Power Grid IPO Review

More on IPO

With a long list of upcoming IPOs coming this year, investors are ready to welcome the next IPO – Power Grid IPO, which is expected to come in March 2021. So here we have brought detailed and relevant information of the Power Grid IPO review that will help you to plan your investment accordingly.

So let’s get ready !!

But before that, we must first know a little about the company that is launching this IPO.

State-owned entity Power Grid is India’s largest and 32 years old Electric Power Transmission firm that is headquartered in Gurugram.

It is involved in the planning, implementing, and maintaining of the inter-state transmission system (ISTS). Besides, this company transmits 50% of the total electricity produced in India.

And the fact is that it will be the first company that is funding its projects through the InvIT (Infrastructure Investment Trust) Route and will be the third InvIT to be registered in Indian Markets, after IRB InvIT and India Grid Trust.

The government expects this company will attract both domestic as well as global investors.

The power minister R K Singh said that this company will launch its IPO to monetize the new and under construction capital projects.

Apart from this information, if you want to grab more information about this company. You can get it by clicking here.

Under this, 5 power projects worth ₹8000 Crore will be sold through IPO. All these projects have no external debt which is the safer side for the investors.

Power Grid IPO Details 2021

Let us take a look at the below table for the Power Grid IPO details including IPO date, Issue size, Fresh issue, OFS, Market lot, and Price band.

| Power Grid IPO Details | |

| IPO Date | Opening Date: [●] |

| Closing Date: [●] | |

| Issue Size | [●] Equity Shares of ₹ (aggregating up to ₹8000 Cr) |

| Fresh Issue | [●] Equity Shares of ₹ (aggregating up to ₹[●]) Cr |

| Offer For Sale | [●] Equity Shares of ₹ (aggregating up to ₹[●] Cr) |

| IPO Price Band (Per Share) | ₹[●]-₹[●] |

| Market Lot (Equity Shares) | Minimum Lot: [●] ([●] Shares) |

| Maximum Lot: [●] ([●] Shares) |

Power Grid IPO Date

Next comes the Power Grid IPO Date in the Power Grid IPO Review.

It is very essential for the retail investors to know the IPO dates so that they would not miss any IPO process.

Power Grid’s Initial Public Offering is to open on [●]. The offer will close after [●] days, i.e, on [●].

Besides, there are also some other important dates of this IPO that you can know right here at the below table.

| Power Grid IPO Date | |

| Power Grid IPO Opening Date | [●] |

| Power Grid IPO Closing Date | [●] |

| Finalization of Allotment of Shares | [●] |

| Initiation of Refunds | [●] |

| Credit to Demat Account | [●] |

| Power Grid IPO Shares Listing Date | [●] |

Power Grid IPO Price

Now, we will see the Power Grid IPO price in the Power Grid IPO Review.

IPO Price mainly consists of two types of prices; the Issue price and Listing price.

The issue price of an IPO is the price at which any private company sells its IPO shares for the first time to the public investors.

On the other hand, the listing price is the price at which shares get listed on the stock exchange. In simpler words, it is the opening price of shares on a listing day.

Power Grid Limited is all set to issue around [●] Equity shares worth ₹8000 Cr to the public investors via. IPO.

The issue size includes a Fresh Issue of [●] Equity shares worth ₹[●] Cr and an Offer For Sale of up to [●] Equity shares worth ₹[●] Cr.

Besides, Power Grid will sell its shares in the ₹[●]-₹[●] price band.

That means the investors can bid for a minimum number of shares by investing ₹[●], whereas they will be required to make a maximum investment of up to ₹[●].

You should try to bid at a higher price band, as there are significant allotment chances.

Power Grid IPO GMP

Next in the line of Power Grid IPO Review is Power Grid GMP.

GMP is a premium value at which IPO shares are transacted in the Grey Market before they become officially available for trading on the stock exchange.

Besides, the GMP of an IPO influences the IPO listing price. How??

If there is a high GMP of any IPO, it signifies that there is a higher demand for IPO shares in the market. It could result in a higher listing price and hence can give higher listing gains to the investors.

Besides, if we talk about GMP of Power Grid, it is seen trading at ₹[●]-₹[●].

Power Grid IPO Promoters

The promoter of Power Grid InVIT IPO is Power Grid Corporation Of India Limited (PGCIL).

It was incorporated on 23rd October 1989 and engaged in the transmission of bulk power from generating stations to the load centers across different states of India.

The current market capitalization of this company is ₹1,20,510 Crore.

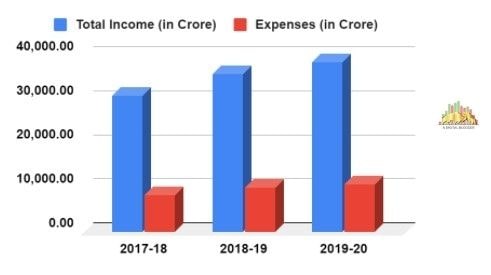

Besides, the total income and net profit achieved by Power Grid during the last three years on a standalone basis is given below:

| Year | Total Income (in Crore) | Expenses (in Crore) |

| 2017-18 | 30,767.00 | 8,245.00 |

| 2018-19 | 35,618.00 | 9,939.00 |

| 2019-20 | 38,318.00 | 10,811.00 |

How To Apply For Power Grid IPO

In the journey of Power Grid IPO Review now we will see how you can apply for Power Grid IPO.

