How Option Trading Works?

Option trading, a trending term among traders like you these days, Right? Most of you might be trading but answer honestly how many of you know how option trading works.

Most of the traders might not!

Do you know why?

Because, traders enter the market thinking it to be a simple process of buying and selling calls and puts.

It is, but it comes with certain rules. So, let’s get into the details of how option trading works in India and know how to manage option trading risk.

How Option Trading Works in India?

Before answering How let’s understand option trading basics!

Options trading is a contract between a buyer and seller. So, unlike the equity segment where actual buying and selling of shares happen between two parties, in options, only a contract is exchanged which gives a buyer a right but not obligation to trade an underlying asset (stocks, commodity, index) on expiry.

Confused?

Let’s make it simpler.

You all might be aware of the insurance. Let’s say you bought a car and along with this bought a car insurance of ₹2,00,000 by paying ₹10,000 premium to the insurance company, valid for one year.

What does that mean?

If there is any issue or damage in the car then you can claim up to ₹2,00,000 from the insurance company.

However, if no such thing happens (which you wish for), then you will not get ₹10,000 back from the company.

This means, to cover the higher loss, you took the risk of losing a small amount of ₹10,000.

This is how the option works.

If you buy options, you pay a premium to the seller. In turn, the seller gives you the right but not the obligation to trade the underlying asset on the expiry day. This means that if the market goes in your favour, then you will make profit otherwise the loss of premium amount.

Before moving ahead, let’s discuss some of the terms related to options trading.

- Underlying Asset: A financial asset like stock, index or commodity on which derivative contract is based on.

- Spot Price: The market value of the underlying price.

- Strike Price: The price at which buyer/seller buy/sell the option contract.

- Premium: Amount paid by the buyer to seller to get the right but not obligation to trade. This is also the maximum loss of buyer and maximum profit of the option seller in options trading.

- Expiry: The date on which the option contract is settled. If the buyer does not trade or settle the trade on expiry then the option value (premium) becomes zero.

Let’s now understand the types of options and how they are traded in the market.

How Call and Put Option Works?

As already discussed, options are contracts that work like insurance in the stock market. Let’s say, you want to buy a contract. Now, consider it as a physical agreement between you and a seller in the market.

On one fine day, you are bullish on Infosys stock which was traded at ₹1500. You want to buy 500 quantities for the short term but at the same time, the company is about to release its quarterly report which might increase the stock volatility and hence the chances of losing money.

To trade at low risk, you bought 1 lot (400 shares) of Infosys option contract of strike price ₹1,450/- at ₹80 premium expiring in 15 days. This means that you earned the right that in 15 days if Infosys value goes above ₹1450 then you can buy 400 shares at ₹1,450 per share. However, if the value goes down then you can exit the trade without settlement. In this case, you would suffer a loss of premium amount of ₹80 per share.

This type of option that gives the buyer a right but not obligation to trade at the predetermined price on expiry is called Call Option.

On the contrary to this, Put Option buyers pay a premium to the seller when they are bearish towards the underlying asset. Here if the value of underlying asset falls below the strike price then they make profit otherwise a loss of premium amount.

Let’s discuss a few examples to understand the working of call and put options.

How Option Trading Works with Example?

Okay, if you are still trying to understand, let’s simplify this even further with options trading example.

We took an example of Infosys above. Continuing with the same example where the buyer bought an option of 1,450 at ₹80 expiring in 15 days.

Now, let’s there are three possible outcomes:

| Option Trading Example | |||

| Infosys Price on 15th day | Buyer P/L | Seller P/L | |

| Case 1: Infosys Share Price goes up | ₹1600 | Profit = ₹150 | Loss = ₹150 |

| Case 2: Infosys Share Price remains same | ₹1450 | Loss = ₹80 | Profit = ₹80 |

| Case 3: Infosys Share Price goes down | ₹1300 | Loss = ₹80 | Profit = ₹80 |

From the above table it is clear that the option buyer would only make profit when the underlying asset, here Infosys value goes up and profit of a buyer is equal to the seller’s loss.

Now, you must be wondering why the buyer makes a loss when the stock price remains the same?

Well! For this, imagine a situation where you bought a mobile phone for ₹20,000 and bought accessories of ₹400. In the very next moment, you want to sell it.

Now, at what price you would make be at breakeven (no profit no loss)

- At ₹20,000

- At ₹20,400

Ofcourse at ₹20,400, because you paid an additional amount of ₹400 on your purchasing value.

Similarly, in the above example, 1,450 is a purchasing value and you paid ₹80 premium (additional value) on your purchase. Thus, you would be profitable not when the stock price would be above ₹1,450 but when it would be above ₹1,530 (1450+80).

From this, it is also concluded that out of 3 possibilities, the chances of profit for a buyer is only 33.33%. Now, this is one possible reason for loss in option trading.

