Kalyan Jewellers IPO- 9 Things You Need to Know

More on IPO

Kalyan Jewellers IPO is the next IPO joining the list of the upcoming IPOs this month. Being the leading player in the jewelry industry, the Kalyan Jewellers IPO has already caught the attention of a majority of investors.

Are you also looking out for the market appearance of the Kalyan Jewellers IPO? Then, here is a list of 9 things that you should know before taking a step forward.

Kalyan Jewellers IPO Details

There are some necessary details that one needs to keep in mind before investing in an IPO. Let us quickly sum up the details so that you don’t miss any chance of making the profit you desire and can make a decision on should you invest in Kalyan Jewellers IPO or not.

- The issue size of the IPO is [.] equity shares aggregating upto Rs. 1,175 crores.

- The IPO will be listed in both the stock exchanges, that is, BSE and NSE.

- The face value of the IPO is Rs. 10 per equity share.

- The market lot of the IPO is 172 shares with a minimum order quantity of 172 shares.

- The maximum lot size of the IPO is 2236.

- The Kalyan Jewellers IPO price band is Rs. 86- 87.

Kalyan Jewellers IPO Date

If you are also eagerly waiting to join the investment line of the Kalyan Jewellers IPO, then it is ready to make its market presence on March 16, 2021.

The IPO will be open till March 18, 2021. Thus, make a wise decision on should you invest in Kalyan Jewellers IPO or not. You can think and try your luck during this duration.

Kalyan Jewellers IPO Promoters

The Kalyan Jewellers IPO has three prominent promoters, Mr. T.S. Kalyanaraman, Mr. T. K. Seetharam, and Mr. T. K. Ramesh.

Kalyan Jewellers IPO Company Details

Kalyan Jewellers is one of the leading players in the jewelry industry. It is one of the oldest family businesses in India.

The foundation of Kalyan Jewellers was laid by one of the prominent promoters, Mr. T.S. Kalyanaraman. The company started its jewelry business in 1993, and ever since then, and it has soared to great heights.

The majority of the business of the company revolves around the manufacturing, designing, and selling of gold studded and various other jewelry.

The company started its business with a single store in Thrissur, Kerala, and now it has around 107 showrooms across 21 states and the union territories of India. Not only does it have its presence in the pan-India but also across borders.

Kalyan Jewellers has 30 showrooms situated in the Middle Eastern part of the world. A significant amount of revenue is generated through gold-studded jewelry. In the fiscal year 2020, it was 74.77%.

The company has grown immensely in all these years, contributing to its popularity.

Objectives of the IPO

Every company comes with an IPO, keeping in mind specific objectives. The objectives of Kalyan Jewellers IPO are as follows:

➡️ The proceeds of the IPO will be used to meet all the general corporate purposes.

➡️ The objective is also to provide finances to the business and to fulfill the capital requirements.

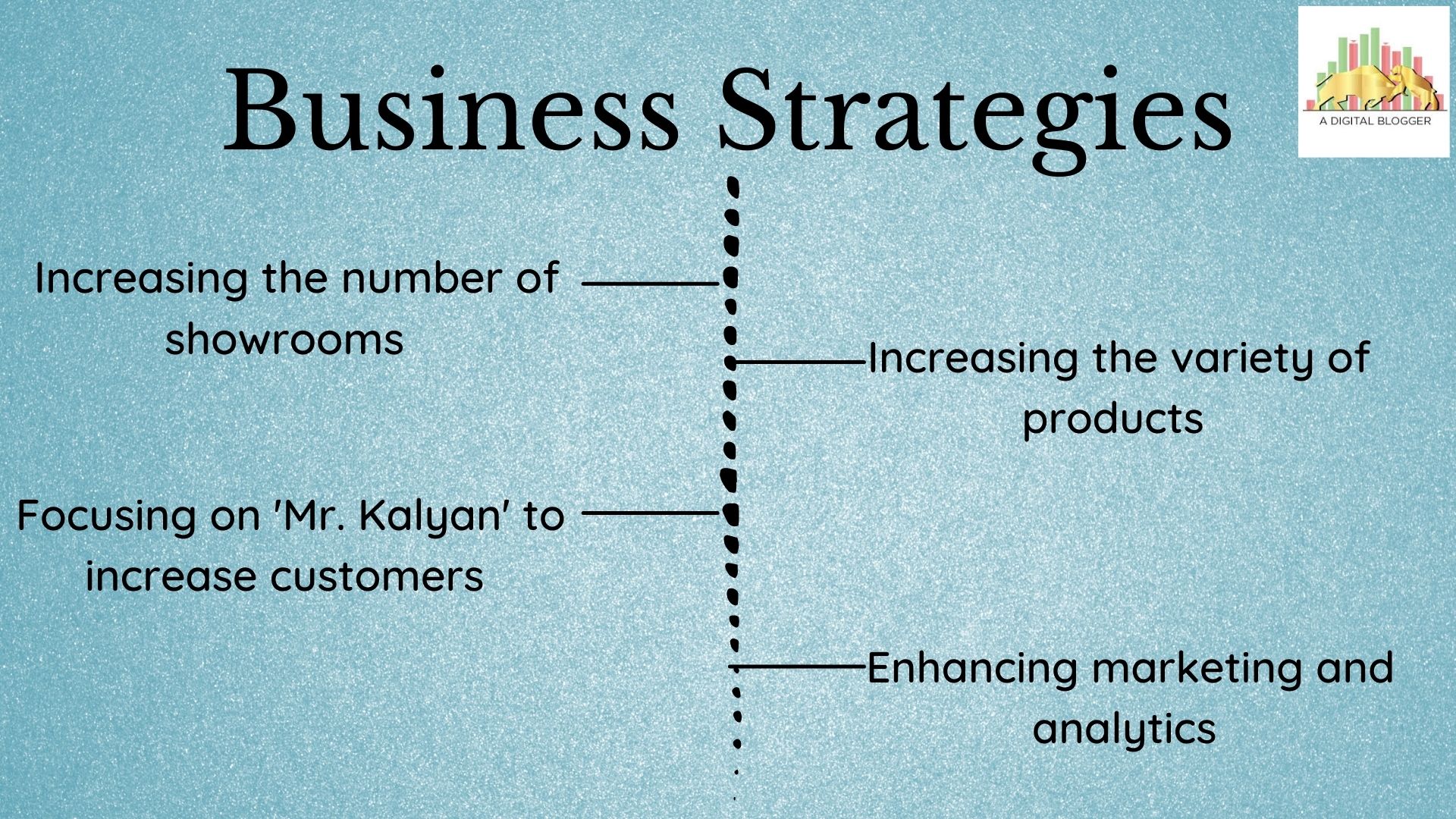

Business Strategies

Kalyan Jewellers Limited is a successful name in the market, and it indeed has some business strategies to forge forward in the game. Some of the business strategies of Kalyan Jewellers Limited are as follows.

▶️ They are working towards expanding their business network by increasing the number of showrooms and improve distribution.

▶️ They are also aiming to increase the variety of the products they offer, to increase the number of clients.

▶️ They also want to leverage their network, ‘Mr. Kalyan’ to broaden their customer outreach and enhance their distribution network.

▶️ Kalyan Jewellers Limited wants to reach the target audience by enhancing its marketing and analytics.

Looking at the business strategies, we hope that it is a little clear should you invest in Kalyan Jewellers IPO?

Financial Experiences

When a company comes with an IPO, it makes all its details public, including the finances as well. This is like a golden opportunity for the investor.

Before making a decision about should you invest in Kalyan Jewellers IPO, it is always a plus point to check the company’s financial background to be extra sure.