In the financial markets, IPOs have been in talks among the investors like an India-Pakistan match as they have a potential to offer very high returns.

But the next thing that comes to mind: how to apply for an IPO?

The procedure to bid for IPO shares is slightly different and quite simple. All you need to have a Demat account with a registered stockbroker, a trading platform, your hard-earned money, and some documents which include:

♦ PAN Card

♦ Aadhar Card

♦ Bank Account Number

In case you don’t have a demat account. Refer to the form below and proper guidance will be given to you:

Once your account is opened, you will be required to go through the following steps:

▶️ Log-in to your trading app provided by the broker.

▶️ Go to the investment section, and click on the IPO you wish to invest in.

▶️ Put the quantity of IPO shares you wish to apply for.

▶️ Type the IPO price at which you want to bid.

▶️ Select the payment option; UPI (Unified Payment Interface) and ASBA (Application Supported by Blocked Amount).

▶️ Confirm and place your order by clicking on “Apply Now”.

Once you are done with this process, your application form gets submitted, and the amount will get blocked in your bank account.

However, in case of the Offline method, you need to submit your IPO application form to the bank executive by visiting the bank directly.

Power Grid Company Details

This is all about Power Grid IPO Review. Now, if you are confused as to whether you should invest in this IPO or not?

So, don’t worry as this piece of information guide will remove all your confusion.

Let us start with the company fundamentals, strengths, and risks associated with this IPO that help you plan your investment accordingly.

Power Grid Limited is engaged in planning, designing, constructing, and financing the power transmission projects not only in India but also set its footprints in other 20 countries.

As of September 30, 2020, eight of these ISTS (inter-state transmission system) government-run entity has started commercial operations, which include 39 transmission lines of 6,398 circuit kilometers (ckm), with 9,360 Megavolt amperes (MVA) of total power transformation capacity.

