Short Call Butterfly

All Option Strategies

Short Call Butterfly is the options strategy which is used when the trader expects a lot of volatility in the market. It is the opposite of the long call butterfly options strategy, in which the investor expects no volatility at all.

It is a neutral strategy in terms of the trend but the purpose is to protect the trader against the high volatility.

Also Read : Option Trading Mistakes

The trader wishes to be a part of the volatility and still keep his risks limited. The short call butterfly involves limited risks and limited profit.

Meaning of Short Call Butterfly

Short Call Butterfly is formed by buying two at-the-money options with a middle strike price, selling one in-the-money call option at the lower strike price and selling one out-of-the-money call option at the higher strike price.

It is necessary that the strike prices of the in-the-money and out-of-the-money call options are equidistant from the at-the-money call options, and all the options have the same options expiration date.

Thus, there are four different options contracts, with three different strike prices.

Again those contracts would be:

- 2 At The Money or ATM

- 1 In The Money or ITM

- 1 Out Of The Money or OTM

The short call butterfly also combines a bullish spread and a bearish spread to result in a neutral spread. This strategy is the exact opposite of the long call butterfly.

It is because the long call butterfly is based on the expectation that there will be no volatility at all in the market, while short call butterfly is based on the expectation of very high volatility in the market.

Short Call Butterfly Timing

The short call butterfly is ideal to be used when the trader anticipates very high volatility in the market.

In this case, he sets up this option strategy to ensure that benefits him from the price movement, along with being protected against the risks of untoward movements.

Thus, when the implied volatility of the underlying asset is low but the volatility is expected to go up, the short call butterfly can be applied.

The strategy aims to capture price movements outside the wings of the butterfly. This means that the strategy will not make any profit if the price of the security does not change.

On the other hand, the profits will be received when the price of the security goes above the higher out-of-the-money strike price or less than the in0the-money strike price. So, the direction of the trend does not affect the outcome.

The market may end up going up or down, the only expectation is movement in price.

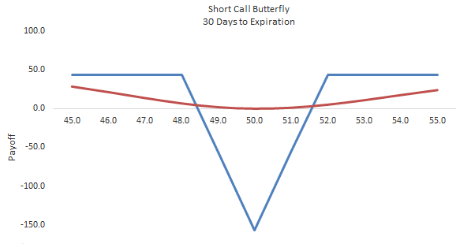

Short Call Butterfly is a limited risk and limited profit strategy.

The maximum loss occurs when the price of the security is at the middle strike price at expiration and it is equal to the difference between the lower and middle strike price, minus the premium received.

The maximum profit occurs when the price moves beyond the wings of the butterfly and it is limited to the premium received for initiating the positions.

Short Call Butterfly Spread Example

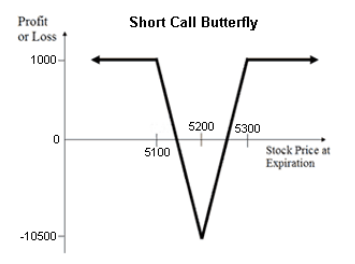

In order to understand the short call butterfly in detail, let us consider NIFTY or NSE. In this case, we assume NIFTY to be at 5200.

The investor is neutral towards the trend; the price may go up or down.

However, the investor is anticipating that there will be huge volatility in the market due to factors like the budget announcement, annual result announcements, changes in policy etc. So, the trader sets up a short call butterfly.

To create the short call butterfly, he buys two at-the-money call options at 5200 at a premium of ₹100 each, sells one in-the-money call option at 5100 for a premium of ₹165 and sells another out-of-the-money call option at 5300 for a premium of ₹55.

The strike prices of the in-the-money and out-of-the-money call options are at equal distance from the at-the-money call options.

Scenario 1:

If NIFTY closes at 4900 or 5000, which shows high volatility, the strategy will generate the maximum profit. At this point, all the options will either expire worthlessly or all of them will be exercised and offset each other to give a zero profit.

The net payoff will be due to the premiums, which is equal to (165+55 – (100*2))= 220-200= ₹20. For a lot of 50 shares, the maximum profit will be 20*50= ₹1000.

Scenario 2:

If NIFTY closes at 5200, which means no volatility at all, the strategy will cause maximum loss. The short call with lower strike price will get exercised and all the other options will expire worthlessly. The maximum loss is also limited. It is equal to (5200-5100)- 165+55-200= ₹210.

For 50 shares, the loss will be 210*50= ₹10,500.

Thus, the maximum profit is limited to the premiums received and the maximum loss is limited to the lower strike price minus the current price, less the premiums. The maximum profit occurs at high volatility and maximum loss occurs at zero volatility.

Short Call Butterfly Advantages

Let’s quickly understand some of the benefits of using Short Call Butterfly strategy in your trades:

- The strategy is highly advantageous when the trader cannot anticipate the trend but is confident of the volatility in the market

- The exposure to risk remains limited, even when the market is highly volatile

- The ability to make profits even when the direction of the trend cannot be predicted

- The premiums can be received without making any extra investment.

Short Call Butterfly Disadvantages

At the same time, there are a few issues you must be aware of:

- The strategy requires significant movement in the prices for it to be profitable.

- The returns are less compared to other strategies like a straddle or strangle.

Conclusion

Thus, short call butterfly is an appropriate strategy when the trader is expecting that the prices will definitely move, however, he is not sure of the direction of the movement.

| Entity | Value |

| Market View | Neutral |

| Number of Positions | 4 |

| Position Types | 2 At The Money 1 In The Money 1 Out Of The Money |

| Options Traded | Call |

| Risk | Limited |

| Reward | Limited |

In this case, he can play on the volatility and still keep his risks limited. If the strategy is not used, the trader becomes subject to very high risk.

It is, indeed, a breakout strategy, that helps the traders to benefit from the breakouts, by still keeping the risks limited.

In case you are looking to start trading in the share market, just fill in some basic details in the form below.

More on Share Market Education:

If you wish to learn more about options trading strategies or stock market education in general, here are a few references for you: