IPO Process

More on IPO

IPO Process these days has become completely streamlined with a set order and number of steps a business needs to take. It involves a need for external parties that assist a business to carry out the complete IPO process for them.

To understand the complete IPO meaning and IPO process let’s break down the complete process in this detailed review and try to explain in the easiest way possible.

When a company is looking to raise huge funds for different business reasons (such as geographic expansion, build infrastructure, complete projects etc) then it may choose to sell part of its shares in exchange of money from the general public.

This company must be aware of the different advantages of IPO as well as disadvantages of IPO before placing their feet into this space.

Although the whole IPO process is very streamlined and structured, it can certainly be very excruciating for the company that is going to get listed on the stock market. The whole process is looked over by the top regulatory body in the Indian stock trading space, SEBI or Securities and Exchange Board of India.

In this detailed IPO Process walkthrough, we will talk about the specific steps involved in the overall procedure along with discussing the specific parties needed in each step.

Here is a quick summary of the steps that we are going to explain at length later:

- Hire an Investment Bank

- File with SEBI

- Get Started with DRHP

- Hit the Road!

- IPO Pricing

- Open to Investors

- Credit the Shares to Bidders

To make the reading relatively interesting, we will take an example of let’s say company ADB who is into manufacturing of Sports Shoes. The business has 2 manufacturing units in Uttar Pradesh.

They sell their products through domestic distributors and at the same time, export it to a few brands in Europe as well.

Now, they are looking to add 3 more manufacturing plants, 2 in West Bengal, 1 in Bihar. They need a capital of ₹400 Crore for the complete setup and that is why they are looking to raise this funding from the public by an IPO.

The IPO process in India is not that different from what it is in the rest of the world. Since, the Indian stock market is regulated by SEBI with some prominent exchanges such as NSE, BSE – businesses that are looking to go public can certainly rely on the IPO process that is laid out by such bodies.

The foremost step before the process is to know the Upcoming IPO Review so that you have a detailed idea about the company your are going to invest in. And finally can decide which IPO is good to invest.

Here are the steps your business will need to go through:

#1 Hire an Investment Bank

Like any other company that is looking to raise public funding, ADB hires a team of underwriters and investment bankers from HDFC securities & Karvy Online to manage their IPO. This team is going to perform some checks such as looking into the financial performance of the company.

This will include looking to balance sheets, Profit and Loss statements, cash flow statements etc of the company ADB over the last few years.

The team will then sign an underwriting agreement that will contain details such as the amount to be raised, number of securities at stake.

They will also be working with the ADB team to understand aspects such as the retail allocation of the IPO and then bifurcation of institutional allocation, exchanges the business looking to get listed in and so on.

The team from HDFC & Karvy (or any investment bankers hired) will focus on making sure that the business actually gets the funding that it is looking to raise, however, they will not be any written commitments from any banker.

#2 File with SEBI

This is the first test ADB needs to go through in the complete IPO process. Here the underwriters discussed in step 1 file the registration application readied by them with SEBI, the regulatory body of the Indian Stock Market.

This registration application contains information on business fiscal data, business plans of the company, information on how the business is looking to spend the funding raised etc.

It is the responsibility of the underwriter team that all aspects mentioned in the application are in line with the requirements set by SEBI. In case it is, then the team can go ahead with the next step.

Otherwise, SEBI will mention a few comments on the application which need to be fixed by the team of ADB along with the hired underwriters before filing the application again.

#3 Get started with DRHP

This step is like testing waters for the underwriting team around the IPO. The hired team of HDFC & Karvy will present an initial prospectus which contains information on the potential price per share (or the issue price of the IPO).

The document shared in this step is called Draft the Red Herring document as this is a draft version and not a finalized document by any means.

With the kind of feedback received for DRHP, the underwriting team decides to stay with the price or goes back to the drawing team if required.

#4 Road Shows

It’s time to disco!

Well, the team goes out in the public domain, holds road shows, meets potential investors (generally institutional in nature) in this particular step.

This 2-week program will require the team to show numbers, provide answers to how, why and whats by the potential investors and can be an excruciating exercise.

This experience gives the team a first-hand idea of what kind of expectations they can keep when the IPO actually opens up for the public bidding.

This activity can be seen as an exhaustive marketing event where the company and its respective agencies MUST go full-throttle in terms of bringing the word out. Investors at institutional, anchor, retail, high net-worth levels must be aware of this upcoming IPO.

#5 IPO Pricing

This is the make-or-break step in the overall IPO process. In this particular step, the complete team gets together again to set up a price or an NSE price band for the IPO (depending on the type of the IPO company plans to launch) on which the IPO will be opened up for public investor bidding.