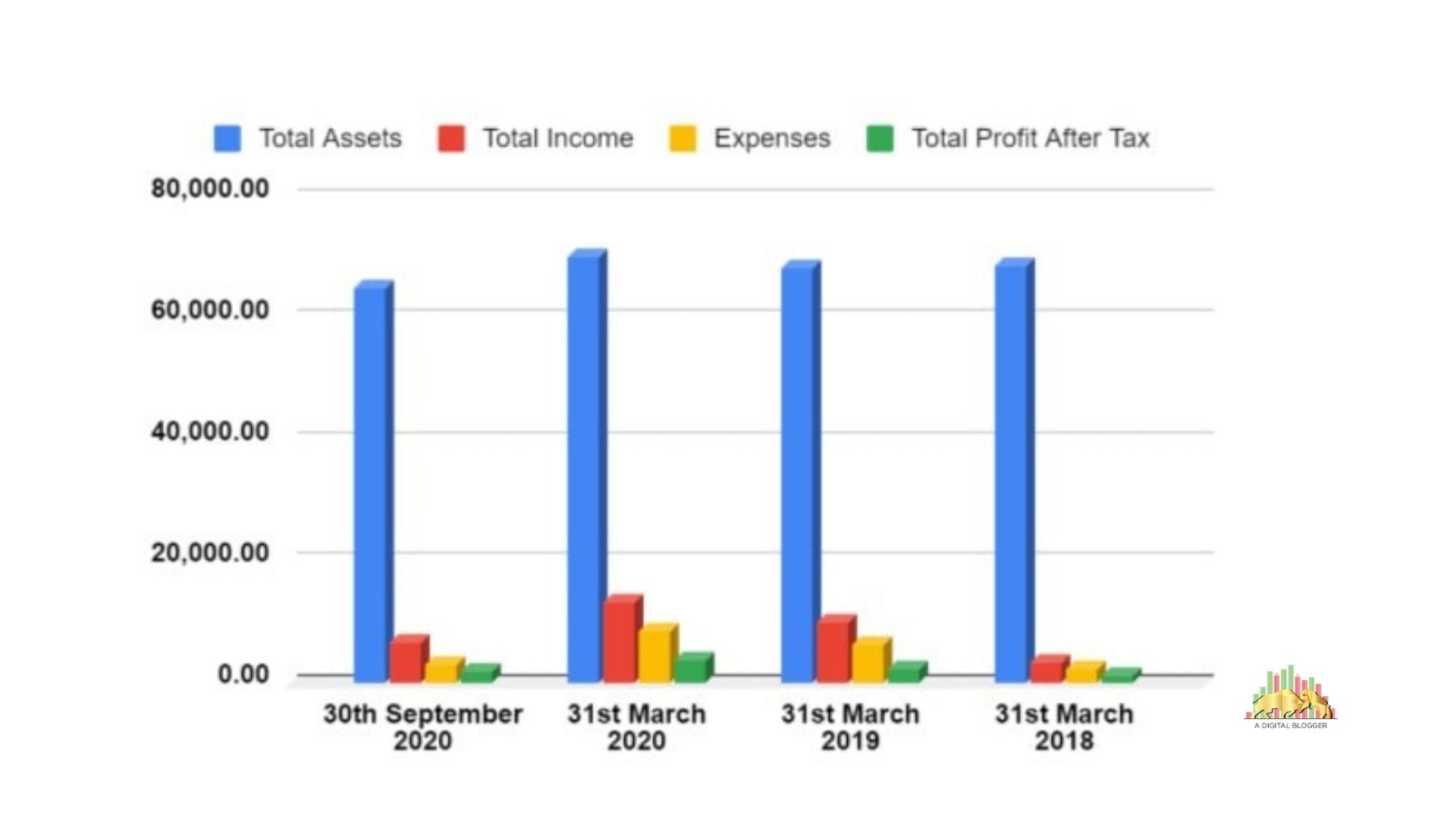

For more clearance, let us have a quick look into the past financial performance of the company to understand its performance of business and growth prospectus.

The summary of financial information is shown in the table and bar graph below for easier understanding.

| Power Grid Financial Performance in Crores (FY18-FY20) | ||||

| 30th September 2020 | 31st March 2020 | 31st March 2019 | 31st March 2018 | |

| Total Assets | 68,727.28 | 68,212.16 | 70,002.62 | 65,048.81 |

| Total Income | 6,745.72 | 13,340.94 | 9,841.20 | 3,455.99 |

| Expenses | 3,076.92 | 8,466.70 | 6,360.84 | 2,170.74 |

Should You Invest In Power Grid IPO?

Before you decide to subscribe to this IPO, you should look at various aspects of the company and IPO too.

It is an interesting fact that a huge announcement has been made by Union Power Minister R K Singh that Power Grid company is going to launch its InvIT IPO which indicates the huge strategy of the government towards asset monetization.

Besides, it is the first InvIT registered with SEBI and is going to float by a public company. There are a lot of hopes with this IPO.

Through this IPO, 5 Projects valued at ₹8000 Cr are to be sold by this company this month. There seems to be a lot of pension funds and mutual funds investors will participate here.

The other announcement made by the government is that this is not only one InvIT. After this, some more InvITs will also come into the power sector. One of them is expected to come into the hydropower sector.

Power Grid has no competitor in the power sector. Also, as the government is keeping an eye on increasing renewable energy, there are chances that transmission volume may grow up by 9 to 10% over the next 5 years.

And with this, there are chances that this company will also grow.

Secondly, the Power Grid IPO aims to raise funds for new and under construction capital projects which is a good factor.

Besides, if we talk about the financial parameters of this company, it is overall good.

The company’s assets and revenue have risen by 5% and 49%, from FY18 to FY20. Also, you can see a rise of up to 45% in its net profits despite the Covid-19 Pandemic, which shows the financial stability of the company.

Some of you might know that two InVITs, including IRB InViT Fund and India Grid Trust, were launched by the private sector in 2017, and the IPOs of both InViTs were successful.

So there are chances that this IPO will also provide higher listing gains to the investors.

We have compiled this data and provided you with our insight but never invest in the IPO without doing an in-depth past and current financial analysis.

Now let’s discuss the competitive strengths and uncertainties associated with this company.

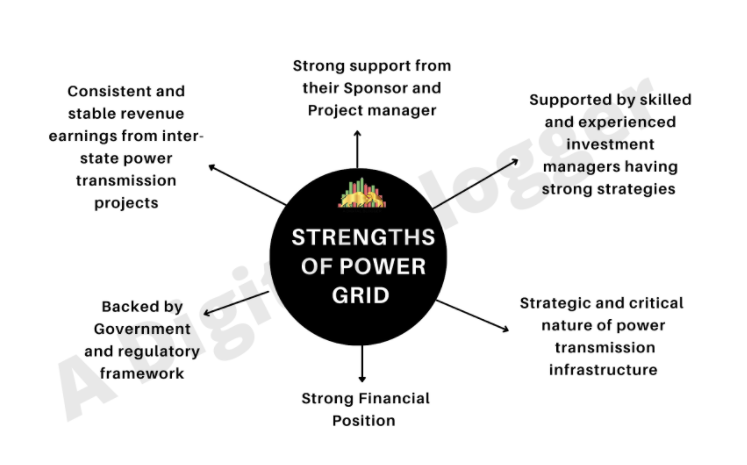

Strengths Of Power Grid

Next in the concept of Power Grid IPO Review comes the strengths of Power Grid.

Although, Power Grid Corporation of India Limited currently has no other rival to compete with. Even then it is all set with competitive strengths so that it can increase its market share through increased efficiency and productivity.

Some of the strengths we have listed in the infographic below:

Risks Associated With Power Grid IPO

Although, Power Grid has shown tremendous financial growth over the financial years. But it’s better to analyze the risks related to this IPO investment as well.

Some of the risks are highlighted in the infographic as you can see below:

After going through the Power Grid IPO Review, we believe that you might think of investing in this IPO. Refer to the form below and proper guidance will be provided to you: