Paytm IPO

After a successful Zomato IPO, another brand that is ready to hit the stock market with its IPO is Paytm. The name is prevailing a separate fandom in all generations and has become one of the most loved payment apps in India. So now, the brand is all ready to come up with Paytm IPO.

Before diving into the details of the Initial Public Offerings of Paytm let’s first learn a bit about the company’s background.

Paytm is one of the leading digital ecosystems in India offering online payment services, commerce, and cloud services to over 333 million consumers and 21 million merchants.

Using the technology in the right way the company comes forward with the objective of improving the lives of the consumer and merchants eventually helping them in growing the businesses.

Although the company has recorded a huge number of customers, in comparison to its customer base, it has not shown much progress when it comes to valuation.

The valuation of the company in the year 2015 was $7 billion dollars which increased only by 128% in 6 years and reached $16 billion dollars by March 2021.

Even then when considering the demand for its shares in the unlisted market, it makes it more interesting and mind-boggling as Paytm shares have been in strong demand and the share price of Paytm has increased from ₹1,000 to ₹2,500 as soon as the news of its IPO is out.

The company has shown success with reliable numbers in which more than 20 million businesses, as well as merchants, are using Paytm for accepting digital payments.

More than 300 million Indians are using Paytm to pay at the stores. Apart from this, the Paytm app is being used by the customers for paying bills, recharge, sending money, booking movies, and paying for travel tickets.

This was the growth of the firm that is getting ready to list in the share market to expand the brand. For that, let’s shed some light on the Paytm IPO details that include the date, size, price band of the IPO.

Then why wait for more? Let’s dive in!!

Paytm IPO Details

But why is the company thinking of registering into the stock market? The reason is based on its objective discussed below:

- Enhancement and growth of the ecosystem of Paytm that includes the procurement of merchants and consumers

- Offering a better approach to the technology as well as the financial services.

According to the DRHP, i.e. draft red herring prospectus, Paytm is looking to boost ₹16,600 crores with the IPO.

It is the right time to discuss more on the most renowned IPO in the market, i.e., Paytm IPO.

Therefore, to get the gist of the IPO details, let’s delve into the following table that covers the information of IPO date, size, OFS, price band, lot size, and more.

| Paytm IPO Details | |

| Issue Date | Opening Date: November 08,2021 |

| Closing Date: November 10, 2021 | |

| Issue Size | ₹18,300 crores |

| Fresh Issue | ₹8300 crores |

| Offer for Sale | ₹10,000 crores |

| IPO Price Band | ₹2080-₹2150 |

| Market Lot | Maximum Lot:15 |

| Minimum Lot: 1 | |

| Listing at | NSE, BSE |

| Percentage of Reservation for Different Investors | QIB- 75% |

| Retail Investors- 10% | |

| Non-institutional- 15% | |

| Objective of the Issue | Investing in new business initiatives, acquisitions, and strategic partnerships. |

| General Corporate Purpose |

Paytm is a company that is professionally managed, and under SEBI ICDR Regulations and the Companies Act of 2013, it does not have a recognizable promoter.

Hence, to know about the promoters of the Paytm IPO, the following table is created. Therefore, let’s check it out!!

After getting the IPO in brief, now, if you found the IPO interesting, then it is the right time to know the various dates that are concerned with the IPO.

For that, let’s dive into the following segment together!!

| Paytm Shareholders Detail | ||

| Name of the Promoter | Number of Equity Shares | % of Equity Shares Capital |

| Founder Selling Shareholder | ||

| Vijay Shekhar Sharma | 5,95,45,834 | 9.61 |

| Investor Selling Shareholders | ||

| SAIF III Mauritius Company Limited | 74,910,610 | 12.1 |

| SAIF Partners India IV Limited | 31,802,020 | 5.1 |

| Elevation Capital V Limited | 3,611,410 | 0.6 |

| Elevation Capital V FII Holdings Limited | 4,233,000 | 0.7 |

| Alibaba.com Singapore E-Commerce Private Limited | 44,282,140 | 7.2 |

| Antfin (Netherlands) Holding B.V. | 183,301,220 | 29.6 |

| SVF Panther (Cayman) Limited | 7,855,970 | 1.3 |

| BH International Holdings | 17,027,130 | 2.8 |

Paytm IPO Date

Apart from the issue date, comes many other dates like allotment date, listing date that are essential to know before you apply for the IPO.

The following table covers the different dates, including:

- The opening date of the Paytm IPO.

- The closing date of a particular IPO.

- The IPO allotment date. It means, on the same date, it will be revealed that the Paytm IPO is allotted or not.

- The date on which the refunds will be commenced.