However, you can reduce the chances of falling in that 66.66% by analyzing your own trade performances and peer comparison with your past trade.

Now the question is, how is that possible?

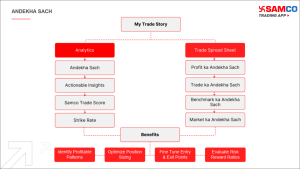

Well, in the present market where most of the brokers are talking about low brokerage, tips & recommendations, Samco comes with the trading feature ‘My Trade Story’ to stay one step ahead.

This feature involves the complete participation of the trader who can analyze and improve their trade performance by themselves by getting hidden unseen insights (Andekha Sach) from past trades.

Also, the trader can know about their success ratio from the stock market & check their trading strike rate which tells them the percent of total winning and losing trades made by them.

Other than this another reason why option traders lose money is the declining premium.

Let’s discuss this in detail now by understanding the concept of intrinsic and time value in options.

Intrinsic and Time Value of Options

How option works and expire is cleared in the above part, now coming to the segment of how premium value increases and decreases in the option trading.

To set a context, let’s repeat the definition of Premium.

Premium is the amount paid by the buyer to seller to get the right but not obligation to exercise the trade on predetermined price on expiry.

Here, the word expiry plays a vital role.

To understand, just look at your daily data in mobile. These days, most mobile companies give at least 1GB data per day. What if you don’t use the internet on a particular day. Will mobile companies provide you one extra day validity?

Of course not! In fact, there is one less day now to use data as per the plan you purchased.

Same goes with options.

Let’s go back to Infosys example again where you paid ₹80 premium to buy ₹1450 call option expiring in 15 days.

Understanding the logic behind this ₹80, which is the maximum profit of a seller. The seller knows that if the stock price goes beyond ₹1530 (₹1400+80) then he would be in loss on expiry which is 15 days ahead.

If the expiry is 10 days ahead, do you think that the seller asks for the same premium then as well, assuming other conditions to be the same as above?

No, the reason being that the day left for settlement is less than before hence the risk of losing money is lesser.

In simple terms, premium has a time value which loses its value with each passing day. This decay in premium also called time decay or theta decay favours a seller and leads to the loss of buyer. This varies according to the strike price and eventually becomes 0 on expiry day.

Now to cover the concept of intrinsic value, just think of Infosys current market price in the example, which is ₹1500. Why would a seller give the right to a buyer to buy shares at ₹1450 on expiry and that too if the stock price rises.

Wouldn’t it be a loss making translation already?

Yes, it is!

And that’s why sellers ask for the minimum premium value which is the difference between the current market price and strike price.

In the above case, the current market price is ₹1500 and strike price ₹1450. This means that in the total premium of ₹80, ₹50 (1500-1450) covers the risk of the seller in the current market.

This minimum value of the premium is called intrinsic value.

The formula for intrinsic value varies for call and put options:

- Intrinsic Value of Call Option = Market Value – Strike Price

- Intrinsic Value of Put Option = Strike Price – Market Value

Also, intrinsic value is defined as the profit made by the buyer on expiry. If the value of intrinsic value is positive, this means that option expires In the Money and the buyer is in Profit.

However, if it is negative, this means that the option expires Out of the Money and the buyer loses the premium paid.

How Index Options Work?

As discussed in the beginning, the option can be traded in stocks, index and commodities. Now, here Nifty and BankNifty are one of the most traded indexes in the derivatives market.

But, how Nifty and BankNifty work and most importantly how they are settled as they are not in the physical form and cannot be transferred to the demat account.

Index option works in the same way as stocks, however when it comes to settlement, unlike shares which are physically delivered to the demat account of buyer or seller, indexes are settled in cash.

This means, if you bought 21,000 CE of Nifty and it expires at 21,500 then ₹500 would be transferred to the trading account of the buyer.

Also, index options have weekly as well as monthly expiry, unlike stock options that are only settled on a monthly basis.

Here is the expiry of different index traded in the Indian share market.

| Expiry in Options Trading | |

| Index | Expiry (Weekly and Monthly) |

| Nifty Midcap | Monday |

| FinNifty | Tuesday |

| BankNifty | Wednesday |

| Nifty | Thursday |

| BSE’s Sensex & BankEx | Friday |

Conclusion

Option Trading is difficult to understand for the beginner and hence most of the option traders lose money.

However, there are ways to do technical analysis for options trading that helps in picking the right trend and momentum to make a profitable trade.

But to be a pro trader one needs to understand the concepts by learning through different sources, using the right platform to trade and analysing your past trades to minimise losses in the future.

Once the concept of how option trading works is clear, one can make a decent profit.

Just fill in some basic details in the form below and a callback will be arranged for you:

More on Share Market Education:

If you wish to learn more about options trading or the stock market in general, here are a few references for you: