What is Change in Open Interest?

All Option Strategies

Option trading is no less than hustling for research and always spiraling in an unending web of confusion for some traders. It gets simplified when you understand the concepts properly. So let us begin by understanding what is change in open interest in options!

A change in open interest can cause a lot of fluctuations in the option chain as well. It is also a very crucial aspect to analyze as it can help you make certain decisions.

Before understanding how a change can cause an overall effect on your options trading, let us understand a little about open interest.

What is Open Interest in Options?

Have you noticed how the hustle of admissions in school has increased? With the growing demand for quality education, people are finding different ways to grab the most. One such idea is to choose the right school.

Let us assume that in an area of Indore there are approximately 70 schools. They are classified in to different categories and therefore the interest for each of them is also different.

Out of these 70 schools, 30 are CBSE affiliated, 20 are ICSE, and 20 are government schools. Now, every year, these schools receive admission applications. These applications are the contracts.

Since these are just applications and the seats are yet to be filled, these are open interest.

| Type of School | Number Of Schools | Applications (OI) |

| CBSE | 30 | 7000 |

| ICSE | 20 | 6000 |

| Government Schools | 20 | 4000 |

The open interest in the market keeps on changing, let us now see what does a change in the open interest signifies for an option trader.

This is exactly what open interest is. The number of option contracts that are outstanding in the market, i.e, the positions that are still open is known as open interest in options. In the above case, the number of remaining seats is the open position.

The open interest in the market keeps on changing, let us now see what does a change in the open interest signifies for an option trader.

Change in Open Interest in Option Chain

There are various instances when the open interest in option trading changes.

It is also very important to keep in mind that the transactions done by buyer and seller are different from open interest. Open interest is just the number of outstanding contracts and thus should not be confused with volume.

There are three major situations when the open interest of options change in the market.

- Whenever a new buyer or seller enters the market. In this case, the open interest will increase by one.

- When buyers and sellers meet at a common point and execute the contract. In this case, the open interest decreases by one.

- When one person transfers his position to a new one. For example, one buyer transferring his position to another buyer. In this case, the open interest does not change.

Let us understand this with the help of an example.

Priya and Vijay enter the market and Priya buy 5 option contracts and Vijay sells all of these 5 contracts. The open interest, in this case, will be 5 as they are entering a new position.

Now, later Vijay wants to exit from the 4 option contracts that he holds. Adeena comes and takes this position from Vijay.

Now, observe carefully that there is no new contract in the market, these are just transferred from one person to another, so the open interest will remain 5.

If Vijay and Priya decide to settle one contract, then the option contract will decrease by one and become 4.

| Change in Open Interest | |||

| Buy | Sell | Held Contracts | |

| Priya | 5 | 5 | |

| Vijay | 5 | 5 | |

| Outstanding Contracts: 5 |

| Change in Open Interest | |||

| Buy | Sell | Held Contracts | |

| Priya | 5 | 5 | |

| Vijay | 5 | 5 | |

| Adeena | 5 | ||

| Outstanding Contracts: 5 |

So, now you see when and how an open interest changes. But what does this change indicate?

Usually, the high and low open interest option represents investors’ interest. When the open interest is increasing in the market, that means that more investors are entering into the market, and the current price trend, whichever way it is going to stay.

If we take the same example of the schools, then the CBSE schools received the maximum number of applications, thus showing the maximum interest.

Now, if out of the 7000 applications which CBSE schools received, 2000 were accepted, then the OI now becomes 5000.

Similarly, if the open interest in the market is decreasing, this means that the money is liquidating and the current market trend is coming to an end.

It is a common ground for a lot of investors to interpret and also confirm the trends and also trend reversals.

Let us now see how the open interest analysis can help investors in increasing their profitability.

High Open Interest

Now, many times you might have seen that the open interest in options is very high. But what does it mean? Let us figure that out!

Open interest is often used to understand the trend strength in the options market.