- The specific date on which the shares of Paytm will be credited to the demat account after allotment.

- The important date of listing reveals the period on which Paytm will be listed in NSE and BSE.

Hence, it is the right time to check the following table.

| Paytm IPO Date | |

| Paytm IPO Opening Date | November 08, 2021 |

| Paytm IPO Closing Date | November 10, 2021 |

| Finalization of Allotment of Shares | November 15, 2021 |

| Initiation of Refunds | November 16, 2021 |

| Credited to Demat Account | November 17, 2021 |

| Paytm IPO Date Shares Listing Date | November 18, 2021 |

Get ready for the IPO investment, by opening a Demat account for FREE today.

Paytm IPO Price

Paytm IPO includes the Issue Price as well as the listing price and at the same time, the IPO holds the (●) equity shares of value ₹18,300 crores for the public investors.

Now, you might be thinking of the issue size. If yes, then it is important to note that the issue size consists of the following.

- The fresh Issue of the IPO is (●) equity shares that are worth Rs. 8,300

- Whereas the Offer for Sale (OFS) is (●) equity shares with the value of Rs. 10,000.

If talking about the Price Band of the IPO, then it is ₹2080- ₹2150.

Paytm IPO GMP

The premium amount on which the Paytm IPO shares are traded is discussed with the GMP of the same.

But what does GMP mean? In simpler terms, GMP refers to the Grey Market Premium that discusses the premium amount that is offered to the individual who had applied for the IPO and on which the IPO’s shares are traded.

But basically, the GMP is done prior to the shares getting listed in the share market.

Hence, the following table discusses the GMP in detail. To know more, let’s dive in!!

| Paytm IPO GMP | ||

| Date | GMP (in INR) | Kostak (in INR) |

| (●) 2021 | (●) | (●) |

| (●) 2021 | (●) | (●) |

| (●) 2021 | (●) | (●) |

| (●) 2021 | (●) | (●) |

Paytm IPO Apply

It is time to buy the IPO, and for that, it is necessary to get the steps on your fingertips. So, to know about it, let’s dive into the following steps and procedures.

The very first step is to open a Demat account with a preferred stockbroker of your choice.

After opening an account, the next step is to select the method through which you want to apply for the IPO. It includes:

- Online method

- Offline method

Now, these methods include the ASBA methods. The offline method is confusing and time-consuming if compared with the online method.

Follow the below steps to apply through ASBA methods:

- Log in to the trading platform of the stockbroker.

- Select and click on the IPO (here Paytm IPO)

- Enter the bid and lot size.

- Now, click on the submit button.

- The respective amount will get blocked in your bank account.

On the offline mode, the applicant is required to download the form, fill it and submit it along with the cheque filled.

Should You Invest in Paytm IPO?

After getting all the necessary and knowledgeable information over the IPO, the Paytm IPO is all set to move on the roller coaster ride.

But to know whether it is good to put money on any firm, let’s check the financials of Paytm in the following table.

| Paytm Company Information | |||

| Particulars | FY 2021 (in million) | FY2020 (in million) | FY2019 (in million) |

| Number of Subsidiaries | 11 | 8 | 2 |

| Equity Share capital | 605 | 604 | 575 |

| Net Worth | 65,348 | 81,052 | 57,249 |

| Total Assets | 91,513 | 103,031 | 87,668 |

| Total Income | 31,868 | 35,407 | 35,797 |

| Total Expenses | 47,830 | 61,382 | 77,439 |

| Profit After Tax | (17,010) | (29,424) | (42,309) |

From the above data, it is clear that although Paytm is a loss-making company, over the years it has shown a drastic decrease in the loss percentage by 59.79%.

Other than this, the company has not shown imperative data in terms of assets and income

On one hand, where the company recorded less income in the year 2021 as compared to FY 2020 the assets reduced from +786 to -739.

It is therefore important for every keen investor to do a proper analysis of the company before investing.

To make it easier for you, let’s now have a look at the Strength and risks associated with the Paytm IPO investment.

Strengths of Paytm IPO

Before applying to the IPO, there would be a thing you might be looking for, and that is the strengths of the IPO that defines its worth.

Just to ease down human nature, let’s now shed some light on the Paytm IPO strengths.

For that, let’s consider the strengths that are shown in the following infographic.

