HDFC Commodity Trading Charges

Check All Brokerage Reviews

HDFC Securities, a bank-based stockbroker, is registered with MCX and NCDEX and thus allows you to trade in the commodity segment as well. So, if you want to trade across commodities in the stock market, then here is the complete detail of the HDFC commodity trading charges.

Without any delay, let’s dive into the details of the commodity brokerage charges of HDFC Securities.

HDFC Commodity Brokerage

Now as already known, one can trade commodities in the derivatives segment. Thus, either the brokerage is charged on the basis of the volume of trade or on the number of lots for futures and options respectively.

For Commodity Futures Trading, HDFC commodity trading charges are equal to 0.025% per trade. Other than this, if you opt for the square-off trade then the brokerage is reduced to 0.020% per trade. Although the minimum charges are fixed at ₹20 in both cases.

The details of the charges are tabulated below:

| HDFC Commodity Trading Charges | ||

| Commodity Futures | Brokerage | 0.025% or min ₹20 per order. (non- square off trades) |

| 0.020% or min ₹20/- per order. (Square off trades) | ||

| Commodity Transaction Tax (CTT) | 0.01% of the transaction value (Sell Transaction) | |

| Stamp Duty | 0.002% of the turnover (Buy Transaction) | |

| SEBI Turnover Tax | 0.00010% on Turnover | |

| Commodity Options | Brokerage | ₹100 per lot. |

| Commodity Transaction Tax (CTT) | 0.05% on Option Premium (Sell Side) | |

| 0.0001% on Exercise Price (Buy Side) | ||

| Stamp Duty | 0.003% of the turnover (Buy Transaction) | |

| SEBI Turnover Tax | 0.00010% on Turnover | |

| GST: 18% (Brokerage+Transaction) |

To understand the calculation of brokerage charges in an easier way, let’s consider an example.

Jatin is a trader in commodity futures in which with a standard brokerage plan, he will have to pay the brokerage of 0.020% or a minimum of ₹20 per order.

If he enters into the intraday futures contract with the order of ₹40,000, he will have to pay 0.020% of the total order, i.e. ₹8. As the minimum brokerage is ₹20, so in this case, he will have to pay this minimum brokerage for the particular order.

Considering another scenario:

If Jatin comes into the futures contract of ₹4 lakh, he will have to pay 0.020% of the total order, i.e. ₹80. So here, he will pay the same amount (₹80) as a brokerage to the broker.

HDFC Securities Brokerage Plans

After a standard brokerage plan, HDFC Securities offers the brokerage plan, Value Plan that one can activate by paying the upfront charges. For Futures and Options, the upfront fees range between ₹4000-₹60000 and the HDFC commodity trading charges reduce accordingly.

The complete detail of the HDFC commodity trading charges according to the plan is tabulated below:

| HDFC Securities F&O Value Pack | |||||

| Scheme | VPD 30 | VPD 25 | VPD 20 | VPD 15 | VPD 10 |

| Upfront Fees | ₹4000 | ₹8000 | ₹12000 | ₹30000 | ₹60000 |

| Free Equity Delivery Volume | 175 | 500 | 1000 | 3000 | 10000 |

| Effective Price Per Option Lot | ₹19 | ₹14 | ₹10 | ₹8 | ₹5 |

| Option Price Post Validity | ₹30 | ₹25 | ₹20 | ₹15 | ₹10 |

| Futures Brokerage | 0.025% | 0.020% | 0.015% | 0.010% | 0.005% |

The other taxes and fees remain the same as discussed in the standard brokerage charges above.

Let’s understand the difference in the HDFC commodity trading charges by considering the above trade example.

Suppose Jatin opts for the VPD 20 plan by paying the upfront charges of ₹12000. According to the plan, the brokerage is 0.015% to execute the intraday trading in commodity futures.

The total trade value is ₹4,00,000 thus the total brokerage is:

0.015%*400000=₹60

Thus, choosing the right plan minimizes the brokerage fees and hence in increasing your profit margin in the trade.

HDFC Securities Brokerage Calculator

HDFC commodity trading charges include brokerage, additional taxes, and fees that often make it difficult to evaluate the exact brokerage. To make it easier for you here is how to calculate brokerage in HDFC Securities.

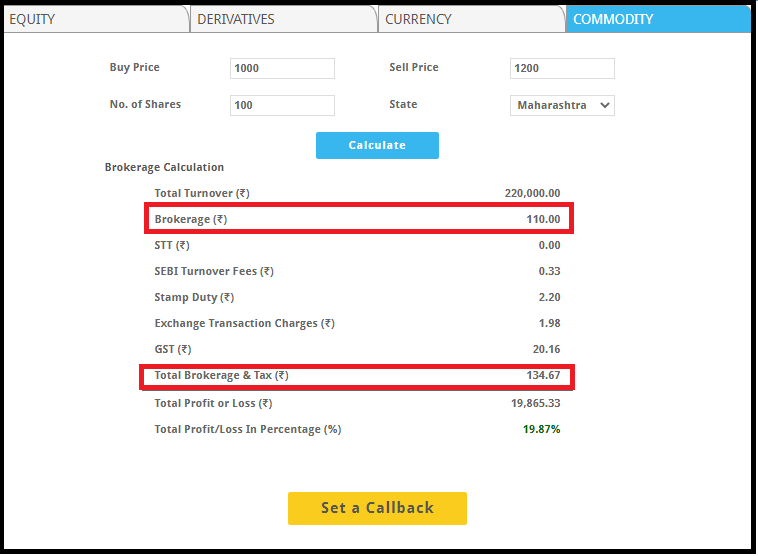

Here you just have to mention the data and the calculation will be displayed after clicking the ‘Calculate’ button as shown below.

The calculator displays the Total Turnover along with the brokerage (excluding taxes), different types of taxes that are to be paid by the investor or trader on a particular stock like STT, Sebi turnover charges, GST, and stamp duty.

Apart from these charges, the calculator shows the total brokerage including taxes that the trader has to pay.

Conclusion

The HDFC commodity trading charges depends on the type of trading opted, i.e. futures or options. Accordingly, the brokerage varies in the commodity segment.

Other than this, as discussed above, there are certain taxes and charges that need to be paid, thus the overall brokerage is different from what calculated according to the plan.

To make the calculation simpler, you can rely on the brokerage calculator shown above.

So why to wait more, check, compare and get into the trade with one of the reliable stockbrokers in India.

Want to open a Demat account, and looking for an assistance. Get in touch with us now!

More on HDFC Securities