range of the circuit.

Given below is the table that defines the limit and the halt duration of the market:

What after the stock or index hits the lower circuit?

In general, the lower circuit halts time work similarly to the pre-opening session of the market. The market re-opens with the new price and the normal trading starts again.

For example, ABC stock opening price is ₹500 with a lower circuit of 10%. Now the share hits the lower circuit by falling down to ₹450 at 1 PM. The market halts for 15 minutes and reopens at the new price, let’s suppose ₹460.

This prevents the loss of traders and allows them to trade normally even when the circuit hits.

How to Exit from Lower Circuit Stock?

If you are an investor, it doesn’t matter if you are a beginner or a long-term investor, it is essential to gain a better understanding of the stock market. If you are also wondering why is it important to exit during lower circuits and how to sell at the price range?

It is advisable to break free from the lower circuit stock as prolonged exposure to it can cause a lot of loss to the investor.

The most convenient and guaranteed way of selling a lower circuit stock especially during intraday trading or short-term trades is to place an order during the pre-open session. It is after these sessions end that the orders start executing.

This is because during the circuit break the market works on the first come first serve basis i.e placing the order at the earliest might help you in selling the stock at the right time.

Thus, the pre-opening and AMO order often helps you in exiting the trade even when the market hits the lower circuit.

Conclusion

The lower circuit in trading is standard as the market fluctuates a lot. It sees sudden ups and downs at times. There are specific breakers used to keep the random fluctuations and changes in check.

It is the limit until a stock’s price will go down on a particular trading day. The type of share and its volatility determine the percentage and the halt of the market caused. Usually following the SEBI guidelines, the lower circuit limit is decided.

In the past years, there have been many crashes in the stock market because of the breaching of the limits. Even after a lot of research, if you somehow get stuck in the lower circuit, then it is recommended to exit it as soon as possible by placing the sell order in advance.

So trade smart and reap the best benefit by trading strategically.