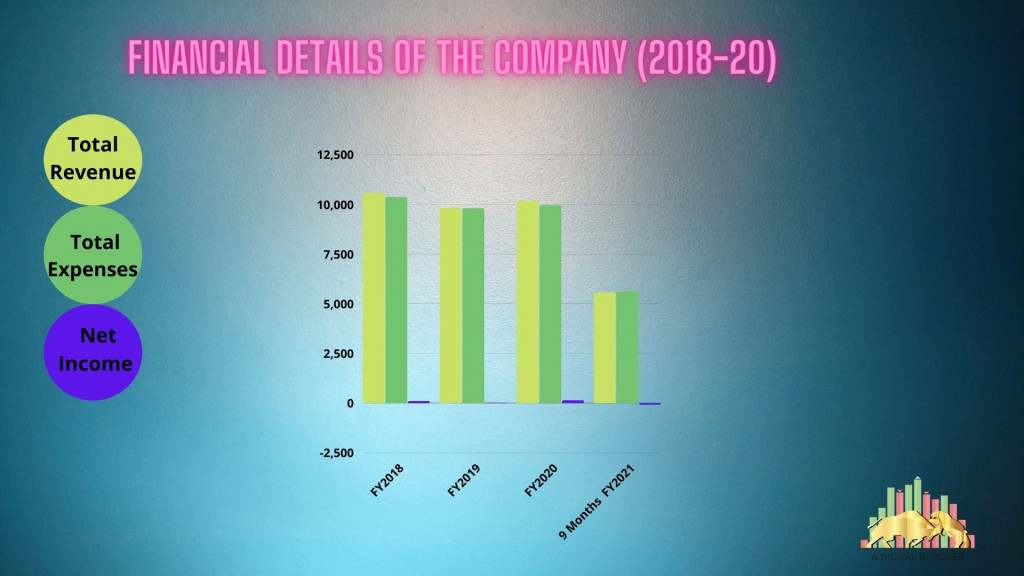

Here are the financial details of Kalyan Jewellers for approximately three years:

| Financial Details of the Company (2018-20) | ||||

| Particulars | Duration | |||

| FY2018 | FY2019 | FY2020 | 9 Months FY2021 | |

| Total Revenue | 10,580.2 | 9,814.0 | 10,181.0 | 5,549.8 |

| Total Expenses | 10,366.4 | 9,793.1 | 9,960.1 | 5,608.9 |

| Net Income | 102.8 | 24.7 | 144.6 | -81.3 |

(All the values are in crores)

(FY stands for Fiscal Year)

Below is the Graphical Representation of the above Data:-

Competitive Strengths

The Kalyan Jewellers IPO is no doubt the talk of the town, so there have to some points to back up the popularity of the IPO.

- Kalyan Jewellers with Amitab Bacchan and Katrina Kaif as their brand ambassadors have a very trusted client base and also a well-established company name.

- It is one of the leading jewelry companies in the country.

- The geographical reach of the brand is excellent. It does not only have its space in the country but also on a global base.

- The range of products is vast, and they have a wide range of products to offer. This helps in increasing their client base and also built their trust.

- A list of experienced and visionary promoters. The consistent track record of success and the constant portrayal of good management is also an added advantage.

- They have a showroom network with a pan-India presence.

These are the pros of investing in the Kalyan Jewellers IPO, and it indeed gives some brownie points if you are thinking should you invest in Kalyan Jewellers IPO?

☻ Risks involved in the Kalyan Jewellers IPO

It might come as a shock, but even though the advantages of investing in the IPO are abundant, there still are some risks involved that will give you an idea about should you invest in Kalyan Jewellers IPO.

Let us have a look at the weaknesses so that you make an unbiased decision.

- Due to the ongoing global pandemic, the business was adversely affected.

- There has been a significant decline in the revenues of the company.

- Since the company majorly has a showroom network, the success of the products and the clients’ permanency depends on the visibility of the showrooms.

- The changing trends in the market can cause a significant negative impact on the company. The company might not be able to adapt to the changing demands of the industry.

- Any discrepancy in the procurement of raw materials and production can affect the business adversely.

- It still has to go a long way when it comes to the global market.

The above-mentioned risks can act as a road blocker in your investment in the IPO.

Is It Worth Investing?

Now that you know almost everything about the Kalyan Jewellers IPO, you might be wondering whether or not should you invest in Kalyan Jewellers IPO?

Kalyan Jewellers Industries Limited is one of the leading retailers and distributors of gold-studded jewelry. It has a global reach and consistent growth in the market.

Though it suffered some setbacks in the fiscal year 2020 because of the global pandemic, it still manages to offer a wide range of products.

We would like to suggest that if you are willing to invest in this IPO, you should look at all the pros and cons of the investment that will help you make a decision on should you invest in Kalyan Jewellers IPO.

The risks can set you back but the advantages can lure you. Analyze, research, and then make the most beneficial decision.

Want to invest in IPO? Refer to the form below:

Know more on How to apply for Upcoming IPO