Bajaj Finserv

Bajaj Finserv

Pros

- Superior brand value as it is a subsidiary of Bajaj Finance.

- Facilitates trading in multiple financial segments.

- Low Brokerage Charges

- Trading platforms can be accessed on multiple devices.

- Multiple brokerage plans

Cons

- Very high AMC.

- Customer Care service is not so good.

- Does not facilitate commodity trading.

Bajaj Finserv is a subsidiary arm of Bajaj Finance Limited. It is a new entrant in the stockbroker industry as a discount broker. In this article, we’ll discuss the various aspects related to this depository participant.

An in-depth discussion is necessary to have a clear picture of the services and facilities extended by the stockbroker. It enhances the customers’ satisfaction and builds trust in the organization.

Bajaj Finserv is registered with SEBI (Securities and Exchange Board of India) as a stockbroker by the name – Bajaj Financial Securities Limited.

The stockbroker has a membership of NSE (National Stock Exchange), BSE (Bombay Stock Exchange), AMFI (Association of Mutual Funds in India), NSDL (National Securities Depository Limited), and CDSL (Central Depository Services Limited).

Now, let’s discuss this new player in the Indian Stock Market in detail.

Bajaj Finserv Review

Bajaj Finserv is the latest addition to the list of Depository Participants. Since the broker is relatively new, many doubts and queries have been raised by its potential clients. So, this Bajaj Finserv Review is going to answer all such questions.

So, let’s begin!

It is a discount broker, which means that the list of services extended by them is limited. Just like every other discount broker, this broker does not provide any research reports.

Bajaj Finserv is headquartered in Pune, Maharashtra. It does not charge any inactivity charges and has a zero account balance policy. This policy translates to no minimum balance to be maintained in your Bajaj Finserv Account.

Further, the margin (leverage) facility is unavailable for all their clients except for those who subscribe to the Professional Pack of brokerage.

The brokerage plans are cheap as compared to its competitors.

Since the broker is not yet registered with MCX or NCDEX, it does not facilitate commodity trading, but it allows derivatives trading in the equity segment.

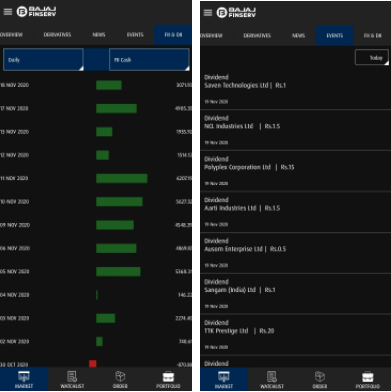

It offers online and mobile trading platforms to its clients. These platforms have been discussed in detail later.

Bajaj Finserv Trading

As Bajaj Finserv is registered with the two significant exchanges of India, it offers to trade in multiple financial segments like Equity, Mutual Funds, Corporate Deposits, Derivatives, currency, Bonds, and IPO.

Trading via these investment instruments has been made easy with the introduction of digitized portals. A trader or investor can trade anytime, anywhere with the help of these portals.

Generally, these portals are accessible on desktops, web browsers, and mobile devices. Some brokers also provide offline trading platforms. This discount broker extends the facility for mobile devices and web browsers.

Let’s discuss these platforms in detail.

Bajaj Finserv Trading Platform

Modern-day traders require the facility of trading platforms to make the most of trading or investing opportunities. Traders can access Bajaj Finserv trading platforms that are available across multiple devices.

The trading platforms are available for web and smartphones – both Android and iOS.

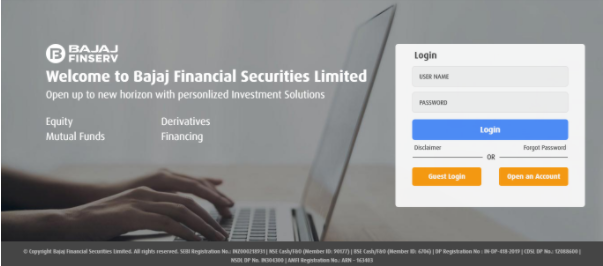

Bajaj Finserv Web

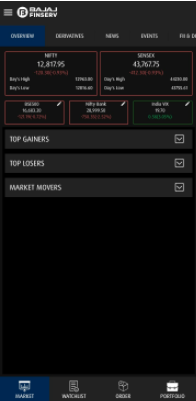

Bajaj Finserv web is a browser-based trading platform that can be accessed through the web. The trader can access the web portal at all times and trade without facing any disturbances.