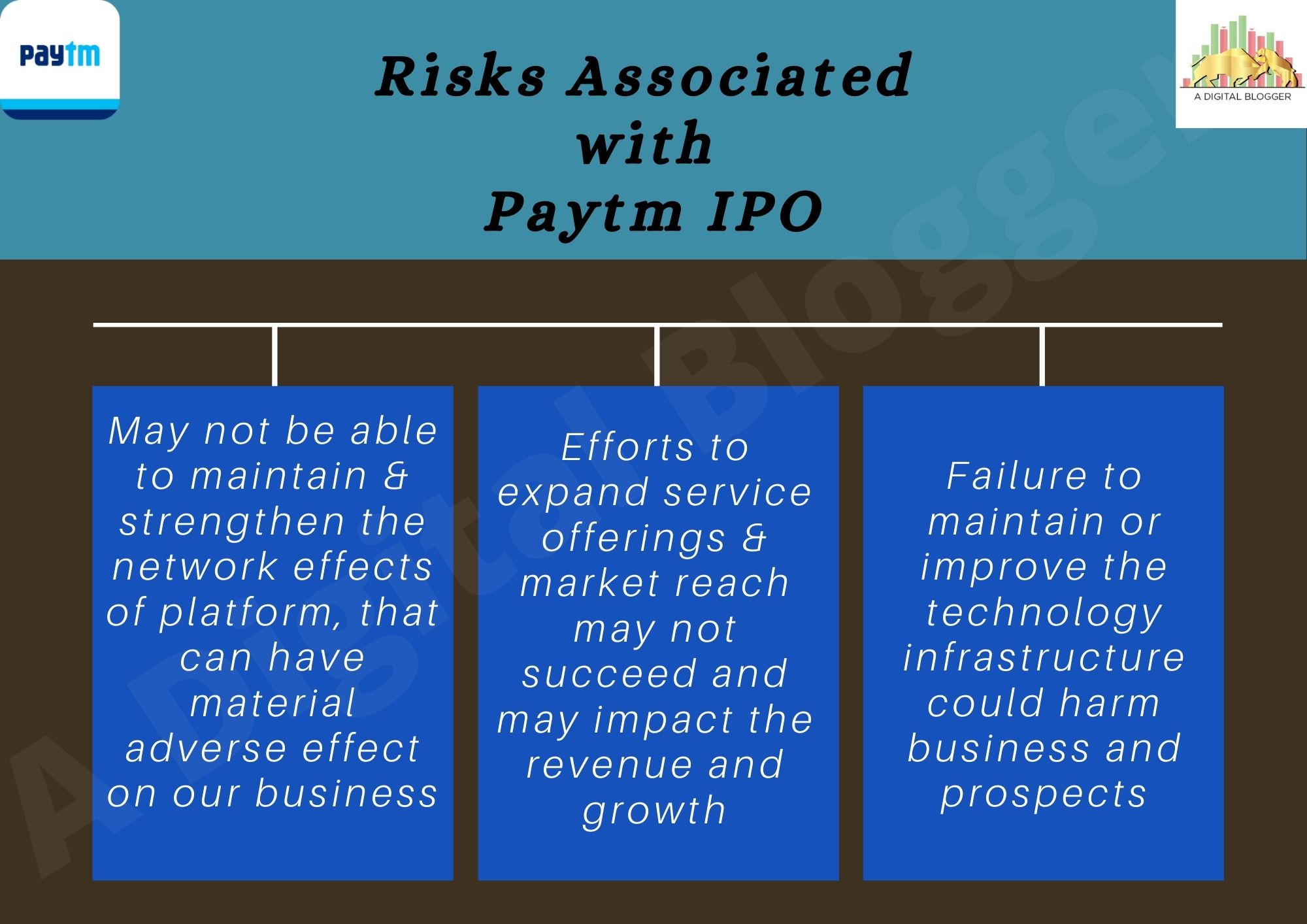

Risks Associated with Paytm IPO

After the strengths of the IPO, it is the right time to check the risks that are connected to the Paytm IPO.

So to provide the risks or threats of the same IPO, let’s go through the following infographic. Therefore, let’s move on it!!

It can be seen that Paytm has shown growth in the years, but it is important to note the risks along with the strength of the IPO to be on the safer side.

Conclusion

Now as far as investment in the IPO is concerned, the investors are looking into the company in quite a different way. On one side where the company has recorded losses in 8 years of its establishment, it remained active in offering multiple services to its customer in the range of digital gold, movie tickets, e-ticketing, and Paytm banks.

Thus, the investors are looking deep into other data like the growing engagement of the customers, net revenues, and the increase in user base, etc. This IPO has gained more expectation after the food delivery company Zomato, is subscribed 38 times despite recording huge losses in its book.

So, yes the IPO might give you a good return but it is good to act more practically rather than emotionally and do your own analysis to grab maximum return from your investment.

If you have made up your mind to apply for the IPO, then let’s complete the first step by opening a Demat account by filling in the following registration form.

More on Upcoming IPO