Alice Blue Brokerage

Check All Brokerage Reviews

Chunmun is from a middle-class family, and due to lockdown, she lost her job. To have another source of income, she decided to start investing in the stock market. After going through the list of brokers, she gets attracted to the discount broker named Alice Blue but is a little confused about the brokerage charges. Let’s clear out Chunmun’s confusion regarding Alice Blue Brokerage.

Alice Blue Brokerage Plans

Alice Blue is a discount stock broker offering equity and commodity trading in exchanges like NSE, BSE, and MCX. So, if you are interested in trading in the mentioned segments it is of utmost importance that you must be aware of Alice Blue brokerage.

Alice blue is known for offering the least brokerage to trade in different segments mentioned above.

Earlier Alice Blue provided three different brokerage plans but with time the broker comes with certain modifications in its brokerage model.

First, it introduced the F20 plan where the brokerage of ₹20 was charged across segments and no charges were levied to trade in the delivery segment. Later it was modified and the broker introduced the Freedom15 plan.

Let’s dive into the details of how this brokerage plan will benefit the traders and investors.

Alice Blue Freedom15 Brokerage Plan

Chunmun got very excited when she came to know about Alice Brokerage Plan that they have shifted from F20 and TPro to FREEDOM-15.

In this single plan ₹15 is charged per order on all segments. The main objective of this plan is to offer customers a low cost and more benefit while trading.

Like Chunmun if you also get excited with this Brokerage Plan, then read further in this segment to know more.

Alice Blue Intraday Charges

Traders are mostly bothered about the Intraday Charges. The traders always wanted to save much of their amount from paying off more as a brokerage.

Alice Blue offers ₹15 per order or 0.01%which is lower as an equity intraday brokerage and acts as a key to open a way for potential traders to get more benefit.

| Alice Blue Intraday Charges | |

| Brokerage | ₹15 or 0.01% whichever is lower |

| Transaction Charges | 0.00325% for both NSE & BSE |

| STT | 0.1% on both Buy and Sell |

| SEBI Charges | 0.00005% (₹5/Crore) |

| Stamp Duty | ₹10 Per Crore |

| GST | 18% of (Brokerage + Transaction) |

Chunmun decided to do intraday trading. According to the broker, she will be charged either ₹15 or 0.01%, whichever is lower. Let us understand the above intraday charges in detail.

CASE1: Total Trade of Rs.25,000

0.01% of Rs.25,000 = Rs.2.5

So, in this case, ₹2.5 will be charged from her.

CASE2: She decided to invest more of her savings for intraday trading. So, she made Total Trade of Rs. 1,75,000.

0.01% of Rs.1,75,000=Rs.17.5

In this case, ₹17.5 is greater than the flat fees decided by the company, i.e., Rs.15, so she will be charged Rs15.

You can easily do multiple trading with this broker as it provides the least brokerage charges.

Apart from the above-discussed brokerage charges intraday, there are some additional fees, Alice Blue auto square off charges.

These charges reduce the overall profit and hence should be considered while trading with the broker.

Alice Blue Delivery Charges

Since intraday trading involves too much risk and hence many beginners prefer to do delivery trade.

To make it easy and more profitable for long term investors, Alice Blue comes up with the special offer where it does not charge any brokerage for delivery trade.

So, if you do trade other than intraday in equity segment than you do not have to pay any fees to the broker. However, as discussed there are some specific taxes and other charges associated which one must be aware of:

| Alice Blue Delivery Charges | |

| Brokerage | Zero |

| Transaction Charges | 0.00325% for both NSE & BSE |

| STT | 0.1% on both Buy and Sell |

| SEBI Charges | 0.00005% (₹5/Crore) |

| Stamp Duty | ₹10 Per Crore |

| GST | 18% of (Brokerage + Transaction) |

Alice Blue Future Charges

The traders are provided with extra opportunities to trade in derivatives, i.e., Futures and Options, by just opening a demat account with this broker.

So along with the equity futures you can also trade in the commodity and currency futures with Alice blue demat account.

Let’s see how much the broker charged to trade in the Futures segment.

Now, the brokerage of flat ₹15 is charged for both Future and Options segments separately.

| Alice Blue Futures Brokerage | |

| Brokerage | 0.01% of ₹15 whichever is lower |

| Transaction Charges | NSE 0.0021% | BSE Rs 1 per trade (each side) |

| STT | 0.01% |

| SEBI Charges | 0.00005% (₹5/Crore) |

| Stamp Duty | ₹10 Per Crore |

| GST | 18% of (Brokerage + Transaction) |

Alice Blue Option Charges

Similar to futures, you can trade in options using the Alice Blue mobile app. Although most of the brokers charged fees per lot, here the broker charged fees per order to trade in options.

As per the Freedom 15 brokerage plan of the broker, here are the brokerage details of the Alice blue options brokerage.

| Alice Blue Options Brokerage | |

| Brokerage | ₹15 per trade |

| Transaction Charges | NSE 0.053% | BSE Rs 1 per trade (each side) |

| STT | 0.05% |

| SEBI Charges | ₹10 per crore |

| Stamp Duty | ₹300 Per Crore |

| GST | 18% of (Brokerage + Transaction) |

Alice Blue Commodity Brokerage

Alice Blue provides an opportunity to trade in oil, metal, livestock, etc.

So, if you also want to trade in the commodity segment then the following are the brokerage charges:

| Alice Blue Commodity Brokerage | |

| Brokerage | Futures: 0.01% or ₹15 per order |

| Options: ₹15 per order | |

| Transaction Charges | NSE 0.053% | BSE Rs 1 per trade (each side) |

| STT | 0.01% on Sell Side |

| SEBI Charges | ₹5 per crore |

| Stamp Duty | Varies according to the state |

| GST | 18% of (Brokerage + Transaction) |

Alice Blue Currency Brokerage

Chunmun decided to trade in forex and discovered that Alice Blue is giving an opportunity to trade at Rs.15 per order as a brokerage.

So, if you also want to trade in the currency segment then the following are the charges:

| Alice Blue Currency Brokerage | |

| Brokerage | 0.01% or ₹15 per trade whichever is lower |

| Options: ₹15 per order | |

| Transaction Charges | NSE 0.053% | BSE Rs 1 per trade (each side) |

| STT | No STT |

| SEBI Charges | ₹5 per crore |

| Stamp Duty | Varies according to the state |

| GST | 18% of (Brokerage + Transaction) |

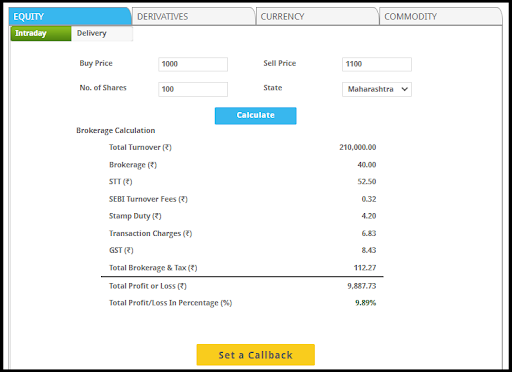

Alice Blue Brokerage Calculator

After knowing all the charges, Chunmun decided to calculate the exact brokerage she need to pay to carry out the intraday trade.

Here she assumed a trade of the total turnover ₹2,10,000.

She calculated the brokerage on the basis of turnover as:

0.1%*2,10,000 which is equal to ₹210.

Since the maximum brokerage is ₹15 per trade thus she ended up paying ₹30 to execute the trade.

But there are other charges as well like STT, Stamp Duty, and other fees. Now all this calculation confused her.

Almost every other beginner trader are not able to calculate the exact brokerage and hence unable to evaluate their profit and loss percent.

To help you with this, here is the brokerage calculator, that makes the whole calculation easy for anyone.

Just fill in the buy and sell price along with the number of shares. Select the state and click on calculate.

NOTE: Stamp Duty Charge depends from state to state.

The main advantage of this Brokerage Calculator is that it transparently displays charges other than Brokerage Charge like STT, SEBI Turnover Fees, Stamp Duty, Transaction Charges, and GST.

Bottom line

Before investing and trading with any broker, it is necessary to know about all the brokerage charges of a particular segment.

If you are facing any issues while calculating brokerage charges, then visit Alice Blue Brokerage Calculator. The calculator not only tells the brokerage charges levied by brokers but also other hidden charges.

Also, apart from the brokerage fees one must consider the Alice Blue DP charges as well. These charges are not displayed on the contract note and hence the beginners generally remain unaware of it.

Start trading now by opening a demat account online for FREE!

More on Alice Blue

Video Review

Video Review