You simply have to visit the Bajaj Finserv website and look for the web log in button, which will direct you to the web trading portal – trade.bajajfinservsecurities.in.

The portal offers you to log in as a guest and have a peek at the trading software. You can access the portal after entering your login credentials – Username and Password.

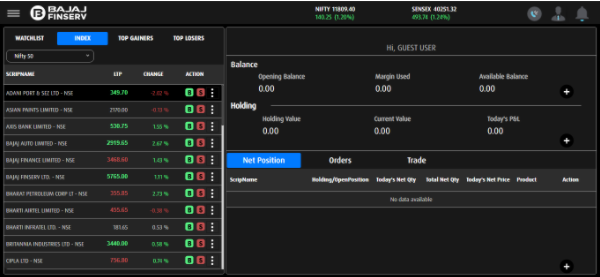

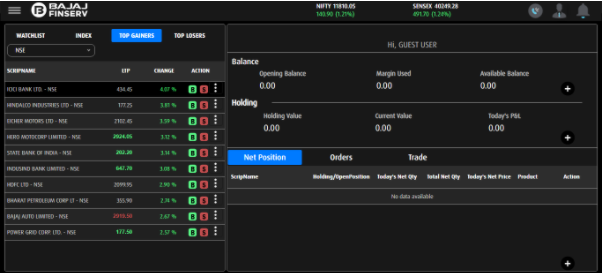

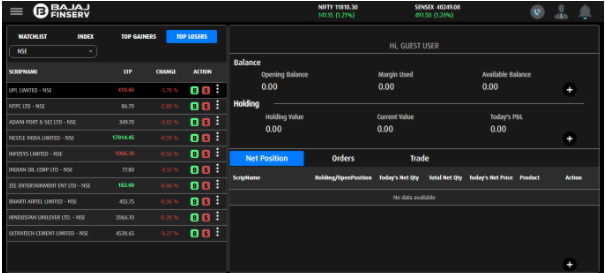

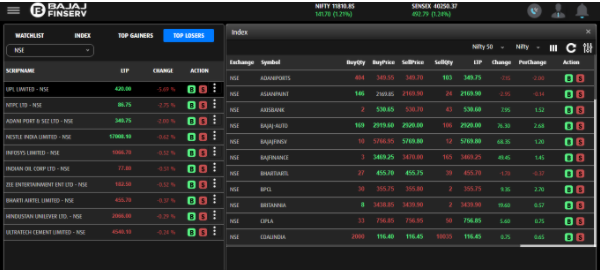

These credentials are sent during the process of registering with the broker. The platform offers you the facility to create a personalized watchlist, observe the index, top gainers, and top losers for the day in the form of a list. This list eases the observation process for the traders.

Further, you can check your balance, margin used, available balance, your holding value, current value, and today’s P&L on the home screen after logging in.

Your net position, orders, and trades are also listed with them.

Just for the sake of trying, you can access the web terminal as a Guest user too. Simply click on the “Guest Login” button and submit your email address and mobile number in the form.

Post this, click on the “Register Guest” button, after which you will receive an OTP on your registered mobile number. You can log into the web portal as a Guest user using this OTP.

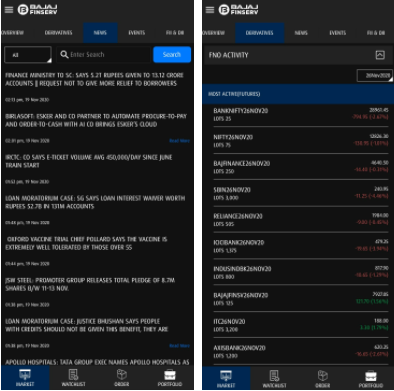

A sneak peek into the Bajaj Finserv web platform is as in the screenshots below:

Bajaj Finserv Mobile Trading App

Bajaj Finserv mobile app is the perfect solution for traders while travelling. You can place trades anywhere, anytime and thus are ensuring that you don’t miss out on any opportunity.