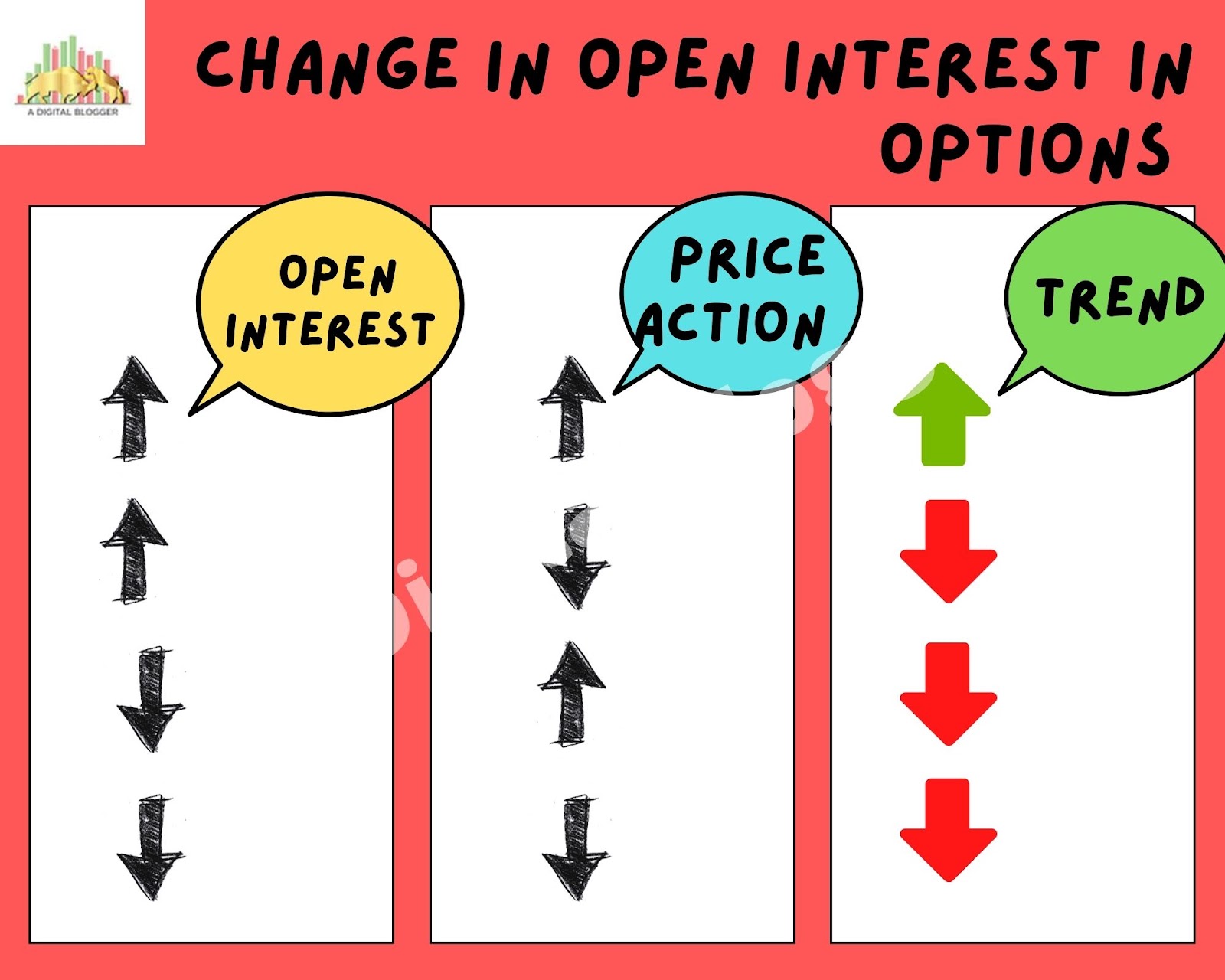

- If the open interest is increasing in the market along with the price of that asset means that there are investors in the market. This also signifies that the capital is flowing in the market. This is usually considered bullish as there is more buying.

- If the open interest is increasing but the price is decreasing, there is a possibility of a downward or a bearish trend.

Note- If the open interest is neither increasing or decreasing and the prices are moving in either direction, it usually indicates a trend reversal.

Low Open Interest Option

Similar to increasing open interest, there is also a decrease in open interest. Let us see, what are the situations when the open interest changes and decreases.

- If the open interest in the market is decreasing but the prices action is seeing a significant rise, it means the short sellers are very dominant in the market. Money is practically going away from the market, therefore signifying a bearish market trend.

- If the open interest is decreasing and the prices are also decreasing, this means that the people who have long positions are selling the contracts due to some reason and signifies a bearish trend. Although, some people believe that there is a possibility of a strong trend once the selling is completed.

So, in these ways, you can use the open interest strategy to come to a conclusion. Although, looking at only the open interest does not clarify anything, so you will have to look at the price action simultaneously.

There are a lot of benefits of open interest in options as by the end of the day, it gives a lot of idea about the trend.

Open Interest Vs Volume

After you understand the calculation of Open Interest and how the change affects the market movement it is also very important to understand the relationship between open interest and volume to understand how it will determine your trading decisions.

Traders often confuse these two concepts so it is important that we understand them clearly.

Volume is the number of contracts that are traded over a given period of time. If there are 40 contracts that were bought and then sold, then the volume will be 40, whereas the number of option contracts that are not settled is known as open interest.

When a trading day begins, the volume is by default set to zero, whereas the open interest might stay unchanged.

When a seller sells 2 option contracts and a buyer buys all 2, then the volume is 2 and the OI is also 2. Now, on the second day, the buyer transfers his one position to another buyer.

In this case, the volume becomes one but the OI remains the same.

So, this is the difference between OI and volume. Both of them should be considered when making a trading decision.

Conclusion

In conclusion, open interest is an important aspect to study trend strength and can aid you when you are doing options trading. Although, make sure that you are checking price action simultaneously.

The change in open interest says a lot about the value of options contracts thus helping traders to trade smartly.

Now, whenever you see an option chain, look at the OI(open interest) also, to have a better idea of your decision!

Start trading in options now by opening a demat account online for FREE!

More on Options Trading