Not only that, in this particular step, the number of shares to be opened for public bidding is decided along with the decision of the exchange(s) where the stock will be finally listed.

Now, the decision on the bidding price and the number of shares is definitely one of the biggest decisions to be made. If the bid price is higher than the customer expectations, then the risk of under-subscription jumps up. At the same time, in case it is under-priced, then the business loses out on an opportunity to raise an even bigger amount through this IPO.

Know about the issue price and the price band of the upcoming IPOs in the table below:

| Upcoming IPO Price | |

| IPO | Issue Price |

| Rolex Rings IPO Price | ₹731 Cr |

| Paytm IPO Price | ₹16,600 Cr |

| Suryoday Small Finance Bank IPO Price | ₹582.34 Cr |

| Kalyan Jewellers IPO Price | ₹1,750 Cr |

| Craftsmen Automation IPO Price | ₹823.70 Cr |

| Laxmi Organics IPO Price | ₹600 Cr |

| Anupam Rasayan IPO Price | ₹760 Cr |

| Easy Trip Planner IPO Price | ₹510 Cr |

| MTAR Technologies IPO Price | ₹596.41 Cr |

After closing the IPO get listed at a specific price that further decides the IPO listing gains or losses.

Now again there are different parameters that define the IPO listing price thus it becomes crucial for you to know how IPO listing price is decided?

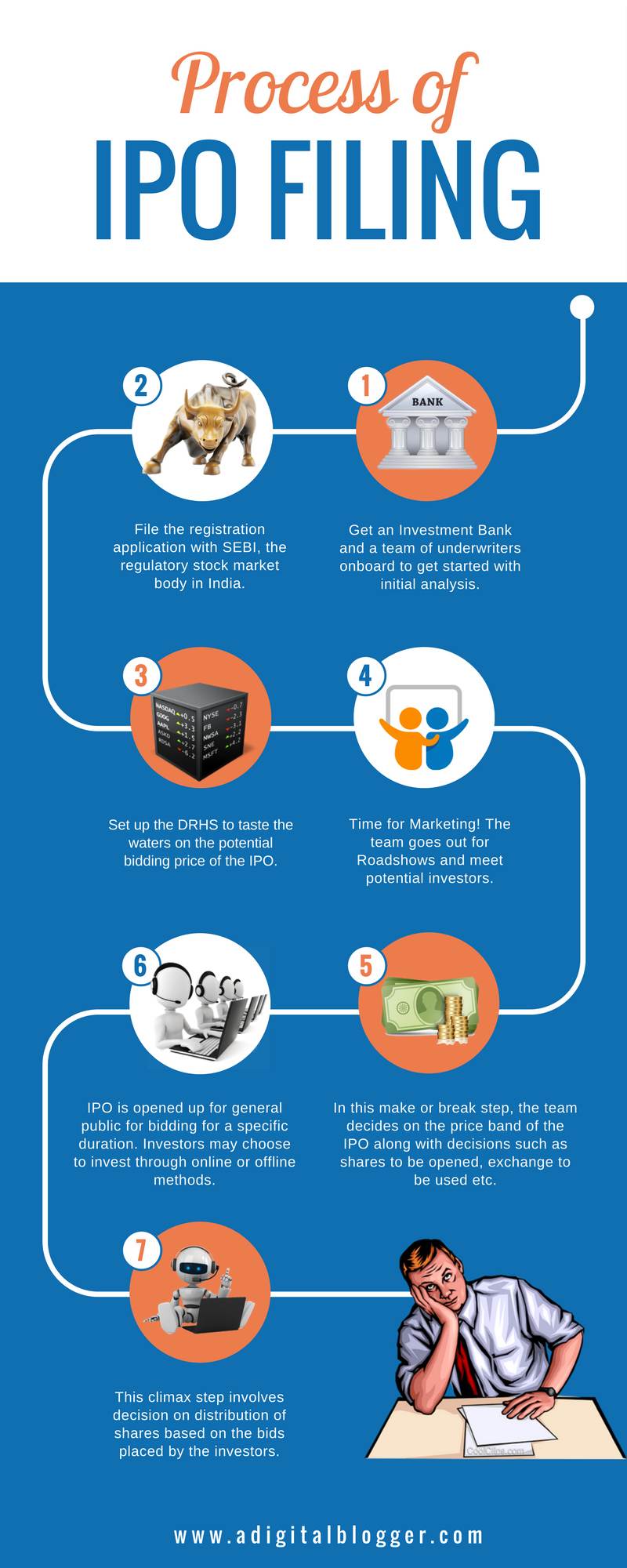

IPO Process Infographic

Here is a quick IPO process flow chart for your reference:

