Best Indicator For Option Trading

More on Derivatives

Volatility is back in the market, and as an option seller, you couldn’t ask anything better than this from the market environment. Over the next few minutes, we will be discussing the best indicator for option trading.

“The trend is your friend but the fade is the ultimate wealth builder.” – Tom Sosnoff.

Many times we have seen that new investors or traders tend to dig into a toolbox whenever a new widget arrives in the market or whenever they find something really mesmerizing.

They follow different trending patterns without understanding what’s actually the bit fit for them and which indicator they should actually choose.

They consider the most popular one to be the best indicator for option trading. However, that should not be the case at all!

There are such good indicators available in the stock market that can be profitable when doing option trading. But, before learning about them, let us have a look at the meaning of indicators.

Typically, indicators are a subset of technical indicators and majorly consists of formulas and ratios. It’s a quantitative tool that is used by traders and investors in the stock market to predict the future movement of an underlying asset.

Indicators show the current top gains and losses in stocks as well as in indices so that one can forecast the market movements.

Now, let us discuss a few technical indicators for option trading, but wait! How can we miss the information about option trading?

So, what do you understand by option trading?

Option Trading is a broader term used in the investment sector, just like equity, commodity, currency, etc.

However, it’s different from other segments since it’s a kind of contract that gives a right but not an obligation to the buyer and seller to execute the trading deal within the timeframe or validity of the contract and at a fixed price.

In technical terms, the fixed price of the option contract is known as strike price and each contract has a separate strike price along with a different expiry date.

Now, further options are of two types, call option and put option.

An investor who bets on the bullish market and predicts that the market will go upside will buy or exercise a call option.

On the contrary, the investor who favors the bearish condition and assumes that after a while, the price of the underlying asset will fall down chooses the put option thus gaining a right to sell it at the strike price.

Choosing the best indicator can help you to an extent to reduce the option trading risk.

Now, it’s time that we must begin with a list of some of the best Technical indicators used for option trading.

Best Indicators for Option Trading in India

There are several technical indicators available in the market that can help you in analyzing a stock carefully. To begin with the same, let’s have a quick look at the meaning of ‘technical indicators.’

As the name recommends, Technical Indicators are used to demonstrate patterns and possible defining moments in the value of stocks.

These are the devices utilized by Technical Analysts to predict market movements and used to foresee when is the ideal opportunity to purchase or sell a stock, security, or any other asset.

Technical indicators are calculated on a specific stock or asset’s previous and current price pattern so that the future price can be predicted.

Important data such as opening value, end value, highs, lows, along with the volume, are utilized to make several technical indicators out there in the financial market.

The ratios and data generally take the stock’s value information from the last couple of days (for instance the most recent 30 days).

They utilize that information to make a pattern or diagram to demonstrate what has been occurring to the stock and ideally foresee what may happen later on in the coming future.

Lagging and Leading Indicators

To learn and know option trading indicators, one must understand the key indicators that are used to predict and analyze the stock and market fluctuation.

To be a rookie trader, you need to understand the basic technical indicators that can help in foreseeing the market and will provide the opportunities that will pop-up while doing your research.

So, here we go!

There are two principal kinds of indicators in the market, namely Leading Indicators and Lagging Indicators.

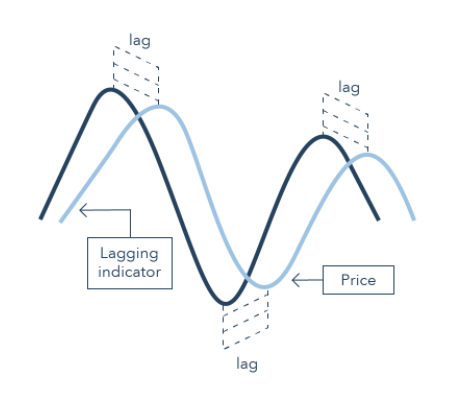

Lagging Indicators

- Lagging Indicators will be pointers that follow the stock’s price pattern; henceforth the name “Slacking or lagging” is highly appropriate.

- Since they depend on past information, they are acceptable in indicating whether a pattern is developing or whether a stock is in a trading range. For instance, these indicators can show that a stock has built up an extremely solid downtrend and is in this way prone to keep falling.

- Basically, lagging indicators inform you – Hey Bud! The match will start, and it’s expected the toss will be won by your team, so get ready with your bat.

- Lagging indicators offer information before the new trend or a reversal pattern is formed in the stock price.

- Some of the examples of Lagging Indicators are moving markers, for example, the Moving Average, MACD, and ADX pointers, and many more!

Leading Indicators

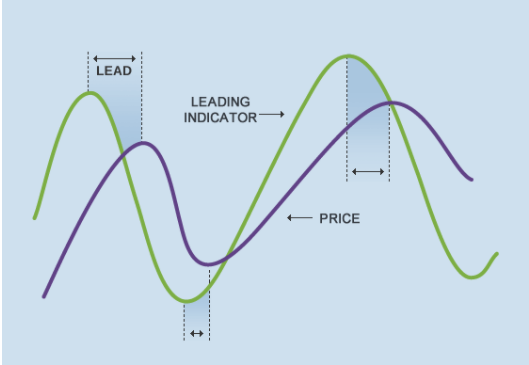

On the other hand, as the name infers, Leading Indicators are better at foreseeing possible future value rallies and crashes. Most Leading Indicators are Momentum Indicators, measuring the momentum of a stock price’s developments.

- Leading indicators prompt a signal when the trend has begun. Basically, it informs you – Hey Bud! The match has been started and you are missing on the field.

- Let’s understand it with a better example for a football match. A football has been thrown up in the air and highly noticeable all around. The presence of mind specifies that the football can’t forever continue to go higher.

- Although we probably won’t realize how high it will go, yet we do realize that once its upward speed begins to back off, it will soon quit going up and begin tumbling down once more. That is the fundamental of momentum indicators.

- Leading Indicators help in revealing to us whether a stock’s cost has gone excessively high up or too far down and whether there is a stoppage in price movement or not.

- On the off chance that the stock’s cost has gone excessively high up, we state that the stock is currently ‘overbought’ and in the event that the price has gone excessively far down, we state it is ‘oversold.’ In one or the other case, the main indicators will show that the stock won’t remain overbought or oversold for long.

- Some of the examples of Leading Indicators include the RSI, which is also known as the Relative Strength Index, Stochastics, Williams %R, and momentum indicators.

Now, let’s talk about some of the best technical indicators for option trading.

In general, there are several technical indicators in the market that an investor or a trader can choose depending on his trading strategy and the type of investment class in which he is trading.

The six Best Indicator for option trading are listed below-

- RSI or Relative Strength Index

- Bollinger Bands

- Intraday Momentum Index (IMI)

- Money Flow Index (MFI)

- Put-Call Ratio (PCR) Indicator

- Option Interest (OI)

We know that understanding each of these may seem like an eternity, but trust us, you won’t regret it! So, let us give each of them a quick shot one by one.

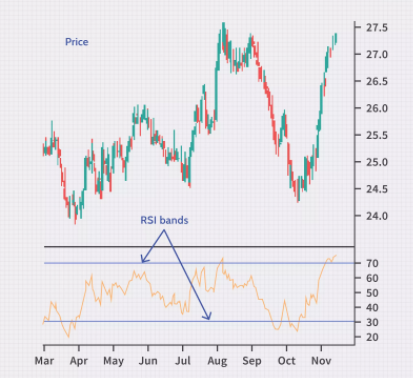

RSI

RSI or Relative Strength Index indicator is one of the best indicators for option trading as well as one of the best indicators for positional trading which is used mostly by momentum traders.

- Basically, it compares the intensity of recent gains to recent losses over a particular period of time prevailing in the stock market.

- This is generally done to calculate the speed of the underlying asset and change in the price patterns or movements to know whether they are oversold or going through the overbought condition.

- The value of the Relative Strength Index (RSI) ranges between 0 to 100. If the RSI value of a stock or any underlying asset is below 30, then this indicates the oversold levels. However, if the value is more than 70 then it is considered as an overbought level.

- Value 70 > indicates an overbought level

- Value30 < indicates an oversold level

- RSI is the best indicator for option trading and best suited for individual stocks to predict the stock level frequently.

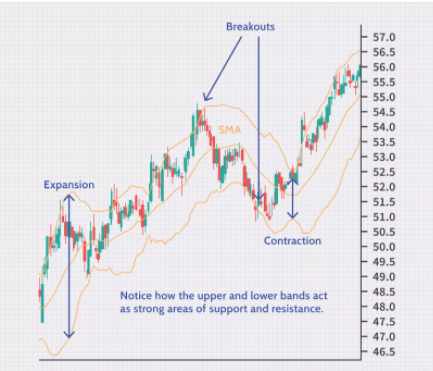

Bollinger Bands

Not all option traders know the significance of the volatility and a few of the chunk who knows preferably use Bollinger Bands to calculate the volatility of a stock. Here are some of the top features of the indicator:

- The major feature of this best indicator for option trading is that it enlarges as volatility in the underlying asset increases and tense up when the volatility falls.

- It is believed that the closer the price moves to touch the upper band, the more chances of that security to be presently overbought.