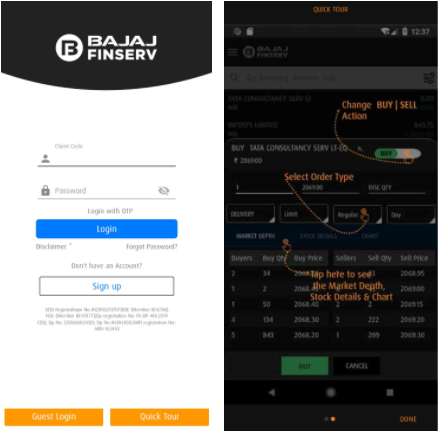

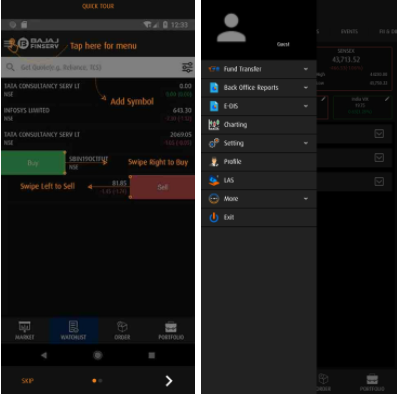

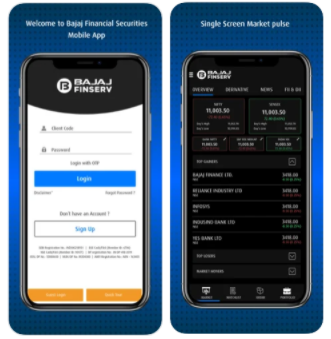

The app Bajaj Financial Securities affords traders a sense of ease in trading. The mobile app is lightweight – just 26 MB in size, easy to navigate through, and facilitates fast trading.

The Bajaj Finserv mobile app is a unique online portal that allows its users to keep an eye on market movements. It helps you in executing the desired trades swiftly so that you don’t miss any opportunities.

You can use this app to open a Demat account in under 15 minutes. The app’s simple user interface ensures that the traders get the market data, charts in the most simplified manner possible.

Traders can place trades in financial products such as derivatives, currency with just a few taps of the fingers. The app helps traders in every aspect, be it stocks for long term investment or be it Intraday trading.

Screenshots of the Bajaj Finserv mobile trading app (Android Version) are attached below:

The data from Google Playstore about the Bajaj Finserv trading app is as follows:

| Bajaj Finserv Mobile Trading App | |

| Number of Installs | 50K+ |

| Number of Reviews | 188 |

| Mobile App Size | 26 MB |

| Update Frequency | 3 months |

| Overall Review | 3.4 stars |

Further, you can download the Bajaj Financial Securities app for iOS from the App Store. The app is among the best trading apps in India.

The app thus ensures an easy, smooth trading experience for the trader.

Here are some of the screenshots of the Bajaj Finserv mobile trading app (iOS Version) :

Bajaj Finserv Account

Many of you might be confused about the Bajaj Finserv demat account opening process.

Don’t worry. We’ve got your back.

First, you must know that there are two types of accounts. Both of them are necessary to trade in the stock market. They are named – Demat account and Trading account. Generally, brokers offer to open a two in one account, i.e., one of them in one application.

This feature fastens the overall process and also reduces the efforts on the part of the client. Thus, the process for opening a Bajaj Finserv account is one.

Let’s discuss them in detail.

Bajaj Finserv Trading Account

Before we talk about the Bajaj Finserv trading account, you must understand the concept of a trading account.

A trading account is considered to be the primary account for traders. It is the account where you transfer funds to transact in the stock market.

Since this stockbroker offers a two in one account, which includes a Demat account in addition to a trading account, the process of opening a trading account with this broker will be discussed in the next section.

Bajaj Finserv Demat Account

Similarly, the talk of the Bajaj Finserv Demat account starts with learning about a Demat account.

Demat account refers to the process of converting your physical shares into a digital form. The exact opposite of this process is known as rematerialization. A demat account is an electronic account that stores all your financial products.

You can open a 2 in 1 account with the broker, which includes both Trading and Demat accounts. Also, there is a provision of opening a free demat account with no annual charges.

The Demat account can be opened by following this simple process –

- Log on to the official Bajaj Finserv website.

- In the top right corner, you’ll find a tab named – Open an Account.

- You’ll get redirected to the account opening form.

- The form is divided into seven stages.

- The first stage is Registration.

- Fill the mandatory details like – Name, Phone Number, PAN Number, Email ID, Date of Birth (DOB), and Annual Income.

- Check the box below the form and click on the Next button.

- Similarly, fill in the details under the next stages – Personal Details, Payment.

- The next step is to upload your documents.

- Subsequently, you’ll be asked to review the information entered.

- Go through every detail carefully as any error might lead to a lot of problems.

- Now, you have to submit the form, and your demat account will be opened.

This process takes less than 15 minutes. The most interesting point about opening a Bajaj Finserv Demat Account is that there is no charge for availing of this service.

So, you can open a Demat account with the broker without paying any charge or fee.

Bajaj Finserv Charges

Being a Discount broker, Bajaj Finserv charges less for its stockbroking services as compared to any full-service broker. The stockbroker levies minimal brokerage charges, which are reasonably fair as per industry standards.

Apart from brokerage, there are several other charges associated with the demat account. These include – transaction charges, DP charges, Demat account charges.

All the Bajaj Finserv Charges are discussed below :

Bajaj Finserv Demat Account Charges

Bajaj Finserv Demat Account charges include various fees such as Demat, Trading account opening fees, and annual maintenance charges for both accounts.

Following the pattern of other discount brokers, the discount broker offers traders the facility of opening a free demat account. The stockbroker won’t charge you for opening a Demat account.

While the Demat account can be set up with the stockbroker for free of cost, it does charge Demat annual maintenance charges.

| Bajaj Finserv Demat Account Charges | |

| Bajaj Finserv Account Opening Charges | NIL |

| Bajaj Finserv Annual Maintenance Charges | Rs 899 |

Bajaj Finserv Brokerage

One of the major aspects that traders look at while considering a stockbroker is the brokerage fees per every trading segment.

If low brokerage charges are what you’re truly after, then Bajaj Finserv is a pretty good option in that regard. The stockbroker charges 0.10% for equity intraday and futures derivatives.

The complete list of Bajaj Finserv brokerage charges for various trading segments is listed below

| Bajaj Finserv Brokerage | |

| Equity Delivery | 0.50% |

| Equity Intraday | 0.10% |

| Equity Futures | 0.10% |

| Equity Options | Rs 100 per lot |

These are the default brokerage charges. Apart from these, Bajaj Finserv offers yearly subscription plans to suit a client’s needs.

The brokerage thus to be paid varies on the yearly plan you subscribe to. The brokerage charges under these plans are tailored to meet the various needs of different types of traders.

Bajaj Finserv Annual Subscription Packs

In total, the stockbroker offers 3 annual subscription plans. Each is designed to tackle various goals of traders and likewise varies in brokerage charges for various trading segments.

1. Freedom Pack – This is the most basic yearly subscription plan offered by the stockbroker. You don’t need to pay anything for subscribing to the Freedom pack.

In addition, you won’t be charged any annual maintenance charges for the first year.

From the second year onwards, you will be required to pay AMC of Rs 365 + GST. The Freedom Pack includes Equity and Derivatives products.

| Freedom Pack Brokerage | |

| Equity Delivery | 0.10% |

| Equity Intraday | Rs 17 per order |

| Equity Futures | Rs 17 per order |

| Equity Options | Rs 17 per order |

2. Beginner Pack – The second subscription pack offered by the broker is the “Beginner Pack.” To avail of this offer, you will need to pay Rs 500 + GST.

Under this plan, you will be provided with the facility to trade in both equity and derivatives products. In addition, you will be charged Rs 899 + GST as Demat account annual maintenance charges.

| Beginner Pack Brokerage | |

| Equity Delivery | Rs 0.99 per order |

| Equity Intraday | Rs 9 per order |

| Equity Futures | Rs 9 per order |

| Equity Options | Rs 9 per order |

3. Professional Pack – The third and last annual subscription plan is the “Professional Pack.” For subscribing to this plan, you will need to pay Rs 999 + GST.

Under this plan, the traders are provided with the opportunity to trade in Equity, Derivatives financial products as well as the facility of Margin Trade Financing.

Here, you will need to pay Rs 899 as annual maintenance charges.

| Professional Pack Brokerage | |

| Equity Delivery | Rs 0.99 per order |

| Equity Intraday | Rs 0.99 per order |

| Equity Futures | Rs 5 per order |

| Equity Options | Rs 5 per order |

| MTF Interest Rate | 0.05% per day |

Bajaj Finserv Transaction Charges

Transaction charges are levied by stock exchanges for executing every order. Bajaj Finserv Transaction charges are listed below.

| Bajaj Finserv Transaction Charges | |

| Equity Delivery | NSE - 0.00325% | BSE - Based on the scrip |

| Equity Intraday | NSE - 0.00325% | BSE - Based on the scrip |

| Equity Futures | NSE - 0.0019% | BSE - Nil or 0.05% of the total trade amount |

| Equity Options | NSE - 0.0019% | BSE - Nil or 0.05% of the total trade amount |

The transaction charges levied by the stockbroker are fairly reasonable in comparison to many of the full-service stockbrokers.

Bajaj Finserv Customer Care

In case of any queries regarding the services offered by the stockbroker, you can get in touch with the support team through phone, email.

Bajaj Finserv Customer care number – +91 020-48574443

Bajaj Finserv Customer care email ID – connect@bajajfinserv.in

Bajaj Finserv Advantages

Having a Demat account with the stockbroker has many perks. Some of the Bajaj Finserv advantages are listed below

1. Open an account in minutes – Opening a Demat account with the stockbroker is an effortless process and literally can be set up in 15 minutes. All you need to do is to provide the mandatory documents during the registration process.

2. Low Brokerage – Being a discount broker, Bajaj Finserv offers low brokerage rates. The traders don’t have to pay much per every transaction. Thus they get the chance to make bigger profits.

3. Subscription Plans – Bajaj Finserv broker offers multiple annual subscription plans that further reduce the brokerage charges.

4. Variety of Financial Instruments – You can invest or trade-in multiple financial products such as equity, derivatives, and mutual funds.

5. Trusted Brand – Bajaj Finserv Securities is the stockbroking wing of the hugely trusted brand of Bajaj Finance Limited.

6. Trading Platforms – Traders are taken well care of in terms of the trading platforms to execute orders, make transactions, keep track of the market movements, analyze stocks. The stockbroker has mobile apps for both Android and iOS smartphones.

Bajaj Finserv Disadvantages

While we have discussed the benefits of having an account with the stockbroker, it is just as important to take a look at the issues associated with the broker so as to make a better choice.

Here are some of the Bajaj Finserv Disadvantages :

1. Limited Trading Options – The most glaring disadvantage of opening a Demat account with the broker is that it offers limited financial products to invest in. You can only trade in equity, derivatives, mutual funds.

2. No Research Facility – Being a discount broker, it doesn’t offer any research tips, recommendations, research reports. This can deter many newbie traders who can face difficulties in the initial phase of their trading journey.

3. Lack of Margin Facility – Bajaj Finserv doesn’t provide the margin facility to traders other than those who subscribe to the “Professional Pack.”

4. Customer Service – Since the broker has just arrived in the industry, there are some doubts over their quality in terms of customer service.

Conclusion

Bajaj Finserv is the newest stockbroker on the block. The discount broker is the subsidiary of the eminent brand Bajaj Finance Limited and is registered with the stock exchanges – NSE and BSE.

The trading platforms offered by the stockbroker score big on user-friendliness, are fairly easy to use. Their trading app – Bajaj Financial Securities, serves traders well in providing market data such as live market feed, news, etc.

There are many factors that can lure traders. For instance – a Demat account with the broker can be set up for free, and being a discount broker, Bajaj Finserv offers reasonable brokerage charges.

But, it is its annual subscription plans that truly set them apart from its competitors. There are a total of three such plans that allow traders to carry out trade across various segments.

These plans further reduce brokerage. However, the trader will have to pay the subscription amount upfront.

As they say, nothing is free from imperfections; Bajaj Finserv broker too lacks in some aspects. The biggest drawback can be found in the form of a low range of investment products.

Despite being a new name in the industry, the broker definitely deserves consideration if you’re on the lookout for one, and who knows what they might conjure up in the future.

Wish to open a Demat Account? Please refer to the form below

Know more about Bajaj Finserv