#6 Avail it to Investors

Like a movie hits the box office on a Friday, an IPO is opened up for public bidding on a set date. In fact, there is a complete Upcoming IPO calendar released that has information on dates of:

- IPO Opening

- IPO Closing

- Allocation finalization

- Shares crediting into the Demat Account(s) of the winning bidders

- Stock Listing on the exchange(s)

Generally, bidders are provided with a window of 3 to 5 days in case they are looking to bid for an IPO. There are multiple ways that you can bid an IPO by. ASBA is one of the most prevalent methodologies of IPO applications these days since it is completely online and convenient to the investor.

At the same time, you have the option to place your IPO bid in an offline way as well. However, it is quite cumbersome and requires manual effort.

Check out the dates of Upcoming IPOs 2021 in the table below:

| Upcoming IPO 2021 Date | ||

| IPO 2021 | Opening Date | Closing Date |

| Rolex Rings IPO Date | 28 July 2021 | 30 July 2021 |

| Paytm IPO Date | [●] | [●] |

| Suryoday Small Finance Bank IPO Date | 17 March 2021 | 19 March 2021 |

| Kalyan Jewellers IPO Date | 16 March 2021 | 18 March 2021 |

| Laxmi Organics Industries IPO Date | 15 March 2021 | 17 March 2021 |

| Craftsmen Automation IPO Date | 15 March 2021 | 17 March 2021 |

| Anupam Rasayan IPO Date | 12 March 2021 | 16 March 2021 |

| Easy Trip Planners IPO Date | 08 March 2021 | 10 March 2021 |

| MTAR Technologies IPO Date | 03 March 2021 | 05 March 2021 |

#7 How to Apply for Upcoming IPO?

Next to the date, the other important step is to know the application process. Here, for all the investors willing to apply in the IPO, it is essential to have a demat account.

If you are not having a demat account, then open it now for free by filling the form below:

Other than this, you need to submit your PAN card number, Aadhaar Card number, and Bank details to fill in the application details.

Now, let’s guide you with the application process.

It is simple and can be easily done via the ASBA method. Just log in to the internet banking portal or the trading platform provided to you by the broker.

There select the IPO in which you want to invest. Enter the bid price and the corresponding amount.

Click on Submit button and you are done with the applying process.

Stay updated with the upcoming IPO and apply for them at the earliest.

This is the climax of the whole IPO process where the business team of ADB and the hired underwriters finalize the complete list of investors who bag the shares. Most of the process is online and done through automated systems, however, the parameters are set by this team itself.

The bidders who are successfully able to get shares, are provided with these stocks in their respective Demat account as per the timeline shared initially.

However, the bigger set of people who do any get any subscription are flagged by the team and their bid amount is credited back to their trading account or the blocked amount in their bank accounts is unblocked (in case they are using ASBA).

Furthermore, if you are interested to bid for any of the Upcoming IPOs?

Enter Your details here and we will arrange a FREE Call back.

More on Upcoming IPO 2021

| Upcoming IPO List | |

|---|---|

| IPO | Issue Size |

| Craftsman Automation IPO | ₹820 Cr |

| Laxmi Organics IPO | ₹600 Cr |

| Anupam Rasayan IPO | ₹760 Cr |

| Easy Trip Planners IPO | ₹510 Cr |

| MTAR Technologies IPO | ₹596.41 Cr |

| Kalyan Jewellers IPO | ₹ 1750 Cr |

| Bajaj Energy IPO | TBA |

| Nureca Limited IPO | TBA |

| Nazara Technologies IPO | TBA |

| Studds Accessories Ltd IPO | TBA |

| Suryoday Small Finance Bank IPO | TBA |

| Stove Kraft Ltd. IPO | TBA |

| Barbeque Nation IPO | TBA |

| Home First Finance Company IPO | TBA |

| Soma Comstar IPO | TBA |

| Apeejay Surrendra Park Hotels IPO | TBA |

| Craftsmen Automation IPO | TBA |

| Puranik Builders IPO | TBA |

| Aadhar Housing Finance IPO | TBA |

| ESAF Small Finance Bank IPO | TBA |

| Macrotech Developers IPO (Lodha Group) | TBA |

| India Pesticides IPO | TBA |

| PowerGrid IPO | TBA |

| LIC IPO | TBA |

| Policy Bazaar IPO | TBA |

| Arohan Avishkaar Group IPO | TBA |

| Seven Islands Shipping IPO | TBA |

| Nykaa IPO | TBA |