- On the contrary, if the underlying asset’s or security prices move towards the lower band, then most of the investors view it under the oversold level.

- On certain occasions, if the price has moved outside the bands’ area, then it’s a signal for the option traders or investors that the security is completely ready for reversal, and they can position themselves according to the scenario.

- Also, it is vital to note that it’s a wiser decision to sell options when the market volatility is high as the value of the stock will be also higher in such cases.

- If you wish to buy options, then choose the periods of low volatility when the options are sold at a cheaper rate.

Intraday Momentum Index

The Intraday Momentum Index or IMI is the best indicator for option trading. Here are some of the key characteristics of the indicator.

- It is known to be highly popular among the option traders who place intraday positions.

- This technical indicator includes the Relative Strength Index or RSI and Intraday candlesticks – both together. Hence offering an appropriate range for intraday traders by showing oversold and overbought levels.

- By using Intraday Momentum Index, an option trader can spot effective bullish deals without a hitch to buy or sell in an up-trending market.

- Quite the reverse, while at intraday price bumps, they can kick off a bearish trade at the stock market moving in a down-trending flow.

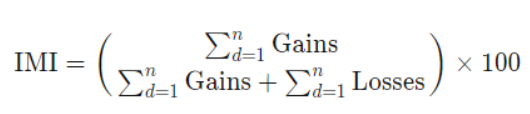

- Calculating the IMI is pretty manageable. The formula used to measure IMI is dividing the sum of up or gain days by the sum of up days or gains and adding it to the sum of losses or down days and further multiplying by 100. It can also be written as-

Here,

Gains= Closing Price−Opening Price, on Up Days – i.e. Close > Open

Losses=Opening Price−Closing Price, on Down Days – i.e. Open < Close

d=Days

n=Number of days

- Although the trader can choose the total number of days to look at, however, generally, the most common time frame is upto 14 days.

- If the outcome is more than 70, then the stocks are known to be overbought. On the opposite, if the total IMI value is less than 30, then the underlying asset or security is considered as “oversold.”

- Perhaps, the value between 70 and 30 is known to normal stock in the market.

- Hence, by understanding these values, an option trader can wisely invest in the stock market and hold positions accurately.

MFI

Now, let us have a look at the other best indicator for option trading known as MFI or Money Flow Index. Some of the key highlights of this technical indicator are listed below-

- It is an important momentum indicator that includes both stock cost and volume information and after combining them, share the accurate information for the option trader.

- This concept is also known as Volume Weighted RSI and is an indicator of “exchanging pressure.”

- The MFI or Market Flow Index is a technical indicator that quantifies the inflow and outflow of cash into an underlying asset throughout a particular timeframe. Typically, this time frame is of 14 days.

- The formula to calculate the Money Flow Index is given as below:

MFI or Money Flow Index = 100-100 / 1 + Money Cash Flow

- Here, Money Flow Ratio is the 14 period positive (+) money flow divided by 14 period negative (-) money flow.

- If the outcome of the above-said formula comes more than 80 then this clearly demonstrates that a security is overbought, while a perusing under 20 shows that the security is oversold.

- Further, if the underlying security or asset’s value is between 80 to 20, then it is normally bought and sold in the market.

- Because of dependency on the volume information, Money Flow Index is more qualified for stock-based option trading (rather than index-based) and longer-length exchanges.

- While trading, at the point when the MFI moves the other way as the stock value, this can be the main pointer of a pattern change.

Now, let’s commence with the next technical indicator that can be helpful while trading in options segment.

Put-Call Ratio Indicator

Put Call Ratio Indicator also known as PCR estimates trade volume utilizing put options i.e bearish versus call options i.e. bullish. Rather than the total estimation of the put-call ratio, the adjustments in its value show an adjustment in the general market assessment.

A score of .7 obtained in the average put-call ratio is known to be a fine basis for assessing sentiment.

- When there are a larger number of puts than calls, the proportion is over 1, demonstrating bearishness. At the point when call volume is higher than put volume, the proportion is under 1, signifying bullishness.

To Sum Up

In addition to the aforementioned technical indicators, there are a plethora of different indicators in the option trading that can be utilized for better and wise trading such as cumulative tick, Stochastics, average true range, stochastic oscillators, and many more!

On top of those, varieties of other technical indicators exist in the stock market with smoothing procedures and a blend of different ranges to predict and analyze the stock.

Along with these indicators, there is option chain analysis. For this you need to download the app that provides the advanced option chain features. In all finding, the right app for option trading helps you in making your trading journey smooth and profitable.

Wish to start trading? For that, you need to have a demat account. Refer to the form below